Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Last Friday the S&P 500 and NASDAQ hit all-time highs. The former closed 0.03% higher to close at a record 2415.82 while the latter moved 0.08% higher to close at 6210.19. Both of these indices have had incredible runs over any timeframe you care to look at.

To an outsider unfamiliar with Wall Street, this would appear as though economic outlook for the U.S. was the greatest it has ever been. You may even go so far as to deduce that major blue chip stocks must be soaring as consumer confidence grows.

This is only partly true. In fact, when you peel back a few layers of the onion you will immediately find that underneath, the structural integrity of this rally isn’t as robust as it would appear at first glance. It would seem that much of it is buoyed by a few concentrated names, such as Apple, Google, Facebook, and Amazon.

Meanwhile, there are many household names that have sat out of this rally—some have even sold off despite of the run to all-time highs. Examples include Ford, IBM, and General Electric.

It seems there is a real split between the haves and have-nots in the world of stock investing. Thus one of the toughest investing question arises: “Do we stick with what’s working or do we cash out of the winners and buy into the losers?”

The MTG Finance Parallel

Sometimes I temporarily forget that I’m writing for a Magic: The Gathering site and not a general finance site. I focus heavily on Wall Street, so it’s easy to get sidetracked. In this case, however, I do have a parallel to draw. It won’t be perfect, but it will end up at the same final position.

Consider this: Magic finance may seem robust to an outsider. If someone had taken an index of key relevant cards to track across the entire game, I suspect the graph would largely go from bottom left to top right. It would be bumpy and imperfect, but I genuinely believe a non-weighted index would be rising over the years.

Like stocks, however, should one lift open the cover of this index to glimpse the details within, I believe the rhetoric would have to alter. Since 2015, this index would be buoyed in much the same way by powerhouses such as Black Lotus, The Tabernacle at Pendrell Vale, and Juzám Djinn.

Power, dual lands, Old School cards, Reserved List staples, and Commander foils would all show strong signs of growth over recent history. Imagine if you had bought one foil copy each of every card in the Atraxa Commander 2016 deck—I’m sure you would have made out quite well!

A basket of these cards would have led to tremendous gains.

On the other hand, there are some noteworthy areas of weakness that would also come to light under sufficient scrutiny. Just look at Gideon, Ally of Zendikar for example—it’s one of the most played cards in Standard (fifteenth most in fact) and it is the most played mythic rare in the format. Historically, the most played mythic would be worth $30-$50; in the days of Jace, the Mind Sculptor and Baneslayer Angel this could climb as high as $100. Yet once enough supply hit the market post-release, Gideon struggled to crack the $30 mark.

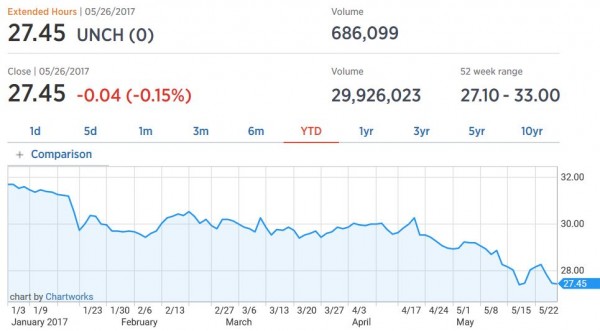

Similarly, Force of Will, the most played card in Vintage and second most played card in Legacy, has seen a dramatic sell-off over the past year due to its reprinting in Eternal Masters.

The same would hold true for the likes of Jace, the Mind Sculptor, Zendikar fetches, Deathrite Shaman, and Abrupt Decay. Even some duals have struggled to climb higher despite their ubiquity.

With this dichotomy, it leads me to ask myself: where is a better place to park new money if I want to invest in Magic? Clearly Standard has some systemic issues that I won’t delve into, but there could be merit to a strategy of buying into beaten and battered Modern and Legacy staples after they bottom in price from a reprint. Would this be a more sound strategy than, say, pursuing already-expensive Old School staples and Commander foils?

The Million Dollar Question

Just like in the stock market, this same debate of trash vs. treasure can be had in MTG finance. Of course the fundamentals differ completely between the two, so the comparison stops here. The answer to this question in the stock market could be very different from the answer in MTG. Then again, there really isn’t an obvious answer for either and I could see compelling arguments made on both sides. However I will do my best to share thoughts on where I stand today when it comes to Magic.

Magic is in a strange place right now that leaves me somewhat uncomfortable. There is a very obvious effort by Wizards of the Coast to increase sales—the player base isn’t growing like it once was, yet corporate leaders still want to see improvements to the top and bottom line. Therefore Wizards of the Coast was left with finding alternate means of tapping the market:

- Commander products tap the Commander market.

- Conspiracy products tap the draft market while also accessing the secondary market (reprints).

- The Masters sets tap the Modern and Legacy secondary markets.

- The Masterpieces tap the Standard market by taxing Standard players further via reducing the value of their cards.

In a way, Wizards has cleverly accessed profits from the secondary market without ever mentioning it directly. This, of course, is helping their sales in the short term, but it could have unfavorable consequences in the future. As players continuously get burned by reprints, they may be less inclined to actively pursue chase cards. They may abandon competitive play in favor of the much cheaper casual scene. And even though it’s amazing what the Commander products have done for their target format, Wizards can’t really market more products to that audience more frequently than they already do.

These trends have made me uneasy, and it’s why I have concentrated my MTG positions in “safer” positions like Power, Old School, and Commander cards. However many other people are doing the same exact thing, which is making this trade a bit overcrowded. It feels secure now to hold a card like Beta Mind Twist, but it may be greedy sitting on something that has done nothing but go up over the years.

Much like Amazon stock, a compelling case could be made that these staples are overpriced and should be sold. On the other hand, the only thing that is outpacing Amazon’s sales growth is the growth in the Old School player base.

I know I’ve made general bearish comments about Magic in the past, and it’s not my intent to do so again here. I maintain positions in Old School and Vintage cards because I believe in their long-term trajectory. However there is something to be said of the stagnation of many Old School staples after their initial hype. A similar trend happened with Legacy and Modern, although on a much longer time scale. Once the player base growth tapers off, we see a flattening of prices. This remains the norm until the next growth spurt occurs…if it occurs.

In the meantime, I will focus on three strategies:

- Continue to hold a core selection of Old School and Reserved List cards as the backbone of my collection.

- Add to positions in Commander foils based on metagame shifts according to EDH REC—the release of Commander 2017 will likely open up tremendous opportunity as new tribal theme decks are launched. Keep a close watch as there will definitely be money made.

- Churn and burn other cards with short-term potential (Pro Tour hype, low TCGPlayer stock, arbitrage). The intent here is to hold these cards for no more than a couple of weeks.

This strategy will keep me in the game for the long haul, generate some short-term profits (hopefully), and offer some mid-term potential for spikes. It covers all my bases without overexposing me to some of the greatest risks associated with the game right now: reprints, player base stagnation, and Standard exhaustion.

Wrapping It Up

Do I stick with the winners or do I move into “value” by seeking some of the underperformers of the market? This is an age-old question that comes up time and again on Wall Street. While fundamentals differ greatly in Magic, the same question can be asked.

While it’s impossible to answer this question with guaranteed success, I believe sticking with what’s working is the right move in Magic. This includes Old School staples, Reserved List cards, and Commander foils. Meanwhile some of the weaker performers—Standard cards and Modern/Legacy reprints—should be avoided. They may present a seemingly attractive opportunity on the surface, but peeling back a few layers I think there’s risk here that’s not worth taking. Especially when there are so many other opportunities on the horizon that won’t carry that same risk level.

Lastly, I want to add one word of caution around speculating on Commander foils. Sometimes the stock on these cards is extremely low. That’s great for triggering price spikes, but it can also lead to some emotional buying and lost money. Just because something jumps 200% on MTG Stocks doesn’t mean the card is truly selling at the new price. This is always the case, but it’s especially true with rarer Commander cards. Make sure you evaluate the card’s utility for yourself before deciding where to make your purchases, and never follow the hive mind that is “MTG finance.”

Thinking for yourself will be your greatest ally going forward!

Sigbits

- In the past when a Legends card spiked, the Italian version followed suit; not in the same magnitude, but at least the same direction. Lately Winds of Change jumped in price and Star City Games is sold out at $9.99. I wonder if the Italian version will get some love as a budget option going forward. SCG has just under a dozen copies in stock with NM listed at $1.99—let’s see if those move or not.

- Not long ago I spoke negatively about Predict, citing its recent price run as nearly complete. I need to double back now and alter my stance. With the banning of Top in Legacy, this card may become more relevant as Miracles players seek out alternatives. Star City Games is sold out of nonfoils at $2.99 and foils at $24.99. With just the singular printing, this card can definitely go higher.

- Diviner's Portent has become an attractive target to pull out of bulk as another alternative for Legacy Miracles. SCG is sold out of these too (albeit with a $0.15 price tag). I guarantee this gets restocked at a higher price. Especially given that Card Kingdom is paying $0.21 on their buylist!

I actually wrote an article looking at the price trend of Magic as a whole among others:

click here

When was Baneslayer ever close to $100?

Otherwise agreed that it may not be the time to go for risky investments.

pi,

I do remember you wrote such an article – it would be great to add a link somewhere above. But I think the link you sent me is the incorrect one? It brought me to another one of my articles.

Baneslayer didn’t get to $100, but it definitely hit $50 and I want to say retail may have gone a little higher. Different price tag but the same message applies: Gideon would have been $40-$50 in a previous life.

Glad you are on the same page with the overall premise of the article. Thanks for reading!

I think the link should work now, WordPress’ editing interface allows for more tricks than the regular commenting fields do; the link was too long for the latter.

My Baneslayer comment was referring to that you present Jace hitting $100 as something that has commonly happened. You would expect some extreme in almost 25 years. It’s better to look at prices that have been regularly reached, like Baneslayer’s $50 and ignore extremes.

Baneslayer definitely hit $100

Even if it did it would still be an extreme.

$100 is an extreme, but there were definitely other $40+ cards in Standard. Elspeth, Knight Errant was expensive when it first came out. Prime Time was over $30 for a while. There were most certainly others but it’s been a while so I can’t name them all immediately.

I wouldn’t object to it if you had gone with $40-$50 and ignored outliers. The way you described it, particularly with the “in the days of” phrasing, it reads like it was a common thing. “Jace even made it as high as $100!” would’ve been fine too, making it clear that it was the highest ever.

Anyway, not a big concern, the message is fine.

Well, investing money on cardboard stock is a risky investment overall. So, not sure what this article means, speculators are innate gamblers no matter how you look at it. So, I think writing on “safe bets” article could be getting old, this nail has been beaten in every article you produce. In my opinion investing in OLD school magic is a bigger bubble. If all the people are thinking this is a safe bet, then when prices go up, are you able to dispose/sell them? Is there real demand for playing these cards? If people just collect a card without any other function then there is no value (Look at Sports cards). Playable cards no matter old school, EDH, Modern standard are what gains in value, and this needs to be identified more in QS articles in my opinion.

I don’t entirely agree here. Scarcity is also a large factor, particularly for a collectible.

My perspective on many Old School RL cards – one I’ve actually discussed with Sig on the QS Cast – is that they’re slowly evolving into rare collectibles such as artwork. Kind of a mix between a Veblen Good and a priceless Rembrandt.

The logic here is that as gaming matures, its audience grows, and the generations of gamers age, these items will be become more and more scarce while the collectible demand for them increases.

Additionally, Magic as a game system is going nowhere. Consider this: if the game were to completely die as a consumer good…do you believe people would not create their own sets, proxy their own cards, etc? They certainly would, as the system itself ultimately does not rely on commoditized game pieces. So long as gaming culture exists, so to will Magic.

And even in such an apocalyptic scenario such as the above, I believe the marquee cards from Magic’s history would continue to grow in value….in fact, possibly moreso. Therefore, theyre probably the safest places to invest, imo.

Sig, would love your thoughts here!

I don’t disagree with the collectible value of these cards. However, not all mtg people think like Goblins like us MTG financiers (hoarding mentality). Try to sell that Juzam Djinn to new players and see if they will buy it? What I’m arguing here is that sure there are nostalgic values in these old cards however, not all players started playing in that old school era. Like me for example, I started playing during Darksteel, I don’t see the value in these old school cards since I tie no nostalgic value to these cards and I don’t feel the urgency to buy into them at all. But my feelings for Modern cards are different since thats when I started playing (I would rather get a foil TS Tarmogoyf over anything else). All I’m saying is that while these articles are informative about old school magic cards, they are not so relevant to the majority of the players since players start at different eras and there are more newer players at the moment. Its time to identify that Blue Ocean on making money with MTG and get out of your comfort zone!

It doesn’t really matter what all mtg people think. People in mtg finance should only consider how their potential customers think. Obviously the new player wouldn’t want the Juzam and if you decide to try to sell it to them it’s simply a sign of you not understanding this customer.

What you should ask yourself is not whether these cards have nostalgic value to you, but whether you have any among your potential customers who would be interested in them. I’m sure that if you could get a NM Juzam for the incredible price of fifty dollars you would buy it regardless of your feelings on it because you know that there are shops among your potential customers who would gladly pay a couple hundred for it even if that fifty would be beyond what you would value it personally. (Disregarding moral considerations on buying the card that cheap of course).

You and Sig may have a different set of potential customers. This article covers a subset of his that is apparently not included in yours. You are asking him to write about a subset of yours that might not be included in his. You may be asking the wrong writer to talk about what these newer players want.

This doesn’t mean that you’re not making a valid point: perhaps QS should consider whether there should be a stronger focus on newer cards. However, that doesn’t necessarily mean that Sig should as that might not be where his expertise lies. Speaking for myself I know I couldn’t say anything sensible about recent cards.

In short, you may not have been one of the people this article was targeted at.

When I started playing I could never afford a Juzam and the time when it was popular was a couple years in the past. Yet I did interact with people who lived through that time and they impressed me with stories about the “olden days”. I’m not personally nostalgic for Juzam the way I am nostalgic for say Dream Halls or Verdant Force, but I do consider those old cards to be very cool. There’s no reason why a player just starting couldn’t ultimately start desiring older cards by the same process, however due to the time that has passed since these cards were seeing regular play the likelihood of this happening is smaller than when I was a new player. On the other hand there are more players out there now and only a few would be needed to create enough demand for a card this rare. Fortunately we don’t all have the same tastes.

I appreciate both sides of this debate. And I think there is some truth to each.

On the one hand, it’s true that Magic cards are an unregulated market controlled by a single entity. They have full control and can choose to do whatever they’d like to the market. The Reserve List is the “gentleman’s agreement” that is the glue that holds the economy together on the Old School / collectible market. As long as we all accept that Wizards will never reprint Black Lotus (or will never go back and bring more of other Alpha and Beta cards as they were originally made), then we can believe that the rarity of these cards will remain in tact.

Then it just becomes a function of Magic’s health. If WOTC were to stop supporting the game, I don’t think the game would die altogether. Plenty of cards would retain their value as the game would likely keep going with 3rd party circuits (SCG for example). Of course casual play will exit for at least another generation. Is this enough to keep prices afloat? Not 100%. Plenty of “tournament staples” will die. But do you think the average Old School player who owns $400 Juzam Djinns cares about new sets being made? Not one bit!

The artwork effect that Tarkan references probably only refers to the most collectible of cards. Graded Alpha cards, Black Lotus, and some other icons of the sort. I don’t think things like Beta Sedge Troll or Unlimited Jayemdae Tome have a chance should this happen, but they’re going to be much more robust than…say…Crucible of Worlds or Fetch Lands.

I’ll close with this: I believe a true investment portfolio (not just talking Magic here) should include some non-traditional holdings. This could be artwork, coins, gold, etc. For me, Magic cards and vintage video games make up this component of my portfolio. It has a risk profile for sure, but so does any other investment. That’s why I stick with the winners (Reserve List, Old School) in Magic: it gives me the alternate exposure without as much risk. Still plenty, but much less (in my opinion). Hence my overall strategy and the premise of this article.

Thank you both for the great discussion! I will try to come up with something outside the box to write about next week. But given that this is my primary focus right now in Magic, I tend to come back to it because I know it best. 🙂

Sig

I’m with Tarkan, old cards are as scarce as they’ve ever been and slow depreciation in their numbers due to accidents leads to ever increasing scarcity unless the game would go bottoms up.

I only see prices crashing for cards of which enough have been printed for a player base larger than whatever the player base size is at a given time. Of course 1 million players couldn’t support high prices on cards printed for 20 million, but a Black Lotus would still be very rare with a print run of only about 20k (assuming a few got destroyed along the way).

Players grow older and start having more to spend. Some will fondly remember playing Magic (or still play) and find themselves in a position where they can actually afford those cards that were too expensive when they were younger. In addition, seeing prices rise some that would’ve traded or sold certain cards in the past now decide to hold them instead because they are showing a good trend. Basically cards are slowly ending up with people who want to hold them for the long term, leading to fewer copies on the open market.

Magic is way too tempting a commodity to not try to move in on should Wizards ever drop the ball. There will be other companies taking over.

Agree 100%, well put pi. Indeed Magic is so profitable that there has to be numerous parties interested in picking it up should it get canned by Hasbro.