Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Over the past couple weeks, a couple of outspoken MTG finance individuals have been pointing out some unexpected trends. Within my own MTG finance circle, a portion of speculators are observing downward momentum across some surprising cards. Consider, for example, the recent trend in one of the most powerful fetchlands in Magic: Polluted Delta.

As Khans of Tarkir approached rotation, I had pounded the table on unloading copies---there was too much demand buoyed from Standard play, indicating to me that even steady eternal demand wouldn’t overcome the massive quantities about to hit the market. While this viewpoint was spot-on, I had not anticipated the continuation of the downward trend throughout 2016.

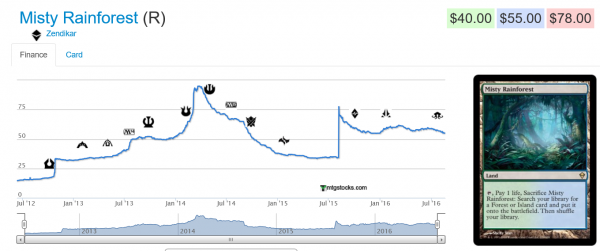

And it’s not just the Khans fetches that are seeing pressure. Even the much rarer Zendikar fetchlands are fading.

While Misty Rainforest’s drop is a far lesser magnitude, the depreciation from $75 to $55 over the past 52 weeks is still cause for deeper consideration.

A Common Theme

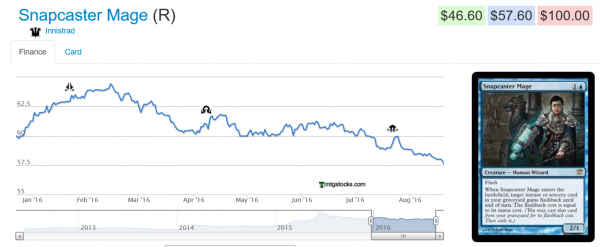

Perhaps a fear of reprints is driving fetchland prices down? That’s possible---everyone expects Zendikar fetches to come back at some point. But how does that explain behavior in a card like Snapcaster Mage?

While the card has certainly appreciated nicely over the years, its 2016 performance has been nothing shy of disappointing. The five-percent drop pictured above may seem innocuous, but should we really see this kind of sell-off on one of the most played cards in Modern and Legacy? This card is only getting older and therefore should climb in price. Right?

Maybe it’s not about reprints or age, but a reflection of metagame shift? I do see Modern Masters 2015 copies of Ignoble Hierarch hitting all-time highs. I don’t know why this card in particular merits price appreciation where Khans fetches do not.

After all, Wooded Foothills is currently the fourth most-played card in Modern, according to MTG Stocks, whereas Hierarch is only the 12th.

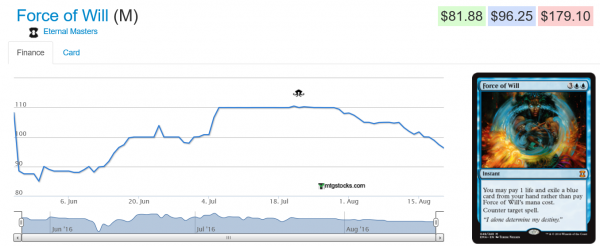

And here’s something else that caught my eye---after months of unmitigated surges in Force of Will’s price, it seems demand has finally slowed down. The Eternal Masters printing was supposed to cause massive interest in Legacy. Wasn’t that the reason for the surge in its price despite the reprint? Someone opens up a copy and immediately wants to trade for three more? Perhaps that short-term expectation has faded?

Of course there are other exceptions (like Ignoble Hierarch for example). But the general trend of most highly-playable Modern and Legacy cards has been negative recently. Even some of the most dominant cards have dropped in price, and this has caused a bit of a stir within my MTG finance network.

Hypotheses

I don’t believe this trend is driven by a single catalyst. Rather, I suspect there are a number of forces at play here that are causing the recent selloffs. Here are some ideas:

- The summer is sometimes a weak period of interest in Magic. Perhaps people are engaging in Pokemon GO rather than picking up Modern and Legacy cards for their local FNM’s. Maybe when the school year kicks off and Fall returns, we’ll see some moderate growth in interest.

- There are a million set releases going on right now. We just had a massive reprint set in Eternal Masters, then we saw a successful release of Eldritch Moon, now we’re seeing a great deal more interesting reprints in Conspiracy 2, and we haven’t even begun Commander 2016 spoilers yet. Perhaps Wizards of the Coast is saturating the market with new products so rapidly that players are allocating a disproportionate amount of their MTG funds to these new products instead of finishing up eternal decks.

- With all the reprints, people are expecting some of the most popular, expensive cards will inevitably take their turn. Therefore, players may be more inclined to hold off on paying $60 for a Show and Tell when a reprint is so possible. (Editor's Note: Case in point, as Show and Tell was spoiled in Conspiracy 2 over the weekend.) Paying $60 for a card that can become $30 within 1-2 months is certainly a feel-bad.

- Highly playable cards like Snapcaster Mage and fetchlands are probably hoarded by a greater number of speculators. Back when Time Spiral was brand new, there were far fewer speculators in the game. Therefore, when Greater Gargadon suddenly breaks out, no one is expected to be hoarding fifty copies eager to ship them all at once. Meanwhile, more recent cards like Snapcaster Mage and Thoughtseize were clearly eternal staples, printed in larger quantities, and speculated on by more people. This is also likely the reason shocklands can’t gain much traction---everyone and their mother sat on numerous copies for years.

- Could Magic’s growth be at an end, at least temporarily? I think the player base has grown stagnant. The fact that Hasbro is clearly trying to grow sales by launching more products, rather than selling to more players, indicates to me that player growth is a problem.

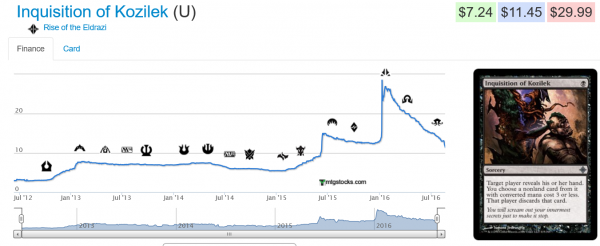

The list above paints a fairly gloomy picture for MTG finance. No wonder some of those I trust most in the community are crying “bubble” and insisting Magic is due for a major sell-off not unlike the one Inquisition of Kozilek is experiencing right now.

The thing is... I’m not sure I completely agree. At least, not universally.

Circling the Wagons

The data is the data. I can’t argue with the fact that many $10-$60 Modern-legal cards are selling off steadily throughout this year. To the mainstream speculator/investor, it would appear that if a card isn’t played in the new Modern Dredge deck, then it’s dropping in price.

But this is not the case.

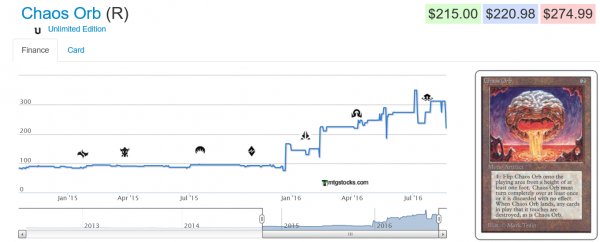

Not long ago I chose to consolidate the bulk of my MTG collection into Old School and collectible cards. Some of these cards have spiked unsustainably---I’ll be the first to admit this---but the overall trend is not likely to reverse drastically. For example, consider Chaos Orb, a card legal in only one format.

Sure, the card dropped from its unrealistic peak of $325 down to $220. This drop only happened because the card tripled in price since the start of 2016! I don’t think this card is going to revisit the $100 price point as long as Magic remains healthy.

Many other classic, Reserved List cards are behaving similarly. There was an unsustainable spike, but the bottom line is even the post-spike selloff won’t drive prices down below where they were at the beginning of 2016. In other words, I’m confident they will continue to appreciate steadily over time.

My advice to you: identify some classic cards you’ve always had your eyes on and start to plan your moves. As cards sell off due to the recent buyouts, take the opportunity to acquire strategically. Here’s a brief list of what I have my eye on:

- Academy Rector

- Power Artifact

- Aluren (if you can find copies at the “old” price)

- Replenish

- Artificer's Intuition

- Anointed Peacekeeper

- Recurring Nightmare

- Wheel of Fortune

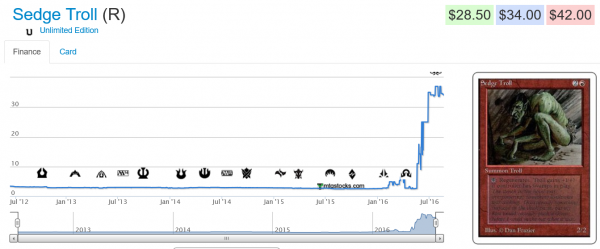

- Any Old School playable Alpha/Beta/Unlimited rare that hasn’t already skyrocketed. And I mean any. If Unlimited Sedge Troll can jump, nothing is immune.

I consider moving resources into cards like these “circling the wagons.” In other words, there may be more turmoil and volatility ahead. By investing in these safer, classic, non-reprintable cards you are setting yourself up for a more consistent trajectory. After all, it really doesn’t matter what’s reprinted in Conspiracy 2 or Commander 2016, nor do their respective print runs matter. Juzám Djinn and Academy Rector won’t face any sort of pressures either way. That’s the way I like it.

Wrapping It Up

A bet on a new card like Windswept Heath or Collected Company is equivalent to a bet on massive player growth, huge metagame dependence, and consistent reprint dodging. Should all of these factors come to fruition, then you can achieve significant returns.

But why expose yourself to such risk?

I find my peace of mind is much greater now that I’m focused on classic, Reserved List cards. Many have already spiked---for this reason, I have no interest in buying up Magus of the Moat or Gaea's Cradle at their new prices. But there are still ample older cards that can’t be reprinted, which players will gradually want over time.

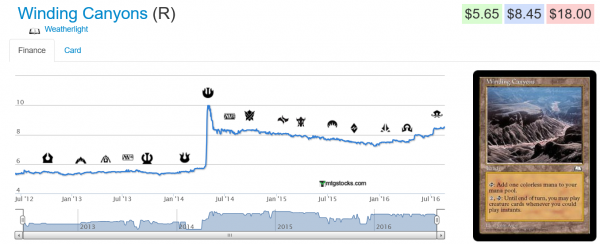

Will a card like Winding Canyons ever get its turn at a buyout (it actually did in 2014). Maybe, maybe not. But even if it doesn’t, I can guarantee more supply won’t hit the market. So as long as Magic remains healthy, this card will gradually become harder and harder to find.

And this is why I advocate these positions and an overweight allocation to Reserved List cards. A wager on cards like Lotus Vale is a wager on the game of Magic as a whole.

It’s almost like buying into the equivalent of a class baseball card (before they were over-printed). It doesn’t matter if Joe DiMaggio’s consecutive hit streak is broken---a rookie Joe DiMaggio card is going to be worth a great deal as long as there’s interest in baseball. In much the same way, playable classic cards will always be worth picking up as long as there’s consistent interest in Magic.

Given the fact that Hasbro is pushing Magic’s growth as best as they can---and my Twitter feed is abuzz with MTG news every minute---I’d say they’re doing a good job. And that’s why, despite selloffs in cards recently, I feel I have nothing to worry about.

...

Sigbits

- I’m constantly baffled by Star City’s lack of Unlimited dual lands in stock. They haven’t had Unlimited Underground Sea available for months now. But what surprises me most now is the fact that they’re sold out of Unlimited Scrublands too. In fact when I check out MTG Stocks’ all-time high list, I see Unlimited Scrubland is indeed hitting an all-time high as we speak.

- I always thought Archangel of Tithes should be worth something more. I guess it never really found a home. Yet despite its extremely limited play, the card is still 19 years old and on the Reserved List. As a result, Star City Games has just a couple copies in stock in the $3-$6 price range depending on condition and language. While this card may not ever break $10, I can say with confidence it will not follow any trend of modern-day cards. This one is about as safe as they come.

- With Dredge becoming more popular in Modern, expect graveyard hate to follow suit. While Star City Games has their share of Rest in Peaces in stock, their foil quantity is severely lacking. This is one of the few newer cards I can really stand behind. But be careful---a reprint can happen at any time. So once this card pops, take your profits and move on.

you are overestimating pokemon GO. Nobody is going to sell more because of that game (or buy less).

Also, noble hierarch is necessary for all bant decks (eldrazi, CoCo versions, some spirit decks), and infect and …

Of course this is going up.

I think he simply means summer is a time for going on trips and playing outside, so less game interest

Exactly!

The Pokemon GO comment was a joke. But I do wonder if seasons play a role.

Hierarch is certainly everywhere in Modern, I’ll give you that. I wonder how high it’ll go. Thoughts?

Thanks for the article! I have one question:

what happens if everyone(traders, speculators, shops etc.) starts buying reserved list cards? don’t we cause a bubble which won’t be related to actual/future demand?

Marian,

This is a great question. My answer is going to be wishy washy.

Maybe.

Maybe if everyone starts diving into RL cards, a bubble forms. Prices would go parabolic and everyone would become bullish. While we have seen a few concerted efforts at buyouts, I don’t think we’ve truly gone “parabolic” yet. Some prices have spiked, but everyone isn’t diving in. If that happens, it’ll definitely be time to sell.

What are the chances this happens though? I think buying RL stuff like Winding Canyons is not for everyone. So perhaps not enough traction will take hold to cause said bubble? What do you think?

Thanks for the question!

Sig

Isn’t something missing from the impacts list the fact that everyone is putting money into the same investments you advocate, if reserved list cards every week are spiking then that is money people are putting in that isn’t going into modern cards, there is only so much money to be invested and it just isn’t going into the reprintable cards because most realize the advice you are giving already.

The problem with buy, buy, buy, reserved list cards is a change to the legacy format. While the risk may currently be low, a change to the legacy format that does not allow reserved list cards would tank all the high value reserved list cards. Yes, there is the collectible market for MTG cards but that is only so deep. Your advice is reasonable but there remains a significant risk that you did not explore.

Why would they destroy Legacy like that? I thought MaRo or Aaron Forsythe already stated there was no plan to create new formats for many years? I think the risk of this is extremely low.

Besides, many of the cards I listed aren’t even played in Legacy. I’m not advocating buying into Force of Will or Sensei’s Divining Top. I’m talking about true collectibles / EDH playables like Academy Rector and the like. These cards mostly don’t care about Legacy since they’re not played in the format. I adamantly believe there’s plenty of niche opportunities such as these that aren’t format dependent (besides maybe Old School MTG, which has been around for many years).

What do you think?

Sig

The way he suggests it, it wouldn’t be a new format but an adaption of Legacy instead. MaRo definitely has made statements in the past that later turned out to have multiple interpretations.

Since when is Rector a true collectible? It’s always been near tournament level and its rarity is nowhere near something like Power Artifact.

Has Old School MTG been around for many years with any kind of significant presence?

Ben,

Do you think the majority of people are already buying into RL cards? Including the ones that haven’t spiked yet? I’m not so sure. I think the mainstream player is focusing on the new Standard, Conspiracy 2, and EDH. I think older, RL cards is still niche enough to not be a mainstream investment. No?

Thanks for the engaging questions/comments!

Sig

Thanks for the Reply Sig,

I think there is an extremely higher number of people looking at and beginning to dabble in RL cards, or at the very least picking up the ones they really need now, because they realize they arent going down and could at any minute. When one person is saving money to buy one Underground Sea instead of a playset of snapcaster mages it all begins to add up. Again just one additional factor on top of all those listed by you but as more and more articles/tweets etc of this nature are put out there the more this will contribute.

If the majority of people were buying into RL cards prices would be way, way higher. However, I believe more and more mtg finance enthusiasts see writers like yourself promoting the merits of buying into RL cards and as a result decide they want part of the action. The number of mtg finance enthusiasts has grown significantly and thus many more people are getting into RL cards.

RL cards certainly are no longer a niche within mtg finance circles. It’s no longer like a couple of years ago when most ignored all but the most important RL cards.

Agree with this exactly PI,

As a finance reader in fact whenever I see buy RL cards articles like this (and this is no knock on Sig) I roll my eyes and shrug as if to think what I didn’t know that?

For people paying for subscriptions to finance content I feel like we need a bit of a different tact from the writers, I like for example that Sig references (a lot) Old School because at least it is an enhancement/additional information on top of the RL cards piece.

also with accelerated reprint products if makes less sense to hold onto a large cache of cards than it use to

Regan,

So true! The more reprints, the more I’m inclined to stick with safer buys. That’s definitely my MO in this environment.

Sig

The problem with buy, buy, buy, reserved list cards is a change to the legacy format. While the risk may currently be low, a change to the legacy format that does not allow reserved list cards would tank all the high value reserved list cards. Yes, there is the collectible market for MTG cards but that is only so deep. Your advice is reasonable but there remains a significant risk that you did not explore.