Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, readers! I'd like to thank QS's own Charles Fey for the suggestion behind this article. The basic premise is that I'll be scouring MTGStocks.com to highlight the big movers (whether up or down) and providing an analysis for the reason.

The first thing I'd like to do is break down potential cards into different categories. The normal stock market tends to split them into these main categories:

- Penny Stocks - cheap, very speculative stocks. The Wolf of Wall Street made his fortune by pushing these onto people and for the most part they lost their money on these picks. This types of stocks are very high risk/high reward (similar to lottery tickets).

- Blue Chip Stocks - these are stocks of established companies, often considered safe and dependable. They are your Coca-Cola's and your Microsoft's.

- Income Stocks - These are the stocks that give you higher dividends but are usually less likely to grow much in value, similar to putting your money in a bank and getting your interest rate as a return.

- Growth Stocks - These types of stocks tend to grow and yield a good return, though dividends are usually re-invested into the company.

- Value Stocks - These are the stocks/securities that are considered undervalued. The market experts believe they are good longer-term investments.

There are certainly some similarities between a few of these options and Magic cards.

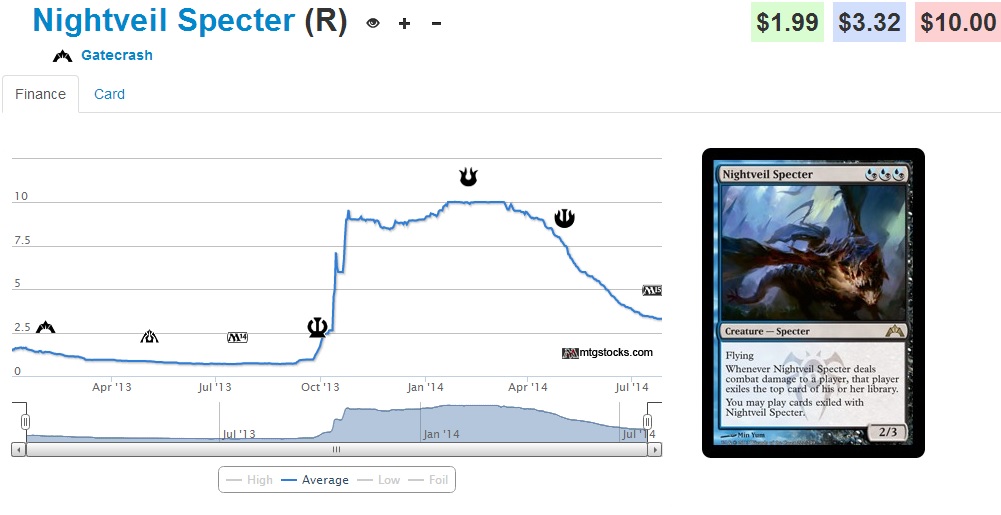

- Penny stocks - your bulk rares and possibly some good uncommons. These are often cards that are at bulk status (up to sub $3) until some new interaction is discovered or spoiled, when they shoot up in value. Nightveil Specter is a great example, as it sold for $0.75 or less (I got quite a few in bulk), then spiked with the Mono-Blue Devotion deck taking PT Theros by storm.

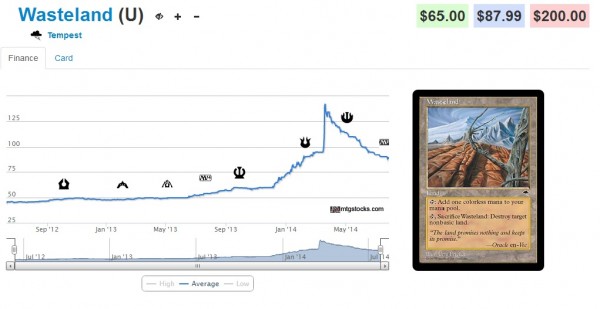

- Blue Chip Stocks - Your Legacy staples, like dual lands, Force of Wills, Wastelands--cards that have proven quite stable in their values. Sure they might go up if a deck is performing particularly well, but their likelihood of tanking is slim to none. They may or may not be on the reserved list and if they aren't they are likely far too powerful to be reprinted in Standard so the danger of a mass reprint is virtually non-existent. These are the cards I like to trade into when I can to "lock in" my value as I feel safe in their stability. My current blue chip stocks are these cards:

- Growth Stocks - These are similar to sealed product. They are expected to grow in value as the product becomes rarer as people crack it for retro drafts.

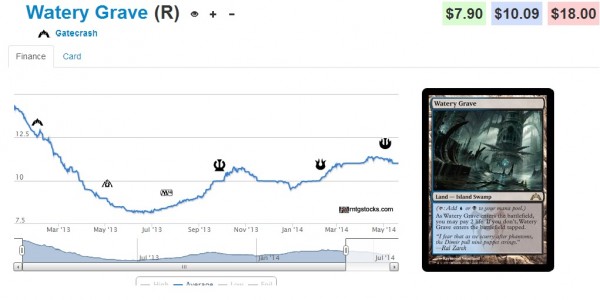

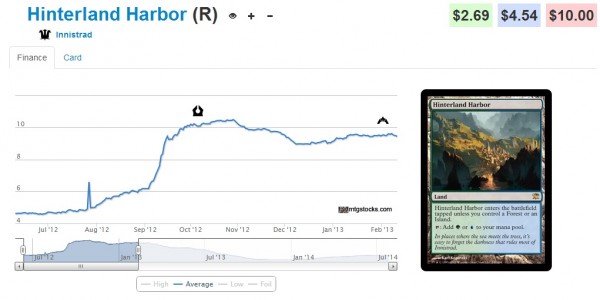

- Value Stocks - These are often the current block's rare land cycle (assuming it's not a reprint). They are almost always undervalued while in rotation and become more valuable once the previous block has left Standard. We saw this occur with Zendikar fetchlands, Scars fast lands, Innistrad checklands and RtR shocklands.

There isn't really an analogous version of income stocks because ownership of MTG cards doesn't pay yearly dividends (unless you can rent them out to people).

Now that we've got our definitions, let's look at the top three movers in each category this week.

*UPDATE* The (%'s) next to the card represent the price change percent from the previous week to the time in which the data was pulled.

Penny Stocks

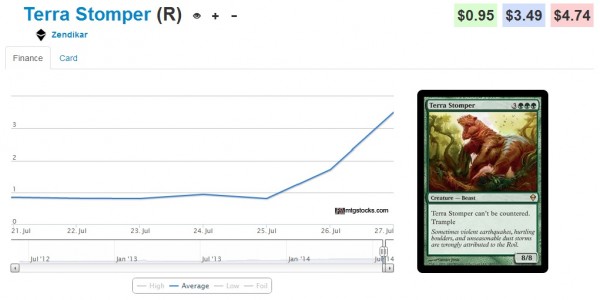

#1 Terra Stomper (+359.2%) - The reason for this guy being the biggest jumper for the penny stock group is that he was included in the green Sample Deck but not in normal M2015 packs. However, many stores didn't realize this and in order to fill preorders they were forced to crack Sample Decks or buy up the Zendikar version. Thus his bump was mainly due to misunderstanding.

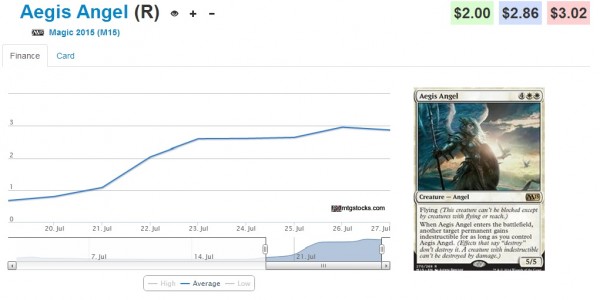

#2 Aegis Angel (+253.1%) - Unfortunately, Aegis Angel falls into the exact same category as Terra Stomper though she was featured in the white Sample Deck.

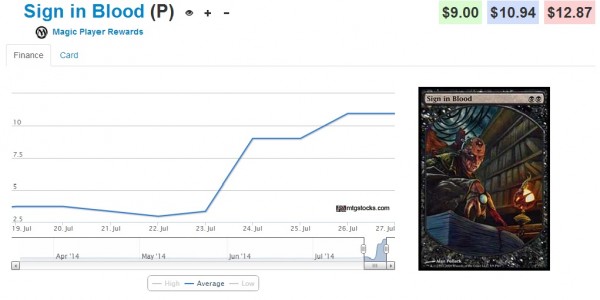

#3 Sign in Blood (textless) (+191.7%) - Though it wasn't at true bulk status, it was under $3 prior to this week's spike. Finally we have one that jumps up due to playability. Sign in Blood has found a home in Mono-Black devotion decks as an excellent two-drop (since they won't always have Pack Rat in hand). As expected by brotha52 in our forums, the card spiked similar to the Brave the Elements Player Rewards when that card started showing up in the aggro decks (usually Naya or G/W).

Blue Chip Stocks

#1 Wasteland (-2.27%) - This card has had a minor dip since last week. With a stronger push towards fair decks in Legacy the tempo decks (which run the full four Wastelands) are being kept in check, thus the demand for the card shrinks down a bit. It also important to note that there was a push by a major retailer to jump Wasteland's stock up (which you can see by the big spike post Born of the Gods) but the market didn't stick and it's trending back to the spot it was pre-spike.

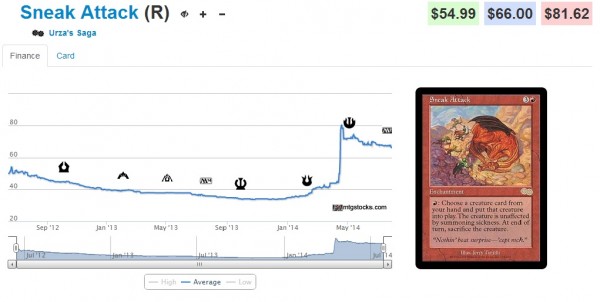

#2 Sneak Attack (-1.848%) - Sneak Attack shows up primarily in the Sneak and Show deck (whereas Show and Tell has found a home in both Omni-Tell and Reanimator). Thus when the Sneak and Show deck isn't doing well on the Legacy Open circuit, Sneak Attack takes a bigger hit than Show and Tell. It's also important to note that Sneak Attack did recently have price correction (similar to Wasteland), however this one appears to have stuck. Even though the price is in decline this week it is a minor decline and it does look as though we have a new price plateau around $65-$66.

#3 Tundra (-1.26%) - Tundra recently had a jump in price as well (this appears to be an across-the-board event). Its price doesn't appear driven by a single retailer like the previous two (which can be derived by the fact that we see a steady increase in price instead of a single-day jump). In early July, UWR Delver took both 1st and 2nd on the SCG Legacy Open Circuit, but two weeks later in Baltimore it didn't even finish in the top 16, which might explain its steady decline.

Value Stocks

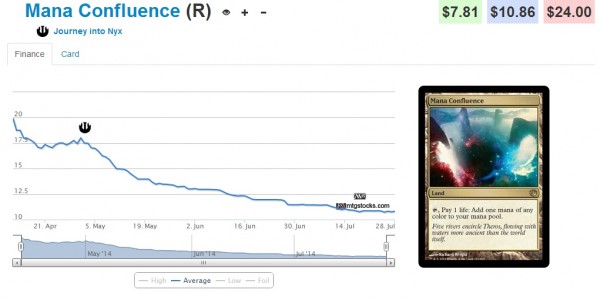

#1 Mana Confluence (-0.007%) - This is the mana fixer for all multi-color aggro decks. It has a home in Legacy (and likely Modern) and is currently at its lowest price ever. With the announcement of Khans being a tri-colored "wedge" set, we know this type of mana fixer will be integral in many decks. I love picking these up now (so much so that I've already purchased 11 and look to be acquiring more, especially since our LGS can't keep them in stock). Looking at the price, the decline has gradually begun to plateau or bottom out, so get them now before they jump back up to $15+ (especially if you're likely to play them).

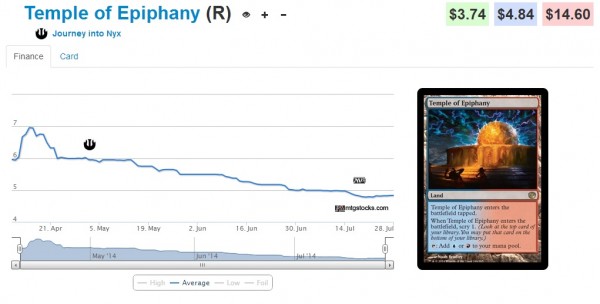

#2 Temple of Epiphany (+0.008%) - While not the cheapest temple you can buy right now, it's currently at its all-time low. There's no gaurantee it won't continue to dip some more, however, we are already into triple M15 drafts at many stores so the Journey Into Nyx packs aren't getting cracked constantly. This one also has the biggest shot at finding a home in Modern as most of the combo decks of the format include U/R. The fact that Modern lacks both Aerial Responder and Preordain does mean that the number of turn one cantrips worth playing are limited and thus the demand for turn one untapped land isn't as high (though it still critical against the decks with a lot of two-drops if you're playing Spell Snare).

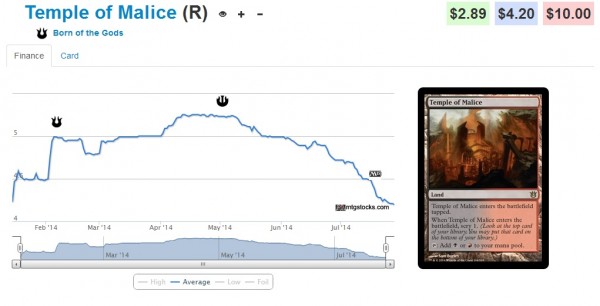

#3 Temple of Malice (-0.0167%) - While not a major color combination in Modern, I like Temple of Malice because it's red (which is often one of the strongest colors out of the gate in a new format, though admittedly aggro decks aren't huge fans of scrylands). More importantly, it's from Born of the Gods, which similar to Dragon's Maze only has one chase mythic (Brimaz), so people aren't cracking a lot of packs of this set. And again most store drafts are now M15, so the supply of these is likely to stagnate soon (if it hasn't done so already).

Growth Stocks

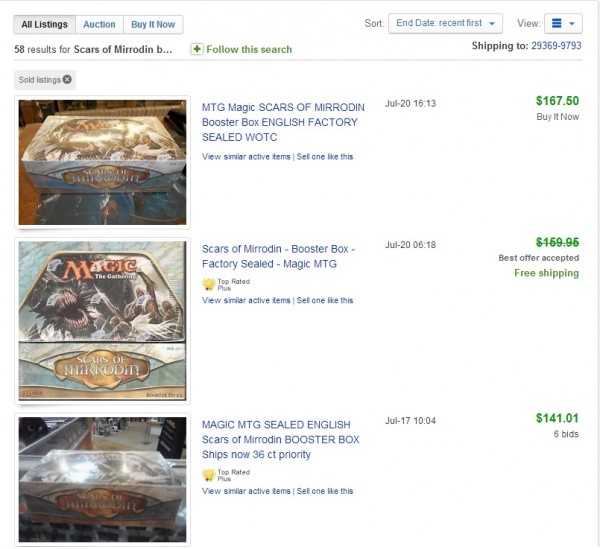

These will need to be treated differently. As they are more of a long-term hold, we don't expect drastic weekly changes. Luckily, we can use sold eBay listings to get a general idea of what the value of each sealed booster box is worth.

First we need to establish a baseline. In order to do this I took the last four completed auctions for each set from the last three blocks to create an "average" price. I realize that four data points isn't a lot, but given how spread out some of these auctions were, I was concerned that going to a more respectable number (like 10 or so) might actually incur some older price bias.

The chart below will establish our baseline and we will monitor changes using this "established price". As time passes we'll compare the current "sold listings" to this established price to determine growth.

| Box | Most Recent Completed Auction | Second Most Recent | Third Most Recent | Fourth Most Recent | Average (Established Price) |

| Innistrad | $209.00 | $199.00 | $195.00 | $209.00 | $203.00 |

| Dark Ascension | $109.00 | $90.00 | $126.50 | $112.00 | $109.38 |

| Avacyn Restored | $122.50 | $117.50 | $139.50 | $138.50 | $129.50 |

| Scars of Mirrodin | $167.50 | $141.01 | $142.53 | $165.00 | $154.01 |

| Mirrodin Besieged | $155.00 | $132.50 | $150.00 | $159.95 | $149.36 |

| New Phyrexia | $290.50 | $315.00 | $301.00 | $319.99 | $306.62 |

| Zendikar | $499.99 | $568.99 | $355.00 | $480.00 | $476.00 |

| Worldwake | $645.04 | $650.00 | $675.88 | $700.00 | $667.73 |

| Rise of the Eldrazi | $579.95 | $493.03 | $510.00 | $574.95 | $539.48 |

**NOTE** It is critical when considering sealed product that the current value of this sealed product is reliant on the assumption that WoTC has previously not chosen to reprint entire sets before. This is a relevant concern with the announcement of "Duel Deck Anthologies" as these decks are currently valued so highly because there are so few of them unopened. I expect the reprint will tank the values, though originals will likely still hold a decent premium (probably 45-50% over that of the anthologies printings).

Comments/Concerns

As this is a new style of article for me, I'd like to get your feedback on it. If it seems valuable to people, I may turn it into something of a regular feature (probably not weekly, but perhaps monthly.) I will rely on your comments/criticisms/concerns to gauge the interest, so please post in the comments section. (I do prefer constructive criticism, but given this is the internet I'll expect the belligerent rant now and then too.)

I wanted to add that I count true bulk rares (<=$0.15) as blue chip too as they just can't go any lower. I am perfectly happy to trade just about anything for bulk.

As for the article format, I think you may not want to limit yourself to the top 3, it might be better to go for the 3 most interesting ones instead. Also, why do some cards have an indication of the change since uhm, some unclear amount time in the past and some don't?

Thanks for the feedback. I do agree that bulk rares could easily be considered blue chip stocks (as I myself love trading for bulk…it’s my favorite thing to pick up). And I definitely missed defining the time for the change. It’s a 1 week time span, though I will make sure to update that missing information. The “Value stocks” don’t have that listed because quiet honestly when I first wrote them up I was thinking they were a medium term hold so minor weekly price changes weren’t going to be a major factor in my targeting of them; however, upon further review it does make sense to list the weekly change for everything simply to keep the formatting the same.

I second using three interesting cards instead of just the top 3. Perhaps both?

Also, I think a biweekly appearance of this article style would be more suitable once things pick up. For now monthly seems appropriate.

I like that as you’re right it’s just as important to highlight the bad with the good (so we aren’t stuck with cards that keep slowly dropping when we could have gotten rid of them weeks earlier at a higher price).

Very interesting article David. I had a few questions though, when you say completed ebay auctions, are you using sold auctions, or completed ones, because a completed auction by ebay is one that has ended I believe not necessarily one that has been sold. If that is the case, I think best way to go about determining a price growth chart would be to use sold auctions. I am curious if you have a timeline you are setting to see the growth on the boosters and if you plan on tracking the same cards monthly or just take the top 3 of each category. I think that it would be interesting to see a monthly update of this article where you take a look at the top 3 in each category and recap what happened to last months 3 choices (although during the summer it might be a very uninteresting read just because the market is so strange). Keep up the good writing!

Cheers,

Byron

I definitely used Sold listings (I actually didn’t know you could find completed (but unsold) but I agree 100%, the only good way to define the market price…is by looking at what the market paid for them…not what people asked for them. For the boxes I will update all the ones listed. I only went back as far as I did because 1) I started back up in these blocks and didn’t play/draft any in previous blocks so I don’t know how much fun they were and 2) I wasn’t going to do it for all sealed product so I focused on the stuff that’s more recent and likely more readily available. The farther back you go, the less available product there is and the more likely you will not have a lot of data points (or that they’ll go back so far that we’ll have “old data” points that skew the price).

That’s the kind articles i am looking for around here. Nice sumup. I will keep it as reference for August purchases 🙂