Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

It is confirmed: articles on the negative implications of MTG finance are well received. Feedback was largely positive, and I really appreciate everyone’s mature and thoughtful engagement on the subject.

As I wrapped up the article last week, the momentum was difficult to halt. Rather than combatting writer’s block, I had to do the opposite—I forced myself to stop even though I could have gone on for many more words on the subject. Due to the positive reception, I’m going to explore this subject even further through a series of articles in the coming weeks. As long as feedback remains mostly positive and the ideas continue to flow, I’ll continue to explore this space.

This week will be the second article in this series and will focus on the impact of buyouts on the community and its economy. This data will be used to segue into actions that should be taken in the face of a buyout.

The Buyout Curve

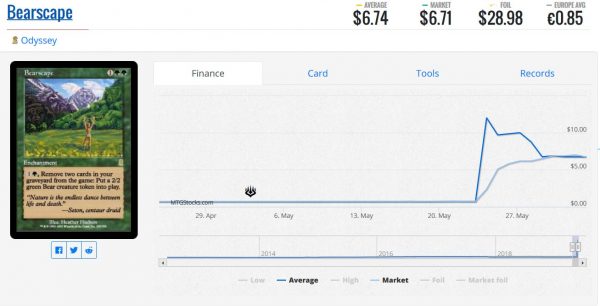

We’ve all seen this happen numerous times. There’s a catalyst of some sort, followed by an overnight buyout, followed again by a rapid “race to the bottom” as sellers seek to undercut one another on price. The resulting graph looks like this:

In the case of Bearscape, a virtually bulk rare shot up to about $12, only to drift back down to under $7 one week later.

This buyout, in particular, is what set me off on this article series because I perceived it to be absolutely ludicrous in nature. There is no way Modern Horizons will give us enough bears to support a massively popular bear-themed Commander deck. And even though Odyssey is an old set, it was printed quite a bit and I’m confident there are plenty of copies out there for every bear fan to obtain their copy. In short, the buyout was hype-driven and fueled by MTG finance: the chase for profits.

Now, on the one hand, the argument made by the MTG finance community about the market naturally setting the price is absolutely true…in the long term. I agree wholeheartedly that the price on Bearscape will be higher now than it was pre-Modern Horizons because of a true increase in demand. I don’t take issue with the higher price tag after a few weeks of settling. What bothers me about MTG finance is the interim period.

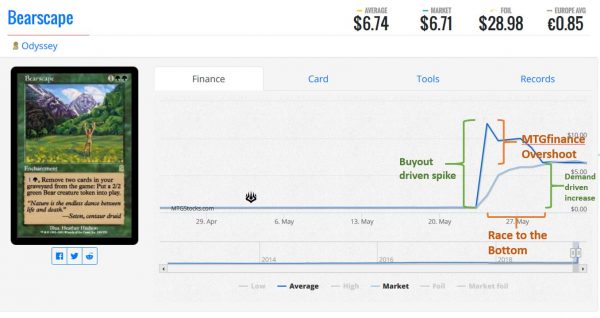

I break down this price trajectory further in the image below.

Here are the numbers:

Magnitude of initial spike: $12

Time it takes for price spike to diffuse and stabilize: 1 week

Final demand-driven price: $6

MTG finance overshoot: $12 - $6 = $6

When the MTG finance community says they are merely accelerating price adjustments that would inevitably happen, they’re right. The price is spiking overnight and will settle at a higher price than previously established, and this is a result of a natural increase in demand. Bears are pretty cool, after all.

What the speculator community doesn’t confess to is the temporary removal of market liquidity in the short-term. After buying out the market, speculators re-list their copies at an exorbitantly high price hoping to capitalize on an emotional buyer afraid they may not be able to own the card if they don’t buy it immediately. The result is an interim period where the price is too high, buyers disappear from the market, and the bid/ask spread—the difference between the least someone is willing to sell an asset and the most someone is willing to pay for that asset—becomes too large.

When the bid/ask spread grows it leads to market illiquidity. An illiquid market introduces a number of risks. Speculators sitting on stacks of Bearscapes that they’re unable to move may become desperate to raise cash. They do so by reducing prices, whether on Bearscape or some other card.

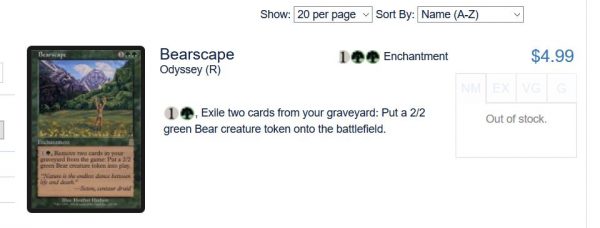

In the extreme, sellers may have to reduce prices and sell their assets at a loss to recoup liquidity, causing the market to overshoot to the downside. This volatility may be great for day-traders, but it disrupts the MTG market and leads to frustration of the masses. Even large vendors may struggle with this volatility, either remaining “out of stock” for far longer than desired or else risk overpaying for a card that is difficult to move, putting a strain on their own liquidity. In the case of Bearscape, Card Kingdom is choosing the former (the right call in my opinion). But there are other cases where Card Kingdom chased a spike, overpaid on a card, and was left holding dozens of copies unable to sell for anything but a loss. I think Star City Games does this too, at times, and I hypothesize this is why they place some of the same cards on sale every Monday.

The average person not participating in MTG finance may wonder, “Why does the price have to overshoot so much to begin with?” The answer is MTG finance, speculation, and the motivation to profit.

What Can Be Done?

A Twitter follower stated in response to last week’s column that this behavior is inherent to Magic because of its economy; it has been this way since the very beginning. To change Magic’s economy is to change Magic entirely. If its economy truly bothers someone, their best alternative is to play Magic Arena because the paper market isn’t about to change.

Since the game itself won’t change, the next best option is to modify one’s behavior to adapt to this volatile environment. Fortunately, I have some ideas to consider.

First and foremost, emotions must be kept in check. Speculative behavior nearly always creates an overshoot in price to the upside, and the worst thing that can be done is making a purchase into the spike. That is precisely what the MTG finance community is hoping for, so they can make that 1000% profit they highly covet. The fewer people who panic-buy, the quicker the price can readjust to a more reasonable level.

In the case of Bearscape, waiting one week to purchase the card post-buyout led to a price drop of nearly $6, a 50% discount from its peak price. Another recent buyout was Fist of Suns, which spiked to $25 for one day before quickly retracing to $13. Again, this is nearly 50% from peak to trough.

Premium cards are no different in this regard. A third example was the recent buyout of Mythic Edition Dack Fayden, which spiked from $60 to $150 before retracing down to $85. While not quite a 50% drop, you are probably starting to get the idea.

In each of these cases, the nearly-50% price retraction from buyout highs took place over the course of about a week. Thus, I’d posit that a “one week rule” be implemented whenever a buyout occurs. From the moment the card shows up with a triple-digit percent increase on MTG Stocks, wait at least one week before purchasing a copy. This same concept is implemented by many well-known traders on Wall Street, except there it’s referred to as the “three-day rule”. Jeffrey Kosnett, a senior editor from Kiplinger, puts it best:

“This prompts me to reiterate a three-day rule, my personal iron law of investing, because Brexit absolutely revalidates it. Simply put, in any news-driven market crisis, wait until the third business day after the news breaks to trade anything—bonds, stocks, funds, gold, anything. Meditate. Breathe. Savor fine wine. Just don’t obsess.”

Such behavior has been effective for Wall Street traders for years. It’s time Magic card buyers behave the same way. The overall intent of such a rule is to combat emotions and refrain from panic buying or selling. Do this, and the speculators won’t be able to profit from the hype. If no one buys Bearscapes at $12, or $10, or $8, or $6 and suddenly speculators have to flip their copies for minimal profit or risk sacrificing liquidity, they may think twice before participating in such activity again.

Wrapping It Up

I’m sick of MTG finance personalities hiding behind generic economic concepts such as supply-and-demand to argue why their buyout activity is somehow a reflection of natural trends. While I do believe the appropriate price will eventually prevail, the volatility that happens in the interim is anything but natural. These buyouts and price spikes occur because of MTG finance, and the repeated pricing patterns on graphs for Bearscape and Fist of Suns highlights this.

In every case, the price overshoots to the upside, liquidity dries up, and the market enters a period of volatility. Can this be healthy for the market? I’d argue it’s not. It feels like the market would be healthier if prices increased gradually as new Bear Commander decks slowly become built by the player base, rather than speculators buying ten copies of the card at a time with the intent to sell with a 1000% markup.

Due to the nature of this game, this activity is here to stay, which is why I recommend the one-week rule. That is, if a card spikes due to a buyout, someone interested in purchasing that card should wait at least one week before pulling the trigger. Most often, they’ll end up paying a much lower price, often 50% lower than the peak buyout price.

If more people embrace this strategy, perhaps the prices will adjust even more quickly. Better yet, if liquidity becomes too much an issue, you may see an overshoot in price to the downside as people panic-sell. It doesn’t usually happen this way—typically I see overshooting to the downside when a card’s reprint is spoiled, and the retrace to a higher price takes much longer. But with enough discipline maybe one day we’ll see it happen during random buyouts as well.

…

Sigbits

- Card Kingdom has made some noteworthy buylist increases on diamonds lately. They’re now paying $175 for both Lion's Eye Diamond and Mox Diamond. These are local highs, and I think these numbers will bump even higher as the market dries up. I have my eyes set on a $200 buylist price.

- One card that spiked and did not retrace 50% is Sliver Queen. This leads me to believe older cards—especially Reserved List cards—behave on a completely different time scale. Perhaps this merits further investigation next week. Until then, keep in mind that Card Kingdom is offering $110 on near mint copies of this card.

- The buylist on Sliver Legion is also up at Card Kingdom, showing a buy price of $60 on their hotlist. This one spiked on MTG Stocks to $140, and is still retracing at the time of this article’s writing. The market price shows as $115, but it wouldn’t surprise me to see this sub-$100 again in a week or two. A time may come when that $60 buylist would be quite attractive.