Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerance and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

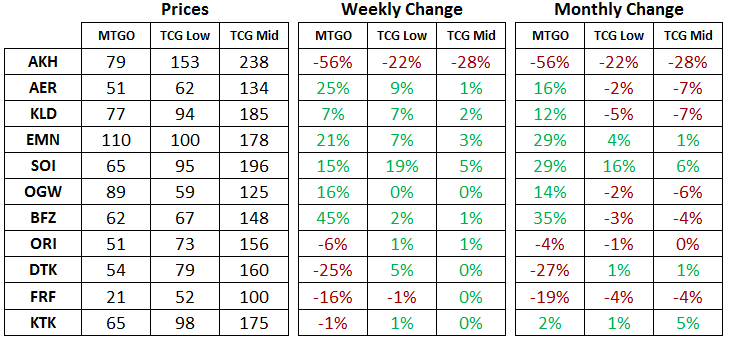

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of May 1, 2017. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead.

Standard

Every set in Standard prior to Amonkhet (AKH) flashed green this week in both paper and digital. This is a ringing endorsement of the decision to ban Felidar Guardian as players got excited about brewing with the new set amid a metagame in flux. This is a great time to be a seller with high demand for many Standard cards just prior to Pro Tour Amonkhet in less than two weeks.

At the individual card level, the price turmoil of the past week was phenomenal. Saheeli Rai and Oath of Nissa both dropped like a rock and went below 2 tix after the addendum to the banned and restricted announcement was made. Although Oath of Nissa has recovered in price, at less than 3 tix it still sits below its average price from the last six months.

Saheeli Rai now looks like it's close to junk as it sits at 1.5 tix. Keep in mind that the Copy Cat combo does appear to be playable in Modern, so this is an excellent price to get in on a Modern-playable planeswalker that has well over a year left to go in Standard. Although redemption for Kaladesh (KLD) will be ending in June, this card represents excellent long-term value at current prices. I was a heavy buyer of this card for the Market Report Portfolio in the past week.

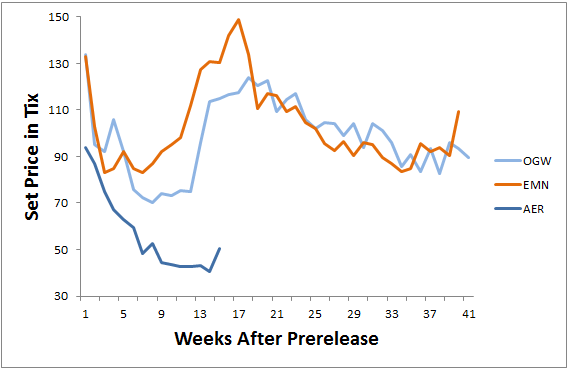

Aether Revolt (AER) was one of the big gainers in the past week with a 25-percent increase in price. With it no longer being heavily drafted, it's got room to run higher. If we look at how the prices of the last three small sets have evolved in the chart below, its easy to see we are in a period of high upside potential for AER. Although it's doubtful that it will reach similar heights as Oath of the Gatewatch (OGW) and Eldritch Moon (EMN), there's a good reason to think AER sets will get into the 60 to 70 tix range over the next month.

Regular readers will know that I have been testing the waters with AER set purchases in the last month. This trade is on a good footing at the moment, and I'll be looking to sell down my position by the end of the month. Remember that redemption for AER and KLD will end in June, so don't be a long-term holder of complete sets. Once the connection to paper sets is severed, only Standard- and Modern-playable cards will hold value. Without redemption, a complete set will only be as valuable as the sum of the cards within that set, and since most card on MTGO are worthless, the set value will follow suit.

On the singles front, the multi-format staple uncommon Fatal Push has quickly breached 4 tix. I was anticipating this card would reach 4 tix sometime next winter, but the influx of demand for Standard staples has had a big short-term impact. If you are holding extra of these cards, there's no reason not to sell into the recent buying as there are plenty of other opportunities to put tix into at the moment.

Modern

It's important to note that Fate Reforged (FRF) and Khans of Tarkir (KTK) will both go offline for redemption at the end of month. You can see the complete list of redemption related dates here. These two sets rotated out of Standard last spring, so that's why their cut off date is a little different from the other sets. If you are holding cards from these sets, it would be best to get rid of your junk mythic rares and even to pare down any Modern playable cards you are holding, and this includes the fetchlands.

There is always some value in online sets tied to being able to redeem that set for a paper version, so when redemption ends there's an inevitable price decline. When KTK went briefly offline for redemption in the fall, the prices of the fetchlands dropped due to the fear that WotC had run out of paper redemption sets. Trim your holdings and sell any cards you are not using over the next months from FRF and KTK.

Rares or mythic rares priced at bulk levels are fine to hold for the long term if you think they have some chance to break out in Modern. A card like Jeskai Ascendency would fit this bill. It's priced too low to be worth selling, considering there is some non zero chance it breaks out in Modern as a top deck.

With all eyes on Standard, it's a great time to be scanning the ranks of Modern playable cards for value. A card like Mox Opal is down by over 8 tix in the last week. Did Affinity or Lantern Control take a big hit as a result of the release of AKH? I don't think so! It makes more sense that players have been selling their Modern cards in order to draft AKH and to buy into Standard constructed. Good speculators and patient players will take advantage of this short term thinking and start picking up cheap Modern staples.

On this note, Dragons of Tarkir (DTK) and Magic Origins (ORI) are two prime hunting grounds for value seekers. Their set prices have fallen substantially in the last week, but they are still available for redemption into November. Cards like Kolaghan's Command and Collected Company are staples in Modern and have an excellent chance at rising above 20 tix again prior the Fall. Although they are not at rock bottom prices, players should feel free to pick up their playset and speculators should be paying attention.

Trade of the Week

For a complete look at my recent purchases, please check out the portfolio. There will be no surprise to regular readers of this column as I bought foil mythic rares from AKH. The strategy is straightforward. Redemption drives value to mythic rares since they are the redemption bottleneck. Foils amplify this effect, and as redemption removes cards from the system, mythic rares become scarcer and scarcer relative to the other rarities. This process drives value out of the commons and uncommons into the rares and mythic rares. This is true for both regular sets and foil sets, but foils amplify the effect because paper foil sets are much higher in price and more stable in price.

Ultimately this makes foil mythic rares a store of value. While it's safe to say regular sets and singles from AKH are going to be cheaper in a month and cheaper than that in two months, it's just as safe to say that foil mythic rares from AKH will be just as valuable in a month and even more valuable in two months. The only caveat to this is that we are talking about a pool of value for all the foil mythic rares together. Individual cards can fluctuate in price as a result of player preferences and metagame reasons.

As a direct result of this insight, I have no fear in buying foil mythic rares from AKH. Overcoming this fear was a challenge but a little experience with the matter can go a long way. For this, I went back to my experiment with Battle for Zendikar (BFZ) foil mythic rares. That was the first time I experimented with the foil mythic rare strategy, so I regularly recorded the price of these cards while the set was being drafted. The first week the set was available online, I bought four of every foil mythic rare for an average of 12.5 tix per card. Following the release of BFZ, the average sell price per foil mythic rare would fluctuate between 14 and 18 tix over the next twelve months.

When I counted up the purchase price of the AKH foil mythic rares, I came to an average of 10.5 tix per card. Between my analysis and the previous experience with this strategy, it was easy to pull the trigger on 8 copies of each foil mythic rare. For a complete list of the purchase price by card, please refer to the portfolio.

The beauty of this strategy is that I don't need to know which cards from AKH will be good in Standard or Modern or any format. The basket of foil mythic rares will just slowly accumulate value over time as a result of the underlying economics of redemption. I will look to sell these cards in August or September, as this will be a prime selling window prior to redemption closing on AKH in the fall. I will repeat this strategy for Hour of Devastation (HOU) later this summer.

Hey Matt, with Kaladesh redemption ending in 5 weeks, how do you think that effects complete set prices of Kaladesh between now and the end of the redemption window?

In a vacuum, I’d expect redeemers would be looking to extract the value out of their online stock, so they’d be looking to be buyers up until they can no longer redeem. So, I think we’ll see a run up in prices, particularly for junk mythic rares.

However, we are not in a vacuum and prices of all Standard cards will fluctuate with the metagame. Ultimately, this means it will be hard to know what happens prior to the end of redemption. If you are looking for actionable advice, I don’t think there is any except for keeping on top of your own inventory and not getting caught holding too many cards from KLD and AER by the first week of June.

I’ll be looking to see if there’s any funny market action. If there is, you’ll hear about it from me!