Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerance and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of January 23 2017. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead.

Standard

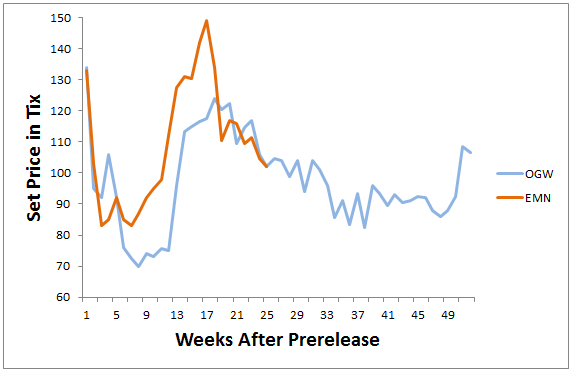

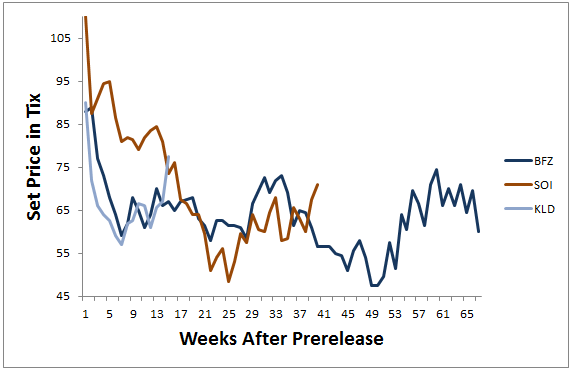

Below is a chart of how the prices of the large sets of Standard have evolved since their respective prereleases. Kaladesh (KLD) is jumping up in price after the bans in Standard. This type of price movement at this stage of a set's release is unusual compared to the past price trends observed for Battle for Zendikar (BFZ) and Shadows over Innistrad (SOI). Price trends tend to be persistent in and KLD is bucking the trend right now on the backs of Saheeli Rai and Torrential Gearhulk.

The recent uptrend in SOI set prices is a similar magnitude to the KLD price move, though SOI has been in an uptrend since bottoming out in early October. With the release of Aether Revolt (AER) this week on MTGO, further price gains on SOI will be harder as the MTGO economy seeks to absorb the new cards with tix in high demand from players and bots alike. If you are holding sets of SOI or positions in individual cards from this set, it's a good time to consider reducing these positions.

The downtrend on BFZ looks to be firmly in place and I think it's safe to expect lower prices on this set over the next few weeks. The ultimate fate of the set price for BFZ depends on where Gideon, Ally of Zendikar lands in the new Standard metagame.

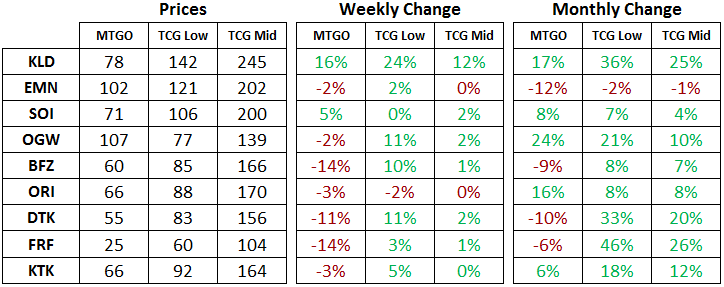

Below is a chart with the price of Oath of the Gatewatch (OGW) and Eldritch Moon (EMN) since their release on MTGO. Looking at how the price of the two small sets in Standard evolved over time, the trends match up very well. The period after release is a steep downtrend while the set is opened in Limited. A subsequent steep uptrend occurs after the release of the following large set and the shift of Limited play to that set.

Similar to KLD and SOI, the price of OGW has gotten the benefit of the Standard bans as well. Nissa, Voice of Zendikar is responsible for a large portion of this recent price move. It will be interesting to see if this spike is the start of a new uptrend or is just a temporary blip. EMN seems destined to continue to fall as it tracks the evolution of OGW's price closely.

Similar to KLD and SOI, the price of OGW has gotten the benefit of the Standard bans as well. Nissa, Voice of Zendikar is responsible for a large portion of this recent price move. It will be interesting to see if this spike is the start of a new uptrend or is just a temporary blip. EMN seems destined to continue to fall as it tracks the evolution of OGW's price closely.

Modern

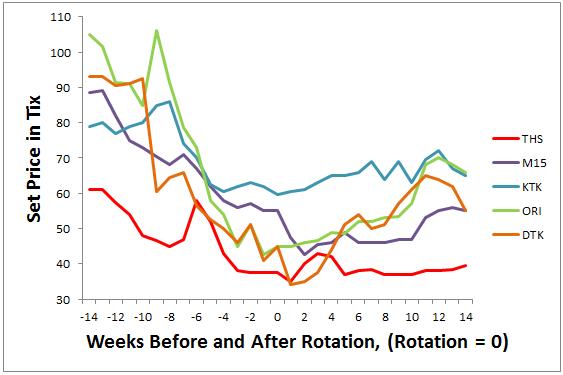

With the pending release of AER, Dragons of Tarkir (DTK) and Magic Origins (ORI) are coming off of their post-rotation highs and look set to drop further. Redeemers are going to have their hands full with the new set, and so price support will only be coming from Modern play. The gains on these two sets have been largely booked at this point. If you were a buyer in the fall, it's time to consider moving out of these cards.

Elsewhere in Modern, the fallout from the Gitaxian Probe and Golgari Grave-Troll bans is still reverberating. Pendelhaven is a staple of Infect strategies and has fallen by 60 percent in the past month. At 10 tix currently, the market has overreacted as it gets close to its low from the past year of 8 tix.

The expertise cycle of cards hasn't show much in Standard so far, but the potential for all of these cards to combine with the split cards in Modern is undeniable. Boom // Bust has always been a favorite of mine and casting it off of Yahenni's Expertise is something I'll be testing out.

Lastly, Sram, Senior Edificier has invigorated the price of Retract and Puresteel Paladin as players anticipate trying out these cards in the new Cheerios deck (combo decks used to all use names of breakfast cereals and this deck is a holdover from that trend). It seeks to get Sram or Paladin into play followed by a few zero casting-cost equipment into play in order to draw a bunch of cards. Retract allows for the next wave of card draw with the end game being a storm kill with Grapeshot.

The boat has sailed on the aforementioned components of this deck. Mox Opal appears to be a critical card in speeding up this combo, and it's just had a price jump in the past two days, so it might have more room to run. If you think the deck is real, then going to the classic storm answer with Mindbreak Trap is sensible, as any deck can play this card in its sideboard. I've been a buyer of both Mox Opal and Mindbreak Trap this week for the portfolio.

Trade of the Week

For a complete look at my recent purchases, please check out the portfolio which is available at this link. The release of AER this week is going to generate a liquidity crunch as players look to sell their cards and boosters in order to draft with AER boosters and to buy the new cards. Simultaneously, the dealers who run the bots are trying to stock the new cards and they'll need tix in order to do so. This means that tix will be in high demand this week, so with that in mind, and the recent price increase on SOI sets, I took the opportunity to sell the sets that I had purchased in September.

The return on these was nothing like the gains from EMN. With the new block structure, we've seen twice now that the smaller set sees a much higher price peak. The bottom to peak price move on EMN and OGW were 80 and 77 percent respectively, while for SOI and BFZ they 45 and 57 percent. Redemption has lent this strategy a guarantee that the value of the sets would be preserved, so it's not yet clear if this trade will be possible for KLD and AER, but it will be worth keeping an eye on.

Two weeks ago i tried the puresteel paladin deck in a few modern constructed leagues, but it quickly became Obvious it was too dependant on the paladin. So when i found out a few days ago Sram is coming, i was excited to give the deck a new try.

I haven’r followed the developments closely last few months, so what do you mean with “Redemption has lent this strategy a guarantee that the value of the sets would be preserved” ? I thought redemption was minimalized to 3 months after setrelease, or did they change that again ?

All sets prior to KLD have the regular redemption schedule, so SOI and EMN will always have the back stop of redemption for their set value. Going forward, with KLD and AER, we won’t have that backstop after Amonkhet goes live for redemption. This means that there is greater uncertainty in doing full set specs going forward.

I think the Puresteel Paladin deck is going to be a player! If it is a good deck, I could see a Mox Opal ban down the road.

I think Retract gets the ban hammer if this pans out, not Mox Opal. Opal is always in the discussion, but Lantern Control and Affinity are not huge threats at present, despite the minor resurgence with Affinity just lately, and WoTC takes a lot of heat if they wreck three decks at once. Retract isn’t necessary in the format and isn’t likely to upset nearly as many players.

Good point! This is definitely the style of bans they have shot for recently where they are trying to depower strategies and not kill them completely.