Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

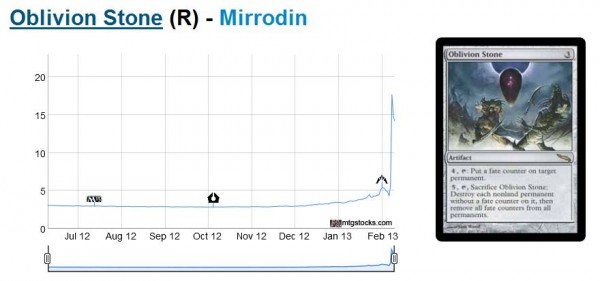

It may seem like Modern has settled based on the price trends of certain cards. Spellskite, for example, had tripled in price before pulling back down below $10 again. But the craziness hasn’t ended yet. Take a look at one of the latest culprits, Oblivion Stone (chart from mtgstocks.com).

In fact, so many cards follow a similar trend of skyrocketing in a matter of days and then immediately pulling back. It’s almost like the speculators take notice, buy out the internet, and then flood the market with copies yet again when they inevitably list theirs for sale in an attempt to profit. Spellskite, Fulminator Mage, and Serra Ascendant all followed a similar pattern.

But I really don’t want to spend another week writing about the Modern phenomenon. The examples may be different, but the overall message remains the same: I’m selling spiked cards which may appear in Modern Masters (I only wish I owned more Oblivion Stones to sell!). This strategy has enabled me to “bank” a significant amount of profits. By selling the Modern staples I acquired a couple years ago for Legacy play, I am ringing the register and taking some investments off the table.

The result: I’m left with significant cash holdings. It’s the inevitable outcome when you sell significantly more than you buy. As my Modern collection dwindles in anticipation of Modern Masters, my cash reserves are building. While this may seem great, I must remember that this cash is not gaining at a rate above inflation, and so in theory it’s dropping in purchasing power.

In other words, cash is very safe but also very stagnant. In order to grow the portfolio some more I need to get back into buying.

I Sold High – Time to Buy Low

I remember hearing a basic mantra along these lines. “Always do the opposite of what the general market is doing”. In other words when people are buying like crazy and sending prices to new highs, I look to sell. When people are panic selling quality cards with upside potential I seek to buy. This applies to both MTG Finance as well as Wall Street.

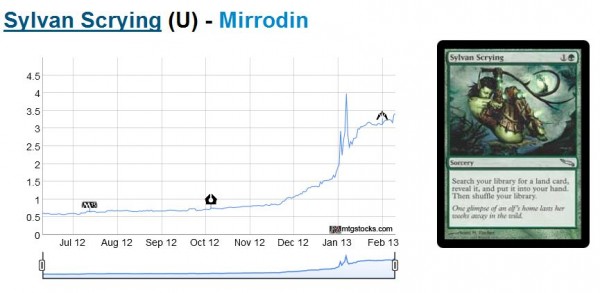

So in this time of massive Modern price increases (Sylvan Scrying is another one – chart from mtgstocks.com), I’ve been freeing up some cash in anticipation of purchasing under-valued cards.

Fortunately, there are many – most of which are in Return to Ravnica. Right around this time is when Return to Ravnica card prices will bottom. And just like clockwork, as fewer packs of the set are opened, the powerful Standard winners will rise to the top.

Return to Ravnica Buys

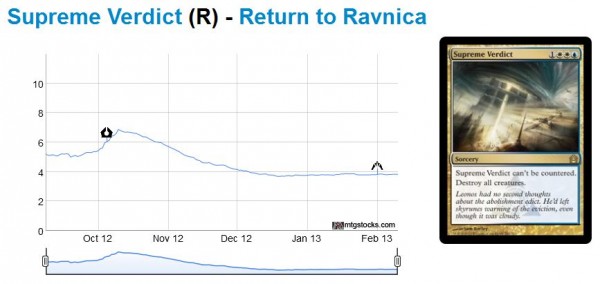

The key here is to pick up cards that are played consistently in Standard today, and should be well positioned for when Innistrad block rotates out. I have my eye on many of the removal spells – both mass and spot varieties. Currently I’ve been attempting to grab sets of Supreme Verdict on eBay for under $3 each. This has been difficult, and I sense a hard price floor of $3 has been hit (chart from mtgstocks.com). Take a look at how flat, how unmoving, that price line is.

As Innistrad block rotates, we will say farewell to Terminus. Starting then, Supreme Verdict will become the premier board sweeper in Standard. And while the promo version may prevent Supreme Verdict from hitting the same highs that Terminus did, I still see this card reaching $5 cash, $8 retail in less than a year.

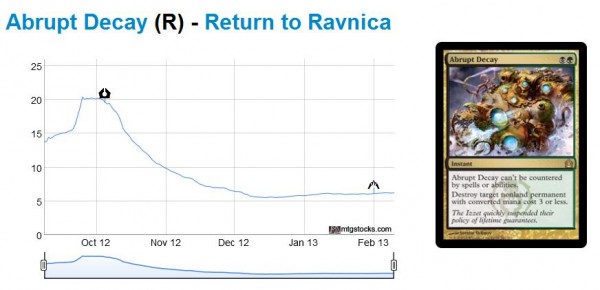

Speaking of $5 cash / $8 retail, Abrupt Decay has also appeared to bottom (see chart from mtgstocks.com).

Seeing as this card retailed for $20 when it first came out, there is certainly some upside potential here. The increase will be gradual, but trading away hyped Gatecrash cards (I’m looking at you, Boros Reckoner) into Return to Ravnica cards like Abrupt Decay will provide stability and upside to your portfolio. Dreadbore, the other Return to Ravnica removal spell, has also bottomed. I like this one less because it’s counterable, a sorcery, and less likely to see eternal play.

Other Places to Store Cash

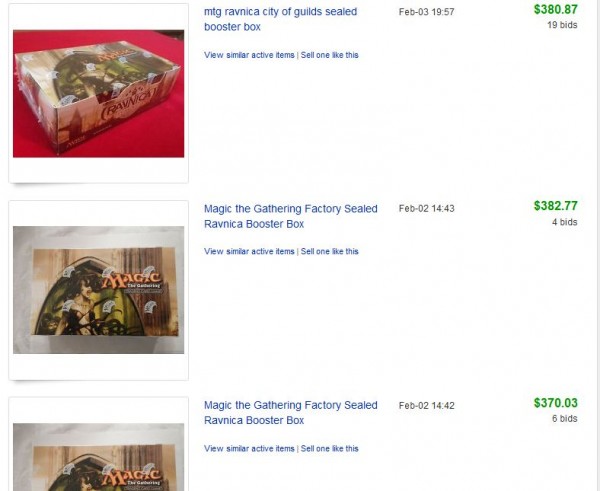

If Standard isn’t your area of interest, perhaps there are some longer-term opportunities worth considering. I would recommend buying a booster box or two of Return to Ravnica to sit on for a few years. Booster boxes of the original Ravnica set are reaching $400 on eBay auctions. Even if boxes of the newer Return to Ravnica reach $200, it still represents a 100% gain over the course of a few years. While less exciting than the Modern price curves observed above, I sure would be pleased with doubling up on an investment in a few years’ time.

Even if you don’t want to wait that long, holding a booster box or two of Return to Ravnica will be just as safe as cash if you can buy in at around $90 shipped. It’s very unlikely the price goes much lower…ever.

If Return to Ravnica isn’t your thing, then you could keep an eye on other Standard cards. We are about halfway through Modern PTQ season, and Standard season is next. Demand for Standard staples will go up, driving prices higher. Just be careful buying into too many Innistrad block cards. There may be some profitability there, but the time horizon to sell these for profit will be short. I know I’m a bit early, but I always consider format rotation when I acquire older Standard cards. Only acquire them if you feel demand will increase significantly within a three month timeframe. If not, you may be left holding the hot potato come Standard rotation.

Buy Something

I’m not quitting Magic. But my collection has reduced significantly now that I’ve sold my Tarmogoyfs, Dark Confidants, Thoughtseizes, Fetch Lands and most recently Vendilion Cliques (chart from mtgstocks.com). Modern prices have absolutely gone nuts, and selling into this boom is rewarding.

But my job isn’t done and I do not intend to stop speculating. I will need to acquire new cards to start the next cycle of buying and selling. I believe with Gatecrash’s release, the time to start acquiring Return to Ravnica cards is now. What’s more, I will also prepare my cash reserves to buy back into Modern as Modern Masters is spoiled. As people panic-sell their collections, I expect this modest bubble to burst.

Again my mantra is to do the opposite of the market. Since Modern willbe around for a while I intend to buy back into the format as everyone else sells. Then as prices re-stabilize and next year’s Modern PTQ season begins I will be well-positioned to sell yet again, repeating the cycle.

…

Sigbits – Return to Ravnica Edition

- Shock lands continue to drop in the wake of the news that Dragon’s Maze will contain more of them. But as I eye eBay, Card Shark, and Amazon I am seeing some copies of Hallowed Fountain priced at $8. The drop may continue for a little more, but eventually buying new Shock Lands at $8 is going to be a steal. It just may take a while. I’m holding my copies, but I’m not shelling out any more cash for them for the time being.

- Deathrite Shaman has also stabilized in price. Looking at the price chart, it appears $15 has become the new target price point for the Elf Shaman. Since this card is slightly less ubiquitous than Snapcaster Mage, I’m wondering if this is a short term price ceiling. Demand isn’t likely to increase drastically for a few months. Then again, supply may decrease a little bit as fewer packs of Return to Ravnica are opened. Still, I may sell a couple copies here or there to take some profits off the table.

- Sphinx's Revelation still sees Standard play and I don’t think it’s any less broken with Gatecrash. But the price has been pulling back significantly in the past couple months. This is one card in Return to Ravnica that likely hasn’t bottomed yet. I may target these in trade eventually, but not at $17.99 - that’s for sure.

-Sigmund Ausfresser

@sigfig8

Hi Sig,

As usual… great article. I am still not sold on supreme verdict solely because of the buy a box promo and boros charm. However I like your arguments.

It’s hard to me find more targets than the ones you referenced…there is niv-mizzet, but that’s a risky call. Given this I started looking to innistrad. I know that it will rotate this year…but given the lower stock, I foresee in the near future some spikes in some cards from this expansion (and short term investments is just my style 🙂 ). What are yours thoughts in here ? I like for example terminus as a short term investment and given the jund performance this weekend in the standard open, I also started analyzing Liliana as a possible call.

Innistrad block definitely has some potential for gains, especially during the upcoming Standard PTQ season. Because of my hectic home life, I generally have difficulty trading out stock quickly, so I try to avoid cards that are nearing rotation. But if you are an active trader, there is definitely some merit to trading overhyped Gatecrash cards into Innistrad block staples, only to trade those out in a couple months.

Liliana makes me nervous. She’s somewhat narrow – is she seeing much Standard play, or is it mostly Modern keeping her price up?

Thanks for the comment!

Great article! It really hits home for me as I’ve sold most of the modern staples you mentioned above and had quite a bit of bank from it, not knowing what to do with it. I’ve been doing the same thing and buying up RTR staples. Some other cards I targeted other than what is on your list are Jace, Architect of Thought and Angel of Serenity. They both seem like they are close to bottom. One other card I like is Trostani as she can be had for close to $3 each right now but I haven’t pulled the trigger yet.

My only issue with picking up these cards is the length of time I have to hold them. I tend to get impatient thinking that if a card doesn’t spike in the next 4 weeks, I’ve made a bad spec. Anyone else have this issue?

Regarding your Liliana question, I haven’t seen her much in Standard deck lists so I think it’s price is being propped up by Modern Jund.

Liliana is in Legacy Jund and the Gate as well.

Hi Jim (and Sig 🙂 ),

Liliana was on the Jund list that won this weekend SGC standard open. I find it pretty low right now and if it starts getting a little more standard play it will get a spike for sure (everybody recognizes it as a great card). Regarding modern, I know that she is being played now and then but I am not sure of how much.

Regarding the Jace… I already though about it, I also think he is more or less in its (standard) ceiling. My issues with him is that in the current metagame I am not seeing great control decks in which he can fit. Now…the angel of serenity… well, it is a nice pick…but for some reason I am afraid to move into it… but probably you are right on this… maybe its because of the RTR huge stocks and given that it already had a great spike in the past.

Thanks for commenting! I am having this “issue” in both my MTG portflio and my stock market portfolio. I’ve done all this selling and now I am sitting on cash reserves without a clue of what to buy next. Return to Ravnica staples will take some time to pay out, but I think they are some of the safest buys you can make. Jace and Angel also seem decent – nice add! Though I don’t see either that often at SCG top tables. It’s usually Naya, RDW, or some sort of Esper-control running like 1 copy of Jace/Angel. Since board sweepers and removal are generally robust regardless of what the format looks like, I have favored these cards. Angel suffers in an envrionment with more aggressive decks.

We are spoiled by our quick flips! My advice is to put some cash into RtR staples and sit one a smaller bit of money to have ready for buying the quick flip targets.

I’m in the same position of having sold a ton of the stuff I’ve profited on in the last year, and while I put $1500 of that into a new fridge for our new home I’m still selling out of Modern staples like crazy and need to put that money back somewhere. I won’t lie, a lot of the money that’s come out of my binders hasn’t gone back in, and I’m fine with that. But I am targeting Jaces (RtR), Verdicts, Decays and Spheres.

What’s better as a booster box investment, Innistrad or Return to Ravnica? How risky are booster boxes; do they ever go down?

I like both Innistrad and RtR – it’s hard to predict how much each will go up relative to each other. But in general, booster boxes are very safe investments. Only time they go down is if they are absolutely terrible sets (Saviors of Kamigawa, Prophecy). But good luck finding boxes of even these sets at less than $90 shipped. So as long as you buy them at this price point, you should be safe.

My only caution is that these are sometimes difficult to unload for small profit margins. You really need to wait long enough so that these go up significantly, so that you can sell them on eBay and make bank after fees/shipping. You won’t be very successful selling these on MOTL for example.

It looks like even boxes of sets like Betrayers of Kamigawa have gained in value, so that would make it appear pretty safe. However, that’s for sets before the big boom in player numbers; there were far more Innistrad/RTR boxes made than any pre-ZEN sets. Assuming that I’m willing to wait, say, five years at least, what are the chances that we’ll see a lower box price pattern on the post-ZEN sets?

I’m trying to justify spending a few thousand on Innistrad & RTR boxes, because old booster boxes seem like such a sure thing to *double* in price for reasonably popular sets, and trying to see why they *couldn’t* be as sure a thing as they seem to be because sure investments like that can’t exist.

The recent influx of players has indeed led to larger print runs. This could impact supply somewhat, but demand largely has kept up I think. If your after post Zen sets, I’m guessing I can’t use Worldwake and Rise of the Eldrazi as additional examples, right? 😛

I wouldn’t dive in at $1000 right away. Maybe start small and buy 4-5 boxes? It’s pretty certain you won’t lose money, but you may not gain as quickly as you’d like.

I’m wondering if renting cards could be a feasible way to get yield from stuff you aren’t playing but don’t want to sell. Yes it sounds like a major hassle, but basically you just need to get a credit card # as collateral and make sure that the cards are mailed back with tracking. Historically the main obstacle was probably more that shops had no incentive to provide an option to buying, but at this point there are a lot of older players that have pretty good “inventories” sitting around.

Another issue is price change. You don’t want to rent out a card you think is going down a lot compared to the rent rate x term. You also don’t want to rent out a card that might go up a lot or you forgo the difference, so ideally these would be stable eternal cards.

I would accept back any copies of equal grade (provided I could make incremental charges if there were an issue). Therefore this would provide a way to short cards, at least in small scale.

This is more of a thought experiment than anything. I seem to recall a dealer hand-waving and saying that renting cards was just impossible at one point, but it may be more of a question of will. Clearly you would want a larger scale to defray whatever scumbaggery there is that manages to slip through.

The best thing would be to pawn them out, so you’d ‘sell’ someone a card at an inflated price, but with a promise to buy it back at market price in the future.

I actually had a similar idea about a year ago of renting full decks at premier events. You would enter your deck online ahead of time and we would provide you the deck and register it for you for the event. You just show up and play. It was a half baked idea and I hadn’t given it further thought until now. Doing individual cards would get you more business. Full decks would ensure you’d get the cards back as no one wants a $600+ charge on their card. I’m not sure you could make the dealer costs work in this instance.

I’d be so nervous about managing thefts when it comes to renting decks. The potential profits from this venture could be wiped away in one afternoon should a Legacy deck walk away.

Yea, you would have to have something in place to protect against this such as a contract that would charge them the full retail price of the deck if it was not returned. There’s probably a good reason no one is doing this in the market right now 🙂

great stuff here Sig

Thanks! 🙂