Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back for another round of High Stakes MTGO!

There was a lot of mouvement again this week as I'm trying to have keep my portfolio as fit as possible. By fit I mean selling profitable or hopeless specs while reinvesting into any position with a decent potential. As I mentioned before my goal is not to spend every single tix on my account but rather to make sure each of my tix are put to good use as often as possible.

The snapshot of the account is here.

Buys This Week

I was not fully stocked with these cards and their price went down to or below my original buying price. I still believe in these specs so there’s no reason in my eyes not to reload on a few playsets here.

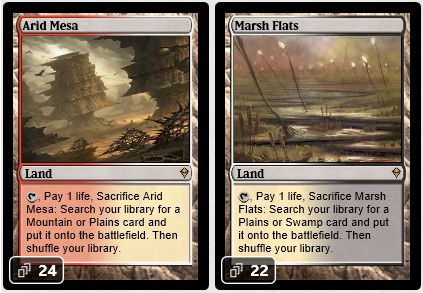

These two fetchlands lost about half of their value since before the release of Oath of the Gatewatch, a likely consequence of the colorless oppression from the Eldrazis. Both seemed like great targets to me with two to three month's perspective of growth. In my eyes rumors of ZEN fetchlands potentially being in Eternal Masters are mostly irrelevant at this point, considering the time frame I have in mind with my ZEN fetchland specs.

Champions of Kamigawa drafts made Azusa’s price dip sharply, especially without a solid Amulet Bloom deck around. That being said we now have an idea of its potential price-wise. This is a mid- to long-term bet investment.

The situation is almost identical for Threads of Disloyalty. This card has a high ceiling and the Kamigawa block flashback drafts didn’t flood the market. When fair aggro decks come back in Modern this blue enchantment should logically find a home again in several decks, as it did after the previous B&R list changes and before the rise of the Eldrazis.

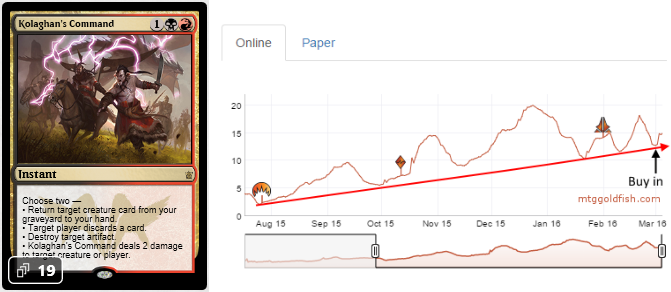

This spec is purely graph-based. Another floor was reached when I bought the black-red command and I’m betting on prices in the neighborhood of 20 tix in the short term. A lot of good mythics and rares from Dragons of Tarkir showed that sort of nice up and down swing since this past summer. DTK is not rotating next April so that leaves me a comfortable room to exit my Kolaghan's Command position with a profit.

Investing in Disciple of Griselbrand is like investing in full sets; I can invest a large amount of tix for only a few copies and expect moderate gains at best. However Griselbrand is playable in all eternal formats and if nothing happens in term of reprints a 60 tix ceiling can be reached fairly easily.

This land is a key card in Modern and in Legacy. Mirrodin Besieged flashback drafts won’t be scheduled for a while so this guy has plenty of room to grow, especially after a likely ban of the Eldrazi menace.

The redemption period for Return to Ravnica is over. With the stocks of this iteration of Jace fixed, the card is expected to follow cyclical Modern fluctuations from now on. I already rode Jace’s trend at the end of last year---the time has come for another ride with a planeswalker that has already proved himself in Modern.

Sales This Week

These Legacy specs were stagnating after the Legacy leagues spike that occurred earlier in February. I was satisfied with their current price so I decided to sell and move to something else.

As I'm writting these lines Counterbalance added another 10-15% to its price, potentially signaling that the growth of these and other Legacy staples may not be over after all. If you're still holding your Legacy specs it may be worth waiting a few more days. I'm still holding onto Force of Will, Tropical Island and Volcanic Island, and I hope they'll follow the trend of the blue enchantment from Coldsnap.

My target selling price was around 4 tix and that price was reached about a week and a half ago. In the short- to mid-term doubling is about the best I'm expecting with any shockland specs so I'm plenty satisfied with a +78% profit.

Ravnica block flashback drafts are just around the corner and if shocklands in Dissension shouldn't weigh too much on their Return to Ravnica or Gatecrash counterparts, I'm ready to bite the bullet with my Steam Vents and Overgrown Tomb. I should have maybe sold them a few weeks ago but I didn't. Shocklands will always have some demand in Modern so I'm ready to hold on to these for a longer run, until Return to Ravnica block flashback drafts at least.

These two positions reached my expected selling prices. Even if their current price trend plays in their favor I'm sticking to my strategy here and will sell happily with a good and certain profit.

2 tix was my goal with the Merfolk Master. I was able to sell a first batch of these at this price and now that they're back in this price range I'm selling the rest of my position.

Another disappointing/mismanaged spec from Khans of Tarkir. Time to let go though.

The last card from KTK/FRF I now have in stock is Dig Through Time. This delve blue instant is bound to be a losing spec anyway and I thought about selling it last week after it peaked around 1 tix. However thoughts of selling don't grant any reward in this speculative game. Dig is back to 0.3 tix. Sometime soon I'll pull the trigger and gather the 12 tix my pile of Digs is worth.

On My Radar

I don't have anything particularly on my radar for the coming days/weeks. I'll try to clean my Standard portfolio while continuing to buy and sell Modern positions as they fluctuate. Starting to buy singles from Battle for Zendikar and later in March from Oath of the Gatewatch is still on my agenda.

Questions & Answers

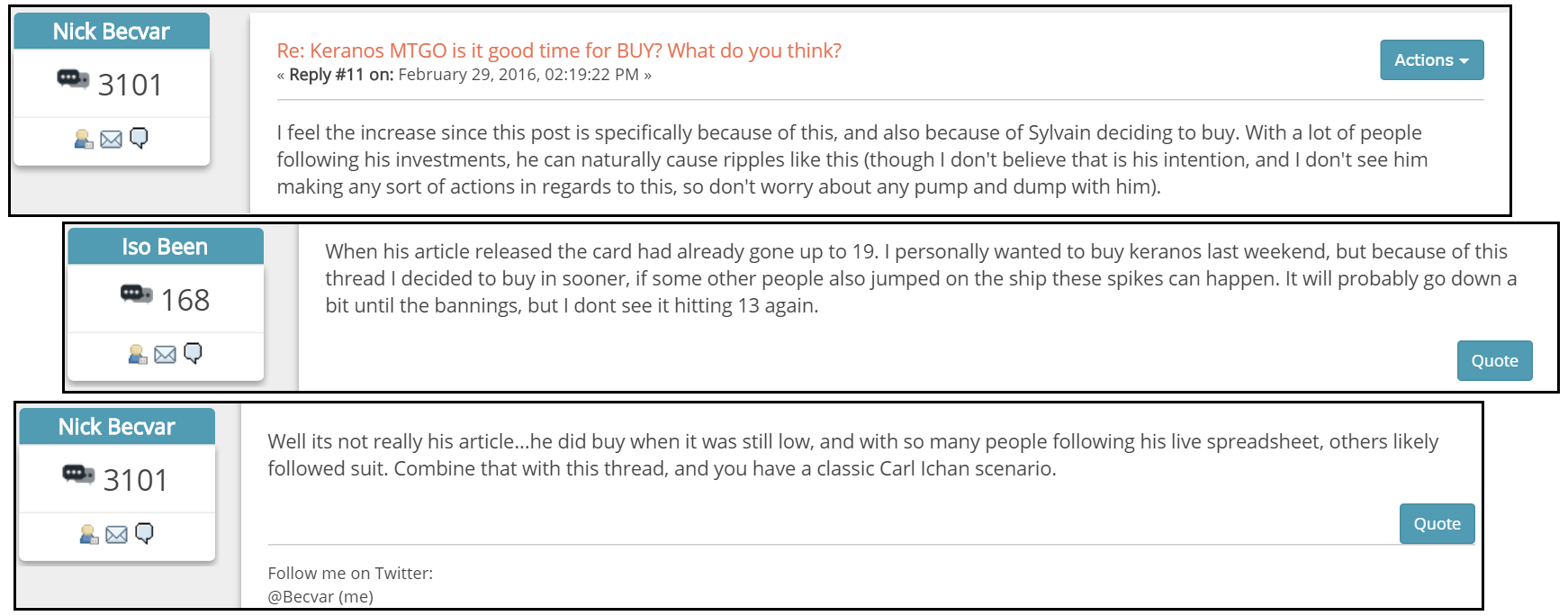

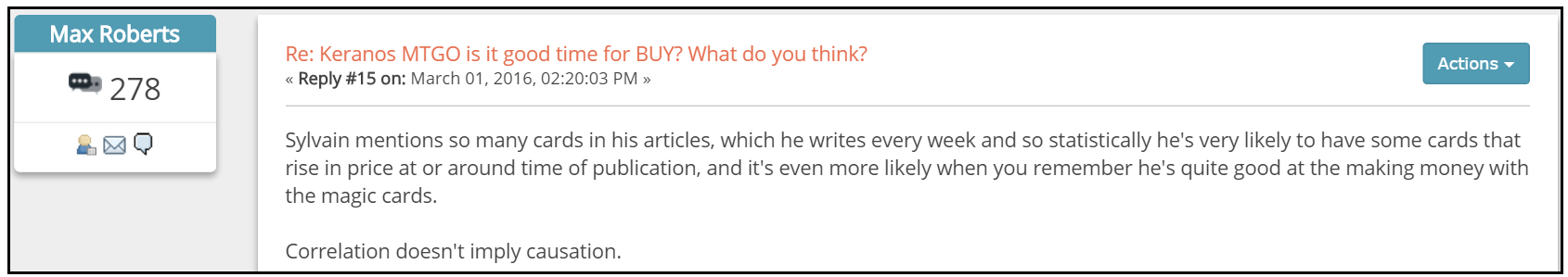

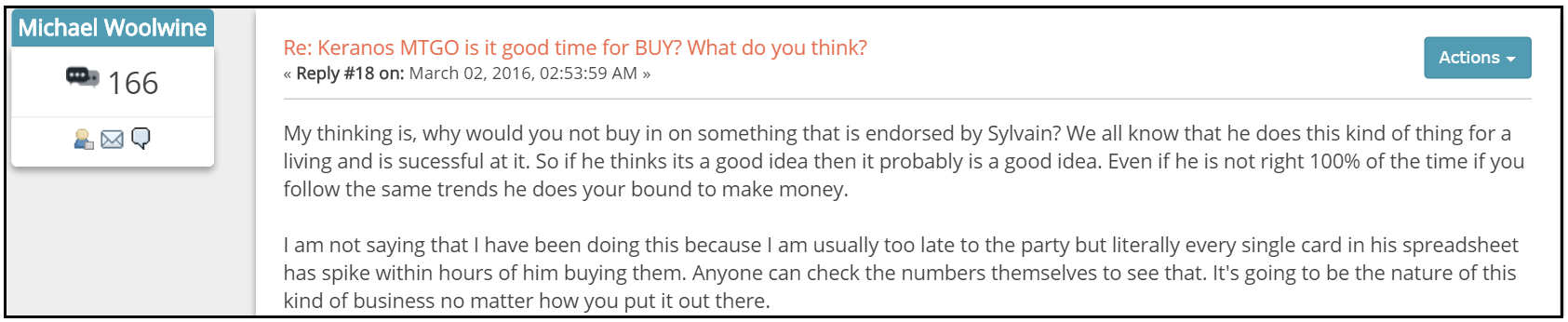

In a thread in our QS forum we had a discussion about my potential influence on prices. Allow me to develop my point of view below.

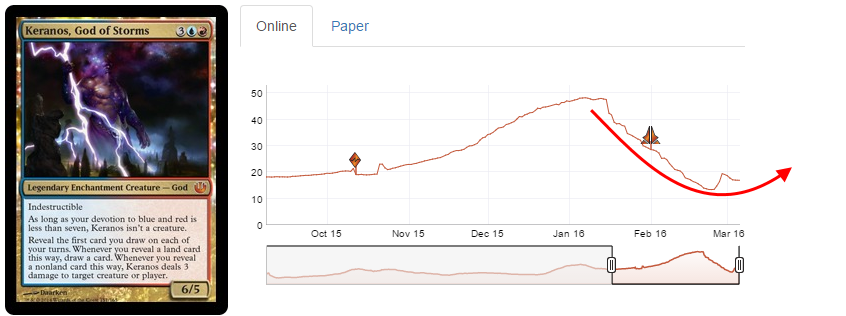

Using Keranos, God of Storms as an example, one could wonder if by---almost---publicly posting my purchases and sales I was able to "dictate" prices, at least in the short term.

A decent number of speculators are out there on MTGO and many of them are posting on QS forums and share their ideas and opinions. A lot more might be acting without ever commenting on our forums.

When a card like Keranos, with a nicely defined price trend, drops from 48 tix to sub 20 tix a lot of people are wondering whether that's a decent floor to buy in. A lot of people are thinking about it and when copies start to slowly disappear, the price drop slows down a bit, and people start being more vocal about buying, then it doesn't take long for supplies to dry up and the price to rebound.

To some extent, this is in miniature similar to the unbanning of a card in Modern. I was clearly not the first to pull the trigger as I bought my copies after the price started to rebound, but undeniably my buys can be perceived as a green light for others to follow. The actual jump from 13.5 tix to 19.5 tix was made almost entirely by speculators, and my 22 copies are only a small part of it.

Keranos natural trend might have been something like this:

A more organic floor might have been found around 10-12 tix and the price probably would have slowly rebounded. If everything mentioned above is true then Keranos's price will probably stabilize around 15 tix in a week or two before resuming an upward trend. Or maybe only speculators were playing here and the price may keep falling.

Speculation in general, and in MTGO for what concerns us, is also a game of deciding what price suits you well. I happened to pass countless specs because other speculators had triggered a rebound sooner that I had planned on, and I simply moved on to another target.

Most likely I have contributed to the spike we observed for Keranos. As I said in the forum and above, a lot of people are following price trends on MTGO. After all it's available for anybody thanks to Mtggoldfish.com. If there may have been some causation in the example of Keranos it's correlation most of the time.

Plenty of other cards I invested in recently, including expensive cards in the range of Keranos, didn't have the same price rebound or even a slight price decrease. Take for example Misty Rainforest, Disciple of Griselbrand, Marsh Flats, Geist of Saint Traft and Blinkmoth Nexus.

Some got a little price increase after I posted my transaction, such as Kolaghan's Command and Creeping Tar Pit. Through the Breach, Jace, Architect of Thought and Threads of Disloyalty had a marked price increase. If any, posting my specs has a minor effect. Correlation doesn't imply causation.

If you think I have an effect on card prices then what about SaffronOlive posting his decks on Mtggoldfish? He must be a market manipulator. Have you seen the recent spike of Legion Loyalist? He simply posted couple of videos of a Modern Goblin budget deck and had good success with it.

The reason is the deck posted 5-0 results in Modern leagues before he made his videos. He and people such as Travis Woo can really set prices on fire with their brews. Speculators, even like myself, are no match in terms of "price manipulation."

Yes that's the nature of this venture and that's the direct and indirect influence we all have on prices. I decided to put my moves out there and that's all of the actual transactions I make. No recommendations, no "you should" or "you shouldn't," no advice I may not follow myself.

Sure, enough of my calls are good and profitable and anyone following them should be making some tix. There are also a lot instances where I'm wrong or miss on the timing at least. There's decent room for improvement for anybody willing to take this to the next level.

Unfortunately as big as the numbers you read may seem, I'm not speculating on MTGO for a living. It could be enough for a young single student sharing an apartment with three roommates in a city where the cost of living is low. But for the moderate life I have in Boston, with a toddler and a wife staying home to raise our kid, I have a day job that is just enough to cover our expenses.

At this point my MTGO specs are surely able to pay some bills but are not providing savings for retirement or health benefits. I plan on taking a trip to Vermont paid for by my MTGO specs but that's about it.

Thank you for reading,

Sylvain Lehoux

Good overall analysis. I mean honestly, readers have a couple choices. One, believe your analysis is correct and participate, or choose to ignore it. As Sylvain says, no is getting rich, but you may be able to grow your collection for a nice discount or throw a couple bucks back in your Paypal account. At least that is my objective. I rode my Jace confidently after reading this article and just sold my play set. $24 extra tix in a couple weeks, now to move that into something else. Rinse and repeat. My only real advise, the trend is your friend, spread your specs around, plan on the spread in advance, and don’t be greedy.

Good luck.

A little criticism. The chart your show for Keranos – as long time technical analyst of charts – there is no real pattern that just fish hooks – usually you get more of a saucer or cup and handle bottom that eventually looks closer to your expectations. But time tends to play a bigger role from my experience. Just my two cents.