Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerances and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

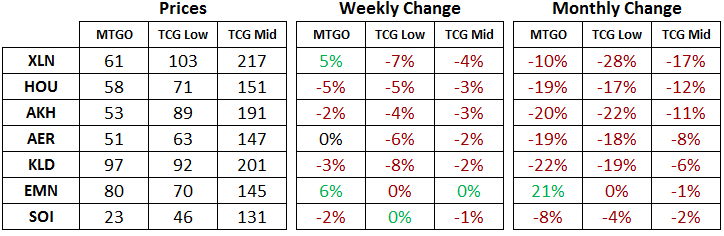

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of December 5, 2017. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead. Although Hour of Devastation (HOU), Amonkhet (AKH), Aether Revolt (AER) and Kaladesh (KLD) are no longer available for redemption, their prices will continue to be tracked while they are in Standard.

With only three sets still available for redemption, the purpose of tracking both the digital and paper prices has largely run its course. I will continue to track set prices with an eye to the overall market, but look for a redesigned price section next week. If you have any feedback on what you might like to see reported every week, please leave a comment.

Vintage Masters

The big news this week is the return of Vintage Masters (VMA) draft instead of the previously scheduled Lorwyn draft. Check out the full announcement here. The real surprise is that they've updated the art on the Power 9 to be the original art and original card frame. This will be the first time these are available online, combined with their super mythic rarity and a short release window, these are going to be hot commodities.

There's not much strategy for speculators. If you like drafting Masters sets, then you'll enjoy drafting VMA. Good luck in opening a piece of Magic history! The one thing that speculators might leverage is the surprise reprinting of a couple of Legacy staples in Force of Will and Lion's Eye Diamond. Both of these cards have been showing some price strength lately and are up 25% since the release of Ixalan (XLN). Depending on how the market develops, they could be worth a look while VMA is being drafted.

Standard

The set price of XLN has recovered this week back over 60 tix. This is a due to a combination of a slowdown in draft while redeemers are still capturing the price differential between digital and paper. Interest in Standard seems quite low with a stable and uninspiring metagame dominated by the Energy mechanic. I still maintain that a ban in the near term is unlikely, with the release of Rivals of Ixalan scheduled for January and the associated Pro Tour event featuring Modern constructed. I think the most logical time to look for a card to be banned in Standard will be in February, in the post Pro Tour timeframe which is an option they have left open for making changes to any format. Here's the last announcement for reference.

With all that in mind, I decided to liquidate my remaining Standard only positions, including booking a loss on last week's spec on The Scarab God and a longer term holding in Heart of Kiran. A stable Standard metagame is a bad environment for speculating and there will be plenty of reasons for players to sell their cards over the next few weeks. The opportunity cost of holding Standard cards is also high right now, with IMA boosters about to go on sale. I'll wait for the release of Rivals of Ixalan before considering Standard cards to speculate on.

Modern

This week I did make a sell out of one of my Modern holdings in Karn Liberated. Although most Modern cards are still in an upswing, and the Modern Pro Tour is still ahead of us, this card looked like it had peaked at close to 40 tix. It also looks like Tron decks are not taking up a growing share of the metagame; the die hards enjoy the deck, but it's not grabbing new interest. It's definitely possible that something changes to favor this card and Tron decks, but I am looking for reasons to start selling my Modern positions over the coming weeks and this was one way to start. I don't want to try and convince myself that a particular card or strategy is just about to break out. It's always easier to sell when interest in the format is high and players are still anticipating events to come.

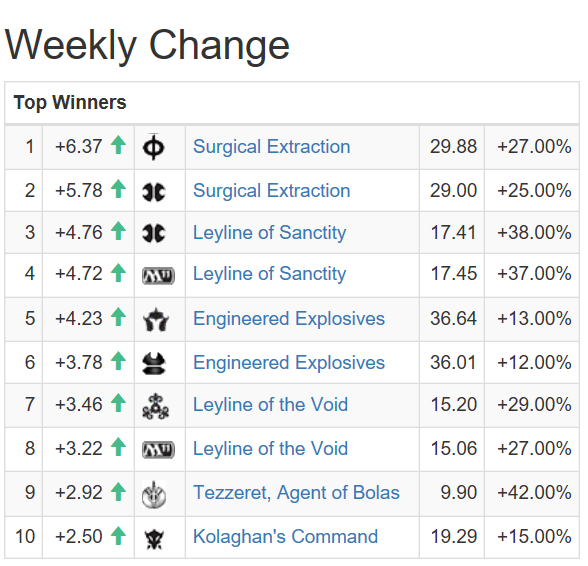

I took a screen shot of the weekly gainers from mtggoldfish as it tells a particular story. Have a look.

Although they get the benefit of having multiple printings, the top eight cards share a few characteristics. They are cheap to play sideboard options that multiple decks have access too. The original sets they showed up in were spring or summer sets, either the third set of block or a core set. Finally, they have not been reprinted lately in a Masters set lately. These are all characteristics of cards that speculators should be aware of if they want to find success.

Boosters

XLN boosters bounced back up to 3.2 tix, but have fallen again back to around 3.1 tix. The outlook on these is unchanged. Don't be caught holding excess boosters as we get closer to Christmas. Vintage Cube and Vintage Masters (VMA) draft is going to soak up a lot of drafters attention, leaving XLN as a second or even third choice. The price of this booster has a strong negative outlook.

On the positive front, Iconic Masters (IMA) draft is going to wind down this week, and these boosters have already gone on sale somewhat, dropping from 6 to 4 tix. There should be another wave of selling in the coming days so be ready to scoop these up at 3.5 tix or less. I will be buying as much as I can at this price; they will be excellent candidates to recover the 4 tix price over the coming months and boosters are a very liquid object with a low spread. They are perfect for speculators with excess tix.

Trade of the Week

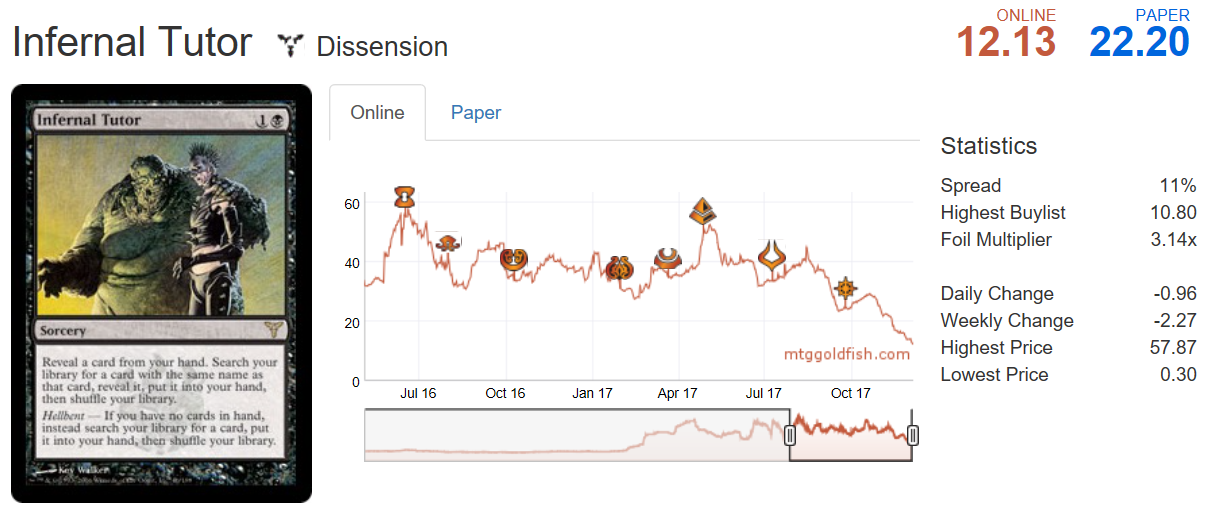

For a complete look at my recent trades, please check out the portfolio. Infernal Tutor is a card that I've successfully speculated on in the past. It's regularly cycled up over 40 tix and down into the 20 to 30 tix range. With that pattern in place, I bought this card for the portfolio a few weeks ago at about 20 tix, with an eye on the Legacy and team Grand Prix events slated for 2018. Subsequently I've watched the price drop steadily and it now sits below 13 tix. Have a look at the chart, courtesy of mtggoldfish.

This is another example of how a card that is lightly played but expensive can have its price greatly reduced by the influx of supply from Treasure Chests. I think there will be an opportunity on this card in the future, but the steady drop past the previous price floor is a big red flag. As a result I decided this morning to cut my losses and sell my copies.

I have to remind myself to avoid niche cards, previously valuable due to their scarcity, that are being printed in Treasure Chests. Modern staples have the demand to support their price but a card like Infernal Tutor does not. I'll be watching this card for signs of establishing a new price floor, but for the time being it looks like it's going to continue dropping and head lower than 10 tix.

You mention in this article that you feel IMA boosters will drop to 3.5 tix and scooping up there will be good since they should recover to 4 tix over time. I make quite a bit flipping boosters myeslf. I took a look at your portfolio and saw that you bought quite a bit of IMA boosters at 4.06 then at 4.09. I picked up 60 when they dropped to 4.02 but now see that you can get them for 3.90. What is your view on these, do they keep dropping and what will be there recover price point for the short term flip and the long term in your opinion. Current .21 spread from buy/sell prices, greater than standard packs, so would need them to move back up quite a bit as selling packs in bulk to a bot automatically changes their buy price each transaction.

Aside from IMA boosters I’m looking at several modern staples that were reprinted in IMA but are raising at a good pace, such as Ancestral Vision, Cryptic Command, and Mishra’s Bauble. I have very strong holdings in the above 3. Are there are any specific cards you feel very strongly about right now?

Thank you for your input.

Thanks for your comment. I thought IMA boosters would have a bigger drop this week, but they seem to be hanging around the 4 tix mark. I think we’ve seen the big selling window already, although maybe there will be another dip when VMA and Vintage Cube goes up for drafting.

I am comfortable buying in the 3.75 to 4.25 tix range. I think long term they will go back to 5+ tix, so I am ok with the high spread. I also know that I won’t be able to sell them all right away. That’s ok. Holding for 6+ months seems right to me. It’s not a flashy trade, but a +10% to +20% trade that looks safe and predictable is pretty good.

As for the cards you mention, Ancestral Vision and Cryptic Command are both showing strength, but I am not a buyer right now. I was a big fan of Mishra’s Bauble as a target heading into IMA draft, and I bought over 30 copies right away. This has been a great trade as I am already up around 2 tix per copy. I think we might see a rise into the 6-8 tix range, and I’d be happy selling at that level.

Generally speaking, I am leaning more towards being a seller of Modern cards over the coming 6 weeks than a buyer. The Modern PT in February should be at or near a seasonal peak, so I want to be selling into this kind of demand. There’s also the reprint risk attached to Masters 25 which will be released in March. That will be the next good buying opportunity, and I want some tix around for that.

On Standard, I think being a buyer of XLN and RIX in March or so will be fine, so I also want to be have some tix for that.

As for specific cards, I think Rowdy Crew is a great long term buy in Standard, but is too expensive right now. I think one or two of Bloodbraid Elf, Stoneforge Mystic and Jace the Mind Sculptor will be unbanned from Modern in March. I think these are all worth looking at.

Thanks for the response. For Ancestral and Cryptic I bought a large quantity of them while IMA was being drafted and I think I’m about to unload on them since it seems they are going on the downswing. I own 30 CSP, 60 IMA Baubles and half of each in foil. They stopped going up but I think I’m still going to hold on them for a little bit. My target was 7 tix for them.

I agree with you on the IMA boosters, even if having to hold for 6 months it’s a safe investment and I think I will keep buying them, although right now i’m waiting to see how far they go down as for the last 3 days they have gone down a little each day.

Between BBE, Stoneforge and JtMS what is your strategy for them? Wait and watch, is there a specific time and price that you will pick these cards up at?

Thanks for your input, your articles have always been a good guide for me as you give a lot of input on the Magic Online part of MTG finance which I focus on myself.

No strategy on BBE, Stoneforge and JTMS. I would just pick up play sets here and there, though definitely do not load up on Jace. I think BBE is a lock to be unbanned, with SFM having a chance and JTMS a long shot. Having said that,