Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

For Wizards of the Coast, Pro Tour Kaladesh can be considered nothing less than a success. The Top 8 was filled with diverse strategies spanning combo, control and aggro. While a few cards did show up multiple times, overall there was no clear dominant deck or card that took over the metagame. Fears of a Smuggler's Copter-ridden format were significantly allayed after watching the Pro Tour unfold.

For the MTG speculator, on the other hand, events did not unfold as favorably. Sure, there were a few cards that made their presence known.

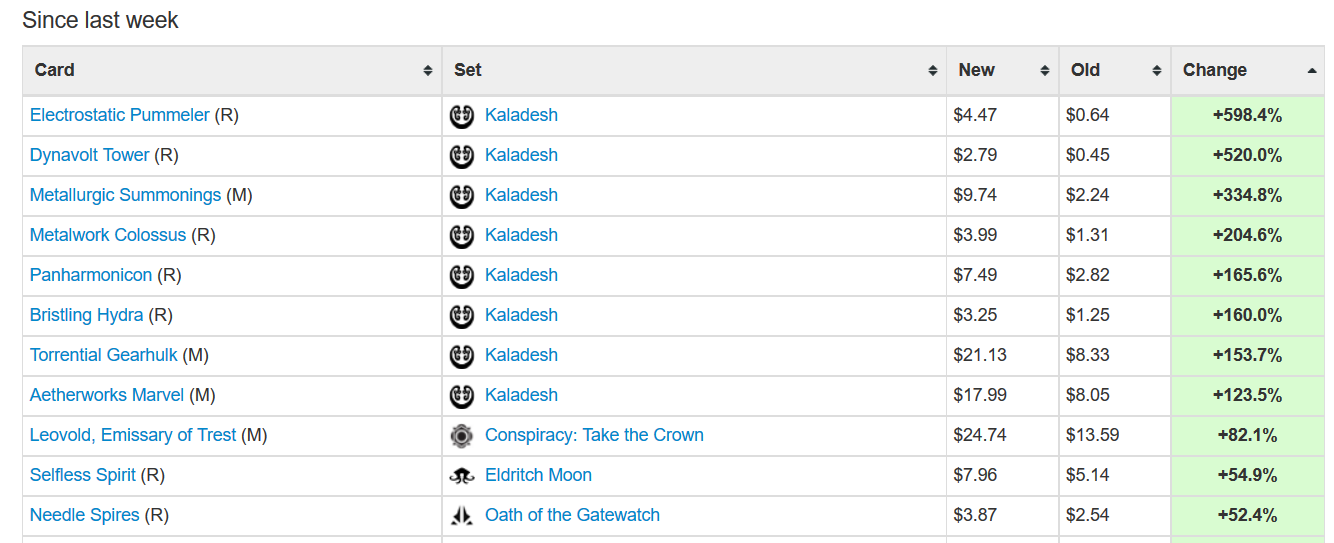

Looking at the movers since last week, there were some clear winners in Kaladesh, with Electrostatic Pummeler notching the largest gain for the week.

But I have an issue with most of these from a financial standpoint. Personally, I don’t think there were nearly as many opportunities to profit from this Pro Tour as there have been in events past. Could this all be a façade for the true future of Standard pricing? Or am I reading too much into things? Well, I’ll share my viewpoint and then you can decide for yourself.

Profits? What Profits?

Pop quiz: when you buy a card for $1.25 and sell for $3.25, what sort of profit can you net? Well if we assume a 10% hit in fees plus a flat $0.80 to cover eBay’s or TCGPlayer’s flat fee and the cost of a stamp, you net about $0.85 in profit for each copy.

I suppose if you’re selling dozens of these at one playset at a time, it could be worth your while. But I’m not sure if flipping Bristling Hydra throughout the Pro Tour weekend would really have been worth your time.

How about something more substantial like Aetherworks Marvel. This card really spiked over the weekend, so folks must have made a killing on it, right?

Well, maybe. But those who waited until Friday to make their purchases came to the party far too late (myself included). By the time I saw the card in action on Friday, it was already up to $12 on eBay for the cheapest copies. I quickly grabbed a few with a $25 price target in mind. Sadly, the card didn’t dominate the tournament as I had hoped. Now I’d be lucky to sell copies in the $16 range, netting me virtually nothing in profits after fees and shipping are factored in.

Granted not all of the breakout cards from PT Kaladesh were busts. I’m sure there was someone out there who was all over Dynavolt Tower when it was in the bulk bin. But the reality is unless you bought in before the Pro Tour and had the copies in hand, you’re not likely going to have sufficient growth in card prices to overcome fees and shipping to make your speculation (read: gambling) worthwhile.

The Race to the Bottom

This brings me to my next tension: the inevitable race to the bottom. In other words, now that the Pro Tour is over we’re going to see sellers undercut each other in an attempt to get their copies sold at still-profitable prices. Those Aetherworks Marvels I bought at $12? You better believe as soon as they arrive I’ll be listing them on eBay at five cents below whatever the cheapest price is at that time.

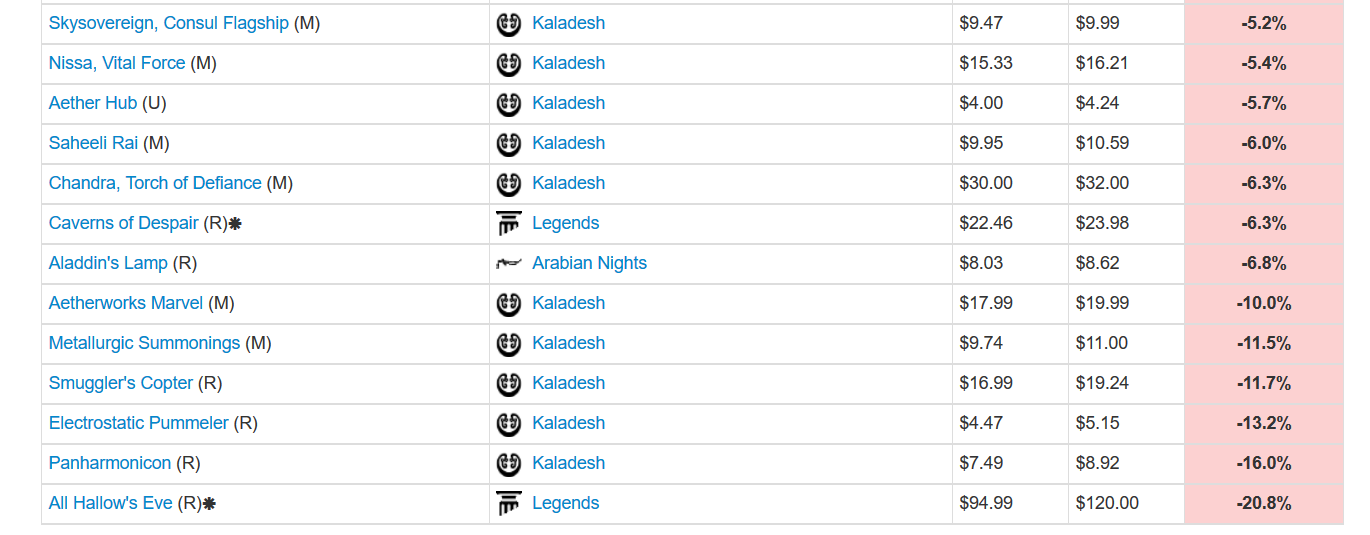

Sitting on spiked Standard cards is poisonous---virtually all cards that showed up in the list above will sell off and be cheaper one week from now than they are today.

In fact, this process has already begun and the Pro Tour isn’t even over yet as I'm writing.

Take a look at Aetherworks Marvel, down 10% already from Saturday to Sunday. And that’s not even the worst performer---Electrostatic Pummeler and Panharmonicon may be critical Standard pieces, but that won’t stop them from massively selling off. The market just can’t support so many cards spiking at once. Speculators have their hands in the pot so extensively that they will singlehandedly manipulate prices upward and then undercut each other right back down again.

And remember, these are TCG Mid prices. This means large vendors can fetch these prices, but if you want to sell your Smuggler's Copters, you’ll have to beat the prices above by 10%. Also, any card on this list that doesn’t win the Pro Tour is likely to sell for 5%-10% less than these prices by the time this article goes live. This is placing a ton of downward pricing pressure on these cards.

We Haven’t Hit Peak Supply

Kaladesh has been on the market now for what? Two or three weeks? We’re not even at peak supply yet! This set will be printed and printed ad nauseam as players draft this set and seek Masterpieces.

As more product is opened, everything on the list above will drop. This is always how prices behave when a new set is released: they start high during pre-orders, fluctuate significantly during the first Pro Tour, and then sell off dramatically (except for the sole couple of cards that really define Standard going forward).

Remember when Thought-Knot Seer was supposed to be the next $20 Standard card because of its utility across multiple formats?

That card continues to hit new lows on a weekly basis. Standard cards really struggle to maintain elevated prices and the pressures only increase as a set is opened more and more.

Speaking of increased product opening, don’t forget about those Masterpieces. Battle for Zendikar has exactly two cards valued above $10: Gideon, Ally of Zendikar and Ulamog, the Ceaseless Hunger. That’s it. Two mythic rares worth opening in booster packs and not much else. Talk about an inexpensive Standard. No wonder Wizards of the Coast is calling these Masterpieces a success and are printing more of them going forward. It is making Standard much more accessible.

Now, let’s take a look at how many cards are currently worth double digits in Kaladesh. By my count there are six, but that number increases to ten if you count cards that are at least a couple quarters away. Here are the big six for now:

- Aetherworks Marvel

- Chandra, Torch of Defiance

- Nissa, Vital Force

- Smuggler's Copter

- Torrential Gearhulk

- Verdurous Gearhulk

That is a huge list compared to Battle for Zendikar. To me, this can only mean one thing: prices still have very far to fall. To me, every single card in Kaladesh is a screaming sell right now.

In fact I’m already regretting my speculative buy of Aetherworks Marvel. I failed to realize that my purchase was essentially a bet that this card would be one of the two most valuable cards in all of Kaladesh. While that may have been possible if there were four or more Marvel decks in the PT Top 8, clearly this can’t be the case now.

There’s simply no room for so many valuable cards to exist within this set. Therefore, everything will drop and it will drop quickly...probably too quickly for folks to make any real profits from their weekend purchases.

Wrapping It Up

Going forward, I think the days of buying Pro Tour standouts on Friday and Saturday to sell mid-week for profit are gone forever. With live casting of the event, rampant speculation, and a cheaper Standard format, there’s just little room for real profits from such an endeavor.

I gave into the hype momentarily on Friday thinking I was still ahead of the curve by buying before the metagame was truly known. But even a Friday evening purchase was far too late. By the time my Aetherworks Marvels arrive in the mail I’ll be lucky to break even. My best out may be a buylist order to someone like Card Kingdom---that 30% trade-in bonus may be enough to keep me from flat-out losing money.

I’m sure others had more success this past Pro Tour than I did. Perhaps they planned better than I did. Perhaps they made their purchases one week earlier. Perhaps they had friends on the Tour who recommended certain pickups.

Whatever the case may be, I can draw one inarguable conclusion: Pro Tour speculation isn’t for me anymore. Prices adjust far too rapidly to make any worthwhile profit given the risks involved. Why expose myself to this kind of volatility when I can sit on something like foil Temple Bell and simply wait for profits to come to me?

I prefer a slow-and-steady style of investing in my stock portfolio; my MTG investing approach should be no different. The thrill of flipping something over a weekend is always enticing, but I’m developing enough bruises and black eyes from my recent bets that I’m starting to learn fear of Standard speculation altogether. Last weekend’s Pro Tour results only solidify this belief.

Perhaps others had completely opposite experiences this past weekend. I’d be eager to hear if I’m voicing an opinion consistent with the community or completely incongruous. Please share your thoughts in the comments below and let us know how you did.

Perhaps the game is still alive and well and I’m just playing it incorrectly. I’ll accept that. But until I hear a solid strategy with an attractive risk-reward proposition, I’m going to stay away from Standard. I miss the Modern Pro Tours already.

When’s the next Legacy SCG Open again? Eternal Weekend can’t come quickly enough.

…

Sigbits

- Did you know that Card Kingdom increased the percentage they pay on played cards? They are now best in class when it comes to high-end played card pricing. For example, Card Kingdom pays $125 on Guardian Beast. But Near Mint copies are tough to come by. Fear not, because they’ll still give you 90%, 80%, and 70% of that buy price for EX, VG, and G copies respectively. Sometimes a collectible card from an older set is difficult to sell if its thoroughly played---now you have a viable out for those played cards.

- Did you know that Star City Games has aggressive buy pricing on Collector’s Edition and International Edition cards? For example, they pay $40 for CE Chaos Orb and $17.50 for CE Demonic Tutor. For non-tournament legal cards, these are pretty generous prices. My assumption is that Old School Magic drove these prices higher.

- Did you know that Channel Fireball is still one of the best places to sell Near Mint Alpha rares to? They pay $125 on Deathlace, $125 on Contract from Below, and even $85 on Farmstead. There are collectors out there who truly appreciate a quality Alpha rare, so while these are difficult to come by there is a market for this.

The speculation portion of the MTG community has always affected card prices. I can only wonder to what degree is the MTG finance community’s FEAR of investing in standard and modern affecting prices. I’m not discounting affect of today’s higher supply and absence of pro modern, but FEAR reigns. If it’s true the most lucrative moves are always ahead of the crowd, then buying older stuff now might not be the best move….perhaps staying on course and investing in modern for when the pro tour returns is where the most returns are. But FEAR tells us no!

With so much finance gurus pushing old cards these days, I think much of the old stuff being bought is being bought by greater fools.

Sparrow,

Thanks for the input! I love your suggestion of buying into weakness rather than strength. In a healthy growing economy this is often the optimal play. I do think there will come a time when Modern will be the best format to put money to work.

However…

With Modern Master 2017 less than a year away, I have to imagine there will be no good catalyst for growth in the near-term. Why buy into something and run the risk of a reprint in a few months? That’s certainly enough to keep me away for the time being. Once MM17 is fully spoiled, stuff that dodges reprint will certainly climb higher. But is that a bet you want to make right now?

As for older stuff getting too overheated, I think you’re right. Everyone flocks to old stuff, but now these Old School cards have grown very expensive and offer much less upside in the near future. Perhaps selling old stuff IS the right play here. Even so, I don’t think I want to put the money to work elsewhere until there’s more known about reprint sets on the horizon.

Terrific comment, I really appreciate it. I need to think on this FEAR component some more!

Sig

Yes, there is the issue of the reprints in MM 2017 to deal with…that’s legit.

But it’s hard to believe the spikes on old cards are the real price…the buy outs have inflated prices, and who will really want to pay $500 for a box of Ice Age? Or how many will actually want All Hallow’s Eve for $200?

There’s probably money to be made in flipping some old RL during these RL hyped times, but it will have to cool off eventually because I don’t think the demand is really there for a lot of the newly bought-out RL.

Yeah, I’m definitely thinking the latest RL hype is passed now, and prices are going to settle down a bit. But you know it’s just temporary. Eventually something will trigger buyouts anew all over again…until the game dies down. But that may take a long time. No harm in taking profits while their juicy – I’ve been trimming my Old School stuff that I’m not actively using just for that reason.

Certainly a pessimistic take.

Before replying, looks like All Hallow’s Eve had another large price increase. Saw you posted that some weeks back. So, good job!

In terms of Pro Tour actions, I think you’re using a personal take and using the facts to manipulate one specific viewpoint. There were a few actionable and profitable cards coming out of this Pro Tour.

Was it as lucrative or volatile as others? Maybe not, I don’t have the data in front of me. But, folks could have (and did in IRC chat) bought into Dynavolt Tower for as low as .49c in the early rounds of Constructed on Friday. Spending $8 and some change on a 4 playsets to then turn around and sell each playset for $8 is extremely good – even after fees/shipping.

That’s not even counting Torrential Gearhulk which could have been had in the $8-10 and was easily selling for $25 a piece.

I only make this post because I’m a fellow writer, which also happened to cover the PT for the site (and plenty of PTs before this). If it wasn’t worth it, then trust me I wouldn’t be spending a majority of the past 3 days covering it and making recommendations to Insiders.

Your point on Supply is correct, we aren’t at peak supply. The problem is, we’re not at peak supply *right now* which means with the PT being almost immediately after release, it’s not surprising we saw drastic price movement. If we look at previous PT, all these prices have nowhere to go but down from here. So, that’s when supply will definitely have it’s impact going forward.

I understand where you’re coming from, and you have a specific investment strategy. PT is not for everyone, it requires you to essentially be glued to a screen for a considerable amount of time over the course of the event. But, I have to disagree in a big way to your overarching argument for PT not being lucrative. They are, but the timing (and time investment) is literally everything.

Anyways – always enjoy your articles Sig.

Chaz,

Thanks for the thoughtful comment, I really appreciate it. I respect your view 100%. In fact, I hope folks at this site have more experiences like the one you describe rather than the one I had. It justifies subscriptions to sites like these ;-).

But in all seriousness, I used to have so much more success with PT’s. It seemed like I was ill-prepared for this one. I should have kept out of it altogether. I think that may be the biggest takeaway – if you want to engage with PT speculation, you need to commit time and resources up front so that you can be fully prepared throughout the weekend. PT speculation isn’t something that can be improvised any longer…at least not by me. I’ll think about this more for next time, where I hope to be better prepared and have better luck.

Thanks again as always for the kind words!!

Sig

Hi Sig,

Great work, as always. I do the QS cast here with Chaz, and I’d like to echo a few point states he made:

1. Timeliness – You’re absolutely correct: friday buys, in the current marketplace, can often be too late. If you do buy Friday, it needs to be quite early. However, if you’re following meta trends, and all the available information, you can lock your buys in by Thursday and be

ready to go.

2. Card evaluation- This is something you’re good at, and the better you are at identifying cards with a higher probability of format impact, the sooner you can buy in, and the better your odds of PT profits.

3. Outs- This is the most critical point. Buylists are getting tighter and tighter with how they respond to spikes. Marvel did not even move until some point late saturday, or Sunday, and that $11-12 window shut quickly. Buylisting is still a viable option for specs quantities above two playsets, especially with credit bumps that can be quite lucrative.

That’s said, your general sentiment that traditional, full-weekend speculation is nearly impossible, is true. You must have your specs locked in earlier and be ready to sell faster.

However – if you’re ahead of the pack, you can adeptly identify high-impact cards, and you’re willing to dedicate the weekend time, the PT can still be quite fruitful.

Tarkan,

Great points, and I agree with you completely. My struggle is twofold:

1) I don’t know Standard all that well, so I am not adept at pinpointing the right targets in advance without Twitter or the QS forums helping me out 🙂

2) I’m not that interested in Standard, so my desire to follow the format closely is low.

Thus my conclusion: this probably isn’t for me anymore. Maybe that’ll change over time. But given that we’re expecting a second baby in January, I suspect my time to follow a rapidly evolving Standard format will become less…not more.

Thanks for the build though, I’m really happy readers can see the opposite side of the coin because there is definitely some merit to your strategy!

Thanks,

Sig

I think this underlines one of the biggest things when it comes to people trying to get ahead of the curve: You need to have a good understanding of the game and what the metagame is going to look like. For every set that is associated with a Pro Tour, Wizards wants to push the mechanics of that set, that is also why they got rid of the Modern Pro Tour, it didn’t push the new set outside of extreme examples.

We knew going in Energy and Vehicles were the big concepts to be pushed, much like Delirium and Emerge were before. That gave you the Tower/Pummeler/Copter spikes. Also people need to just realize what a good card is, aka Gearhulk. The other spikes were due to the majority of players (casuals) seeing a couple decks do well by a popular person and buying in.

Some other cards briefly went up like Hydra, but in reality that card is very medium compared to what the rest of the format is doing.

I honestly think speculation has 0 to do with PT spikes though. What is there to speculate on? The Pro Tour already happened and we saw what cards were doing well, thus players buying in and causing cards to go up. I know when I see most of these terrible cards go up I am trying to race to the bottom to unload them since I know where they will end up.

Honestly this might all be ramblings but I swear there is a good point or 2 in there some where.

Stu,

Appreciate the comment! I think your point is: if you’re going to speculate on Standard, you need to know what cards will be good in the format before the PT. And this is the same sentiment that others are echoing. Clearly I did not do this, hence my failures. It’s a tough lesson learned and I hope others will learn from my mistakes going forward.

Sig

I think you kind of see but didn’t directly address the real issue here. MTG Finance is a victim of it’s own success. You can’t make mass numbers of people aware of opportunities and them remain opportunities. In this case the pro teams THEMSELVES are speculating on their own decks before the PT hits. Has been going on for several PTs now. That leaves you a day late and three dollars more.

Very true. Once a strategy becomes known, it’s not really a good strategy anymore. We need to find different ways to get ahead of the curve, and to me Standard is not it.

It’s important to acknowledge the good times and the bad. There is a tendency for some mtgfinance writers to stick their heads in the sand when times are tough since we’re used to years of constant gains. I’m glad you’re willing to speak you’re mind. Mtgfinance has clearly changed and the days of making a quick buck seem to be over. I’m all for playing the long game; I’ll keep picking up glittering wishes and grand architects instead of chasing pro tour standard breakouts (ie: the end of the rainbow).

Jonthan,

Thanks for the support. Indeed things are shifting in the MTG finance world and it’s better to acknowledge it and adjust accordingly rather than ignore it. I’m really happy to see others are also experiencing similar trends – it reassures me I’m not the only one with this cautious view. I like your ideas of finding good long term holds and just waiting patiently…as long as we can dodge reprints that’s a great strategy. I recently picked up a few foil Temple Bells as I think this is another long-term hold worth grabbing and sitting on. These are about all I’m willing to buy nowadays (considering my position in Vintage/RL stuff is already where I want it to be).