Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Another week has passed by, and another round of Reserved List buyouts occurred.

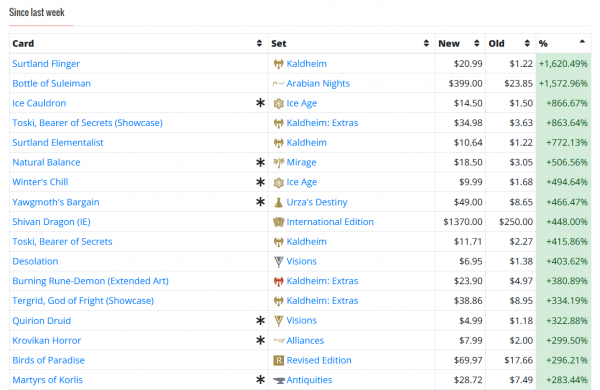

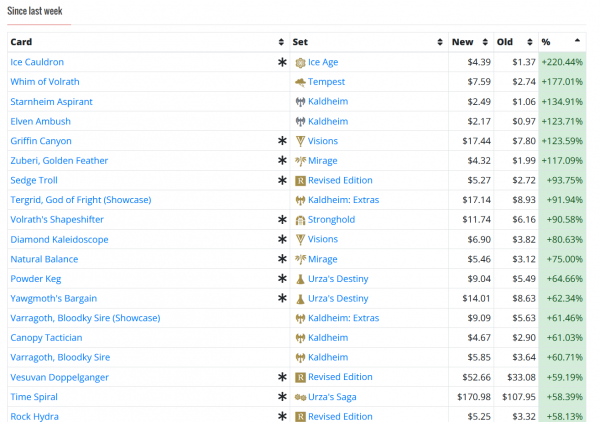

When the 17th largest weekly increase is still a rise of 283.44%, you know there is rampant speculation going on. Many of the playable cards had already risen to new heights; now, some purely collectible, yet largely unpayable cards are rising in turn.

For example, have you read Ice Cauldron, the top Reserved List mover this week? I mean, look at the thing! It’s basically War and Peace squeezed onto a card. No one is buying this thing to play.

You may counter that TCGplayer’s market price is inflated and manipulatable. These numbers don’t accurately reflect what you could sell these cards at. That would be a fair pushback. But look at some of the market price increases from last week!

There it is again, Ice Cauldron at the top. Of course $4.39 (market price) is a far cry away from $14.50 (TCG mid price). But the trend is the same: dozens of Reserved List cards are climbing in price and selling at higher prices than before.

That’s where I come in. This week I’m going to remind you to follow the old mantra, “Be fearful when others are greedy and greedy when others are fearful.” In my nine years of writing about MTG finance, I’ve never seen a market as greedy as this one.

It’s time to act.

The Case to Sell

It’s clear speculators are scooping any and all Reserved List cards they can get their hand on. Of this I have no doubt. So with the likely decline in the U.S. Dollar and a period of rampant buying, why would I advocate selling?

First off, I want to clarify that I’m not advocating you sell out of Magic completely here. I’m still maintaining the bulk of my collection with the end goal of paying for my kids’ college costs. While I’m much closer to that goal now than I was three months ago, I don’t think we’ve seen peak prices in the long term.

But in the short term, it’s hard to argue that prices aren’t stratospheric. Even beyond silly buyouts on cards like Ice Cauldron and Diamond Kaleidoscope, the playable cards are also at or near all-time highs.

Over the weekend, Revised Underground Sea hit a peak buy price of $650 on Card Kingdom’s site. According to Trader Tools, this surpassed the previous high that happened in 2018.

When Dual Lands peaked in 2018, there was a rapid cool-down period after. On July 19th, the best buy price for Underground Sea was $575. In mid-December, just five months later, the best buy priced dropped 25%, to $432.87. Then the card bottomed out throughout 2019 and into 2020 before finally climbing last summer.

Gaea's Cradle followed a similar trend during that time period. The buy price peaked at $419.93 on June 2nd, 2018 and then dropped in half to around $200 by the New Year. Granted the card’s price remained higher than it was before the 2018 buyouts, but nowhere near its peak.

Well, here we are again making a new peak with a buy price of $650. It wouldn’t surprise me if this card’s top buy price was $400 six to twelve months from now. Especially if the world opens up and large Magic events resume.

Finally, it’s worth noting that many of the spiking cards are straight unplayable. If you have random Ice Cauldrons lying around from collection buying, you were just given a gift. That gift is the ability to liquidate these cards for real money rather than having them take up space in your boxes. If you were savvy enough to speculate on some of these garbage Reserved List cards before the spike, why not cash out and put those funds into cards you can really use?

Don’t Sell Indiscriminately!

Assuming I’ve convinced you to take advantage of this seller’s market, you may ask what cards make the most sense to liquidate and which to hold onto.

For starters, I wouldn’t sell any Reserved List or Old School cards you’re actively using in decks. Unless you’re planning to dismantle the decks, you’re better off holding these cards and continuing to enjoy them. You may see their value peak and then retreat some, but the long-term trajectory for these cards will still be upwards and to the right. In other words, I’d remain “long” on Old School and Reserved List cards if your time horizon is at least 3-5 years.

Instead, I’d consider trimming your position on some of the cards you’re not actively using that have risen dramatically these past couple months. I can’t rattle off every card, but it should be pretty apparent which cards fit the bill. Cards you’d never play like Griffin Canyon have no business being $20. These will retrace hard when the rampant buying settles down. Non-Reserved List cards that no one plays are especially juicy to sell to buylists now, such as Whim of Volrath.

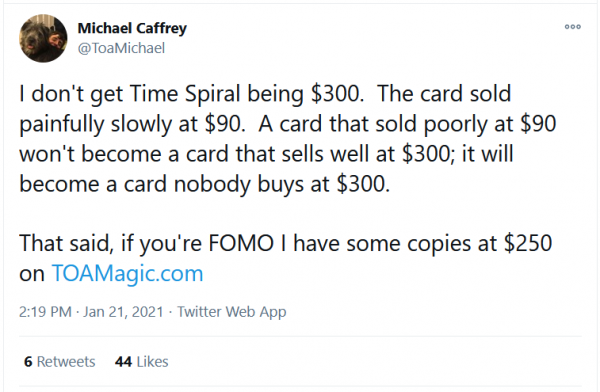

Marginally playable cards that recently soared are also worth bailing on. A card like Time Spiral, for example, is very niche and has limited demand. Now it is nearing $300 and buylisting for $130 to Card Kingdom.

If players (read: not speculators) weren’t willing to pay up for these before, they certainly won’t be interested now. Michael Caffrey of Tales of Adventure put it eloquently on Twitter the other day:

I believe Michael is spot on in his observation. If you had trouble selling some of these slow-movers before, you’ve been given a gift: the gift of liquidity (and some extra cash). You won’t be able to sell Time Spiral to a player at the “new price”, but you may be able to sell them to a speculator experiencing FOMO. Cards in this category definitely warrant selling.

Most generically, I’d recommend selling any overheated cards if you’re looking to buy Reserved List cards that haven’t spiked (as much) yet. What I mean to say here is, bringing new cash into Magic could leave you with a sour taste if you end up overpaying for something only to watch its value drop over the next six months. Instead, trading is the way to acquire new cards in this environment. This way when you are punished by having to offer more value in trade to acquire cards, it’s balanced out by the fact that you’re getting more for your cards.

Since trading is severely reduced in COVID times, this manifests itself either in trading cards into stores or selling cards to immediately buy others. It’s not exactly the same, but it’s a close enough approximation that the actions are justifiable in this environment.

Here’s an example: I wanted a Diamond Valley for an Old School deck recently. With the help of someone sitting on Card Kingdom store credit, I managed to acquire a heavily played copy for $365.

This was somewhat painful because just a few months ago, mint copies sold for that price. However, I justified the purchase for two reasons. First, Diamond Valley hasn’t reached its all-time high yet—in September 2018 this card buylisted for $450 and today its top buy price is $418. Therefore, I think it can climb even higher. Second, I sold other cards to fund this purchase. It’s no coincidence that the cards I sold (e.g. an HP Old Man of the Sea and an LP Collectors’ Edition Forcefield) had also risen in price lately.

What’s more, the cards I sold netted me a healthy profit; so while on paper I paid $365 for the Diamond Valley, I justified the purchase by considering the cards I sold cost me a fair amount less. Of course, this is sketchy logic as I could have taken that $365 and used it however I wanted. But the idea is, if you’re looking to acquire something and the steep price tag is bothersome, it’s wise to sell other stuff to help fund that purchase and reduce the pain of having to pay a “new price”.

Wrapping It Up

It’s 2018 all over again. Only this time, there are no large events to encourage players to sell their cards to vendors, the U.S. Dollar is dropping, and the government continues to pump out money to those in need (and some who don’t need as much). These factors are likely to re-create the 2018 buyouts and then some.

However, I don’t think this is a permanent fixture in MTG finance. Card prices will once again settle down, just like they did two years ago. Because of this, I’m advocating that everyone sell something they’re not using. Right here, right now. Take advantage of the market’s temporary dynamic and take some money off the table.

But before you rush out to do so, make sure you’re selling wisely. Yes, some prices will be lower six months from now than they are now. But many cards will find a “new floor” and never be as cheap as they were pre-2021. So I’m advocating that you trim the fat—sell cards you’re not using that have recently spiked. Don’t sell everything unless you absolutely have to.

While I do predict prices will cool off later in 2021, I also predict that we’ll have another cycle of buyouts again at some point in the future (2-5 years out). So if you don’t need the money and you aren’t looking to fund other purchases, don’t feel obligated to sell aggressively. I’m merely suggesting you consider taking advantage of this seller’s market and make a little extra bank for yourself. If you’ve been holding some of these Reserved List cards and are now watching your collection’s value balloon, you deserve to recognize some gains.

I’m largely attached to my collection as it currently sits, yet I’m taking advantage to sell a little myself. It’s only the logical thing to do in this market environment: be fearful as others are clearly greedy.

I think the nostalgic aspect of the current trend shouldn’t be downplayed. There’s the old school players who want a last shot at getting and holding those cards they once played with, like Time Spiral, and younger players who never got to experience the old card design and want to experience a taste of that, even if it means playing with crap from Ice Age. After all, these cards are still part of the game and were always meant to be played with. I think the value is real and will continue to steadily climb, especially with Alpha and Beta virtually all sold out at Cardkingdom and collectors holding out of the buylist. In many ways the past two years were the perfect time to buy Magic. I can’t Y things going back to that massive stockpile of vintage cards Cardkingdom had a year or two ago. If that’s the case then the value can only go up.

Yamil,

There is most certainly a nostalgia factor here; but I would debate that you are overestimating the number of players who have a passion for owning something “old” just for the sake of it. Players who have been around for a while (like me) certainly appreciate the old templating, awkward wording on cards, and classic artwork. But the vast majority of players are on the newer side, and I’d argue the percentage of players who heard of a card like Winter’s Chill is < 1%. I agree with you that, long term, these cards have an upward trajectory. But, much like in stocks, the prices don't normally teleport from $0.50 to $10 and stay there. Not without a serious catalyst. These cards will likely come back down. Don't forget, there are a TON of Ice Age rares printed. Probably more than the number of people who desire an Ice Age rare for the sake of having one to collect. Alpha and Beta, I agree with you 100%. Especially Alpha. I've seen CK slowly dry up in stock of Alpha cards--even low end commons--and I have been trying to grab a few for my collection before they're all "gone". The ratio of nostalgic players to cards printed is far higher for Alpha than it is for Ice Age. It'll be interesting to see things as they unfold, especially when large scale MTG in person events return! Thanks for reading and sharing! Sig

That’s true. It’s interesting to see Necropotence finally reaching $50 after being stagnantly low for so long, given that it’s such an iconic and powerful card. As cards like Necropotence see a steady rise in value, the rest of the set should see a rise in value as well as many collectors also like to complete the entire sets as well.

Very good write up! I agree completely and have actually started to sell of some of my higher end cards from EDH that I don’t really use. My plan is to invest into revised duals for play and for future gains. My question to you is, when would you think I should look at investing in duals? Do you think this is a month or so or at the end of the year? Thanks!