Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Last week Wizards of the Coast dropped a massive announcement that could potentially disrupt the MTG finance game forever. Investing in Standard cards already became difficult when WOTC initiated the 18-month rotation schedule. It appears that wasn’t enough, and Standard cards were still deemed inaccessible:

“Through market research and social media, we learned that many of the players who were interested in playing Standard felt it was something beyond their reach. We had to find ways to address this.”

This quote came directly from the WOTC announcement that introduced the Masterpiece Series, their proposed solution.

These beautiful reprints will have a profound impact on the MTG finance community. I’m going to make sure my investment decisions incorporate what I anticipate this impact will be. This week I will provide a deep-dive assessment of how I think people will shift their resources in light of this news and how we should plan ahead to protect our investments in Magic.

Here’s the beauty of my strategy: if I’m wrong and this introduction doesn’t impact Standard prices, we basically have written documentation now that Wizards of the Coast will strive to improve accessibility. This is WOTC code for “make Standard cheaper.” So if it’s not Masterpieces that hurt Standard prices it’ll be something more.

Predicting Implications

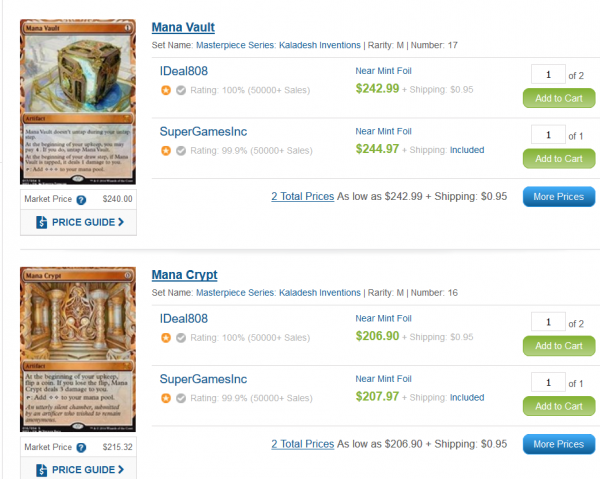

It appears two stores are brave enough to issue pre-orders at this early stage of the set’s cycle. Already there is an opportunity to open a pack of Kaladesh and pull $200 worth of value. We saw this same trend when Wizards released Expeditions within Battle for Zendikar and Oath of the Gatewatch.

By including these ultra-rare, expensive cards in packs, it funnels a lot of a set’s EV away from the usual rares and mythics and into these ultra-rare items. Wizards tested this strategy out with Battle for Zendikar and Oath of the Gatewatch and the result was profound. Because you can open a $100 Wasteland in a pack of Oath, you have a situation where there are only two non-Expedition cards in the set worth over $10.

That’s it. Two. Even some of the most popular cards in the set, such as Thought-Knot Seer and Nissa, Voice of Zendikar, are worth far less. Despite the set’s utility in Standard play, there just isn’t enough room for many expensive cards thanks to the Expeditions.

The situation with Battle for Zendikar is even worse. In that set you can open multiple $150+ cards because of the blue fetches. Also being a large set, the value is simply spread extremely thin. Again there are only two cards worth over $10, with the most valuable being a mythic under $18.

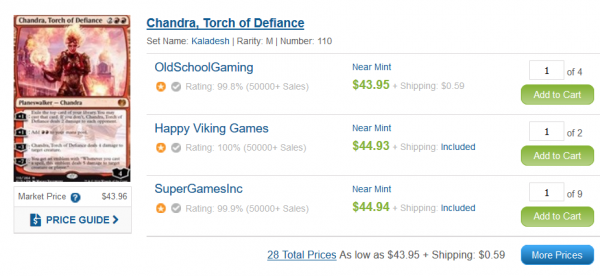

Now let’s fast forward to Kaladesh. Preorders are in high gear now, so we can start to see where the market is willing to value cards from this set. Overly optimistic is the only way I can describe what I see. There are four cards pre-selling for over $10, with the most valuable card of the set pre-selling in the $44 range.

I know I know---Chandra, Torch of Defiance is supposed to be the next coming of Jace, the Mind Sculptor. I don’t really care if she is. Worldwake was a small set overshadowed by Zendikar and it sold during the Great Recession. As such, very little of that set was printed and opened, as evidenced by its current booster box retail price of nearly $800.

Today the Standard MTG finance landscape is extremely different, and the Masterpiece Series is only going to apply more downward pressure on prices. Net, I think it will be virtually impossible for Chandra to maintain a $40+ price tag once enough Kaladesh is opened. In fact, I feel the same way about all the cards in the set. They’re all pre-selling for far too much relative to what Battle for Zendikar prices are now.

Where to Play

Based on my dire assessment, one may ask if I believe Standard speculation and investing is altogether dead. Not quite.

The way I used to invest in Standard is likely dead though. My strategy used to be fairly straightforward and easy to reapply set after set: buy the mana-fixing lands of each set at their low and sell a few months afterwards at their high. This plan marginally worked with the recent creature lands.

Hissing Quagmire gave me a nice double up. But here’s the problem: I didn’t only buy Hissing Quagmires. I also bought Wandering Fumaroles and Needle Spiress along with a smattering of Lumbering Falls. These other creature lands did see some play in Standard, but their bounce was barely measurable, netting me losses across the board.

Clearly money can still be made, however. Anyone who bought solely Hissing Quagmire could have done very well. Same with folks who bought Chandra, Flamecaller at its low and sold at the high. But here’s the problem: I am not a Standard expert. Therefore, I don’t have line of sight to the cards most likely to be played at rotation, for example. Because I don’t follow the format closely anymore, I am not really qualified to be buying heavily into newly printed cards.

But to be successful with Standard speculation nowadays, you have to be. You have to be able to identify the one or two cards that are undervalued with potential to pop. Then you have to put your money to work in your pick before anyone else decides to. Lastly, you need to sell immediately into any spike because elevated prices in the new Standard environment seem to last for a very short period of time.

This is not something I am interested in pursuing. So for me, Standard speculation is dead.

But this doesn’t mean speculation in MTG is an extinct species---far from it. I believe this will simply shift others’ focus to new areas to put their money to work. At least, that’s my own strategy. Why would I ever want to mess around with Standard when I know I can buy something like Beta Royal Assassin and then sit patiently while the card continues to evaporate from the open market over time?

I can’t help but beat the same drum yet again here, and the recent introduction of the Masterpiece Series only underscores the criticality of what I say. Not only is Wizards actively trying to reduce Standard prices, they’re also doing so by reprinting older cards again and again! It’s the perfect way for them to sell more packs and improve accessibility to Magic.

Naturally this comes at the sacrifice of the MTG speculators, who will see some of their collection depreciate as a result. But when parking resources in stuff that can’t be reprinted or won’t be impacted upon reprint, all of this downside risk is removed from the equation.

And given recent performance in this older stuff lately, it’s not like you have to give up a chance at exciting returns for this safety. These aren’t your typical blue chips like a Disney stock would be, where there are still some bumps in the road. We’re talking about exciting growth potential and minimal downside risk. What more could you want?

Wrapping It Up

Again with the Reserved List and Old School writing? Absolutely. I believe the newest developments in Standard calls for this avid reminder. Can money still be made with Standard speculation? Of course, that will never change because the format is very dynamic. But the difficulty level was just turned up from six or seven to nine. In other words, only the most in-touch and agile speculators will be able to profit handily from new sets.

I’m not one of those people.

Therefore, I recognize I need to confine my speculation and investing to other areas. I may always keep Modern in the corner of my eye watching for obvious opportunities---the format evolves more quickly than Legacy, but it’s not under constant rotation pressures like Standard. So there is some room to buy and hold certain targets. I just have to watch out for reprints in the form of Modern Masters sets.

But the occasional Modern speculation aside (I still like Phyrexian Unlife by the way), I will continue to focus my resources in cards where I don’t have to follow metagames closely or risk reprint threats. To me, it’s the most obvious place to park resources for the long haul. If I also want to reduce the amount of time this hobby demands, picking up some Reserved List cards to sit on for twelve to eighteen months can be the perfect way to stay “in the game” of MTG finance.

Given my current life dynamic, this is exactly what I need right now.

…

Sigbits

- A while ago I listed Wheel of Fortune as a Reserved List target worth acquiring for the long term. This prediction has come to fruition faster than I anticipated. Now we’re in an environment where Star City Games is completely sold out of Alpha, Beta, Unlimited, and Revised copies completely. The cheapest price is $34.99 for those Revised copies, but even this price is likely to rise given the recent pricing performance of the red sorcery.

- Star City Games remains completely sold out of Alpha and Beta Hypnotic Specter. This comes as no surprise given the popularity of the card in Old School. What does surprise me is their climbing prices: Alpha copies are sold out at $129.99 and Beta copies at $79.99. You know what? I think these can climb even higher.

- Now I want to call out something negative: check out Star City’s stock of Force of Will. For a while it looked like this card could overcome the reprinting in Eternal Masters, but this resistance is finally failing. Star City has 85 total Alliances copies of the card in stock ranging from $72.99 to $99.99 depending on condition. They even have over 30 EMA copies in stock with a $109.99 price tag. Honestly, unless Legacy sees a massive renaissance, I’m not sure if there’s a path for this card to climb in price over any short-term time horizon. Eventually copies will dry up, but this just goes to show you the risk of speculating on Legacy stuff not on the Reserved List. For an even more bleak example, just look at Show and Tell’s price chart.

The fact you have to twice call yourself out as banging the same drum means you know what everyone is thinking, I like your writing Sig but if all you have to offer is as an old school speculator on cards that are much higher buy in I don’t see the longevity of writing financial pieces…..

Appreciate the feedback. If you’re thinking it then chances are others are feeling the same way. But if no one says anything, I’d never know! 🙂

I tried writing about Commander decks last week and I received no comments. I’m always open to some suggestions on other topics on people’s minds, if you have some recommendations.

Ok I will try and be more specific. I actually don’t mind if your article is how to maximize your returns by buying these specific old school cards, these will spike, opportunities to be made etc. Condition impact, decks it can go in.

But writing about other topics and then finishing off with so that means its best to invest in old school seems pointless. Just commit to old school articles but make them all these are specs we can all try and get in on before anyone else and why and I think I will enjoy them more and get more relevant financial actionable takeaways