Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

One of the major difference between the paper and online versions of Magic: the Gathering is the ability to "print" sets and cards at will on MTGO. There's no such a thing as the Reserve List online and pretty much all cards can be reprinted anytime through flashback drafts, MOCS promos and other special decks or sets.

Reprinting cards on MTGO is one way to keep prices on check and make sure that eternal formats remain, somehow, accessible. The most expensive cards online, Force of Will and Lion's Eye Diamond, once hit 150 tix a piece. With their recent reprint in Vintage Masters they completely collapsed to 35 tix and 15 tix a piece, respectively.

Aside from the newly-introduced-to-MTGO Black Lotus, Rishadan Port and Wasteland became the most expensive cards online. The incoming Tempest flashback drafts have momentarily deflated the price of Wasteland to a more bearable 100 tix price tag.

From a speculative standpoint, this reprint policy on MTGO renders any sort of long-term speculations harder, if not impossible. Two or three years of slow and steady growth can vanished in a matter of days with the announcement of the new MOCS promo card or most effectively with the spoilers list of a Masters set. As of now, no card is sacred online. There's no reserve list and it's presumably only a matter of time before any given card is being reprinted.

Given these parameters you can't buy the equivalent of paper Vintage staples, P9 pieces, dual lands and other reserve listed cards, sit on it and wait years for prices to rise with a certain degree of certainty.

Nonetheless several cards have been around for quite a while on MTGO and had the time to reach a pretty high value. If Force of Will and Lion's Eye Diamond have seen their prices shattered by the massive reprint that was VMA, others such as Rishadan Port, Misdirection and Mox Opal, to name the top ones only, are still cruising to new heights every day. Sure they have not been reprinted yet. But they also were at some point in time really cheaper. Do such opportunities still exist nowadays?

When looking closer at reprints and their impacts on prices I see two things:

- For some cards, and mostly true staples of eternal formats, reprints didn't really do anything in the long run, even in the form of a popular draftable set.

- Reprints are actually the ideal entry point for long-term speculations! The more massive the reprint the better it is for your ROI.

Long-Term Modern Trends

When looking at the older Modern staples, even reprinted in a popular set like Modern Masters, Tarmogoyf, Vendilion Clique, Cryptic Command and Dark Confidant barely tilted in the grand scheme of price trend.

Take a look at Dark Confidant. Without looking at the time scale, do you see a marked price drop due to Modern Masters? In the very long run, that are these four years on MTGO, the black wizard is on a continuous upward trend.

How about Vendilion Clique?

For sure Modern is a popular enough format to maintain these kind of trends. Heavy reprints have momentarily delayed the raise, at best. Since the inception of Modern, key cards of the format have been heading up despite big swings.

And when looking at Modern staples from later sets the trend is about the same once out of Standard.

Depending on the card they have bigger or smaller swings, but if a card is a true Modern staple its price is inevitably heading up in the long run.

Long-Term Legacy/Vintage Trends

Mtggoldfish doesn't have prices prior to 2011. Between 2011 and Vintage Masters, Legacy and Vintage staples saw mostly increased prices.

Not all cards increased in price during that period--Force of Will had big ups and downs around 100 tix without a real upward trend. However other staples such as Lion's Eye Diamond, Misdirection, Show and Tell, Rishadan Port and the dual lands have gained tremendous value over the years since their initial print on MTGO.

Reprints and promos also affected the prices of Legacy/Vintage cards but only Vintage Masters had a strong effect on prices. You can see the big price drop for Volcanic Island; this fall is about the same for every Legacy/Vintage staple reprinted in VMA.

Vintage and Legacy don't have the same popularity as Modern and I don't expect staples from VMA to rebound as fast as Tarmogoyf and Cryptic Command did. Nonetheless I expect cards such as Force of Will and Lion's Eye Diamond to slowly recover and converge to the 100 tix mark again sooner or later.

Finding Long-Term Positions

In light of the examples above it appears that long-term investments on MTGO are not as impossible as one may think. In the course of several years swings can be high but the general trend is conserved.

Only massive reprints in the form of draftable sets such as Vintage Masters and Modern Masters seem to be able to significantly alter a long-term trend. Alternatively, these Masters sets also constitute excellent buying opportunities--prices are bound to rebound after a big drop.

Rotation out of Standard also appears to be a good initial entry point for long-term growth in solid Modern and Legacy/Vintage staples.

Vintage Masters

Talking about massive reprints in the form of Masters sets and good long-term buying opportunities, VMA is exactly what you want. Prices are already on the rise but are nothing compare to what they should be in a year or two and after VMA stops being available at the MTGO store (in two weeks or so).

Vintage and Legacy are certainly not as popular as Modern, and the continuous disappointment in the V4 client might slow down the rise of VMA cards. However Legacy cards made their way up before and will do so again. Fixing MTGO and popularizing Vintage would surely help and make prices go up faster. I hope WotC is genuinely willing to improve the MTGO experience and consequently keep the player base expanding, for the sake of both Magic and our specs.

There are two kinds of potential long-term specs in Vintage Masters--reprints and new cards.

All reprints of true Vintage/Legacy staples dropped considerably, losing easily 80% of their value for some. Even Vintage restricted cards are good targets. After all, now that Mana Crypt is worth ten times less than before VMA, more casual players will be inclined to get their copy. To name only the top ones, here are some Vintage staples you may want to consider for long-term investments.

More into uncharted territory, and besides P9 pieces, VMA brought its lot of new cards to MTGO. The new cards are mostly from Conspiracy but also from Arabian Nights, Portal and Starter 1999.

I see Conspiracy cards in VMA like cards from Mirage, Tempest, Urza and Masques blocks. Meaning that these sets and VMA have been drafted for a very limited period of time and contain high quality, undervalued cards. Conspiracy cards that are going to be in demand have never been released before and are in limited supply. Some of these cards are mythics from a set of 325 cards!

In particular, Dack Fayden is a potential Misdirection or Show and Tell in terms of price. This planeswalker could easily be worth 50 tix or more in two years from now.

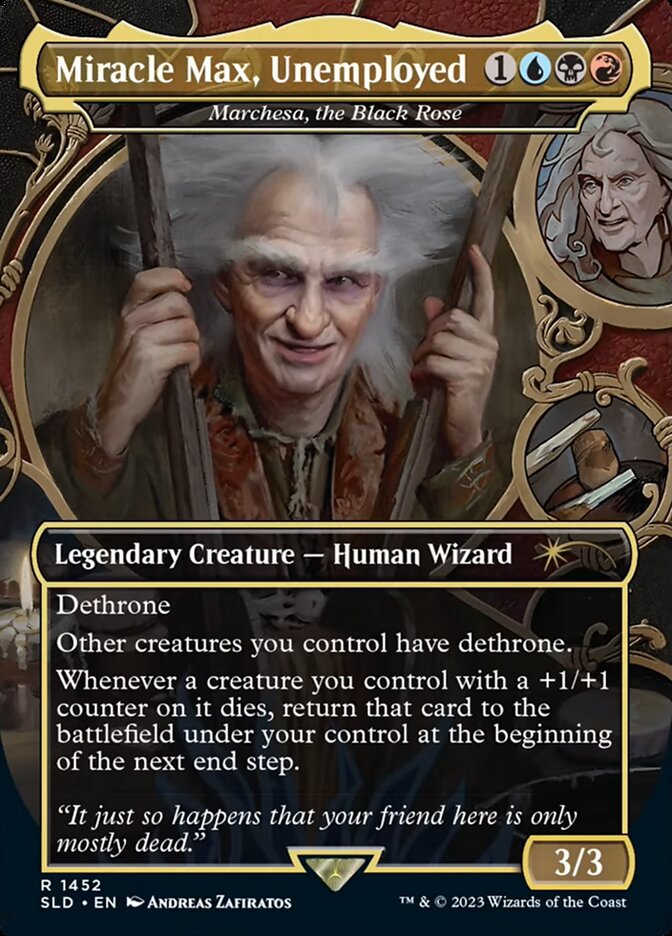

In VMA, Marchesa, the Black Rose, Coercive Portal, Scourge of the Throne and Muzzio, Visionary Architect are also mythics and are worth about 0.1-0.2 tix now. If you want my opinion they not only won't stay that low for a long time but will be way more pricier in a year or two.

To a lesser extent the same reasoning also applies for Conspiracy cards that are rares in VMA. For now, the supply is high compared to demand. However, in the grand scheme of things, supplies are pretty low and prices won't wait to increase.

If these were never released online, they are either functional reprints or cards with almost no interest.

I would also consider Commander cards reprinted in VMA, such as Edric, Spymaster of Trest, Baleful Strix and Chaos Warp. These cards held significant value before VMA. Now that their value has been slaughtered by this reprint, prices are set for a long-term rebound. Edric was above 15 tix last May. How long do you think he is going to be worth 0.2 Tix? Even a bounce to 2 tix is a 1000% increase! In the long run I foresee only great upside for these cards.

Finally, if you think MTGO will still be around in couple of years, betting on Power Nine cards is probably a good move.

The Modern Pool

If Modern maintains its popularity, we have nice fertile ground for great speculations and potentially for long-term investments as well. Reprints are expected to be more frequent in Modern though, whether in the form of individual cards as in the case of Thoughtseize, or in the form of sets like the expected Modern Masters 2.

Modern is also the ideal format for sudden spikes. Here I'll focus on cards that are known to be Modern staples and, similarly to Dark Confidant and Cryptic Command, should keep gaining value over the next few years, with or without a potential reprint in Modern Masters 2.

After Innistrad block flashback drafts, Snapcaster Mage should be set for a constant rise. Playable in all eternal formats, only a reprint in Modern Masters 2 could stem its price rise.

All the other cards on this short list are about to rotate out of Standard are will be at their absolute bottom next October. They are all true staples in Modern or Legacy/Vintage and are guaranteed investments for a long period of time.

Exiting Long-Term Positions

Many of the cards I mentioned here should constitute strong investments in the long run. With patience they should yield great returns. If you should decide to commit to some of these positions, you want to make sure you are not in a rush to make profits--plan on investing for one or two years minimum.

As shown above with some examples, the trend might be a constant upward slope with ups and downs that can last several months or even a year. It took a year for Vendilion Clique to recover its January 2013 price, before finally rising even higher.

With the history of prices available on Mtggoldfish now, you want to take advantage of that knowledge when you exit your long-term investments. Based on previous price swings and overall history of a card you may want to anticipate a high to sell your positions, and you must be ready to wait for a low to pass.

If you are buying cards that are now very low because of VMA, a target price to sell these cards could a price near the previous highs of these cards before VMA list was spoiled. I would believe that Lion's Eye Diamond will be worth again around 100 Tix in a distant future.

Thank you for reading,

Sylvain Lehoux

This is a fantastic read, especially for those who are trying to wrap there head around longer term specs. Nice article man.

Thanks!

Long-term specs may sound strange on MTGO but after this article I convinced myself that is was clearly feasible. 🙂

Yes, you are the one ! keep up the good work.

Thanks for the comment!

This is a great detailed read, thank you!

Thanks! Glad you enjoyed it.

Hi Sylvain! Love your articles man. I just want to ask something. Why are cards rotating out of standard going up? I imagine most people who plays standard would sell them, increasing supply, but those prices should be supported by the ones that plays Modern. How is it that more and more people are willing to pay for them so the price go up?

Hi Sheva,

Thanks for the comment,

When rotation occurs supply is getting to its highest while demand its lowest. The vast majority of cards will hit their record low (whether it is 0.05 tix for junks or higher for more valuable cards).

Everyone wants to get ride of these cards to get as many tix as possible for the new fall sets. During these 2 to 4 weeks players wants Tix and tix only to draft and buy new set cards and build new decks for the new Standard.

Modern (or Legacy/Vintage) demand is at its lowest during that period, so even cards that are eternal formats staple are low.

After a month or two the frenzy for the new set has gone and people think about eternal format again and buy back some of these freshly rotated out cards. Prices are picking up.

Also, boosters are no longer available once out of Standard (unless I’m wrong?) so that’s it for fresh available cards. Redemption is now removing cards for MTGO. This will affect mostly mythics and almost not rares though.

Basically it’s the supply/demand model combined to the fact that players don’t have bottom less pockets so they have to sell X to buy Y, and after some time they sell Y to buy X. As speculators/investors we want to buy whatever is low and sell whatever is high, according to players demand.

Hi Sylvain, nice article! Next week will you talk about the skyrocket price of Glittering Wish?

I can’t belive it was at 0.6 tix at the beginning of this week and now it’s 10 tix!!! 0.0

Hi Naka, I’m glad your enjoy the article.

My article next Tuesday won’t be about Glittering Wish. But I keep that in mind for future articles and maybe talk about this sudden spikes.

For the Wish cases, from what I saw/heard it took Travis Woo and Sam Black (and maybe others) to have ideas about Modern decks with 4 Glittering Wishes in it to spark this huge spike.

I caught the spike 24h later and was able to grab 2 playsets of the wish at, already, 2.5 Tix per copy.There was no where to fin any other copies!

Future Sight cards are in very limited quantity which really helped the price to skyrocket.

With such spikes if you get the info too late with prices already high there is very little you can do about it. I’m not planing on holding my copies for too long, I’ll be happy with doubling here.

This spike being pure speculation as nobody posted a strong result with one of these decks in Modern, the price of the Wish may as well be back to 2 Tix in 2 weeks. Modern season is not what people are looking for now so I doubt the price will hold, especially on MTGO.