Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, readers! I realize this week is typically an MTG Stockwatch week and while I still have every intention of continuing that series, I thought that analyzing some buyouts might prove really useful, especially with quite a few having occurred relatively recently.

Here's how Wikipedia defines buyout:

Buyout - an investment transaction by which the ownership equity of a company, or a majority share of the stock of the company is acquired.

Okay, so technically that's not the ideal definition for what's happening with certain Magic cards, given that no one person can likely purchase the actual majority of the total stock of a given card (given the massive print runs of every set from Revised onward).

WoTC disclosed the print runs of earlier sets. There were 289,000 of every Revised rare printed (so there are almost 300k of each Revised dual land). Granted some of those have likely been destroyed, lost, or forgotten about--but it's unlikely that even the largest MTG store has even 1% of any given rare, especially newer ones.

It's very likely that recent print runs (and probably some pretty old ones too) were far, far larger, as the player base has grown exponentially since the first few sets were printed.

For argument's sake, let's say print runs have only increased tenfold (I'd imagine this is an extremely conservative estimation). This would mean that there would be 2,890,000 of any given rare. So in order to get 0.1% of the total number in the market you'd need to purchase 2890 of any given rare. Unless you're collecting some oddball card, this is highly unlikely without an exceptional amount of effort and cost on your part.

But, someone can purchase all the "stock" available on the market, which typically is a much smaller amount. For example, if someone were to buyout Boon Satyr on TCG Player alone, they'd need to buy over 1000 copies. This does not include many major retailers who don't sell on TCG Player. However, if this same person instead wanted to purchase all the copies of Argothian Enchantress they'd only have to buy about 200 copies. So we can see that some cards are scarcer than others, and those are the ones that tend to get "bought out." Of course, the challenge is that rarer cards also tend to be more expensive and buying even 60 copies of a $20 card ties up a considerable amount of money.

Recently we've seen the following cards skyrocket in value (a few of many):

Heritage Druid

Horizon Canopy

Grove of the Burnwillows

Goryo's Vengeance

Nourishing Shoal

Olivia Voldaren

Huntmaster of the Fells // Ravager of the Fells

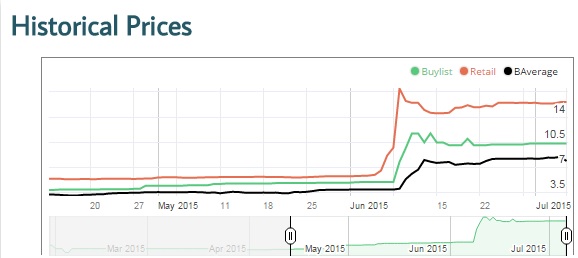

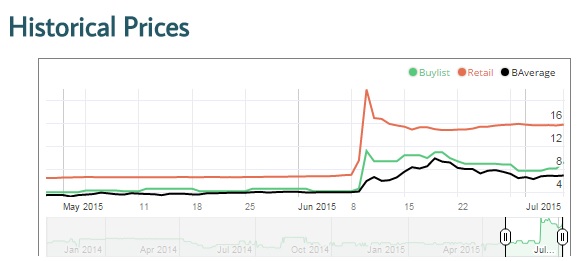

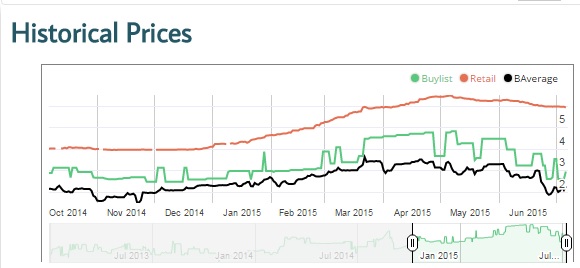

The biggest thing you'll notice is the sudden and sharp incline on the graphs. This is usually the strongest indicator of a buyout, as compared to something like Chromatic Lantern, which shows a nice gradual increase over time.

Chromatic Lantern

The other major differences you'll notice is that every card that spiked had an immediate drop from its high as retailers overpriced a card, noticed nobody was buying and then dropped the price back down. You'll also notice that the buylist prices of spiking cards is delayed by a little bit (sometimes as short as a day, other times by as much as a week). This is because the dealers know that spikes are often indicators of artificial demand.

Again, Wikipedia:

Artificial Demand constitutes demand for something that, in the absence of exposure to the vehicle of creating demand, would not exist.

This basically means that dealers are cautious of raising their buy prices in the case of a suspected buyout. If one person was simply manipulating prices in order to sell cards back to dealers at a profit, the dealers could be left with a card that nobody else wants to pay the "new" price on.

Nourishing Shoal and Heritage Druid show the fastest buylist price increases above, as they (and Goryo's Vengeance) spiked because of GP Charlotte. We can also look at their current spreads as indicators of how confident dealers are in their current price sticking. Both have spreads in the 30% to 45% range. Compare that with Horizon Canopy which has a 51% spread, meaning that dealers are only willing to pay half of what they'd sell it for, indicating a lack of confidence in the new price (though Heritage Druid's 44% spread indicates they aren't too confident on that one either).

The other big challenge with orchestrating buyouts is that once someone has managed to get a card's price to jump, they have to unload the copies they picked up, and as you'd expect the more copies they picked up (and the more likely the price jump was greater) the harder they are to unload.

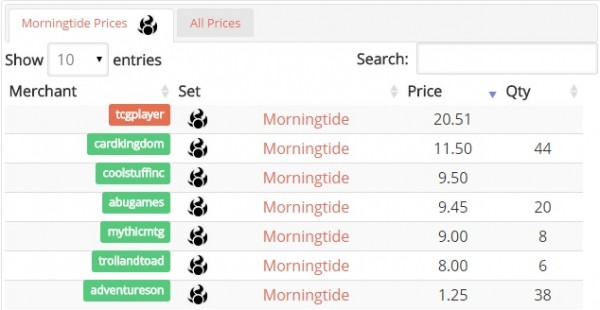

Below are the buylist options for Nourishing Shoal:

This basically shows that you can make $6.5 on your first 24 copies, $5.40 on your next 5, $4.93 on your next 16, and $2.50 on the rest. So you can make $261.88 on your first 45 copies. Not bad, if you got them when they were $0.3 each, but if you bought any when they were above $5 you lose money on all but the first 29.

Let's look at another example. Here are the buylist options for Heritage Druid:

Looking at the retail/buylist chart on this card, any copies you purchased after May 18th (assuming retail prices) would have lost you money, despite the fact that the card almost doubled in value.

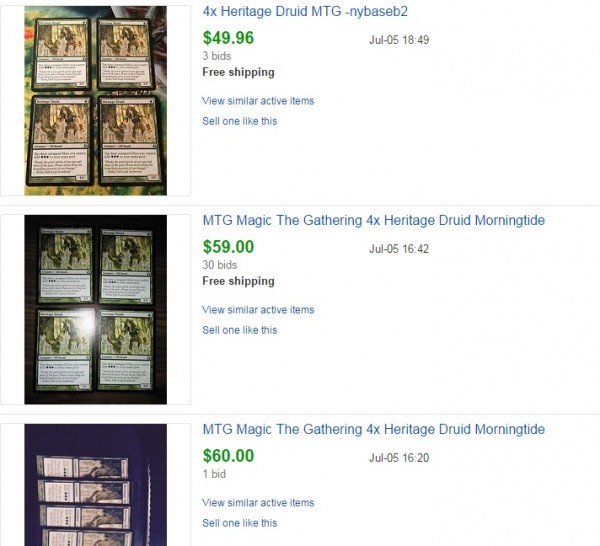

So if these spikes aren't that profitable by reselling to dealers, than one would have to find an alternate out. If we look at eBay listings for Heritage Druid and Nourishing Shoal we see them only really selling a good bit below the TCG average price.

So with eBay sales only going for around 75% of the TCG Mid price and only a small number of sales per day (around 2-6), it would take a good bit of time to unload a large quantity, all the while the price was likely trending downward.

The other option is of course trading them off. I tried posting both in my "Haves" list on Pucatrade and got zero hits (although my trading is limited to the US). If that's not a reliable option, you're limited to trading them off locally or at major events. Your local trade base is likely limited in size and major events only occur on weekends, thus you're subject to a (likely) falling price as the week progresses.

In Conclusion

The MTG finance realm is not regulated, and in some cases buyouts occur because some new combo or deck comes out that sparks interest. However, in many cases they are simply attempts by one or a few to manipulate the market--it turns out that is not actually a good investment strategy.

Very nice write up. I actually bought into Gilt-Leaf Palace before the spike for 2.66 and sold them for an average of 8.55 after everything.

I spent 50 dollars and made 150, but it took a lot of updating tcg player and looking at buylist during that week. So while I gained 100 dollars from the whole experience, I dont think that was worth the time.

Thanks for the great example. I honestly believe that a lot of people don’t value their time appropriately and will often spend exorbitant amounts of time trying to make a little money. Feel free to PM me if you have any other examples/stories you wouldn’t mind sharing…I like to use other QSers anecdotes in my articles if it validates a point I’m trying to make, whenever I can.

Yes very good article, I’m glad to see a relevant article posted regarding these buyouts! I’ve never seen so many price spikes in a short time. It’s like amateur speculators are like OMG this magic card is in a deck, lets buy them all out!!

Its really too bad because Modern was created to be an affordable format, but because Wizards cant actually control the market, and printing Modern Masters didn’t really help, (and in my opinion actually made things worse) it is far from affordable for the normal player without already having a decent collection or money to blow. More cards increase in price because they are not “reprinted” than the value of cards that decrease in value due to being “reprinted”. Not only that, I watched too many players burn holes in their wallets buying packs $10 at a time, instead of buying cards they actually need to play modern. Great for drafting, aweful for the average player and format. Sorry for the rant but I felt like it all tied in together because it is mostly Modern cards being bought out.

Agreed….I purchased 0 packs of MM2 and instead used my money to buy the cards from the set I needed and/or wanted to speculate on (mainly Spellskites, Fulminator Mages, and Noble Hierarchs)