Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerance and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

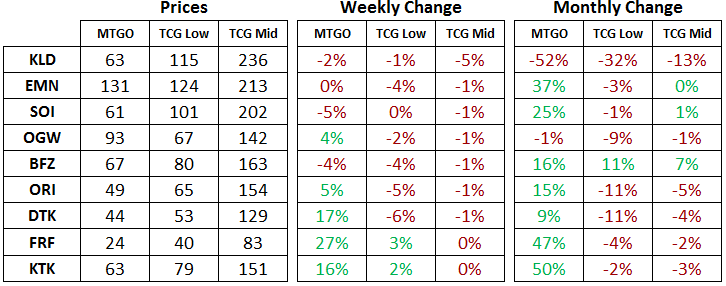

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of November 14, 2016. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead.

Flashback Draft of the Week

This week, the flashback draft queues feature Avacyn Restored (AVR), a large set expansion to finish off the first Innistrad block. Here's Paulo Vitor Dama Da Rosa's take on the format. It's generally considered a big step backwards in terms of draft format quality, so its safe to expect a quiet queue.

Although there are no top commons or uncommons in this set, the most expensive card is the rare Cavern of Souls, which weighs in at over 30 tix. This multi-format staple is ripe for a reprinting in Modern Masters 2017, so don't be stuck holding this one too long if you take a position in this card.

Another rare which hasn't seen much fanfare in Modern lately is Restoration Angel. With the current speed of the format, a four-CMC creature that can provide value is out of step at the moment. This is a card that could benefit from a slower format, though it might take a banning for that to happen. Picking this one up this week with an eye to the long term is a decent bet, though all cards from AVR face the risk of reprint in the near term.

Standard

Standard has settled into a fairly stable metagame with U/W Flash and B/G Delirium making up nearly half of the top decks on MTGGoldfish. Until something upsets this balance, prices in Standard will be largely stagnant and unattractive for speculators. We'll need a shakeup with either a brand-new, heretofore-undiscovered archetype – or more likely the release of Aether Revolt (AER) in January 2017.

In the meantime, picking through the cards that are powerful but under played could be worthwhile, but speculators should be wary of parting with tix at the moment. If the metagame remains unchanged, prices on cards that are not being played will drift down, so sitting on tix is a wise strategy. If you've got your eye on a particular card, its price might be attractive today, but it could be even more attractive tomorrow. Modern is also proving a very fertile ground for speculators at the moment.

Modern

Tom Ross brought an innovative Tron build to the Star City Games Modern Open in Columbus and took the trophy home. As a result of his victory, classic Tron pieces like Karn Liberated, Wurmcoil Engine and Oblivion Stone have all jumped higher this week. Ryan Overturf briefly went over the deck for Quiet Speculation readers here, and you should definitely check out the top decks from Columbus.

This is typical of the way Modern prices move up and down over time on MTGO. Decks fall in and out of favor and the pieces of the deck go down and up in price as well. Eventually an old standby, like Tron in this case, finds itself reborn with a slightly different build in the hands of a capable pilot. It's not clear yet whether this version of the archetype is going to establish itself in the upper tier of Modern decks, but players are keen to try it out.

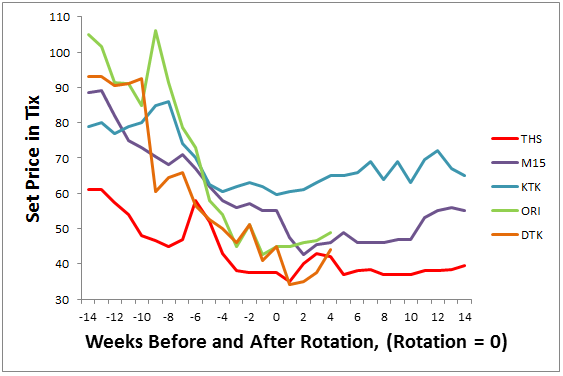

Elsewhere, speculators and players alike should be paying attention to the recently rotated sets to identify a good time to be picking up cards from Magic Origins (ORI) and Dragons of Tarkir (DTK). The chart below shows their set prices from the other three most recent large expansions that have rotated out of Standard. The time frame of the chart is in and around the date of rotation. It can give us a sense of when sets have found a price bottom – and it look like the bottom is in on both ORI and DTK.

If you've been humming and hawing about when to pick up a playset of Collected Company, the best time looks to be in the rearview mirror at this point. If you've been a buyer of cards from these sets, then it's time to sit tight and wait for further price increases. Once paper prices establish a firm price bottom, this will set the stage for further price gains on MTGO. In the meantime, expect a flat trend with some ups and downs along the way.

Trade of the Week

As usual, the portfolio is available at this link.

The MTGO market is a competitive one with bot margins under steady pressure. As a result, buy and sell prices on cards don't tend to vary too much between bots, especially for Standard legal cards. But if you start digging into parts of the market where the volume is lower, you can find some interesting discrepancies. This week's trade focuses in on the foil market, this time for SOI and EMN.

Both of these sets had the new style of release events, where the overpriced prerelease events were scrapped, and the new release events gave out a foil rare or foil mythic rare from the new set to use in your sealed deck. With this change, a flood of foil rares and foil mythic rares entered the market and this has depressed their prices relative to other sets.

Foil mythic rares from Battle for Zendikar (BFZ) and Oath of the Gatewatch (OGW) typically go for 10 or more tix while many of the SOI and EMN mythic rares are priced below that level. Notably, this is also a function of the higher quantity of mythic rares in the the latter two sets due to the inclusion of the double-faced cards. Regardless, the relative abundance of foil rares is reflected by the high price of foil uncommons from SOI and EMN, which is where I have been focusing my thoughts lately.

When SOI and EMN rotate out of Standard in October of 2017, both sets will lose a lot of value as usual. When it comes to the foil versions, though, prices tend to be much more stable due to the high prices that foils can fetch in paper. With redemption being the mechanism to remove foil sets from MTGO and converting them into paper, all cards from a given set are needed and in demand from redeemers.

As a result of all of these factors, when a set rotates out of Standard, value tends to flow from the (no longer) Standard playable cards to the most scarce cards, which are usually the foil mythic rares. In the case of SOI and EMN though, the foil uncommons will be part of the equation. There is a strong case to be made that foil uncommons from these two sets will appreciate in value next year around rotation. For more on the foil market and redemption, be sure to read up on my three-part series from last year which gets into more of the details.

With such a long-term perspective and no historical evidence to point to as an example, I want to dig a little deeper and see if there is an advantage to choosing one set over the other. In the case of buying non-foil full sets in September, the clear winner has been EMN as the gains have been in the 50 percent or greater range while SOI sets have gained around 20 percent.

There are two factors which distinguish these sets. The first is that EMN was opened for less time, and the second was that EMN was always opened alongside SOI while being drafted. This means that foil rares and foil mythic rares from EMN might be even more abundant than from SOI, as there has been less time for drafters to open foil uncommons. Therefore I am going to focus my efforts on EMN foil uncommons as a long-term speculative hold.

When I started digging into the market and the prices that foil uncommons were selling for, I noticed two big discrepancies between the two bots I use most often, MTGOTraders and GoatBots. With foil uncommons, MTGOTraders typically has better prices than GoatBots, often with a difference of 10 to 30 percent. In comparison, on a Standard staple like Liliana, the Last Hope, they currently sell this card for 34.50 and 34.03 respectively, a difference of less than two percent. Clearly, shopping around on foil uncommons was going to help me to control costs, so I started buying foil uncommons from MTGOTraders.

But when I got to the lower-priced foil uncommons, the prices on MTGOTraders bottomed out at 0.4 tix or so. A quick scan of GoatBots showed a number of foil EMN uncommons priced in the 0.2 to 0.4 tix range. Here was another market inefficiency. On the one hand, GoatBots was overpriced relative to MTGOTraders for most uncommons, but for the cheaper ones, Goatbots had the preferable price.

With this in mind, the rule of thumb I set out was to buy any foil uncommons from EMN for 0.4 tix or less from GoatBots, and then to fill up the rest of my purchases from MTGOTraders. As a result of this, I have amassed over 400 foil EMN uncommons at an average price of 0.71 tix for a position of roughly 300 tix. We'll see how this spec turns out, but I think this will be a long-term winner. I've purchased most of the uncommons from EMN since I want to make sure I catch the uncommons that are the most scarce and see the biggest prices gains. If you are thinking about following this strategy, I would recommend doing the same. If you want to take a gamble with only a few tix, you could try to hunt around for the cheapest foil uncommons and see what happens.