Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

In Part 1 of this two-part series on insuring trading cards, I wrote about some basic insurance principles and connected the insurance industry with our beloved game and hobby Magic: the Gathering. If you haven't read Part 1, please do so as Part 2 builds off of Part 1 quite a bit.

The research I did for these articles taught me that trading cards are typically not insured by standard U.S. homeowners, renters, or condo policies. My intent was to make readers aware that when they experience a loss affecting their trading cards, residential insurance coverage would either provide a severely depreciated compensation (through the Personal Property Coverage Section of the policy) or exclude the trading cards entirely.

The latter is more likely, as they will be viewed as collectibles—which are explicitly excluded by most Personal Property coverage sections. As mentioned last week, most collectibles require a scheduled personal property policy to protect them. Because of this, I advised readers to talk to an insurance agent about filling the gap in coverage if their collections of trading cards were valued at $5,000 or more. I brought up standalone scheduled personal property insurance as a means of filling that insurance gap.

Today I'll discuss more about what that entails. I'll cover how to buy a policy; what my buying experience was like from a reputable insurance agency called Collect Insure; and what the policy actually covers. Snippets of my interview with Robert (Bob) Brodwater, Director of Personal Lines at Collect Insure, are also interwoven throughout the article. Let's dig in!

Filling the Coverage Gap

Last week I covered Loss Prevention, but it should be clear that no matter how perfect we are at protecting our cards on a day-to-day basis, there is still always some risk exposure present. As a result, the only surefire way to protect ourselves is by acquiring an appropriate amount of insurance for our trading card collections.

I began thinking about what I would do if my roughly $35,000 collection were stolen or destroyed by a fire. As I contemplated these scenarios during my research for these articles, I decided to get a quote for my personal collection.

It turns out that finding companies who will give a quote for trading card (collectibles) insurance is much harder than you might expect. In the U.S. there are only a few companies that specialize in providing collectibles insurance policies. I ultimately went through two quoting experiences. One of those really stood out to me: Collect Insure.

Quick background about Collect Insure:

Source: https://collectinsure.com/why-insure/about-us (and confirmed by Bob Brodwater in my interview)

- The company was founded in 1966 by an avid stamp collector, Horace Harrison.

- The company is currently owned by Global Indemnity Insurance.

- The company boasts an "A" (Excellent) rating by A.M. Best. This is very important when considering the financial solvency of an insurance company backing your policy, as it translates to the company being able to pay out on claims without going out of business.

The Quoting and Buying Experience

Collect Insure blends an easy-to-use quoting application (which only took about 5-10 minutes to complete!) with quick turnaround from their customer service team.

After reviewing the coverages and discussing my questions with the customer service representative, I realized the Collect Insure policy provided exactly what I was looking for to protect my collection. Perhaps most important of all, I felt the policy was reasonably priced for the amount of coverage I needed, so I went ahead and purchased it.

If you visit Collect Insure's website to get a quote, be prepared to answer a few basic questions about your collection's value, the way you protect/store it, and a little about your insurance history. If you do complete a quote on their website, a representative will reach out to you to answer any additional questions or concerns.

The individual I spoke to was not pushy towards a sale at all and was very genuine and conversational. I already had my mind made up that I was going to purchase, but this experience solidified my decision even further.

FAQs

Before I dive into the details of my past experience and why acquiring a policy was so important to me, I want to start with some questions I felt might be commonly asked by a trading card collector looking for insurance coverage. I am only scratching the surface with these questions, so be sure to ask a licensed representative all of your additional questions as they will be able to give you the best guidance.

Q1: Does the policy have coverage for cards which are in-transit, such as those being used for play or display; or cards in-transit between the scheduled premises (the place your cards reside / are stored) and another property (such as a local-game store or a tournament)?

Yes, Collect Insure's policy provides coverage for cards while they are away from your scheduled premises. This includes shipping coverage if done by an approved vendor (see the policy guidelines for details) and while in-transit (exclusions do apply). In fact, the policy even provides a specific coverage limit for Collectible Exhibitions in the event you are putting your cards on display.

According to Bob Brodwater from Collect Insure, their policy form is intentionally written as an inland marine policy as opposed to a scheduled personal property policy because of the flexibility in coverages it can provide. The coverage for "in-transit" trading cards mentioned above is just one example of this—traditional SPP policies do not always cover articles as thoroughly when they are away from the scheduled premises.

Q2: Do I have to pay a deductible for losses I experience?

No, in the case of Collect Insure, their policy form does not include a deductible. However, there is a minimum loss requirement of $50 to file a claim through the Collect Insure policy. In other words, you cannot make a claim for a loss under $50.

Q3: Will I be required to document every card I own to apply for insurance?

While there isn't a specific requirement to have every single card itemized, you do have an inherent responsibility as the insured to be able to provide factual evidence of your collection's value. Insurance companies must protect themselves from fraud. It is reasonable for them to expect some form of documentation, whether via photos, sale receipts, an itemized inventory, an appraisal form, or something else.

I encourage you to document the most expensive pieces of your collection with photos (aim for around 80% of the total value). This will ensure an easy claims process should you experience a loss. It also helps to guarantee you don't miss anything major and leave yourself underinsured.

I would also encourage you to consider keeping a manifesto of the most valuable cards in your collection; some examples of how to do this include retaining receipts of purchase, or keeping a record in a spreadsheet. (For starters, be sure to include the price, date, condition, and quantity purchased.)

Q4: I'm a collector and I'm always growing my collection's value: is there a way to increase my coverage regularly as my collection's value increases?

Yes, the policy includes an option for an Automatic Monthly Increase to the total coverage amount. Mine updates the base coverage amount by 1% per month. You can also call Collect Insure to endorse (change) the policy should you make a purchase that substantially increases your collection's value all at once. Be aware that you'll likely have to pay an additional premium for this type of change.

Q5: What types of perils (losses) are covered by a Collect Insure policy?

According to Bob Brodwater, Collect Insure will cover all perils unless explicitly excluded in the Exclusions page of the policy. This includes things like water and fire damage, burglary and theft, transit and shipping damages, flood (unless in flood zone A or V), and accidental breakage. The inland marine form provides these coverages regardless of the type of collectible being insured. This is important if you are considering this policy as a means of expanding coverage beyond your trading card collection.

Reminder: for all of your questions pertaining to how best to protect your collection, I want to reiterate that you should talk to a licensed representative.

Applying Prior History to Current Decisions

I alluded to this already, but the buying experience with Collect Insure was excellent. Their process is not tailored specifically to trading cards; rather, they are experienced at insuring collectibles generically, and thus their quoting application allows you to tailor it to your needs. I only focused on my trading card collection—a mix of mostly Magic: the Gathering cards with a smattering of valuable sports cards from my childhood—but I easily could have added pieces of a different collection to the quote.

The reality is after contemplating my past it was an easy decision to acquire coverage for my Magic collection. I went into the quoting process with Collect Insure knowing I wanted to buy.

I didn't share this personal story in Part 1 because it did not feel like the right place, but I feel it is important now to drive home awareness of the coverage gap we face by not insuring our trading cards and collectibles thoroughly. I will admit I contemplated not sharing it at all because it isn't easy to recount without getting a little emotional.

Tragedy struck me once when I was 16—my family endured a near-total-loss fire that started in our upstairs bathroom. Jumping right to the most important fact from this story: no life was lost. My Mom and I were the only ones home that morning and we got out safely before things got really bad; our cats smartly hid in the basement and we got the dog outside, so all was good there, too.

Our possessions were less fortunate. At that point, I wasn't collecting Magic cards in a serious manner but I did have some (which actually survived because they were not upstairs). I also had a decent number of 1st edition Pokemon cards.

The most devastating part of the fire affected my sports cards collection, sports memorabilia, and many of my toys from childhood. Many of my most valuable cards and memorabilia, including Ken Griffey Jr. and Michael Jordan rookie cards, a Kobe Bryant-signed jersey card, and a Michael Jordan signed picture, were all destroyed in my bedroom and the attic.

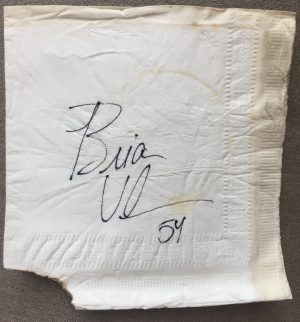

Here's a napkin signed by Chicago Bears great, Brian Urlacher, for my Mom at a bar in 2001 after a Packers/Bears game. You can see the singed edges, especially the lower left corner, yet somehow it miraculously survived intact. This was in a fireproof safe along with many other paper documents (including the aforementioned rookie cards) which were not as lucky.

My family's insurance policy paid out a huge dollar amount when it was all said and done. They had to redo nearly the entire home because of the fire, smoke, and water damage. It wasn't a "total loss" but it was very close.

As for my cards and memorabilia, they paid me $1,000 (and that was after extensive negotiation by my Mom). The same items which were destroyed were probably valued at $10,000 back then and would likely be closer to $50,000+ these days.

I never did get a replacement for those items. Partly because the $1,000 wasn't enough to come close to replacing those seemingly one-of-a-kind items, but also because I couldn't rationalize a "replacement" in lieu of my originals.

Coming to Terms

Loss is a devastating experience. The Kübler-Ross model tells us that human nature is to deal with loss through stages of grief. While this model is normally applied to loss of human life, I can tell you from experience that there is something to be said about the grief of losing seemingly irreplaceable material items as well. The memories that go with material items can be very powerful, and I was young enough when the fire happened that I didn't really know what I was dealing with. It took me years to get over the items I lost and past the grief and depression that ensued.

Among the most important things I lost was my collection of early-1990s Legos which I would estimate a current market value of $10,000 or more. I would actually say the memories of losing my Legos hit me way harder than any amount of money.

I am able to joke now that they melted into one colorful block, but for a long time that comment would have brought me to tears. To drive this emotion home, my wife and I are expecting our first child in April and it will always haunt me that he won't get to inherit my Legos collection (and the majority of my other toys from my childhood) because they were destroyed.

It is true that insurance for all of these items would not have changed the fact that the originals were destroyed and the memories were relegated to my mind, but at least I would have been reasonably compensated to try and replace most of it. If nothing else, instead of $1,000 for all of my items I might have gotten something closer to the $10,000+ value for my memorabilia and sports cards, for example, and I could have tried to reacquire certain pieces of the collection.

In retrospect, when I talk about this with my Mom (who is an insurance agent in the Chicagoland area), we regret not treating my toys and memorabilia more seriously. I have tried to rationalize by saying, "they were just toys," or, "it was just a jersey." But as time passes and I look back, I see the amount of collectible value that was lost on that fateful day of the fire. There were individual items that I took very good care of which would auction for hundreds or more today (ex: I had this Playmobil train).

It's hard to recount and write about what happened, but I want to drive home my experience for you. Insurance would not have prevented what happened with our house fire but it would have led to a better outcome afterwards. I may not have been able to get another picture signed by Michael Jordan, but I might have gotten some compensation for the market value and potentially even been able to replace it with something similar.

My personal experience ultimately led me to buy the insurance for my Magic collection with Collect Insure. For about $250 a year, my policy gives me the piece of mind that my collection is covered should another tragedy strike. This means my little guy will have a better chance of inheriting his Dad's collection, or at least a similar-looking one should something happen. That alone is worth it to me.

Wrapping Up

I hope sharing my personal experience helps paint a picture of what loss to a set of valuables can look like, and makes you at least pause and think about your own.

It goes without saying that nothing is more important than protecting human life, but I must admit that I underestimated the grief I would feel from losing tangible items that held forever memories. Prepping for this article made me reevaluate the monetary and intangible value of certain material items I own, particularly in my Magic collection. While I wouldn't say that all of the $35,000 collection is important to me, there are certain pieces that I fully intend to pass on to my children someday (i.e. cards that I would never sell, trade, etc.).

While buying an insurance policy won't prevent loss from occurring, or the devastation and grief that accompanies a loss, it does help mitigate the long-term impacts, particularly at a financial level. I mentioned the current market value of some of the items I lost in the fire—it still hurts thinking about what could have been.

Those items could have been sold to help pay for college, or my first car, or a down payment on a home. Hell, many of those items could have led to new memories seeing my children play with them someday. Insurance would not have brought back the originals, but it sure as heck would have helped replace them like-for-like, enough so that neither my child nor I would have to think about the fire again.

As it is, I cannot dwell on or regret what happened almost 20 years ago. Rather, I acted on that history by purchasing a collectibles insurance policy for my Magic collection and I made sure my family won’t have to deal with that situation again.

As always, you can reach me with your questions and comments here, on Twitter @ChiStyleGaming, or on the QS Discord.

I use bank safety deposit boxes for majority of MTG storage. At ~150$ a year it’s a steal of a deal imo. The costs of insurance on large/ very valuable collections means all the power and rarities live in a vault.

Safe deposit boxes are definitely a great alternative, especially to protect cards you don’t plan to play with. The nice thing about the policy I acquired is it covers my decks for play as well (important because one of my EDH decks makes up close to 20% of my collection’s total value). Thanks for the comment!

Thanks for the article. Important iderduscussed topic.