Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Who remembers this game when they were a kid (or maybe adult)? For those who didn't get to enjoy this wonderfully designed game, the premise was pretty simple. You are a monster who shoots bubbles that can trap your enemies and if you capture them in a bubble you need to pop the bubble before they escape.

Who remembers this game when they were a kid (or maybe adult)? For those who didn't get to enjoy this wonderfully designed game, the premise was pretty simple. You are a monster who shoots bubbles that can trap your enemies and if you capture them in a bubble you need to pop the bubble before they escape.

What does that have to do with Magic: The Gathering?

We often compare Magic cards to stocks when we speculate. While it's an easy comparison it's not entirely accurate. Every stock is for a specific entity (typically a company) and there's a lot of public information available about that entity. A savvy investor can look up their previous earnings, equity, and other important characteristics to evaluate the health of the company before they invest.

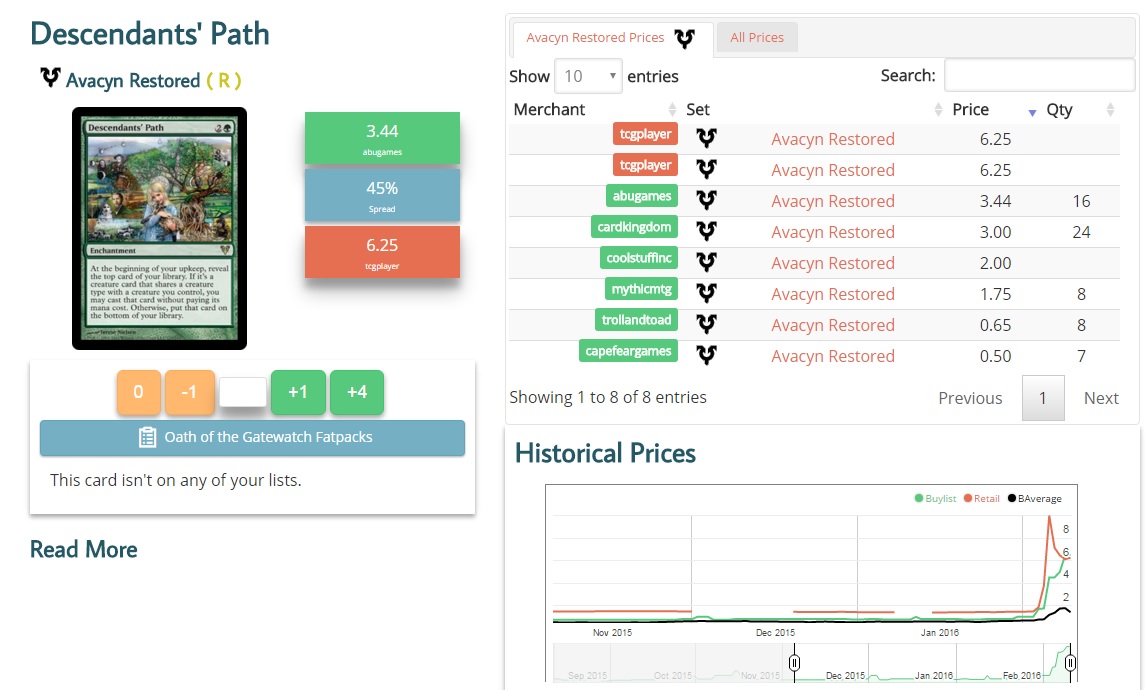

We don't have that option with Magic cards. We can look up previous values; check out winning decks on MTGtop8.com to get a general feel for the demand for a specific card; and look at the spread on buylists with our own Trader Tools here on QS. But all this information amounts to much less than what's available for just about any stock on the market.

The concern is obviously that with little information it's harder to determine how "real" a price is. When large price spikes occur we view it as either a missed opportunity or a nice hit, but what does it mean about the overall market?

The Tech Bubble

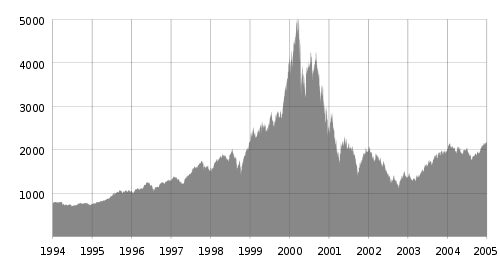

Who remembers the stock market around the millennium?

A whole lot of people around January of 2000 thought they had made a lot of money real fast. Investment firms were throwing money at internet startups that showed even a sliver of promise and young "tech" entrepreneurs were the kings of Silicon Valley.

Sound familiar?

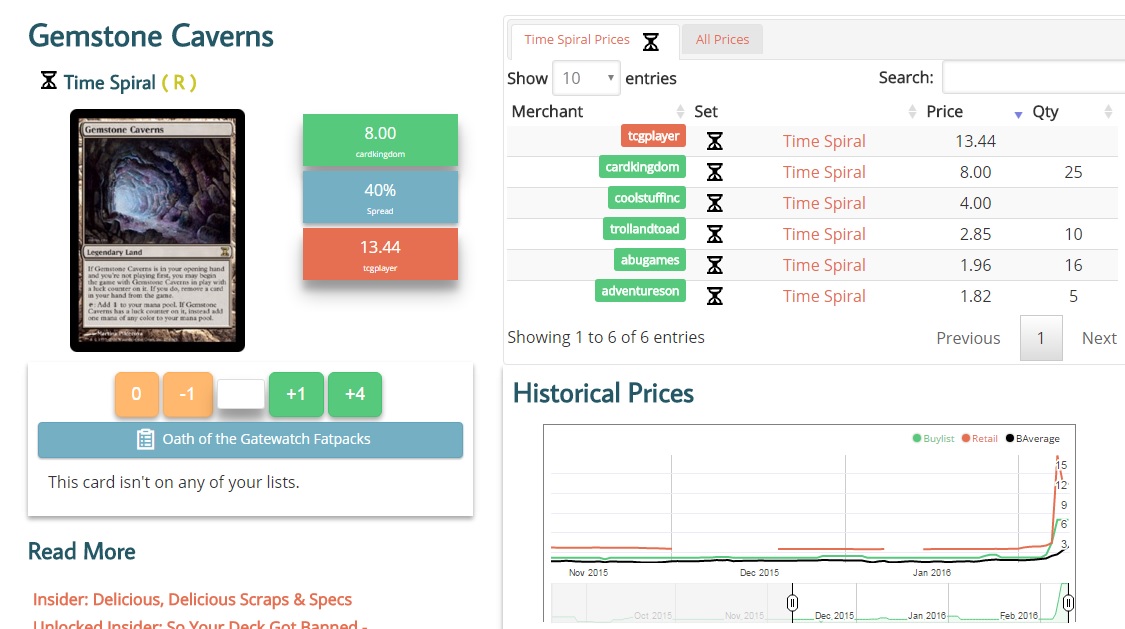

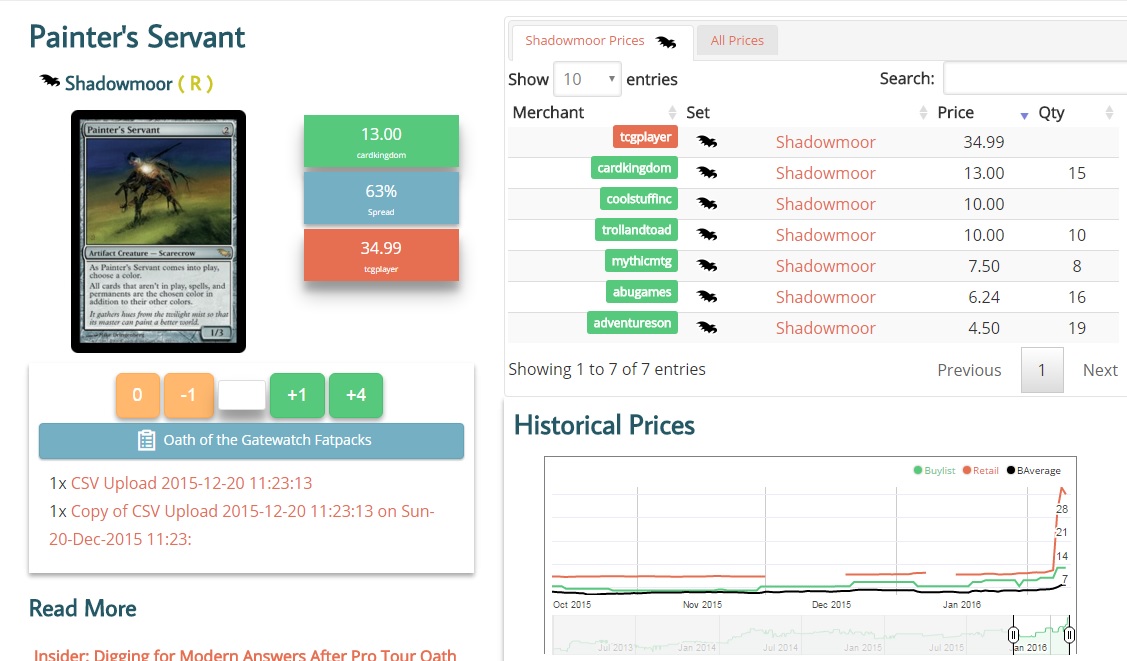

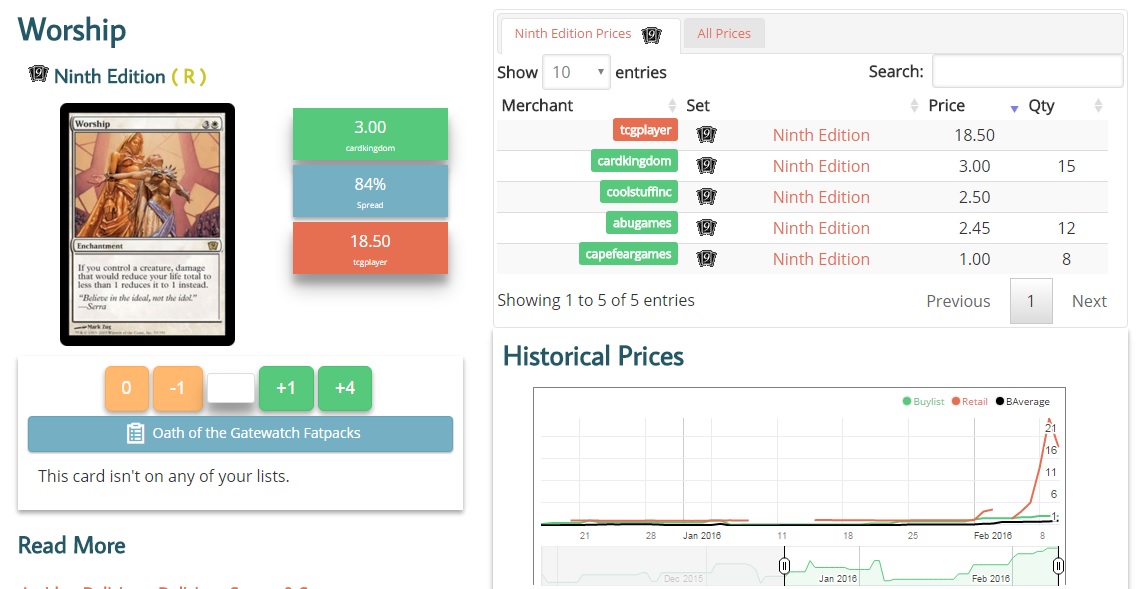

All of these cards experienced massive spikes with very little results to back them up. We saw a lot of companies do the same thing in the late 90's and early 2000's.

Learning Tree International did have some valuable intellectual property (Carmen Sandiego, Myst/Riven, and Reader Rabbit series). It's IP value was greatly inflated before its purchase by Mattel, and Mattel ended up taking a huge loss on the acquisition.

Why Does This Matter?

While the difference in scale between an individual Magic card and a business is very large, we can see the same patterns. Now it's easy to look at the cards listed above and see they had minimal or no impact in successful decklists at the Pro Tour. This implies spikes caused by artificial demand and/or buyouts.

Unlike the stock market, Magic finance doesn't have any policeman like the Securities Exchange Commission. There are no laws in Magic finance to discourage securities fraud or protect investors.

Some might argue that a rising tide lifts all ships, which is true when the tide rises slowly; but anyone who has been on a dock before a tsunami hits knows the rate of rise matters a lot. Too fast of a rise sinks all ships.

Expected Outcomes for Magic

A good number of people made a lot of money (and kept it) during the dot-com boom, most likely by getting bought out before the crash. But plenty of people lost a lot as well. These people were the ones who either stuck it out or weren't aware of everything they were invested in (people who owned large mutual funds or who had 401K/retirement funds).

Either way, someone got shafted and many people simply stopped investing after this.

If people keep creating artificial spikes in the Magic market via buyouts, then one of two things is likely to happen.

- WotC views the demand for the Modern format as much greater than it actually is, and reprints a massive amount of cards to bring prices back down. This will end up tanking prices across the board because the supply would now greatly outstrip demand.

- New players stop entering the format because the price of entry is too high.

In the latter case, stores will make windfall profits at first as they see their existing stock rise rapidly in price and new players rush to pick up everything they need or can think of. But once the cards are acquired by the existing players, demand dries up. Stores are left with their remaining stock rotting away while players focus on picking up only the newly released cards.

This lack of demand causes stores to lose interest in supporting the format, and then the Modern players are forced to search far and wide for events to play in and enjoy, as Legacy and Vintage players do now.

Doom and Gloom

I didn't write this article to cause people to start fearing for the future of Modern. WotC is a smart business and they will do what they have to to keep the format interesting (whether it be by printing more and more powerful cards or banning ones they already printed).

However, those of us who speculate and enjoy Magic finance as a hobby need to be exceedingly careful with our financial dealings and decisions. It's fine to buy copies of cards you feel are underpriced; it's not okay to buy them with the intention of causing a price increase (or "pumping and dumping").

It's also incredibly important for those of us who aren't "pumping and dumping" to keep an eye out for these types of buyouts. The more buyouts we see, the more "bubble-like" the financial future becomes and the more unstable speculating on the format becomes.

A Warning to the Pump-and-Dumpers

For those who are pump-and-dumping, note that while it may seem incredibly lucrative at first, it's increasingly difficult to unload large quantities of cards. Many stores have taken a "wait and see" approach with regards to price spikes (raising their sell prices to match the market price, but holding off on raising any buy prices).

So while it may look like you made a lot of money, you haven't until you've actually sold the cards.

~

The purpose of this article was to highlight the similarities between previous financial bubbles and a potential one in the Magic: The Gathering finance sector. As you can see it's a relevant comparison.

I hope my arguments will help dissuade the continuous manipulation of card prices via buyouts. At the end of the day, it's bad for everyone who loves Magic, and everyone who profits off it currently---let's not ruin a great thing with irresponsible speculation.

Another awesome article based on sound financial principles. Keep them coming!

Thanks Nick.

Great article and an interesting read! Especially the portions highlighting the pitfalls of buyouts and “pump-and-dumps.”

QS has a great group of intelligent, finance-minded individual, which makes up a portion of the larger Magic community. The information in this article was great, and highlights an important facet of the (current) Magic finance landscape. Always beneficial to have the reminder.

Having said that, it would be great to get this article/message out to the people that might really benefit from it. Perhaps those who are unfamiliar with the nuances of the Magic markets or recent buyout trends. Or better yet, those people actively participating in the buyouts and “pump-and-dumps.” Those are the individuals that NEED to read and understand the points brought up in this article.

Not to focus on doom and gloom, but to educate the Magic community. Any way we could get this message out to the masses? Make it available on the “free” side, maybe?

Just some thoughts. Thanks again for the great article and content!

100% agree with the above statement, make this a free article… the naive “investors” buying into the spikes are the ones that enable it to keep happening. I think the more educated people become, the less bandwagon-buyers will exist. And hopefully, the outcome will be fewer spikes on insignificant or obsolete cards. Nothing will prevent good cards from going up in value, but the 50-200% jumps overnight need to stop.

I have no issue with them moving it to the free side…I just don’t make the call.