Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various constructed formats, and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budget, risk tolerance and current portfolio before buying or selling any digital objects. Questions will be answered and can be sent via private message or posted in the article comments.

Redemption

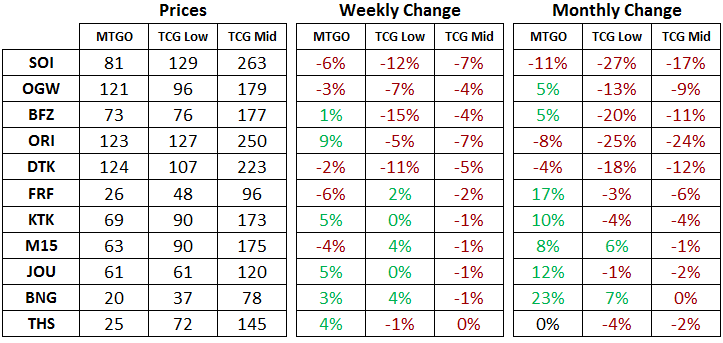

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of June 6th, 2016. The TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid price respectively. Note that sets of Theros (THS) are out of stock in the store, so this set is no longer redeemable.

All MTGO set prices this week are taken from Goatbot’s website, and all weekly changes are now calculated relative to Goatbot’s ‘Full Set’ prices from the previous week. All monthly changes are also relative to the previous month prices, taken from Goatbot’s website at that time. Occasionally ‘Full Set’ prices are not available, and so estimated set prices are used instead.

Flashback Draft of the Week

This week drafters get to add a booster pack of Morningtide to their Lorwyn drafts. Scapeshift, Vendilion Clique, Bitterblossom and Mutavault all show up in the new booster. This makes the Morningtide booster relatively high value compared to Lorwyn, so we should see continued drafts firing and a steady supply of singles entering the market.

Modern

The fallout from the full set spoiler of Eternal Masters (EMA) is still being felt, although the shock waves are dissipating. Many staples are near their long-term price ceilings, including Infernal Tutor, Blinkmoth Nexus, Cavern of Souls and the recently unbanned Ancestral Vision. Now is the time to be reducing your holdings of these cards, in advance of EMA release events and the attendant liquidity crunch.

Standard

Let's take a close look at the price charts on a few Standard cards. I am not going to reveal the names of these three cards, but you'll notice they are all from Shadows over Innistrad (SOI). They also all have something in common.

Each of these cards started below 0.5 tix, and by the time SOI was released on MTGO on April 18th, they were all roughly 0.5 tix. Over the course of the past six weeks, they have all climbed to over 2 tix. Any guesses as to the name of these three cards? Well, the first is Humble the Brute, the second is Nearheath Chaplain and the third is Reckless Scholar. The trick is that these are the foil versions.

Each of these cards started below 0.5 tix, and by the time SOI was released on MTGO on April 18th, they were all roughly 0.5 tix. Over the course of the past six weeks, they have all climbed to over 2 tix. Any guesses as to the name of these three cards? Well, the first is Humble the Brute, the second is Nearheath Chaplain and the third is Reckless Scholar. The trick is that these are the foil versions.

Once again, relative scarcity leaves its mark on the price of digital objects in the MTGO economy. In this case the prerelease events for SOI are the culprit. These events awarded a bonus foil rare or foil mythic rare which means that these cards are relatively abundant compared to the foil uncommons.

In the past, this hasn't mattered much since prereleases had poor prize support relative to normal release events. Players just waited to play the events with better prize support. With the release of SOI, release events were eliminated and prereleases now carry improved prize support. This meant that many players chose to enter these events, which generated a flood of foil rares and foil mythic rares.

This is great news for speculators as it provides another strategy on foil cards to employ during set releases. Unlike foil mythic rares, which appear to be a profitable long-term strategy, this strategy should be profitable in the short term as long as the trade doesn't get too crowded. It's also helpful that the buy-in price on foil uncommons should be low, so novice speculators will get a chance to test out the strategy without investing too many tix. Players who want to try out the new cards should also feel confident in buying into foil uncommons during set releases.

To outline the strategy in detail,

1. During the first two weeks of a set release, buy a basket of foil uncommons. It is very important to buy a variety of uncommons since it's unpredictable which ones will rise the most.

2. Hold for one to three months.

3. Sell the foil uncommons as their relative scarcity drives up their price.

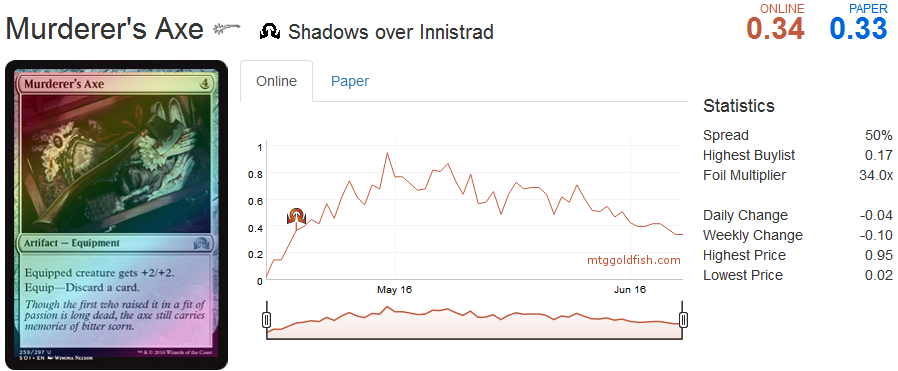

In the case of the three cards chosen above, I cherry-picked the three most expensive foil uncommons. To illustrate the risk of choosing the wrong ones, let's look at the lowest-priced foil uncommons to make sure this strategy won't be a disaster in the making.

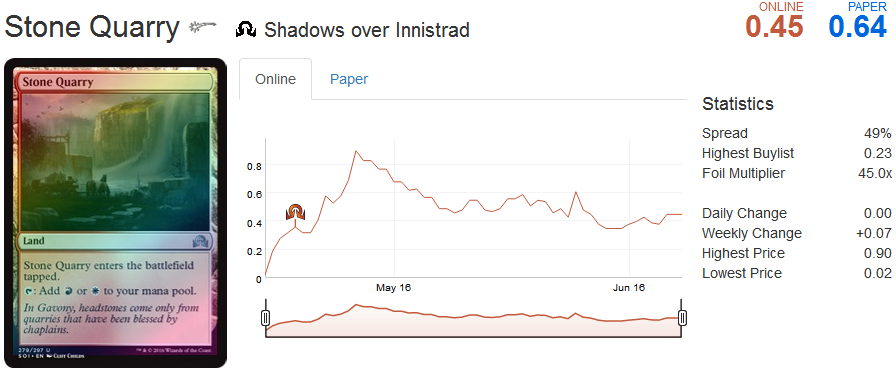

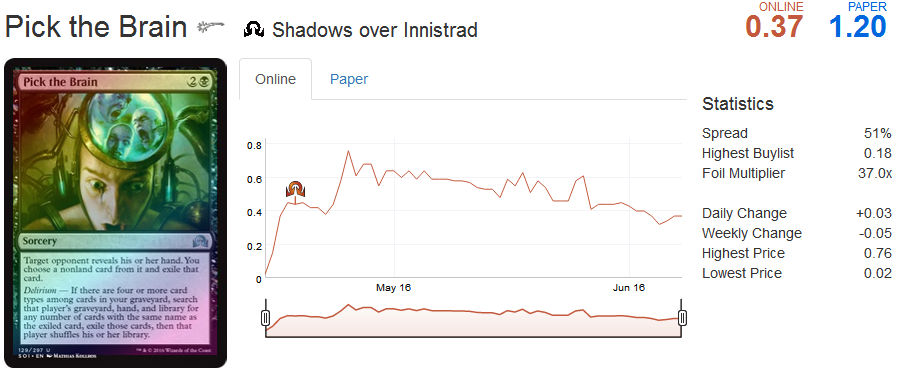

There are six different foil uncommons listed for sale at Goatbots and they have buy/sell prices in tix of 0.31/0.54. Murderer's Axe, Stone Quarry and Pick the Brain are the three at the bottom. Here are their respective price graphs from MTGGoldfish.

What we learn from looking at the worst three performers is that you don't want to overpay as you could be saddled with cards that don't appreciate in price. So, let's add another step to the strategy.

4. Do not pay more than 0.4 tix for any particular uncommon.

This strategy depends on the entry fees and prize structure of prerelease events. If prerelease events are the same for Eldritch Moon (EMN) as they were for SOI, then the strategy will be successful.

Longer-term, the foil mythic rare strategy will have to be reappraised in light of these changes. I suspect that foil mythic rares will still be a good store of value over the long term, but we'll have to see how prices develop on foils from SOI in the fall before I can confidently recommend foil mythic rares as a speculative strategy. Players will still be well served by purchasing a complete playset of foil mythics, but speculators would be better served in the short term by looking to foil uncommons.

Standard Boosters

Oath of the Gatewatch (OGW) boosters have seen a significant price jump this week and now sit above 3.6 tix. The outlook for these is to hit 4 tix sometime this summer. Though with the pending release of Eternal Masters (EMA) next week, interest in Battle for Zendikar (BFZ) block draft will tail off and players will be selling anything they're not using for tix in order to draft the new set.

As a result, prices are expected to be flat or falling in the next few weeks. Once EMA drafts wind down in early July, the uptrend should resume as players look to formats other than SOI to draft while they wait for the release of Eldritch Moon (EMN).

BFZ boosters have not appreciated at the same rate due to the noted disparity in the ratio of OGW and BFZ boosters awarded in prizes (7:5) versus the ratio of boosters needed to enter a draft (8:4). This ratio favors the price of OGW boosters over the long term as they are awarded in prizes less frequently than they are needed for draft entry. Tix flow towards scarcity and that is why we are seeing prices of OGW boosters rise so aggressively.

It's not clear when or even if BFZ boosters will ever rise to a similar level. I expect them to be higher in a month and then to reach a medium-term peak at the end of August, but how high they ultimately rise is just a guess.

Trade of the Week

As usual, the portfolio is available at this link. This week I put a playset of Thoughtseize and Cryptic Command into the portfolio. Flashback drafts should be the bread and butter for any speculator interested in Modern that wants to expand their portfolio. With triple Lorwyn draft on the go, you don't have to look very far to find a couple of Modern staples in these two cards.

Timing the purchase of cards from flashback drafts is more of an art than a science at this point. When I perused the prices on these cards this week, I noticed that both were near their long-term price floor. At 4.79 tix a piece, I felt it prudent to start buying.

It's possible that a flood of supply from the drafts would make this early purchase look foolish. But it's also possible that that the fear of reprints had driven players to sell their extra copies, driving down the price too far. In either scenario, if a speculator holds a long-term perspective, then buying near the price floor will yield good results. I anticipate holding these cards for 6+ months or until they get back into the 8 to 10 tix range, whichever comes first.

Lastly, there are other Modern-playable cards in Lorwyn, but a card like Doran, the Siege Tower is much more fringe than the two cards I bought. The legendary treefolk might eventually yield a good return. Maybe there will be a new Tier 1 deck using Doran that catapults its price well over 10 tix. However, the weight of the historical evidence is that Doran will continue to only be fringe-playable and that a speculator is better off allocating tix towards cards that are played more frequently.

Re-read this article today, and it occurs to me that the last rule about not paying more than 0.4 tix is only apparent because we’re looking back on the data, during actual pre release it might not be clear that the floor is 0.4, and in future sets it might be higher or lower.

You are right, it might work out differently for EMN. I put this limit in as a way to avoid over paying and losing money on the strategy. By putting a cap in of 0.4 tix, the chances of over paying on an uncommon that doesn’t go up are reduced. Since we don’t have a real way to predict which uncommons will go up, it’s best to try and limit the downside and hope to ‘get lucky’ on the ones you do buy.

I have a question about redemption : is KTK being redeemed atm, i mean does it pay off for people who want the cards from KTK to redeem the set ? The difference between low and mid is so great i have no idea (never dealt with real cards).

I do not know the precise answer to your question, but I believe TCG Low is a better guide. If we had the sum of buylists, I’d expect that number is below TCG Low. I’d say that when buy list prices are approaching the cost of redeeming a set, then there will be dealers who it is profitable to redeem sets.

This might be a good question for the forums, to get some input from current dealers who may redeem sets.