Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various constructed formats, and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budget, risk tolerance and current portfolio before buying or selling any digital objects. Questions will be answered and can be sent via private message or posted in the article comments.

Redemption

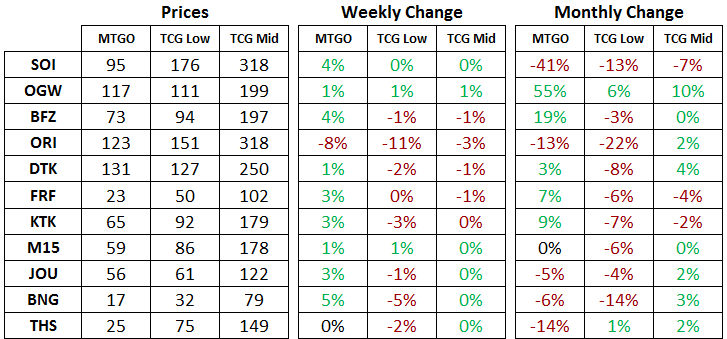

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of May 16th, 2016. The TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid price respectively. Note that sets of Theros (THS) are out of stock in the store, so this set is no longer redeemable.

All MTGO set prices this week are taken from Goatbot’s website, and all weekly changes are now calculated relative to Goatbot’s ‘Full Set’ prices from the previous week. All monthly changes are also relative to the previous month prices, taken from Goatbot’s website at that time. Occasionally ‘Full Set’ prices are not available, and so estimated set prices are used instead.

Flashback Draft of the Week

This week Time Spiral block draft finishes up with the addition of a booster pack of Future Sight. Keep your eye out for the high-priced rares from this set, such as Tarmogoyf, Grove of the Burnwillows and Horizon Canopy. This is still a pre-mythic rare set which means rares are harder to come by than they are today. Time Spiral block was not the most popular draft format either, so I wouldn't anticipate substantial price dips on Future Sight singles.

A reminder for the players: the complete block draft format adds the powerful Virulent Sliver to the sliver tribe. A 1/1 for G isn't much to look at, but it only takes 10 hits from this card to kill an opponent with poison counters, so it's almost like a 2/1 for G, which is decent and playable depending on the draft format. The fact that it also gives other slivers the ability to deliver poison counters pushes this card over the top. It's also a common that will routinely go around the table if you are the only sliver drafter.

An interesting note on the sliver deck from Time Spiral block: that was the strategy that propelled Chris Lachman and Jacob van Lunen to victory at Pro Tour San Diego in 2007, the first and only Two-Headed Giant Pro Tour event.

Legacy

There are now two significant events for speculators to focus on related to these formats. The first is the pending complete spoiler from Eternal Masters (EMA). The second is the just-announced Legacy Festival in July. Both of these will drive prices in different ways.

First of all, spoilers for EMA will begin on Monday, May 23rd and culminate with the complete spoiler by the end of the week. We know that Reserved List cards will not be reprinted, and we know that Force of Will and Wasteland will be reprinted. Beyond that, there is a lot of guessing!

For players holding playsets of Legacy- and Vintage-playable cards that might get reprinted, it's not worth trying to sell cards if they get spoiled. You will have to be very attentive and sitting at your computer to catch prices before they plummet. I think players are better off just holding onto the cards that they enjoy playing.

Speculators, on the other hand, should be considering reducing their holdings of cards that might be reprinted. For myself, I am not going to worry about it, and if Grove of the Burnwillows gets reprinted in EMA, so be it. The market portfolio will take a hit, but if history tells us anything, EMA will not be full of value. This means that a well-diversified portfolio will be able to bounce back quickly as it's unlikely that most of the portfolio suffers from reprint risk.

Next, the Legacy Festival is offering substantial prizes for players to play the Legacy format. This will drive interest in all Legacy-playable cards, so although we have to be a little wary of reprints, it's a good time to start looking for deals on Legacy cards. Most of the Reserved List cards have been rising in price since EMA was first spoiled, so looking elsewhere for potential opportunities is a good start.

Modern

Prices on Modern staples are recovering from their Shadows over Innistrad (SOI) release lows, but there are still plenty of cards on sale relative to their historical prices.

I put Blinkmoth Nexus into the portfolio this weekend, and I was fortunate to catch a key card from the winning Modern deck from the Magic Online Championship this past weekend. Infect had been largely off the radar since recent banned list changes in Modern, but it only took this one high-level finish to pump some life into the price of the Mirrodin Besieged rare. Check out the trade of the week for more on this card.

Standard

Prices firmed up for all redeemable sets this week except for Magic Origins (ORI). With Jace, Vryn's Prodigy // Jace, Telepath Unbound dropping down to 35 tix before rebounding to 40+, ORI isn't what it used to be! It's possible that the recent high prices for paper sets of ORI have encouraged box-cracking which has started having an impact on paper prices, which has then started filtering into MTGO prices.

The next six weeks will likely be the last best opportunity to move out of ORI cards before interest in Standard wanes due to the release of EMA. ORI will rotate out of Standard in the fall, but the selling window to get out of cards from this set at a decent price will be closing soon. A similar line of reasoning can be applied to Dragons of Tarkir (DTK).

Elsewhere in Standard, sets of SOI have been holding steady in the mid-90 tix range this week, but value is flowing to and from cards within the set. The performance of Nahiri, the Harbinger in Modern has catapulted that card into top spot for singles prices out of the set, knocking Archangel Avacyn // Avacyn, the Purifier under 20 tix for the first time.

Using Battle for Zendikar (BFZ) as a guide, we are months away from any buying opportunity on this set. Targeting junk rares and junk mythic rares that have some shot at play in Standard is the only viable speculative strategy right now from the new set.

Look for mythic rares priced below 0.2 tix and for rares priced at 0.01 tix or less. But remember, they have to have some chance at showing up in Standard otherwise they will just rot in your collection forever.

Geier Reach Bandit // Vildin-Pack Alpha is an example of a card price at 0.009 tix right now that I think has some potential to see play. If a Werewolf tribal deck gets support in Eldritch Moon, then this card will be tested. From Under the Floorboards seems like it could be playable in the right context, and it's almost fallen to junk prices.

Standard Boosters

It might be trite to say this, but before anything will go up in price, it first has to stop going down. When any price is in decline on MTGO, it means that more people would rather hold tix than hold the object in question. When prices stop going down, then the market is in balance. Sometimes prices stop going down only temporarily before resuming a downtrend, but with boosters the price range is usually well defined.

Checking in on the only boosters with potential for decent gains at the moment, that being Battle for Zendikar (BFZ) and Oath of the Gatewatch (OGW) boosters, it looks like BFZ and OGW boosters have stabilized at 3.3 tix and 2.2 tix respectively. Although BFZ boosters had been dropping about 0.1 tix per week, I am tentatively seeing that a bottom has formed at this price. OGW boosters bottomed at about 2.8 tix and an uptrend has been established.

Week to week, we'll have to confirm the continuation of the trend. For example, if BFZ boosters are at around 2.3 tix next week, this would confirm that a bottom has been put in place at 2.2 tix, and that an uptrend has started. Typically the uptrend continues until interest around a new set release starts to build, at which point the uptrend typically levels off.

With Eternal Masters (EMA) and then Eldritch Moon (EMN), there are two upcoming sets that could interrupt the ascent of these two boosters, however EMA is a premium product which quickly won't be providing a lot of value. Therefore the weeks prior to the release of EMN will be the short-term target for selling these boosters.

After that, there will be another window at the end of August before the hype starts building around the release of the new fall set, just announced as Kaladesh (KLD). When October rolls around, it will be correct to start accumulating SOI and EMN boosters, with an emphasis on EMN boosters since they will be structurally favored and in lower overall supply. For BFZ and OGW boosters, if they haven't peaked at 4 tix by December or January, that will be the ultimate selling window before rotation starts eating into the value of the booster contents.

Trade of the Week and Process

As usual, the portfolio is available at this link. There's always room to be scouting out for Modern staples that are out of favor, for whatever reason. Blinkmoth Nexus from Mirrodin Besieged is a great example. This card is played as a four-of in two different Modern archetypes: Affinity and Infect. The fact that Infect is also a legitimate deck in Legacy means that there will be some added upside heading into the Legacy festival.

My process for targeting and buying this card starts with the trends observable in the MTGGoldfish price charts. Since the release of Modern Masters 2 (MM2), Blinkmoth Nexus has seen a price range of 15 to 30 tix, with a brief spike to 35 to 40 tix during the window when the Eldrazi were running rampant in Modern. At around 18 tix, current prices are not far off from the bottom of the recent price range. This is a good signal that further downside, while possible, is limited.

Having identified that a staple of Modern was priced near its lows from the past year, I start looking at the various bots for their prices and available stock. Since this card is a small-set rare from a few years ago, supply is not that high and there are not many ads in the classifieds. I search the classifieds by entering "inkmoth nexus sell" and a few ads pop up, but most of them are selling at over 20 tix so I head to the regular bots I use next and check what they have available.

Goatbots has about five play sets, MTGOTraders has a similar amount listed on their website, and there is another five play sets on the various MTGOlibrary bots. All prices are around 18 tix, though there are some cheaper play sets on MTGOlibrary. With this information in hand my experience tells me that the market is not oversupplied at current prices. This is a judgment call, but it looks like another good signal for an entry point.

With the list of available supply in hand, I then buy a couple of play sets from MTGOlibrary and one play set from Goatbots. At this point, I am just dipping my toes into the market since I don't know for sure that prices won't be lower tomorrow. On Saturday night I put three play sets into the Market Report Portfolio at an average price of 17.8 tix, which is a little under the MTGOtraders price of 18.2 tix. Next I will check back on Sunday morning to see how things are going.

The next day, prices are listed at 16.2 tix on MTGGoldfish. Uh-oh! Was my judgment off? Did I buy in before prices had fully bottomed? Did I make a mistake? Who knows! All I know is that Blinkmoth Nexus will probably cycle back up to 25+ tix over the next year, and that buying in the 15 to 18 tix range will yield long-term gains. So, I scrounge a few more tix and head to MTGOtraders to add another play set.

But lo and behold, the price when interacting with the bots was 18 tix, the same as Saturday night. This type of discrepancy between the price listed at MTGGoldfish and the actual price crops up from time to time, so it's a good idea to always confirm prices before doing anything rash. This check confirmed that my timing had not been proven wrong yet.

Next, I recheck all the usual suspects, which also tells me that nothing has changed overnight. There are still some play sets available, but prices are a notch higher. However, another scan of the classifieds reveals a bot that was not listing Blinkmoth Nexus on Saturday night. The posted sell price was 16.55 tix and they indeed had a play set for sale which I happily scooped up. With four play sets in the portfolio and 280 tix committed to this trade, I am happy with what I have bought and will probably not buy more at this point.

The one real downside is the possibility of a poison theme emerging in Eternal Masters (EMA). I will be on the lookout for spoilers this week as getting reprinted as a rare in EMA will quickly lower the price of this Modern staple and I will have to be quick in order to get out of this trade with minimal losses.

If no reprint is pending, then I will happily wait until interest in Modern rises, and Affinity or Infect takes down a high-profile tournament and pushes the price back up to 25+ tix. The Legacy Festival could also drive buying interest.

Just wanted to point out there’s a big difference between poison and poisonous… i played a lot of slivers allready in the flashbackdrafts, and when I or my oponent had a virulent sliver out, never ever did it get to 10 counters, because if you manage to hit your oponent ten times you pretty sure allready won; in my opinion virelent sliver is by no means a high pick, unless you’re really eager for more slivers…

Yep! Poisonous does not equal infect, that’s for sure. And I agree, Virulent Sliver is not a high pick. It’s a sliver deck only card that you should expect to wheel.