Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

2019 has been a fantastic year for me MTG Finance-wise. I've sold more this year than in any previous years, and I have been steadily growing my inventory while downsizing some of my bloated personal collection. Every year, I like to take some time to reflect on some lessons I have learned over the previous year and I felt that being transparent with my readers on those lessons would make for a good article. Here's what I learned:

1. Organization is Huge

This year, I built two wooden frame systems for card storage. The large rack I made to hold my bulk rares and uncommons that are sorted by set, and a smaller card hotel I used to hold my current store inventory. These two additions to my office have made finding cards a whole lot easier which in turn means I can fulfill orders that much faster. For those interested, they look like this:

Card Hotel

The black boxes holding the cards are just the bottoms of fat pack boxes, which if you buy a fair number of collections, you end up accumulating. Some stores will buy them, as they are perfect for this. I also keep my shipping envelopes on the top shelf of the hotel which I pre-stamp with a custom stamp I also bought online as I wasted a lot of time writing the return address on every envelope going out.

An additional benefit is that because the stamp has my store name on it, I've also been able to stop including packing slips. I found that they tend to waste a lot of paper and printer ink. As a customer myself, I never care for them unless I order a large quantity of cards. I've decided that should someone order 10+ different cards, I will print out the packing slip to go along with the order, but I rarely sell more than three different cards on any given order.

Card Box Rack

I also purchased some standard 2x4-inch labels online and made all the labels you see on the ends of each box. I had previously used just some masking tape and wrote the set name and rarity on it, but I found the labels help me remember set symbols and look cleaner. The colored stickers on the uncommon boxes are to let me know they aren't full as I found I wasted a fair amount of time opening up full boxes when I was trying to add handfuls of cards to them and I'd have to keep closing them and looking for the next option.

2. Strike While the Iron is Hot

My morning routine includes checking the Interests pages on MTGStocks to see what cards have moved in price since the previous day. Whenever I see a card spike, I try to ascertain whether or not it was for a legitimate reason. If so, I quickly dig through my boxes/binders and list those cards, either at the new price or (if I think there is still more room to grow) at a price I hope they'll hit in the very near future. However, there is an obvious danger to doing this.

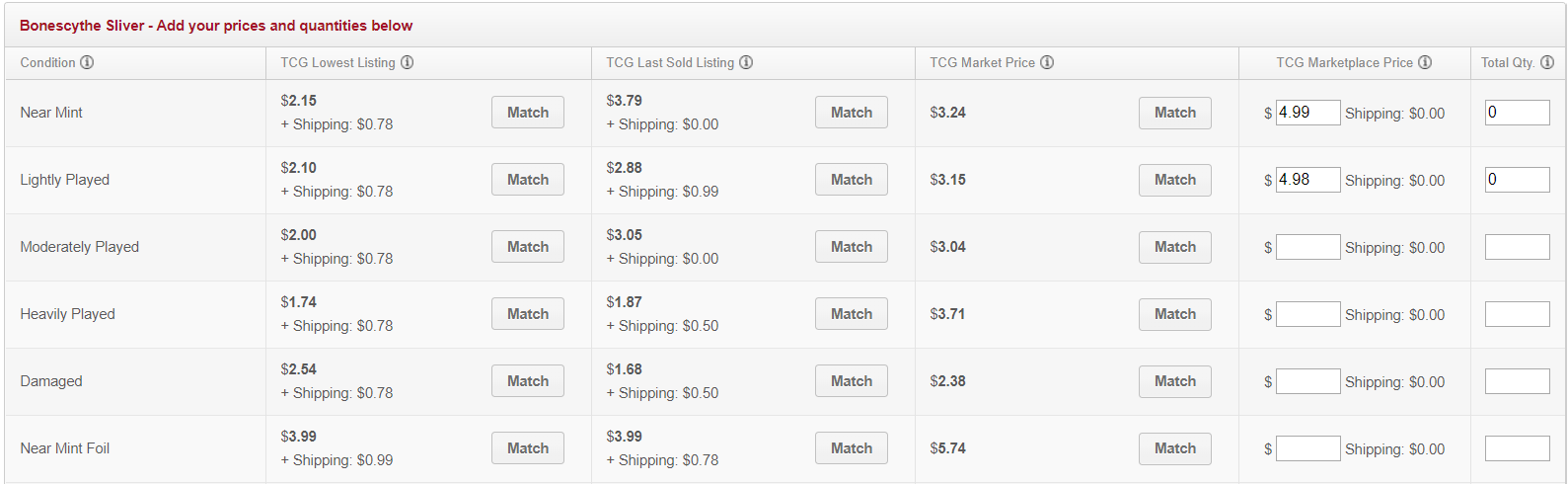

I'm not the only person who runs this routine. If I price too high, it's easy to get undercut by the next person and you can easily miss out on sales. Remember, the ideal time to sell is when a card's price peaks before it starts to drop and everyone races back to the bottom. Here's an example: while digging through my foil rare binder, I came across a copy of Bonescythe Sliver I didn't realize I owned. I immediately went to list it and noticed that the foil price is now lower than previous sales prices; far lower than I'd had back when Modern Horizons came out and new slivers were added to the Magic library.

I remember when this card first showed up on MTG Stocks interest page. I combed through my M14 rare binders and dumped all copies but one on TCGPlayer. Now, they have rapidly cooled off and lost 1/2 their value.

As I recently purchased a decently large collection, I've come across this same issue repeatedly as I have been adding new inventory. I missed the rise on many cards because I got a bit too greedy, or was a bit too slow to list them. I am feeling this the most on all my extra dual lands which I sat on during last year's meteoric price rises. I believed that primarily because they were on the Reserved List and would be immune to the same kinds of pullbacks we see on many other cards. This leads me into my next lesson of 2019.

3. Current Real Profits are Better than Future Hypothetical Profits

If even you have a passing interest, you'll remember times when you sold out of a spec "too early" in fact every speculator I know has at least one of these stories. We suffer a different version of FOMO (Fear of Missing Out) than those who just buy cards. While they fear buying too late, we fear selling too early. However, if you made a decent profit on a sale then you still made money. We can't control what a card's price will do tomorrow, a week from now, or a month from now. We can control what we sell a card at.

My best example was two years ago when I purchased 2x played Gaea's Cradles from the Troll and Toad cash only case at a GP for $150 each, which at the time was a great price. I listed them on a local Facebook page and within a week I had a local player who needed one.

He offered me $200 in person which was about $25 less than the cheapest on TCGPlayer. I took it. Within two months, the cheapest copy on TCGPlayer was $300. Now they are right back down to the $240 price. The key takeaway was not that I missed the opportunity to potentially make more money several months later, but that I made $50 for almost no effort within a week.

The reason so many people on our site repeat the idiom "Cash is King" is because it has the highest liquidity of any asset you can have. If you can walk away from a speculation target and make a decent profit now that's better than any hypothetical greater future profit. You can use the money from the sale to buy other targets or pay for other living expenses.

Great advice on checking out the Interests section. I never even know that section was there to begin with! I was using the Goldfish weekly losers to sort out which cards were getting dumped. I’ll make sure to use both in unison to get a bigger sense of potential buys. Between those two lists, there should be something to look out for, for at least a week before the lists are updated 1 week later. Also I have noticed cards that pop or drop first on MTGO before physical cards. I trade MTGO a lot and I spend quite some time on MTGOWiki and on the front page there are ” Best Buyers/Sellers” If I see something on the move there at any particular time, I will check its physical version price to see if it is also moving or potentially about to move. Quite often you’ll some of the cards on digital be predictive, for a short while, on where physical may go. Of course it’s not always the case. Thank for the article.

I absolutely agree with looking at MTGO for signs and trends. I have written about that very subject previously as with the speed of information these days waiting a week for results is too long. We are now at a point where hours us pushing it.