Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Short selling may be a novel way to speculate on MTGO, but what remains the same is the possibility to opt for short-term flips or long-term investments. Two weeks ago I discussed the option of long-term short sale speculation; today I'll focus on the short-term possibilities.

In the short term, short sales are enabled by the same context as elsewhere---full set speculation, made by you or someone else.

Short-term short sales basically amount to quick flips. Sell, wait a few days or up to two weeks max, and buy back.

The idea behind a short-term short sale is to react to a sudden and exaggerated price spike. As soon as the price returns to its baseline, you want to close the position. If it hasn't come down after two weeks, you may have lost your bet, or you might be on board for the long run.

Price spikes occur fairly frequently on MTGO and prices come down just as fast as they went up. We often say it's a good move to sell into the hype, because after prices have spiked unreasonably, a wave of selling off is almost inevitable.

If such spikes can help traditional speculators, they can do likewise for short sellers.

Taking Advantage of Spikes, in a Different Way

With traditional speculation, anticipating spikes early is a great way to generate extra Tix in a short amount of time. Short selling during these spikes is a much more forgiving approach that can generate an equal amount of Tix in the same short period.

Forgiving, because you don't need to react right at the moment the card in question goes under the camera. There's no hustle to purchase before the spike hits, since you already own copies of the card (or are planning to borrow them).

All the short seller needs to concern themselves with during the spike is when to sell. The key to short sale quick flips is to wait for the buying price to be as high as possible in reaction to the spike, which may take a few hours to a few days.

The good news here is you can check Grand Prix or Pro Tour results after the event is done, or even the next day, and probably not miss the selling window.

Price spikes often occur without a real justification. One single Daily Event result, one tweet, or one post from a popular pro are enough to generate hype around a particular card. You missed the tweet and the subsequent spike? No worry, you can probably short sell the card now, and the price is likely to come back to its base level very soon.

Last year, from a stable floor around 5.5 Tix, Ashiok, Nightmare Weaver jumped to 9 and then 11.5 Tix in late August/early September and fell back to 8.5 Tix, a 25% loss. In the hype surrounding Pro Tour Khans of Tarkir (KTK), Ashiok again spiked to 12.1 Tix but sharply dropped to 7.5 Tix for failing to show up in enough top decks.

In both situations Ashiok's price rose sharply with no concrete support. The subsequent drops of almost 30% could have been anticipated and turned into profit in the form of quick flip short sales.

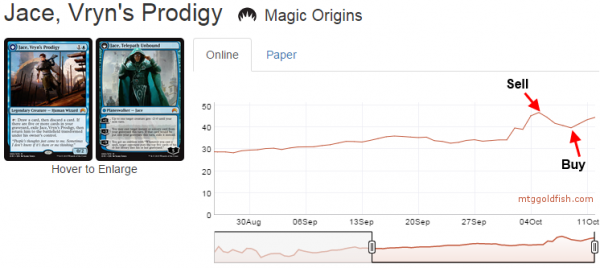

This is similar to the situation I exploited with Jace, Vryn's Prodigy // Jace, Telepath Unbound earlier this October. From a farily stable 32 Tix baseline, Jace rose in a couple of days to 45 Tix and became a profitable short sale opportunity.

Earlier, on my main account, I short-sold 19 copies of Monastery Mentor in the wake of the little spike triggered by Legacy GP Lille. I sold my copies a little bit late at an average of 9.8 Tix per copy.

The peak was clearly due to a sole high finish at the GP, insufficient to sustain an 11 Tix price for more than a week or two. In addition, Modern Masters 2015 (MM2) drafts were about to stop, signaling a return for drafters to Dragons of Tarkir (DTK) and Fate Reforged (FRF) that would inject more FRF cards in the system.

I bought my Mentors back at 8.3 Tix with a little extra profit while waiting for FRF sets to gain value.

With my "100 Tix, 1 Year" project I also executed some of these quick flip short sales. As far as I know, these were the very first examples of short-sold Magic cards on MTGO.

I short-sold four different positions and was able to make a profit on three, +2.65 Tix with Jeskai Ascendancy, +0.42 Tix with Narset, Enlightened Master and +4.87 Tix with Bloodsoaked Champion. I lost -0.09 Tix on Surrak Dragonclaw, a negligible dent in the overall profits.

The common denominator to all these short sales was to sell in reaction to an unusually high price spike. In each case I closed the position and rebought after a few days or weeks, when prices returned as close as possible to their previous level.

As you can see, I could have waited a little bit longer for Bloodsoaked Champion. Its price eventually dropped farther to 0.5 Tix prior to Origins (ORI) release events. But from the optic of a short-term flip, two weeks had already passed and as the price was starting to rise again, I simply wanted to exit the position.

You may also have noticed that all these transactions included fees. To perform these short sales I had to borrow these cards from my main account (remember, I had just bought 50 sets of Khans of Tarkir). My "100 Tix, 1 Year" account was not investing in full sets at all and therefore didn't possess these cards.

Thus these transactions are actually as close as you can get to stock market short sales. Even if I technically borrowed cards from myself, I wanted to be totally fair to the spirit of the "100 Tix, 1 Year" project, so I charged fees to the account. This means anyone could have borrowed cards in order to short-sell for the same fees.

There's a lot more to discuss regarding fees and borrowing cards, but that topic will be reserved for my next article.

Pro Tour Misses

Hype around Pro Tour results can break either way. PT performances can cause prices to shoot up, or drop like a stone. For any given card, a lack of results combined with prior speculation in the lead-up can sometimes result in a heavy price fall---constituting an opportunity for short-sellers.

Polukranos, World Eater built up from ~7 Tix in July to more than 18 Tix as Pro Tour Khans of Tarkir was opening. Nonetheless, the legendary hydra didn't meet people's expectations. A speculative selling frenzy dragged its price below 12 Tix the following week, shaving off more than one third of the price.

Clearly the market overreacted here, as Polukranos jumped back to 16 Tix no more than a week later.

Stormbreath Dragon and Sorin, Solemn Visitor found themselves in the same situation, after Pro Tour Khans and Pro Tour Battle for Zendikar (BFZ) respectively.

Even Jace, Vryn's Prodigy // Jace, Telepath Unbound suffered from the latest Pro Tour over-hype, its price crashing from 68 Tix to 52 Tix. The only difference for Jace is that the crash and rebound were only separated by three days.

I sold my copies of Jace on Sunday night after Pro Tour BFZ and chose to go for the long run. Nonetheless, a quick flip short sale, with a term of just a few days, would have definitely been a good option here.

In Response to Buyouts

About a year ago, sudden spikes triggered by waves of buyouts affected several mythics. At first, these buyouts targeted mythics freshly rotated out of Standard. They created nice selling opportunities for speculators holding these mythics for traditional speculation.

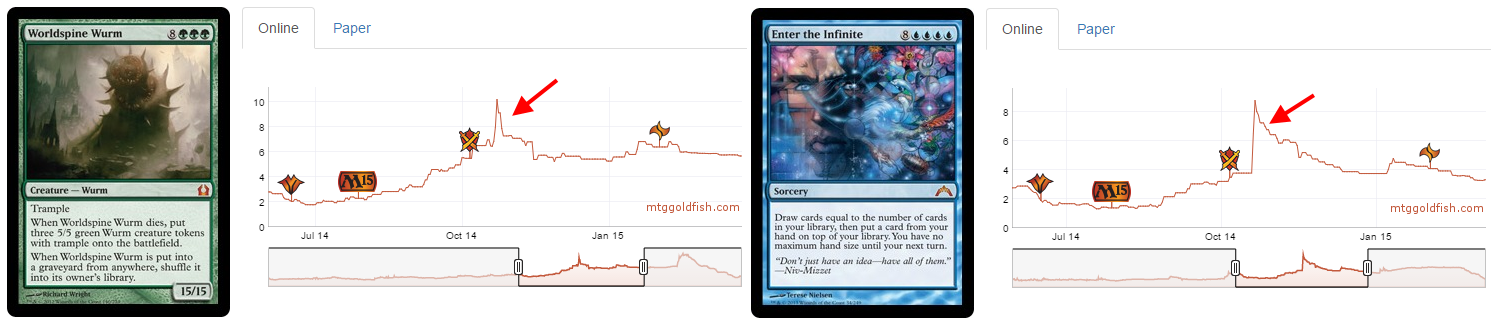

Enter the Infinite, Worldspine Wurm and Borborygmos Enraged were notable mythics affected by the new phenomenon. These artificial price spikes were followed rapidly by an equally intense price fall, which could have been exploited with short-term short sales.

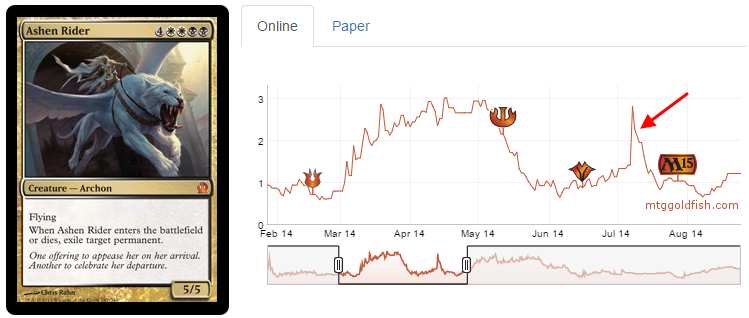

Buyout price spikes have also affected mythics from current Standard-playable sets. July last year, Ashen Rider was quietly cruising in the neighborhood of 1 Tix when its price spiked to 2.8 Tix overnight. Sure enough, the Rider was back to 1 Tix about a week later.

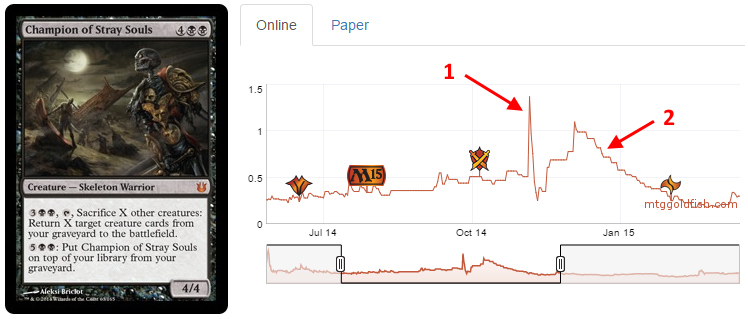

Champion of Stray Souls jumped from 0.5 to 1.2 Tix and fell back to 0.3 Tix in less than a week (indicated by Arrow 1 below). This too could have been fairly easily exploited with a short sale.

Arrow 2 indicates another possible short sale opportunity, although the upward and downward trends were more subtle here. Calling a short sale in the second peak isn't easy as it was more difficult to predict when the upward trend would stop.

In all these examples, you probably couldn't have profited off the full difference observed on the graphs. With varying spreads, a difference of 50% on a graph may only translate to 20% cash in your pocket in the end.

But for most of these cards, any short sale would have been a quick flip with a fast turnaround---20% profit in less than a week is quite respectable.

Next Time

Next time I'll discuss what lies beyond short selling. Speculating on full sets not only puts you in a position to short-sell your own cards, but also in a position to loan out cards to other speculators. And if you can loan cards for short sales, you can certainly loan them to play with as well.

Would it be worthwhile to invest in full sets during their one-and-a-half-year tenure in Standard plus the following year, in order to facilitate short sale opportunities and lend cards simultaneously? Could this be an untapped business model lying in wait on MTGO?

Thank you for reading,

Sylvain Lehoux

I was kind of hoping you would address the bad parts of short selling as well. Several people here(including me) sold jace, VP at 30 during the first spike, only to see a much bigger spike to 60. Now we are stuck with sets that are 99% complete and facing a 30 tik loss to be able to redeem. Short selling can be a great tool, but it is not for everyone.

The risks/bad parts are about the same as for any specs, you can’t be right all the time.

Short selling Jace a 30 Tix seemed a decent move at the time, although maybe a little bit too premature considering it could be played everywhere.

% wise the loss in not greater than buying 250 tix worth of Woodland Bellower at 1.5-2 Tix like I did while this guy is now around 0.5 Tix.

And as for any other specs you have two options: wait for better and take your loss and move on. One could argue that at least with short sales you have some cash you can work with waiting for prices to deflate. You may have totally made up for you losses with Jace with some Modern specs this past month. With my Bellower, I’m down and have no cash to play with in the meantime.

I would believe that jace is going to come to 30-40 sometimes this Winter or Spring. The speculative question is will Jace do that while the rest of your ORI retain some value so that you can sell full ORI set with some benefit?

Finally, Jace is a very extreme example as he spiked way over 30 Tix (unseen for core set mythic) and therefore suck up more than half of the value of the set.

the real problem with short sales is they have no ceiling. if you buy woodland bellower for 2 and it becomes 0 you lost 2 tickets. If you sell Jace for 30 and it goes to 200 you lost 170. That’s obviously an extreme example. But if your suggesting to borrow cards from a friend and they spike 10X you can be in real trouble when the friend wants his cards back