Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Picture this:

You pay $75 to participate in a massive Monopoly tournament, where the grand prize for winning is $5,000. Midway through the tournament the top players have a significant amount of Monopoly money, such that even landing on some of the most heavily reinforced spaces barely puts a dent in your budget. Meanwhile those on the verge of bankruptcy can barely watch as they roll the dice each turn. Then the unexpected happens.

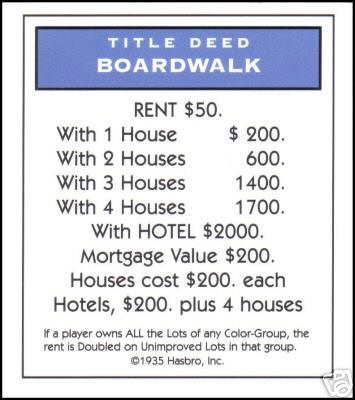

Someone breaks the rules of the game and offers real money when they land on that Boardwalk with a hotel on it—not $2,000 mind you, but maybe $10 of real money. After all, in doing so they can remain in the tournament and try to bounce back from near-defeat. The other player accepts the offer and real money is exchanged.

Suddenly everyone is considering both Monopoly money and real money for each transaction the game demands. The value of the Monopoly money rapidly drops—players demand large premiums above what the cards require if a player wishes to pay with Monopoly money rather than real U.S. dollars. The economy becomes unbalanced as the demand for real dollars far outweighs that of Monopoly money, and ultimately the game collapses.

The Parallel to Magic

Obviously the above scenario won’t ever happen. For one, there is no such thing as a Monopoly tournament…at least, not one with the payout I described above. Additionally Monopoly is a self-contained economy per the rules of the game. But if Monopoly money and real money could be interchanged, the resulting economy would drive massive inflation for the Monopoly money because it loses all value once the game ends.

Let me try to draw out how this scenario could parallel Magic: the Gathering. Consider that pieces of cardboard are like Monopoly money. The cards are necessary to win games and therefore have immense value within the game. But outside of playing Magic, the value is far less. Sure, there is a collectible aspect that Monopoly lacks, but let’s put that aside for a moment and assume a significant portion of card value is determined by playability.

As we all know, the Monopoly money of Magic, meaning the cards, can be interchanged for real dollars. This is a two-way street because as long as players require the cards to win games, they will be willing to give up real dollars to acquire these cards. But what happens if more cards are printed, introducing more inflation in the game? Suddenly there are more cards in the economy of the game, but the cards become worth less relative to the U.S. dollar. Simple enough.

But if the lower-end cards become worth less relative to the U.S. dollar, then they can’t be as easily traded towards higher-end cards. This interferes with the flow upward of card values within the Magic economy. Four Snapcaster Mages can no longer be traded for a Library of Alexandria as was once possible.

So for someone who wants to acquire a Library of Alexandria, they have two choices. They can either trade more than the equivalent of four Snapcaster Mages—maybe ten copies instead, or perhaps throwing in a couple of Tarmogoyfs—or they can pay with real dollars. With the former they end up forfeiting more critical game pieces, and in the latter they need to forfeit real dollars, which could have been used for other things in life.

Here’s the Problem

While lower-end cards (Standard, Modern, et.al.) were rising in price and offered significant value, there was no difficulty making trades for higher-end cards. Standard could be turned into Modern, Modern into Legacy, and Legacy into Vintage over time. But something has changed. Hasbro has altered their strategy to grow sales of product by introducing Masterpieces, Modern Masters sets, and an array of other reprint products.

This act is lowering the bottom rungs of the MTG ladder, making it more and more difficult to reach to the upper rungs. Suddenly, many people are becoming priced out of Legacy and Vintage because their collection values are shrinking. The only option becomes paying up with real dollars, but it is very difficult to stomach an outlay of hundreds or thousands of dollars for a couple pieces of cardboard.

When everyone was using “Monopoly money,” people didn’t give this as much thought. Sure, you were giving up “$600” by trading that set of Tarmogoyfs for a played Mox Ruby, but it was a cardboard-for-cardboard transaction. Or maybe you buylisted the cards to a vendor, took the store credit, and picked up that Timetwister you’ve been wanting for Commander. The economy was self-contained, so this wasn’t an issue.

With many price trends drifting downward lately, these trade-up transactions may be occurring less frequently. To me, this poses a major problem for high-end cards. They will end up becoming less liquid because the market cannot afford them with “Monopoly money” and they will not want to pay up using real dollars as often. This may cause Power prices to remain stagnant at best or even drop at the worst. I genuinely believe this is a real possibility now.

And if a few owners of Power decide they don’t want that “Monopoly money” any more and insist on cash, they may be willing to sell at a slightly lower price. It may be slow, but the market will adjust lower. It has to.

A Reality Check

As someone who collects Magic cards as an investment, I have one fear when it comes to positions in these cards. This fear dictates all of my recent transactions, including a concentration of value in Reserved List cards that cannot be reprinted. But even that strategy won’t make me immune to this: a retraction in the MTG market.

There are already signs that this is happening. I haven’t changed the people I follow on Twitter, yet instead of hearing about card prices and trends, I am reading more and more about Hearthstone, Pokémon, and even political movements. It seems many are already finding other avenues to spend time (and money) on outside of Magic. One look at the top spectated games on Twitch further reinforces Magic’s lagging position.

Then you have Wizards of the Coast releasing nonstop sets. The market flooding of new products keeps prices down and suppresses demand for anything other than the newest and shiniest product. Add in Star City Games’s and WotC’s dwindling support of non-rotating formats and you have a recipe for a stagnating market.

So now there are no new players, Standard is inexpensive and Modern is getting cheaper, and there are far fewer opportunities to enjoy Legacy and Vintage. What does it all mean? Less demand for high-end cards.

So let me ask the question this way: would you rather have an Unlimited Black Lotus or a family vacation? An Ancestral Recall or a mortgage payment? A Mox Sapphire or a year’s worth of college textbooks? When we were looking at Magic cards as “Monopoly money,” we didn’t really consider these options. Now that real dollars need to be involved more frequently, however, I think this begs the question: are we making the right choice?

Every day I choose to keep my Black Lotus I am simultaneously choosing not to remodel my bathroom’s shower stall (true story). This used to be a subconscious decision I was making, but should it be? Perhaps not.

Perhaps going forward, we should be considering opportunity costs a bit more seriously. In a world where the Monopoly money of the game of Magic is depreciating, we need to truly consider if we’d be better of with “real money.”

Put another way, I will feel incredibly stupid for sitting on all these Magic cards at these valuations for the foreseeable future only to watch their value steadily decline. Since I don’t play Magic much these days, I’d probably be fine swapping out a piece of Power for home repairs or mortgage payments (or in my case, college tuition savings). I won’t be fine to watch that opportunity escape my grasp if card values drop.

Wrapping It Up

This article has tended to ramble a bit, and for this I apologize. If there seems to be some hesitation in the paragraphs above, this is simply because I am struggling with this decision and you’re picking up on that. Magic is a game—and one day the game may end. If that happens collectibility will certainly keep some values afloat, but overall a collection’s worth will be much lower than it is today.

Current trends in Magic are starting to worry me. There’s more and more supply of cards in the system, increasing the gap between Standard/Modern pricing and Legacy/Vintage. As this gap widens, players will be unable to use their “Monopoly money” for Power and other high-end staples. Instead they’ll have to use cash. Will these players choose to spend that cash on Magic cards? Or will they choose other real-world applications? Trends may slowly drift from the former to the latter.

I, for one, know my spouse doesn’t care much if I trade a bunch of cards into a vendor for store credit so I can purchase a $1,000 card. But if I told her I was spending $1,000 new dollars on a Magic card, she’d certainly express her reservations. And now, without a prospect of decent price appreciation on the horizon, I can’t even build a compelling case to do so.

Maybe it’s time I start considering that opportunity cost. Maybe we’ve gotten to a point where investing in mutual funds can yield better returns than a Time Walk. Maybe. I need to think on this further—I’ll be sure to share my thought process through this journey, and I hope you will all share your thoughts in the comments below as well. We’re all in this together, so let’s work together to make sure we are maximizing value as best as we can from our collections.

…

Sigbits

- Old School cards continue to be a pocket of strength in a decaying market. For example, Hypnotic Specter remains one of the cornerstones of black strategies in the format. Therefore it’s no surprise to see Star City Games sold out of Alpha and Beta copies ($129.99 and $79.99 respectively).

- Another bull market in Magic is the casual market. Here, you need to be cautious about reprints. But dodge them for long enough and you have some real upside potential. Consider Time Warp for example. The card is $18-$19 now, depending on the set it’s from. When was the last time Time Warp was so expensive? Perhaps when it was first printed in Tempest?

- It looks like Mirror Gallery is hitting all-time highs lately. Once again, a casual card from an older set with a unique ability is the perfect recipe for profits. That is, as long as you can dodge that reprint. Star City has a handful of played copies in stock in the $4-$5 range, but that may not last if demand sustains.

http://monopoly-championship-history.wikia.com/wi…

The link didn’t work for me, but I assume you’re showing me a Monopoly tournament with big payout. 😛

Great article as always. The more I read your stuff the more I understand the struggle you are going through with the decisions in front of you. To me, it sounds like there is some intrinsic value resting in some of the cards you’ve mentioned, presumably because there is pride associated to having built a fantastic collection over the years (and rightfully so you should be proud).

As someone in a seemingly similar age group with similar choices in front of me, I will offer you these pieces of advice I have been reminding myself everyday:

1. Remember your priorities in life: with kids, a wife, a house, etc. you have entered that time of life where there are others who rely on you for financial stability (I am in this boat, too, and it definitely makes Magic take a backseat).

2. Exiting now doesn’t prohibit re-entry later: if you sell pieces of your Magic portfolio there is always the prospect of re entering later when it makes sense. If we truly are in a downturn there is no reason not to take gains while they still can be had and move back in on older cards once they bottom out.

3. Tangible money is almost always more valuable than material goods (with some obvious exceptions that don’t apply to Magic): if your financial situation requires the extra $5,000 from your Black Lotus, or even small chunks of cash in the form of a Mox, Tabernacle, or a complete set of Beta commons and uncommons, I strongly advise taking the money and run. There is no denying the Magic bubble has popped or is popping in the secondary market. Your analysis in the article on trading up into Power is very true and accurate, and should continue to see more disparity over the next few years as reprints continue to flood in.

However, you must remember that our collections are more valuable now than they were two years ago, and that substantial gains are available for the taking. Constant growth year-over-year is always unsustainable, let alone at the rates we were seeing spikes in cards since 2014 (give or take).

4. My last point is simple: don’t let intrinsic or sentimental value cloud your judgment on making the right financial choices for you and your family. Regardless of situation, it would be a smart financial decision right now to cash in on the gains witnessed over the past three years, taking money out of the “Magic investment community” and putting it into real Securities. Dividend stocks are great right now because they’re getting beaten up due to the threat of interest rates climbing. Similarly, there are plenty of cash cow stocks that may not give you tons of growth but will be steady cash providers for years to come (Apple, AT&T, Bank of America, Wal-Mart, and Cisco all come to mind for me).

I have personally recommitted most of my savings to these types of stocks along with growth stocks to diversify. There are plenty of ways to have your money work for you, but right now Magic is not one of those. Realistically, it was farfetched for us to think we could make significant money on Magic forever. It’s an unprotected security that most insurance companies won’t even cover on their Scheduled Personal Property clauses… Magic is a game, a hobby, and a pasttime first and always has been. The collectibility is what makes it so appealing, but the financial side is no longer as attractive as it was just a few months ago.

Christopher,

First off, let me applaud you for the well-written comment. I must say that you and I agree on your points 100%. I don’t even think I could have put it better myself! I’ll try to share a few quick thoughts:

1) I am impressed by how similar we really are. In fact, I have been involved with all the stocks you specifically called out except for Wal-Mart. I am out of Apple right now (Sold at 115) but would be happy to get back in on a sell-off. I still own AT&T and BAC, though I just recently sold all my CSCO stock for a healthy profit. I may get back in at some point, but the recent earnings call didn’t impress me, so I feel like I have time to buy into that one if I really want to. I do really like Nike here, though, being so close to 52 week lows.

2)I am also head out household from a financial standpoint, so all your points about selling now, taking profits are very valid. It’s exactly why I’m considering a move out of MTG and into stocks for the long haul.

3) You’re also right in observing that I do have emotional attachment to my collection. This is especially true for my Vintage deck, which I just now completed this year after 19 years of playing Magic. That said, I am hoping I can find some good offers at GP Louisville and that the temptation of cold hard cash will help me overcome emotional attachment.

I’ll wrap up with a question. Do you think this is truly the “peak” for Magic? This is ultimately the question I’m seeking to answer, and at this point I think it’s too early to call.

Thank you again – we should talk more sometime. Send me a PM on Facebook or Twitter if you’re interested in expanding the discussion 1:1.

Sig

For a very long time it was all but impossible to trade 4 recent rares for a high end card such as a Library, especially if those rares were not the top cards in the set. When Snapcaster got older the playerbase increased and thus with that its relative rarity while it remained very popular. Library’s relative rarity also increased, but it makes sense that such rare cards are slower to respond to that as new people just don’t see them around and just don’t know it exists. As such the window appeared in which we could get a library for 4 Snapcasters if we were quick enough and knew about the possibility. Ultimately Library’s price adjusted too. The current state of having to trade 10 is more like the rule, not the exception. Looking at this window as being normal reinforces your view on the current state of Magic, but if you look at a far longer period, say the 19 years I’ve been trading, we’re simply back to normal.

A common argument I hear against trying Magic from my many friends who are avid tabletop gamers is the cost. Wizards lowering the rungs mean more people feel capable of playing the game without having to spend a lot. It’s fine if the vast majority of these new people will never be able to play Legacy or Vintage, it’s always been difficult to reach this high, it’s just not meant for everybody.

The question is not whether new players will be able to reach the high end cards, but whether enough people decide to keep the ones they have and whether there is enough demand for those that remain in or return to circulation. Given their rarity you only need very few people to want to own and keep a Lotus. Magic players age and reach the point that they can afford to obtain a Lotus and then decide to keep it, which means one more will be off the market for a time. With people continuously reaching the point that they could afford a Lotus and some of those people slowly taking them off the market while others slowly decide to add theirs to the market the question is whether there is more demand or supply and given how buylist has long been roughly stable we’ve apparently reached an equilibrium state. I could certainly imagine prices lowering when more people sell, but that will also encourage more people to buy as they suddenly reach the point that they can afford one quicker. I honestly can’t predict with certainly how this will end up balancing out in the near future, but over the long haul I am counting on the steady upward trend the card has always shown that relates to more people wanting it than there are people selling it.

I have not changed my Twitter either, I have mostly seen a lot of extra discussion on Trump. I have barely seen those other games come by. You may have perhaps chosen to follow people who think the same way you do, but to what extend are they representative of Magic as a whole?

Personally I don’t have trouble getting Monopoly money together and I even do it with bulk, but I do realize that that’s not for everyone.

pi,

You take a very long-term view, and I certainly respect your opinion wholeheartedly. None of us can predict the future that far out. Here’s what I’ll say: Magic has seen phenomenal growth over the past 20 years. I don’t think this growth can sustain over the next 20 years. Therefore, the returns on MTG investments over the next 20 years probably won’t be as favorable as they had been previously. Therefore, it may be a good time to take a pause, reassess priorities, and reallocate some funds into better investments. I think you and I can agree on this, principally.

Where we differ is in our outlooks going forward and the potential for “disaster”. I’m of the camp that a lot of Power and higher end cards are owned by a select few individuals and companies. If a few of those people decide it’s time to do something else with those resources, the market could suffer measurably. With the rungs between Standard/Modern and Vintage growing further and further apart, I also believe entrants into Vintage will slow down dramatically. It’s just harder to justify $10k for a Vintage deck when you can’t trade up at least a portion of the way. This decline in demand, along with the perpetual risk of a spike in supply, truly has me concerned.

I guess I can’t predict with the Dan Bocks of the world will do – I can only control my own choices. Rather than let my collection’s value be dictated by what a few market movers decide, I’m inclined to reduce risk by cutting exposure now. 20 years from now if Magic is obsoleted by other games, I’m not sure what Dan Bock is going to do with 50 Black Loti but if it were me, I would prefer to have real cash at that point.

It’s a tough situation, that’s for sure!

Thanks for commenting,

Sig

I can in principal agree that it might be a good time to reassess priorities. I think any time might be.

I’m not sure why it would be important to see the same phenomenal growth in the next 20 years? Isn’t a card a great investment simply when it outperforms other investment possibilities?

Assuming you’re right regarding the distribution of Power those people are in a Mexican standoff. None of them would want to sell enough to crash the market because the others will panic sell too and none of them would get as much as they would like. I’m sure these people are in touch and would coordinate if one of them would want to get out. Likely if one does it would be at a slow pace as to not kill the value.

I disagree with you when it comes to the growing distance between Standard/Modern on one side and Vintage on the other. There are assumed to be about 20k Loti. This number is not changing (except for likely insignificant losses to outside causes). Naturally as the playerbase has increased so has the relative rarity of the Lotus. We simply need demand for 20k copies and we now need it from a bigger playerbase while many are already in the hands of people who play Vintage or who collect and who both tend to keep theirs. Vintage simply can’t grow: to enter into Vintage is to push someone out. More and more end up with long term holders so Vintage growth becomes harder and harder. I’ve never played a Vintage game in my life, yet I own a Lotus and intend to hold. People like me aren’t common, but with only 20k copies to go around and far fewer on the market you don’t need many either.

Over the past 5 years I have managed to trade for a set of Power (except the Emerald that I got in a collection, but I could manage to trade for one if need be). If I can do it so can others. I’ve also traded for many other high end staples during the same time and I could now put together any Vintage deck after trading for a few newer cards. Yes, in the past a larger percentage of the playerbase was able to do the same, but with supply reducing due to long term holders and the player base growing you would expect this percentage to drop correspondingly as it’s simply impossible not to.

I believe the people with large holds are smart enough to try to avoid crashing the market when they do decide to get out, not because they care for the market after they are gone but simply because it increases the total amount of cash they can get out.

This is not to say that it cannot possibly be wise to get out. There’s always a risk of outside influences and there are outside factors from your life to consider too. Whatever we decide to do I hope neither of us will regret it later.

Hi Sig,

I’d like to reinforce a couple of the points Pi makes, as I think they’re quite relevant:

1. Your concerns about the privileged few who hold a large percentage of the power dumping their supply may be overextended. As mentioned, not only do these individuals put themselves into a Mexican standoff, but they also shrewdly await opportunities to acquire.

Because they’re nearly in their own market segment, should one of these groups choose to firesell, I don’t see a domino affect. Rather, I see Power then being concentrated among even fewer Diamond-level collectors/merchants, as the remaining ones will scramble to pick up the flooded copies at as low a cost as possible.

I see Power being viewed as modern pieces of art. Samples of craftsmanship from the beginning stages of the gaming era boom. As such, there will always be demand, and the fewer people that own these…the higher their price will be. If Renoir’s work was held only by a handful of art collector’s, they would be nearly impossible to obtain by even the wealthiest of collectors.

Not apples to apples I know, but you can see the analogy.

2. Pi’s final comment is the most important. Anything could potentially happen here (especially short-term), and you should always prioritize what matters most. If that is your family, there is nothing wrong with cashing out, collecting gains, and reinvesting at another time. Frankly, if we truly are riding a downward slope, that could be the optimal financial decision because your future buy-in could be at all-time lows.

While your collection provides emotional joy…so do other things in your life. Perhaps it’s time to slowly liquidate, invest in those other areas that are meaningful, and return to Magic in the future.

Tarkan,

Appreciate the perspective. I still worry about market manipulation when it comes to Power prices. At this point in time, the behavior is supportive of Power investing but can that sustain forever? Once the cooperation breaks down, we could enter a true bubble pop. I like the analogy with artwork, actually, but does Dan Bock really need 50 Renoirs? Seems excessive. It would be like someone hoarding all the Van Goghs or something – I guess the pieces could remain with the family forever, but it seems like EVENTUALLY selling some is inevitable.

Otherwise you’re painting a picture where Dan Bock passes down his Black Loti to his kids, and they pass down, and so on. I just don’t know if MTG has that kind of staying power. What do you think?

Sig

Personally, as a speculator, I welcome all of this extreme chicken little, the sky is falling mentality. This game has been around for 20 years. Every market goes through downturns. The smartphone market is at near saturation levels considering pretty much everyone has one. Yet apple still has more cash on hand then most countries. Do you think Apple will all of a sudden go out of business? I think not. This mass hysteria is providing the best opportunity in years to make returns because I am able to buy collections at rock bottom prices and make excellent profits. So by all means keep panicking

A couple quick comments in response to your comment, though not sure I can do it justice. You always present very well-thought advice and perspective.

You hinted at some collusion between all the big names of the game – the “Diamond” investors, as some have put it. Wouldn’t this alone be a red flag that suggests we should think about selling immediately? You are essentially claiming market manipulation, in a market which we are just pawns. Why should I be OK with allowing these few people to dramatically impact the value of my MTG portfolio?

Before you parade how easy it is to trade up to Power, think about the amount of time you’ve spent to achieve this. Then compare your lifestyle with someone who is married and has kids, who may not have the same free time available to invest in MTG trading. Honestly outside of GP’s, I’ve never been able to trade into Power. I had to use buy lists and cash to get most of my pieces, and even this took more time than my spouse would have liked ;-). What’s more, this trade-up will be getting harder and harder as the value of the monopoly money decreases relative to cash.

All that said, you do bring up some points I’ll think more on. I haven’t sold anything out of my decks just yet!

Thanks,

Sig

As for the ease of doing this: it’s not easy at all, my main point though is that it doesn’t need to be because there are only 20k Loti around on 20m players.

In a rush now, will check back for the rest later.

I’m not sure why Diamond investors is a problem? If anything the more they hold the smaller the incentive they have for dropping a lot on the market because that just doesn’t get them the maximum value. If anything they are more likely to slowly put them out, carefully making sure to at most meet demand at any given time.

I did not mean to parade, I just tend to try to be complete. I know the effort required is beyond most, but, we only need 1 in 1000 players to be able and willing to put in that effort (or 1 in 2000 if we are looking for an average of 2 each; don’t forget stores having multiple beyond big collectors, I also know some smaller collectors who have 2 Loti). Incidentally, you traded me a Jet, so you know exactly how easy it was for me ;-).

Diamond Investors are a concern of mine because history shows that cornering a market is extremely difficult and often unsustainable. From Wikipedia: Although there have been many attempts to corner markets by massive purchases in everything from tin to cattle, to date very few of these attempts have ever succeeded; instead, most of these attempted corners have tended to break themselves spontaneously.”

So the more concentrated Power becomes, the more I worry about a bubble popping – it’s a precarious situation with a lot of risk to mess around with market cornering.

What your quote doesn’t say is what it means to corner a market: does Dan really have the market cornered if he has 50 out of 20k Loti? I don’t believe anybody has the market cornered to the extend referred to by the quote, but possibly I am wrong?

Dan Bock could crash the market on power by himself if he ever gets a need or want to. Last I heard he has… 50+ lotus? Where the hell would he out those without tanking prices?

There could be a short term crash, yes, but I’m quite confident other collector’s/vendors would quickly swoop in to gobble them all up.

It doesn’t serve the Dan Bock’s of the world’s interests to firesell. But even if one did, another would arrive to collect the spoils of war.

If people are colluding now to keep prices high, what’s to stop them from colluding to crash the market as well?

What’s the benefit in crashing a market when you are holding assets from that market?

Consider if one day WOTC announces they are making an exception to the RL to try and sell more product. Those cornering the market may decide that’s the “last straw” and start to sell. We can’t predict the future, but we are relying on everything to remain unchanged as long as we remain invested in a cornered good.

Heck, someone with tons of Power may have a medical emergency all of a sudden and have no choice but to sell, driving prices lower and inciting fear in others with large exposure. The bubbly behavior here is extremely risky.

If Wizards makes an exception to the RL everything is going to break, in full agreement with you on that. I expect that many people will panic sell their RL cards fearing a price crash and in the process causing that crash. Even worse, it shows that Wizards can’t be expected to keep a promise, causing further instability even in the market.

What does it mean to have a market cornered? How large must your share of the market be to do that? Wikipedia says to have the greatest share, but also to have sufficient control to manipulate prices. I don’t think the former is reached by the people you are referring to as they don’t own 10k Loti taken together. The latter may be reached, but if anything the price would be manipulated upward as that’s to the benefit of these people.

Yes, outside reasons can cause someone to sell, but nobody owns a large enough share by themselves and likely the remaining people with tons of Power will want to gobble up whatever is sold to keep prices like they are. Only if many of them get into a situation like this would it have an impact. This is exactly the case when the RL would be abolished.

I trust in Wizards promise to keep the RL. Fair enough if you don’t, but lets not distract from this discussion by a discussion on that (I will not be convinced in any case).

Btw, I like the Monopoly analogy. I have actually offered drinks as incentive beyond game resources in other tabletop games.

Hehe so the idea isn’t so farfetched then? That’s good to hear 🙂

No, not at all for the right game. There’s a particular game event at the youthclub here that would have you talk with people in character to solve some quest. Bringing whiskey always made it much easier to get the right information from them.

Just wanted to say that I echo your sentiments, at least as far as modern is concerned, and leaning towards modern / legacy staples that can also be reprinted. With the rate at which reprints occur, I don’t find it sustainable to have any kind of stock / specs at all for any period of time when at any second a masterpiece, straight reprint, or functional reprint will crash a price before it can rise. I honestly feel like the day of the speculator is nearing its end aside from quick spikes in standard between / right after competitive tournaments. I feel that WotC / Hasbro has taken the position of reprint all that you can as fast as you can to make as much money as you can. We’ve already seen the way this shortsightedness hurt standard w / the set rotations that they’ve now gone back on, it’s only a matter of time before pre-cons of the most popular decks in modern / legacy get released, either in a boxed set or individually, that will spell the end of the first “C” of CCG. Imagine how much $$$ hasbro can make if instead of a cycle of commander decks, they did a cycle of modern decks… the number signs would flash in their greedy little eyes as they trade in long term growth for short term gains. I don’t even consider this an “IF” statement… I consider it a “WHEN” statement. It’s took much money left on the table to NOT make a duel deck of “Legacy Infect vs Modern Naya Burn” or however they try to position it. I’ve also been thinking that there will come a time when they print an entire CUBE and bypass their reserved list by changing the card backs or something, making them “not tournament legal”, but functional enough that the (already non-existent) need to ever buy P9 will cease to exist. There’s already almost NO support for non-rotating formats because the key is they don’t make product sell, it’s all secondary market.

Doom and Gloom from my standpoint because wotc / hasbro has already shown they intend to do all that is necessary to push product sales w / things like expeditions / masterpieces which as you indicated depresses the value of the originals.

(Sorry for the long babbling comment I’m trying to write this between my calls at work… and I work for a bank so things aren’t exactly all the greatest w / int rate uncertainty right now either after that election…)

Sounds like you are already on the “sell now” wagon, which I certainly respect. Do you think that even the most iconic cards get reprinted and lose value as well? I certainly have no interest in owning any cards off the RL unless they’re Alpha/Beta/Unlimited copies for Old School, but are you suggesting I take it one step further and sell out of everything?? That’s a bold claim, and contrary to what others are posting here. Not looking to start an argument, but a healthy debate of both sides would be very helpful.

Also, I would think you’d be singing and dancing now with bank stocks on a tear lately?

What I will find interesting (and case in point your article) is what will happen when OTHER people also start to think like we are and exit their positions as well. THAT’S when the REAL “race to the bottom starts”, so my new “position” is be at the front of the pack when the selling starts so that by the time the markets have caught up (aka crashed) I’ll have already liquidated all of my positions. Call me chicken little, but I’ve already started liquidating…

I’m not going to call you chicken little since that’s my usual nickname here. I definitely understand :).