Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, readers! Today's article will focus on Wizards of the Coast as a company.

First off, I'd like to thank QS's own Charles Fey for the inspiration for this article. He wrote not one but two articles, which really made me think about the future of my MTG investing decisions. You can find them here and here.

In his articles Charles brings up the fact that above all, WoTC is a company owned by a publicly traded company (Hasbro). As such it is subject to the same sort of market demands as Microsoft or Apple (the often exceedingly high or unrealistic expectations of its shareholders).

By examining WoTC from an outsider's perspective, we will get a better grasp of how they will act and what it means to us as MTG speculators.

Secondary Market

The first major point to bring to light is that WoTC doesn't make any money on the secondary market. They don't sell singles, they sell sealed product. Their prime goal is to sell as much sealed product as possible.

What does this mean?

This means that WoTC would rather have a lot of cards in the set with medium price points than one or two with very large price points. Most players are smart enough to realize it's not economical to crack packs looking for that chase mythic. When WoTC has a set with one or two high-dollar cards, it's usually because the rest of the cards are really weak/cheap and is an indicator of a weak/bad set.

This directly correlates to lower sales numbers. If you want an example:

You can currently buy an out-of-print set (Dragon's Maze) for less than most stores paid for it when the set was in Standard. The reason is that only one card (disregarding the shocklands that you could also pull) from the set is worth more than $10 (Voice of Resurgence) and many stores had a hard time selling the product. This means distributors didn't re-order it, which means WoTC didn't make as much money.

Now let's compare that to Innistrad. While it is a larger set and all, that also means that it had longer time for singles to be cracked. So in theory the average value of a rare/mythic should be lower:

Instead we see the price of the sealed box being worth three times a Dragon's Maze box. Granted, Innistrad is a bit older, and even Innistrad only has three cards valued above $10 currently, but the demand for the sealed product is much higher. In the end, Innistrad was a much more popular set than Dragon's Maze and likely made a lot more money its first three months (as we don't have exact numbers, I can only think anecdotally about how long sealed product sat on our LGS's shelf.)

The fact that all of WoTC's income comes from selling people sealed products is the driving factor behind the company trying to expand it's sealed product line.

Seven years ago WoTC introduced the first Duel Deck (Elves vs. Goblins). Prior to that, WoTC's foray into non-Standard sealed product was limited pretty much to the World Championship decks of old (which weren't tournament-legal and were more of a collectors item), Collector's Edition, Unhinged/Unglued, and a few other random runs. In the past seven years' time we're now up to a total of:

- 13x Duel Decks (with another on the way)

- 7x From the Vaults

- 3x Premium Decks

- 2x Planechase

- 4x Commander

- 1x Conspiracy

- 1x Archenemy

- 1x Modern Masters

That's a whole lot more additional sealed product and thus a lot more potential profit for WoTC. This trend has really grown the past few years.

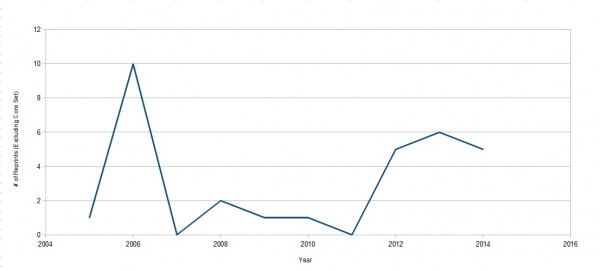

The following chart shows the number of supplemental product releases by year. Note that 2011 through 2014 were the only years with a product that included Standard-legal cards. The last data point includes one product slated for release this year.

This likely indicates that we will continue to see at least six (if not more) supplemental products released each year moving forward.

Reprints

As a company, WoTC clearly understands the value of reprinting valuable cards. It's shown time and time again that adding a few valuable reprints to a set can drastically increase overall demand (and thus sell more product). Khans of Tarkir is an excellent example--it is by no means a weak set as it has some excellent Eternal cards besides the fetchlands, but the inclusion of said fetchlands has everyone cracking packs left and right.

What does this mean?

Khans will likely prove to be one of WoTC's most profitable sets (even if you were to normalize the playerbase to compare older sets to the newer ones). This likely implies that we'll see an increasing number of reprints going forward.

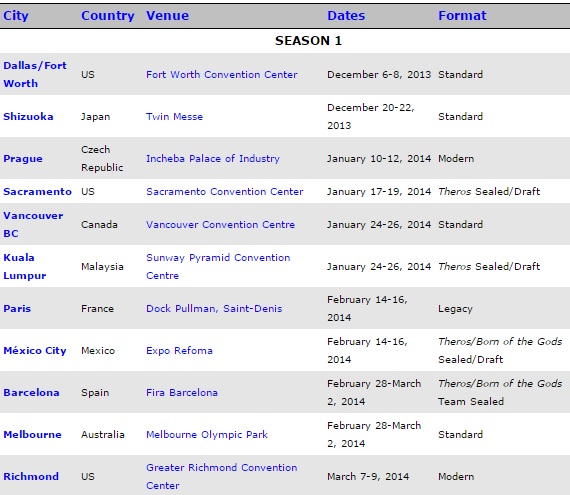

This chart shows the number of reprints worth $2 or more by year:

What we actually see is a lot of reprints in the mid to late 2000's followed by a massive drop (when there was no core set), followed by something along the lines of 15 reprints a year.

It's important to note that the two years with the most reprints (2005 and 2007), a large majority of those reprints occurred in the core set (of which there wasn't one in 2006 or 2008). There were core sets in 2009-14, but WoTC chose to limit the number of reprints in them. The fact that they recently announced that 2015 would be the last year with a core set implies that even with the reduction in reprints from previous core sets WoTC still wasn't happy with it.

This trend actually contradicts our original hypothesis and shows that WoTC has been limiting the amount of reprints it puts out per year. It's also important to note that a decent percentage of the reprints were planeswalkers and rare lands (fetches/shocks/painlands/buddy lands).

However, if we dig a little deeper and remove the core sets from the data we see a much more noticeable trend.

Note that Time Spiral came out in 2006, which was the reason for the uncharacteristic spike that year--if you ignore Timeshifted cards then the number drops to 0. Up until 2011 we saw around 1-2 non-core set reprints per year. However, in 2012 and onward we're seeing 5.5 on average. While that might not seem like a lot, it represents a more than 300% increase in non-core set reprints.

It's important to note that all this data comes from Standard-legal sets only. I did not include reprint data for supplemental products, though they obviously will affect prices.

Format Focus

The last subject we'll go over today is WoTC's push to focus on the Standard format. WoTC clearly understands that Standard is its bread and butter, and the prime driving force behind product sales.

If we look at next year's PT and GP schedules we see a strong focus on Standard (especially if you include Limited, which also sells sealed product).

Looking at GPs, we have 3x Modern events, 4x Standard events, and 4x Limited events. Compare that to the same time last year:

We had; 4x Standard, 4x Limited, 2x Modern, 1x Legacy. In fact the only difference is that they eliminated the Legacy one and replaced it with a Modern event.

What does this mean?

Of all the formats, WoTC makes the least amount on Legacy/Vintage so it makes sense from a business perspective to focus on events that actively contribute to the bottom line. I don't expect WoTC to completely abandon the Legacy format, but in 2014 we only had two Legacy events; in 2013 and 2012 we had three each. It's very likely we'll see WoTC drop to just one event in the near future.

If so, we'll likely start to see demand for Legacy staples drop and prices will likely drop accordingly. The recent changes to the SCG Open series will also play a role in this likely decline.

I don’t see all the fuzz about the SCG announcement.

But anyway, we knew this day would come. With the current prices, it’s just stupid to start playing legacy.

While I can’t claim it’s the best investment….Legacy is a VERY fun format with a good bit of diversity…it’s not stupid to play (just maybe not all that wise to invest in).

Thanks for the shout, Dave. I really love that you dug into the numbers here. I find it very interesting that a rise in reprint rates has been almost directly in reponse to the big years for playerbase growth (2010-present). To me this substantiates the argument that there has been a clear attempt to keep the Innistrad double-digit growth train rolling via reprints.

Yep. Though to be fair, a large # of those reprints were for the modern land base.

Aren’t we missing some product here? There have been preconstructed decks since as long ago as 4th Edition. I realize those still exist, but if you would include them everywhere the graphs would look far less impressive.

Wizards has also been adding cards to the market through promo’s.

Pi,

Excellent points and I am aware of all the precon decks and that definitely would have an effect on prints, however, my focus was on “non-standard sealed” product, the precon decks were (as I recall) standard legal at the time of their release. This is also why I did not include event decks.

But is that a fair exclusion?

Consider for example your first graph, looking at it you get the impression supplemental product went from 0-3 to 9/year, a 200% increase, at least. Yet if you factor in let’s say 10 precons per year (the number is higher), it becomes an increase from 10-13 to 19, not even a 100% increase.

I would argue that excluding some of the data is really skewing your graphs. I can understand your reasoning for doing so, but I would then at least more clearly present that there is more product to consider.

I’m convinced they’re throwing everything at the wall to see what will stick – and I’m not sure there’s any sort of strategy behind it. At least, nothing intentionally malicious, or designed to undermine the game.