Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

It’s PSA time. No, not prostate-specific antigen time – I mean a public service announcement.

I fully expect various readers to roll their eyes throughout this article, wondering who could possibly benefit from its contents, but I feel this is necessary, especially after seeing recent communications on Twitter and in the QS forums.

Namely, today I want to re-visit the classic buy-out. Jason talked about this a couple weeks ago, and I wanted to emphasize certain points he made and add my own specific observations. Perhaps I can even come up with a rule of thumb for folks to follow so they can identify what buy-outs are sustainable and which ones are purely pump-and-dump.

I’m also going to recommend a new practice for everyone who wants to avoid that horrendous perception people occasionally have about speculators and the QS community.

Hype

Hype is a powerful force. It can instigate instant euphoria or incite sudden fear.

On Wall Street, either type of hype results in a sudden swing of a stock or commodity price. For example, JC Penny’s stock has been incredibly volatile lately. One day they’ll share a soft sales result and the stock will plummet, then a month later holiday sales will beat expectations and the stock will jump. The roller coaster ride upsets my stomach, so I tend to avoid stocks like these altogether.

With Magic Cards, trends behave a little differently. While the underlying trends caused by hype have a similar effect, the timescale needs to be adjusted dramatically.

This is because at any given time there is a very finite supply of a card on the market. This supply can be bought up in a matter of hours, driving an overnight price spike.

On the flip side, however, fear cannot take a card’s price down overnight like it can in the stock market. Instead, decreases of the hype variety take a few days as more copies get into peoples' hands and appear on the open market.

What worries me is this delayed feedback loop. When a stock tanks on fear, it happens so quickly that it effectively punishes those who were in on the action. This aversive reaction so closely follows the behavior that it is an effective way to alter how people behave. This is a well-documented relationship in psychology, and it is termed “contiguity”. According to Wikipedia,

“Contiguity is important to reducing behavior because the longer the time interval between an unwanted behavior and a punishing effect, the less effective the punishment will be.”

When a hyped buy followed by a mad sell-out occurs, the price response is much slower. Losses happen gradually, as people receive their cards too late and slowly realize their profits aren’t what they previously anticipated. But because the response is delayed, my concern is that speculators aren’t feeling enough pain when they buy too late into a price spike. Thus they are more likely to make the mistake again and again.

Furthermore, I suspect an even greater consequence: speculators are more likely to be influenced by people who hype up a card and sponsor a pump-and-dump.

This is where my PSA comes in.

PLEASE HAVE YOUR OWN THESIS AND DON’T CHASE

Once again I’ll use an example in “RL Investing” to illustrate my point and then draw a parallel to MTG Finance.

An unprecedented announcement was made recently – President Obama is entertaining discussions with Cuba to lift some of the strict trade embargoes that have been in place for many decades. The result of such an economic decision would result in a major jump-start to Cuba’s economy. While having access to vices like Cuban rum and Cuban cigars may be nice for some, the positive effect in Cuba would be profound.

After hearing this news, I did a swift search at my stock broker’s website for any stock that has major focus in Cuba. My search failed, but a short time later I read about an Externally Traded Fund (ETF) that tries to assemble stocks that at least have some business in Cuba. Ticker symbol: CUBA (convenient, right?).

I was holding my finger over the left click button on my mouse, hemming and hawing over whether or not this was worth buying. The stock then climbed…and climbed… and climbed some more. Once the stock hit $8 I decided not to chase – the risk became too real.

Do I regret not buying? To a degree. But two things help me sleep at night.

First, there will be other opportunities like this one, so I’m fine sitting it out. You can’t buy into every single opportunity, right?

Second, I had no clue when to sell. I could have ridden this thing up to $14 only to get crushed as it tumbled back down towards $8. And the drop doesn’t even appear to be over yet. We could see a return back to sub $8 by the end of the month, erasing gains for everyone who got in after the initial spike.

Only my level-headedness kept me from chasing this one too high and stomaching immense losses. I rationally knew that the White House had only begun talks about a new relationship with Cuba. It could be months before anything comes to fruition, and then years after that before these companies saw any measurable increase in profits to drive their stocks higher. This whole trend happened due to short-term hype.

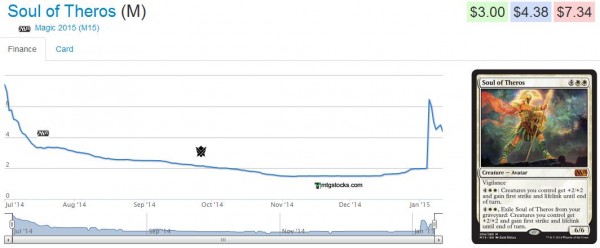

In the world of MTG Finance, similar phenomena happen almost weekly. Last week, it was Soul of Theros’s turn to join the hype parade.

A strong performance at a major Magic event and we have a $6 Avatar! That’s when I saw the Tweets and QS posts.

A select few were arguing this card would remain $5+ for a longer period of time. People were neglecting basic economics as they clung to their copies. Surely this card will remain powerful in Standard for a while now, sending its price higher, right? And it’s a Mythic from M15 – an underopened set – and so the upside is enormous, right?

Here’s where my Public Service Announcement comes in: it doesn’t work that way anymore.

It Doesn't Work That Way Anymore

Not with new cards, not with Standard, and definitely not with 6-drop creatures that only do something for a deck if its in the deck’s graveyard (Golgari Grave-Troll).

This buyout was purely hype driven, catalyzed by a few and fueled by one weekend of success in Standard. When this kind of hype occurs, it’s correct to sell into that hype 99.9% of the time. Soul of Theros was no exception.

So please – I beg of you – do not chase. Much like the CUBA example I shared before, those who bought after the initial jump are not going to profit a whole lot. Even if you paid $2 for your copies, selling now will realistically net you $4 a copy before fees and shipping.

If you have an online store and you can sell cards at TCG Mid, good for you. You’ll make profit. For the regular guy such as myself, I’ll be paying 13% in fees to eBay and PayPal, and then another $0.70 in shipping costs. For a $4 card, that leaves me with about $2.75 net proceeds. And if I decided to wait for the next big Standard event, I could even be looking at a loss.

Once I realized I had missed the first car of the hype train, I moved on. My level headedness came through again and I avoided chasing the hype. Always think logically when dealing with these instances. Never let emotions dictate your actions. In the stock market, you’ll at least have a decent chance you’ll be able to sell to a greater fool.

But when you need to wait a few days for your cards to arrive, the gradual decline in profits will be painful. But not so painful so as to discourage you from trying again next time, which is why it’s so important to be okay with letting these hyped trends pass on occasion.

The Exception?

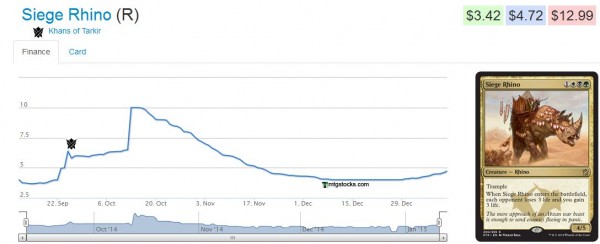

Before I close, I want to share two examples of cards that are on the rise in a sustainable way. Not all price increases are pump-and-dump schemes, after all.

First, we have Siege Rhino. This creature has been on a steady incline over the past few weeks (when I called the bottom) as it gains more and more traction across multiple formats. Despite a superfluous amount of copies in existence, demand is still outpacing supply to drive this card higher.

This kind of gradual price increase is very sustainable. It’s happening due to fundamentals and not hype. Players truly want more copies of these to play with, so the price increases.

It’s that simple. The same is the case for Sidisi, Brood Tyrant.

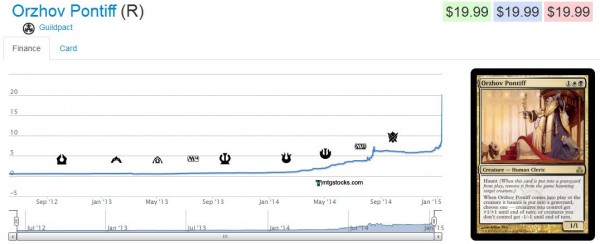

Another example is that of Young Pyromancer-fighter Orzhov Pontiff.

This Guildpact rare was just recently bought out at TCG Player, so it skews my recommendation a bit.

Up until today, I felt this was a solid buy. Supply on this card was low being from such an old set, and demand has been creeping upward due to Modern playability. Apparently someone else also observed this and went to town.

That being said, I see this card holding a lot more of its gains compared with Soul of Theros. The reason? There are going to be far fewer copies flooding the market in the coming weeks in response to this spike. I, for one, will not be selling my two copies – they’re in my Melira Pod Modern list, right where they belong.

Lastly

Due to the length of this article, I’ll need to end abruptly here. But one last item comes to mind before I close. I have one recommendation to make to everyone who wants to recommend buying into a card fervently, especially during a hyped moment: please add a disclaimer to your message stating how many copies you’re in for and when you intend to sell. Better yet, follow up with another communication stating that you did sell.

I just did this recently with Thought Scour. I posted a thread in the QS forums stating my attraction to this card, but I also added a disclaimer that I was in for 25 copies at $0.20 per copy. People know my agenda. They know I’m biased.

But what I’ll also do as a service to the community is tell people when I decide to sell! If there were just as many Tweets and posts describing people’s sell strategy instead of focusing on buys all the time, perhaps there would be less hype. Or perhaps the subsequent drop-offs would be a bit faster. If this were the case, maybe people would feel the pain of getting onto the hype trains too late and they’d be discouraged from joining in the future.

One can only hope.

…

Sigbits

- Foil Thought Scour has jumped and jumped hard. Some will argue that this trend has been in the works for a while now, but if this is the case, what is Star City Games waiting for? They are sold out, sure, but their price is still only $5.99. I’ve got this one on restock alert, and I’ll buy any copy they re-list below $10.

- Aggravated Assault has been on an absolute tear lately. It’s gone from being virtually unknown to sold out at SCG at $4.75 over the last couple years. But recently the card’s trend went from one of gradual incline to accelerated buy-out. This one is likely in for some volatility ahead, but because it’s so old I wouldn’t whiplash just yet. Wait for this one to randomly double overnight, and then you’ll have your sell signal.

- I’m thrilled to see Gemstone Caverns continue its climb. After seeing the card’s potential in Legacy, I bought a couple foil copies knowing it was a gamble. But the card’s upward motion isn’t hype-like, and since it’s fairly old, I know a price increase is sustainable. I’m content to wait patiently for this one to have its day. SCG is sold out of nonfoils at $2.59 and foils at $4.99.

I feel like “Don’t chase” could be a good chestnut to make sure people remember in the future.

I like that idea. Maybe we should start using it as a hashtag on Twitter when people start tweeting to hype cards up. Someone says “Chalice of the void bought out, it’s now $20! #DontChase” This is a way of communicating price trends people need to be aware of without further adding fuel to the hype fire. Thanks for the comment!

That is a great idea. I know personally I don’t buy on the hype of people saying “X is going up, has been bought out here and here”, but I feel like I lost out. Maybe seeing #dontchase would ease my mind a little as to if I didn’t have any it was meant to be.

Corey, thanks for the comment! I’ll try to use that hashtag when I next see some wild spike with people hyping the card up on Twitter. 🙂 Best thing to remind yourself is, if you missed a spike don’t fret. There will be another, guaranteed.

Somehow I feel most QS articles like this ones are very reactive in nature and it is quite frustrating. So basically it is something quite useless to us readers since the ship has sailed already. I would like to see more forward thinking articles that will actually provide solid advices on what to look out for next. I know that there are forums to check but most of those forum articles are also white noise. Since you have written an article about “Dont chase” why not write article on how to predict spikes before it actually happens that is more useful to us. Like you guys have mentioned, MTG finance is changing why not change your writing content too to meet the needs of the readers for the current MTG finance market space. Instead of the usual “reactive review articles” provide some Proactive articles that predicts the next spike.

I understand your frustration. I think one thing you need to keep in mind is that these spikes happen literally overnight. By the time our articles go live, another spike/buy-out can occur. With these happening so haphazardly, it’s difficult to predict an actual spike. I always try to provide ideas for where to invest and what to trade for, but I can’t just say “Gilt-Leaf Archdruid is about to get bought out, so buy those now” because I can’t predict this precisely. I can see that it’s moving upward, and I know it’s from an older set…so it feels like a good candidate. But yesterday it was Chalice of the Void’s turn. The day before it was Orzhov Pontiff’s turn. Tomorrow it may be something else, like Amulet of Vigor again. Who knows?

I do think a good article topic would be a solid look-back at what type of cards spike and why, so that we can look for these opportunities in the future. But when it comes to predicting a buy-out – especially an irrational one – it’s a shot in the dark more often than not. Sorry I can’t be more definitive, but this is my honest opinion. Others are welcome to chime in and share their own thoughts.

Either way, I love your comment and I appreciate your taking the time to share your true opinion. The only way we can improve is if we receive constructive feedback. 🙂

And, that said, we did predict both Chalice of the Void and Gilt-Leaf Archdruid literally weeks in advance, in article form and in the forums.

I feel like we’re reading different articles. The tone of every article I’ve read on premium has shifted over the few years I’ve written for this site. And why are you posting anonymously?

Part of the issue is also deadlines and publish date. For example, publishing on Mon/Tue/Wed means we need to have our article in by Sunday so the editor can get to it … I’d love to write an article about the banned & restricted announcement next week, but it falls on a Monday. By the time my article slot comes around again the topic will be a week old and other writers will already have hit it.

Calling out spikes is especially hard to do in article form, because if you’re wrong (often) you get chastised for it … I’ll take “not causing people to lose money” for certain over a chance at “people making some bucks.” Which is why I tend to lean more heavily on the methods side of the spectrum than the “called shots.”

The only problem with “sold now” tweets, is that it looks like bragging. I had 40 Forked Bolts I got at 50 cents, and recently outed at nearly $3 apiece to buylist. Posting that may be helpful to some, but looks a like bragging to others.

Corbin,

Very fair point. I would propose that you don’t mention your entry price in the same breath as your exit execution. If I say “Chalice of the Void is $20 now, selling my copies immediately #DontChase” this should not at all come across as boasting. I definitely agree that if I instead say “Tripled on my Chalice spec, time to bail!” it comes across way too braggy. I think it’s all in the wording used.