Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Sylvain Lehoux and Matthew Lewis. The report is loosely broken down into two perspectives. A broader perspective will be written by Matthew and will focus on recent trends in set prices, taking into account how paper prices and MTGO prices interact. Sylvain will take a closer look at particular opportunities based on various factors such as (but not limited to) set releases, flashback drafts and banned/restricted announcements.

There will be some overlap between the two sections. As always, speculators should take into account their own budget, risk tolerance and current portfolio before taking on any recommended positions.

Redemption

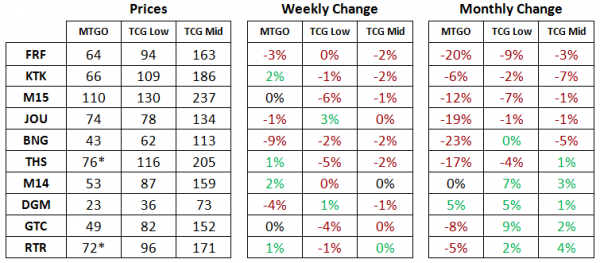

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of March 31st, 2015. The MTGO prices reflect the set sell price scraped from the Supernova Bots website while the TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid-price respectively.

Usually Supernova’s prices are a good proxy for market prices. They are not perfect, but they are close. Recently though, their prices for RTR and JOU have been too low, so I’ve put an asterisk (*) beside those set prices. The set price for RTR and JOU on goatbots is currently 87 and 89 tix respectively.

Paper prices on THS block and M15 are almost all negative in both weekly and monthly changes. This is likely the start of the long slide as the inevitability of rotation gets closer.

For MTGO speculators, this means the price floor of redemption will not be supporting prices. As paper prices drift down, expect continuing price weakness in digital. Speculating on what are seemingly cheap rares and mythic rares will probably turn into a painful lesson. Check out the comments on last week’s article for some insight from one of our readers.

Targeted Recommendations Summary

Today’s report is going to be a little different as we take a look back at the first 3 months of the MTGO Market Report and perform an analysis of our buy and sell recommendations.

Each closed call (i.e. the card was bought and sold) can be evaluated and judged a success or failure by looking at percentage gains or losses. We’ll also construct a mock portfolio to estimate what the net gains or losses could be for a speculator following the recommendations. Lastly, we’ll make comments on any outstanding buy calls and discuss their future.

Evaluation Method

There is no absolute and unique method to evaluate the performance of our recommendations, but we’ve come up with what we think is an objective approach to estimate gains and losses. Gains and losses presented here may also be different from a given person’s portfolio, even if they strictly followed our recommendations.

Buy Prices

For every recommendation, the buy price we used is the price as recorded by mtggoldfish.com on the day of the recommendation. The bias here is that it’s possible to buy cards at a lower price than the listed mtggoldfish price. Mtggoldfish uses mtgotraders prices which are frequently not the cheapest (they focus on stocking every card, not the lowest price). Also, acting on the recommendation on a different day might yield different results as prices might have fluctuated in the interim period.

Sell Prices

The sell price we used is the price as recorded by mtggoldfish.com on the day of recommendation, with the following adjustments. For every card price below 2 Tix, 80% of the listed sell price was assumed to be retained. This accounts for the buy and sell spread of most bots on low-priced cards, which tend to have higher margins. For cards above 2 tix, 90% of the listed sell price was assumed to be retained.

Again, the exact price which a given speculator gets will probably not correspond perfectly to the sell price either. The purpose is to illustrate what is possible, given a reasonable set of assumptions and the actual buy and sell recommendations given in the report.

Current Prices for Open Recommendations

Prices used for recommendations still open are as of Saturday, the 28th of March. The same 80% and 90% price adjustments have been taken into consideration for cards less than 2 tix and cards greater than 2 tix, respectively.

The Mock Portfolio

A mock portfolio based on these recommendations was built in order to put the recommendations into a different, more tangible context. The rules of this simulated portfolio are as follows. A maximum of 50 Tix was dedicated to each recommendation, and an upper limit on the number of copies was set to 40. Based on our experience, buying or selling up to 40 copies of a given card, without significantly affecting prices, is possible if a number of different bot chains are used.

Evaluating the Recommendations

The table below presents the percentage change in each recommendation as per the above assumptions.

* indicates the maximum buying price we recommended for this card, although the price on Mtggoldfish was higher on the day we recommended the position.

Considering all recommendations, both closed and still open, the average gain is +16.7%. If closed positions are considered the the average gain is +31.6%.

Now let’s take a look at our mock portfolio:

The mock portfolio would have initially used 2431.5 Tix of our recommendations. The total value of this portfolio (both closed and open positions) would be now at 2682.3 tix, a gain of 250.8 Tix, or +10.3%. Considering only the closed positions, this portfolio would have gained 408.8 Tix, or +24.4%.

Overall, these results are within the range of what you should expect from a diverse portfolio containing cards from different sets and different formats, with both short- and longer-term potential. A growth of +5% to +10% per month over the course of several months usually represents a very decent return for a speculator on MTGO.

Outlook for Currently Open Recommendations

Standard Positions

Among the still open recommendations, about half of them concern Standard positions, with the majority of them being from Theros block. With Dragons of Tarkir newly introduced and Pro Tour DTK in less than two weeks, the interest in the Standard format will be ramping up. Standard prices are likely to rebound. The best window to sell any Standard cards will be between PT DTK and the release of Modern Masters 2015. Stay tuned for specific targeted sell recommendations over the coming weeks, but expect the majority of THS block and M15 positions to be closed out.

Siege Rhino and Anafenza, the Foremost may also bump up in price as drafters focus on DTK, switching from the KKF to FDD, in terms of boosters. Note that these two cards will still be around after Standard rotates in the Fall, so they are fine longer-term holds at the moment.

Modern

Several of our Modern recommendations printed in MMA have only rebounded from their bottom following the MMA flashback drafts last January. We think that for these and the other Modern positions from recommendations, selling is not suggested and holding is what we recommend. These surely have a chance to be reprinted in MM2 but considering their current price we think there’s more to gain than to lose.

For the Modern positions that won’t be affected by MM2 reprint, namely Domri Rade, Restoration Angel and Sphinx's Revelation, the risk of losing value is extremely low. We recommend waiting on more favorable times to sell them with profit. This holds also true for Deathrite Shaman.

Pauper

The Pauper cards we recommended still have room to grow. Mental Note recently tanked because of the ban of Treasure Cruise in Pauper. Nonetheless, for all Pauper specs we think the mid-term to long-term outcomes are positive and are worth the wait.

Targeted Speculative Buying Opportunities

None.

Targeted Speculative Selling Opportunities

None.

Seems like there are some good standard specs right now based on the normal pre-release liquidation that took place over the last 10 days. They are starting to tick up currently, but are much closer to all time lows than highs:

Stormbreath

Elspeth

Courser

Confluence

Brimaz (all time low right now)

Any reason why you think these are not good targets?

You are right, we though about these ones + also others (Temple of enlightenment, Goblin Rabblemaster…).

The prerelease events are probably the best window to get those. We think that next week might be the best time overall to get these.