Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

A few months ago I started a series of articles focused on the opportunities presented by Eternal Masters (EMA) on Magic Online (MTGO). I hoped you enjoyed, and profited from, these pieces. Today is the final article in that series---we’ll boil down the lessons we learned and keep an eye out for future opportunities. I will continue to contribute occasional pieces to Quiet Speculation as opportunities emerge, but this is my last regular article for a while.

Before we dive into lessons learned, I wanted to take stock of my picks over the past few months. Not all these were hits, but overall the portfolio did quite nicely. Most of these were driven by Legacy though others were driven by price weakness caused by flashbacks.

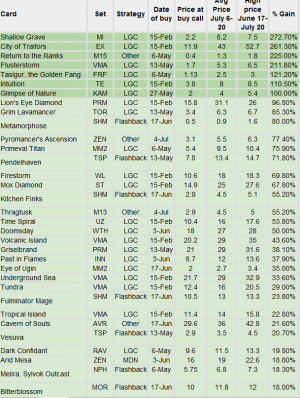

As discussed in my article series and forum posts, we were targeting the window from July 6-20 to sell most of our EMA-driven specs, so I used the average price during that window for our sell price. I’ve also indicated the “high” price for these cards from the moment of EMA release, though it’s unreasonable to expect you can time the market on most cards. However, this provides a "best case scenario" if you were following the market day by day:

The cards above increased enough to more than cover the spread on MTGO and yield a profit. Some of our top picks were very profitable indeed.

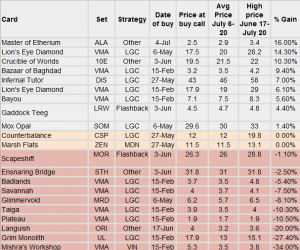

These specs were less successful. Those that yielded a gain of 16% or less I put in grey. If you bought these cards for playsets you were happy, but as a velocity-generating spec their performance was poor. Finally, the red cards were our misses.

It's worth noting that some of these were big winners if you caught them at their peak---I sold a half dozen copies of Infernal Tutor over 50 tix and liquidated about half of my Lion's Eye Diamonds near their peak.

I am a fan of taking profits with your specs in stages, rather than always waiting for your target sell window, and that approach was largely validated here. Counterbalance and the Vintage Masters dual lands would have also yielded strong returns if you sold them at the right moment, but timing the market is not a winning long-term strategy.

Lessons from EMA Speculation

1. Eternal Masters was a well-designed set for Limited and paper but seems to have entirely ignored MTGO economic considerations. Wizards could easily have corrected the expected value (EV) for online play, but failed to do so, either from lack of attention or desire. The result was a set that was fun to draft but unsustainable unless you played phantom.

We should not assume that future EMA sets will take MTGO equities into account, though perhaps they will learn from their failures. In addition, we may see more gains from EMA cards in the future because the set was not heavily opened.

2. Legacy never broke through on MTGO. Even at the height of competitive leagues there were barely 500 players (compared to two or three times that for Modern and Standard).

There are many reasons why Legacy is an attractive format online and why we’d expect players to migrate there and build up their Legacy collections. That’s what I predicted would occur, but it never really happened. Why not? Several possible explanations, which are not mutually exclusive:

- Interest in MTGO is closely tied to sanctioned formats and paper Legacy is a dying format. While many pros prefer Legacy to Modern, there is a rising group of players that just won’t touch it because they are priced out in paper and don’t see a future that justifies buying in. Why invest in a digital version of a deck if you’ll never play it in paper? Why invest the time mastering Legacy when it is in decline?

- Wizards never really promoted Legacy during the release of Eternal Masters. In fact, by offering Vintage Cube drafts they cannibalized the very audience that would be interested in Festival qualifiers. This is consistent with WOTC’s incentive structure---they want folks to play just enough Constructed so cards retain value but don’t want folks to substitute it for Limited, which brings in most of their revenue.

- The assumption has been that more people would play Legacy as the barriers to entry fell. But perhaps Legacy is so beloved in paper not despite its massive price tag but because of it. The very fact that players traded and scraped for their Legacy deck creates a loyalty to the format which does not exist online.

3. As a result of the weak interest in Legacy, most of the gains in Legacy prices were speculation-driven. The speculator community on MTGO includes a portion of QS readers, but a much larger community of investors and botters that are trying to beat the market. Once these investors saw the low interest for Legacy the market corrected---not back to where it was before, but lower than during the bubble.

The best time to sell depended card by card, but was often not the July 6-20 window. (You'll recall that I debated whether it was better to sell before EMA release or during that window---the answer ultimately varied card by card.)

4. Modern remains a powerhouse format for MTGO speculators. Most of the Legacy-relevant cards I am still holding are also relevant in Modern, and will see gains in the future. Flashback drafts are the gift that keeps on giving.

I hope you enjoyed this series and made some nice profits off of it, like I did. EMA was a great set to draft---hopefully we'll see it return in the future.

Best,

-Alexander Carl

@thoughtlaced

Hi Alexander,

Great Article. Ive speculated on the last 2 legacy events of the past year, pretty sure I’ll be sitting the next one out. Legacy just doesn’t seem like a great place to spec.

Thanks Peter.

I think there are still profits to be made–the key is getting in and getting out at the rigth time, and not making bets that are reliant on the long-term growth of the format. The higher spread on Legacy cards makes short-term specs (e.g those driven by MTGO events) challenging. Meanwhile, the risk of reprints makes “buy and hold” risky.

That said, if the conditions are right, as they were with EMN, Legacy specs can return strong yields in the short run. We’ll keep an eye out for future opportunities.

I build a legacy and a vintage deck online, because I can afford it here (not possible in paper).

I rarely play them, because modern is just so much more fun (and I don’t have the time to play other formats online).

I loved the article because I learned from it. Most interesting insight:

“perhaps Legacy is so beloved in paper not despite its massive price tag but because of it”

Glad you enjoyed the article!