Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

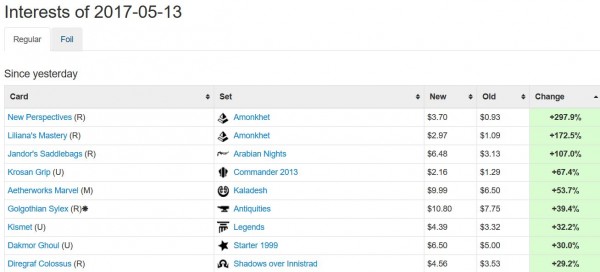

The Pro Tour was a wild success! Actually, it’s Saturday morning as I’m writing this week’s article so can I really claim that? One look at MTG Stocks convinces me that I can!

Four cards popped overnight thanks to Pro Tour play, and that number is likely to double throughout today and tomorrow as the Pro Tour enters its later rounds and Top 8. I thoroughly enjoyed engaging with QS Insiders in the Discord chat when I could pop in to discuss all the Pro Tour finance buzz. Shout-out to Chaz for orchestrating Insider Alerts and Discord discussion as well!

A Pre-Pro Tour Purchase

Most of you already know Standard isn’t my forte. I generally try to avoid the format as it requires an aggressive agility that’s difficult for me to maintain. Also, margins have become far thinner with the advent of the Masterpieces. Lastly, the dip in Standard interest throughout the era of Copy-Cat made for an underwhelming environment, financially.

This may have shifted, and that can generate opportunity. But at the same time, rotation is on the horizon and that will bring with it another shift in the Standard metagame. Net, I don’t go deep on Standard.

Right before the Pro Tour I did pick up a few Sphinx of the Final Word for around $2 each after noticing it sell out on TCGPlayer.

When I tweeted about the card, I received backlash from prominent members of the MTG finance community. Why did I purchase a Standard card that was yet to be proven? What kind of upside possibly existed for this card if it’s only played as a one-of? What kind of margins could I really expect by buying a card at $2 and selling at $5? These were some of the questions I received, and I didn’t bother attempting to fend them off as it would have resulted in a dialogue which held no value for me.

But there is a point I wanted to bring up here that addressed one of the above questions. I can’t argue the merits of Sphinx of the Final Word as a spec nor can I comment on its playability. What I can defend, however, is the premise of purchasing cards at $2 and selling at $5…

Value Trap?

The practice of buying cards at $2 to sell at $5 has developed a bad rep. Some have gone so far as to state that it's a complete value trap. But this rests on something of a misconception of what the term means.

"[A value trap is] a stock that appears to be cheap because the stock has been trading at low multiples of earnings, cash flow, or book value for an extended period of time…the trap springs when investors buy into the company at low prices and the stock never improves.”

- Investopedia

Ford stock would be a good example of a true value trap.

Ford stock has been trading at a very low P/E multiple for a long time now—some may be interested in the equity because, relative to the S&P 500, the stock is incredibly cheap. Despite this, the performance of the stock has been abysmal. It’s currently at a 52-week low and is approaching its five-year low set back in mid-2012. Other than the dividend, there was very little money made holding this stock for the long term.

Sphinx of the Final Word was not a value trap in the same sense. Those who bought at $2 could out their copies for a profit. If you hold the card for five years, it’s also unlikely you’ll lose money, as the card is a mythic rare that sees steady play in Commander.

Profit Is Profit

Taking this one step further I want to state here that buying a card for $2 to sell at $5 in general is a fine proposition for the right population. Some MTG speculators work with seemingly limitless capital—you know the type. They post about their incredible collection and arbitrage purchases totaling four or five figures. They leverage their network to get the best returns they can on a sizable bankroll.

Others, like myself, are more about small-time speculation. We don’t like to commit hundreds of dollars to a single spec because a miss could wipe out a large fraction of our available speculation funds. We’re not in this as a business—we focus on MTG finance to support our hobby and achieve a long-term goal. We accomplish this by running the margins one buy at a time.

For us, there’s nothing wrong with buying a card at $2 and selling it at $5. The math suggests this is still profitable. Selling a single card for $5 on eBay nets $3.36 after fees and shipping. This represents a 68% profit margin. But I don’t think I need to convince anyone that the margins are solid. I need to justify why the time investment is worth that $1.36 profit.

Buying the cards takes a negligible amount of time. I can literally buy copies of a card on my phone while at a red light (not that I’d condone this). Waiting in line for a coffee, that morning lull at work while your computer’s booting up, or while you’re waiting for lunch to microwave—all viable ways of buying cards without actually taking up time.

Listing a card on TCG Player is extremely fast. I generally use eBay, which is a little slower but still fairly quick. Especially because I use existing listings to “copy-to-create” a new one. I’d estimate this takes about 1.5 minutes. Then after a card sells, it takes about 3.5 minutes to package it up in a plain white envelope for shipment. I actually timed myself doing this, so I can report this time is accurate. The grand total time invested: about 5 minutes.

So now we can multiply that $1.36 profit out over an hour’s time for a comparison that most can relate to. 12 * 1.36 = $16.32/hour. By combining trips to the post office and buying shipping supplies in bulk, you can really drive out other costs. Thus, it’s not a bad hourly wage if you ask me.

Is it worth it? Perhaps not to those high rollers, but I’m never unhappy when I can make this kind of money doing something that I love. And that’s really the missing piece: the fact that I truly enjoy the thrill of the hunt and the practice of flipping cardboard for cash. The sound effect my eBay app makes when a sale is made can alone make it worth my while!

Not to Mention the Alternatives

The numbers above make a major assumption: that copies are sold out at a time. In reality, many Standard and Modern staples can sell four at a time. In these cases, margins are far improved as there are fewer shipping costs.

eBay isn’t the only route to sell cards. Sometimes a hot card will get a reasonable bump on a store’s buylist, offering another easy out for that $2 purchase. Now, of course shipping a single card to a buylist for $3 isn’t a winning proposition. That’s not how I do it. If I want to out a couple cheaper cards to a buylist, I always combine the order with some other sales I’ve had sitting idle for a while. Keep in mind I have a large position in Old School cards. These fluctuate in value often as vendors adjust their numbers and stock. Any time I want to sell something, I browse through my Old School collection and I typically find a few other things I can sell to make the order worth my while.

Lastly, there’s always trading. I don’t do it much these days so I won’t position it like it’s a universal option for everybody. But it is an option. When trading, there are no fees and no shipping. This is truly the best way to maximize value of those $2 cards that spike to $5.

Some Specifics

This wouldn’t be a true finance article without some specific ideas. If you’re like me and you appreciate the modest profits that come from those $2 to $5 jumps, then these could be targets to appreciate. They don’t all follow a $2-to-$5 price trajectory exactly, but they’re close enough that they may escape the radar of those “big-time” speculators who cannot justify the $16/hour rate.

Hapatra, Vizier of Poisons has caused a lot of price spikes from older cards with -1/-1 counter generating abilities. Necroskitter is one of the more popular includes in the Commander deck. While the MM2 foiling process wasn’t great, they’re still foils. I like these in the $2 range and can see them approaching $5 over the next month or two.

Another Hapatra staple, this card has been dwindling in stock over the past couple weeks. While it had been reprinted back in 2014, all copies now are three years old or older. The cheapest ones I can find on TCGPlayer are in the $2.75 range. These are likely to dry up slowly, while no one is watching, and then suddenly spike to $6-$8. You won’t be able to stake your retirement on this move, but this pickup seems like a solid low-risk play on a hot trend.

Is Jandor's Saddlebags a playable card in Old School? Beats me. I do think it partners with Colossus of Sardia very well. Stock is very low on TCGPlayer, but you can still pick up some played copies for $3. Given the fact that Arabian Nights is ancient and will only appreciate in value over time, this may be a no-brainer if you’re patient enough. I can see these selling for $6-$8 given enough time. Oh, it’s also worth mentioning that the top buylist is $3.73 according to Trader Tools. So you have that as your downside support.

All of the original Theros block gods are casual gold. Some of them are already on the pricey side, but others are fairly inexpensive given how unique they are. I called out Karametra specifically because her price movement has been gradually climbing from a low base. But honestly I like Thassa, God of the Sea even more because of her power level. The right Modern deck could really leverage Thassa’s strengths in the right metagame. Price memory is also a factor with Thassa as well, which is perhaps why she hasn’t dipped nearly as low as some of the other gods.

Wrapping It Up

I bought a few Sphinx of the Final Word for around $2 each and I hope I can sell them for around $5. This will net me a decent profit. Some MTG speculators have written off these small-time profits as not worth their time. You know what? I think that favors us home-gamers. We are the ones who love the game so much that making any profit from it whatsoever is a thrill. I get to build out my Magic collection, appreciate some sweet card art, and get paid in the process? Sign me up!

After all, profit is profit. I always like to say that no one ever went bankrupt selling for a profit. And if some folks don’t see the smaller gains as worth their time, then it leaves more room for me to scrape those margins. When you do the math, the hourly rate really isn’t that bad—I suspect blueprinting collections to pull out three-cent cards pays a far less attractive hourly rate.

So I think I’ve found my sweet spot. It has worked out very well for me lately, making gains on stuff like foil Dusk Urchins, Debt of Loyalty, and Conqueror's Flail little by little. In enough quantity, these profits can really add up and help make the hobby self-sustaining while gradually banking some money for my son’s college education. Little by little. For me, that’s good enough.

…

Sigbits

- For those of you curious about Legends Spirit Link, I can say that it absolutely is a playable Old School card. The price you’re seeing on MTG Stocks nowadays is completely real. I myself had two playsets of HP copies that I bought from Star City Games at $1 each a while back. I sold one set on eBay for around $14 shipped and I buylisted the other set to Card Kingdom for about $10. Star City has just a couple copies in stock, with Near Mint ones listed at $5.99.

- There aren’t many English Thassa, God of the Seas left in stock at Star City Games. The only copies they have in stock are MP ($5.59). This isn’t going to double in price overnight, but this kind of casual all-star is the perfect buy-and-hold target. Reprinting these will be really tough, so it seems like these are safe holds for the time being.

- Meditate is a Tempest rare on the Reserved List. It has seen competitive Legacy play in the past, and the decks it was played in just got better with the banning of Top. Sounds like this should be a $10-$20 card right? Nope. It’s $3. In fact Star City Games has over fifty SP/MP copies in the $2.45-$2.99 range. Clearly this won’t be spiking imminently, but the potential is always there and you could do worse than to park twenty bucks in this card for a rainy day.

meditate has spiked at least once in the last couple years

Yup, it sure has! I didn’t mention this, but if you look at the price chart you see the sudden spike and then ensuing sell-off. The card is very powerful, it just needs the right deck/metagame to get there.

“Profit is Profit”. Great quote to always abide by if you take mtg finance seriously. Some just hunt for the 500% spike cards which is quite hard to predict and also harder to sell (people just sometimes refuse to buy the card at the post spike price).

Any small business that operates on net 20% after costs is doing pretty well, in my book. Regardless of whether that’s on $5 or $500.

I’m baffled that so many still carry the misconception that only double-ups are meaningful…

Indeed! People who deem the $2 to $5 move as not worth their time aren’t engaging in traditional MTG finance. Here’s a question to ponder: I wonder if the average shop is happy every time they buy a card for $2 and sell it for $5 on TCG Player?

KaiAn,

You hit the nail on the head! Making money in MTG Finance isn’t about the flashy 400% gains (that never materialize in practice). It’s about the slow, steady grind and making 20% at a time.

I get such a sinking feeling when I’m trying to race others to a lower and lower price post-spike. The cards just don’t move unless you undercut drastically. I much prefer selling in a rising price environment, always.

A great example lately is Conqueror’s Flail. I bought a handful of copies in the $3 range, and have been selling 1 at a time between $6 and $7.50 on eBay. This is far from exciting, but these cards have moved easily and every sale is another profit.

I’m definitely on the other side of this, so can’t resist to reply. I wasn’t one to give backlash, had I seen your tweet I would’ve probably wondered what a Sphinx of the Final Word does. I am the type ;).

– You assume all cards bought sell. For every Sphinx you get right, how many cards do you get wrong? I’m happy to grant you it worked this time, but at your $1.36 profit you’d have to be successful about 3 times for every 2 failed purchases of $2 just to break even.

– Your “free time” isn’t actually free when you consider that you could’ve also spent it doing something else, such as buying cards that give you more profit. I’m not against using your time efficiently just saying it’s not “free”. There’s also the cost of spending your money on this rather than something more profitable.

– Your time spent on the card does not include unpacking and validating its grade and potentially getting in touch with a seller to discuss a misgraded card. While the latter won’t usually happen the times it does it takes a relatively large chunk of time. There could also be time spent on interacting with the buyer when something goes wrong with shipping cards to them. I have no way to estimate time spent on issues, but it seems fair to assume 10-20 seconds on unpacking and grading.

– Are you counting time spent on identifying these cards? I’m sure you didn’t wake up one day thinking “Sphinx of the Final Word!!!1”. If you spent half an hour researching cards with potential before settling on the Sphinx that’s another half hour to figure in on your time spent on average.

– While combining reduces time on the post office trip you need a lot of cards to be shipped to make it insignificant (unless the post office is next door, but most people won’t be in that luxurious position). I could probably post cards in 5 minutes, that means I need to post 30 cards at a time to get to 10 seconds per card, selling 3 playsets means an additional 25 seconds per card.

– 5 minutes seems a low estimate of the average because of the previous points, if you adjust your average up to 6 minutes you lose $2.72 on your hourly rate and the estimate still seems rather low to me.

– Even when buying in bulk supplies are not free, I would be surprised if they cost you less than $0.06, which is another $0.72 lost on your hourly wage assuming your 5 minute number for time or another $0.60 assuming my 6 minute estimate.

– Are you paying tax on these profits?

What I am mostly trying to show is that things get worse quickly as real costs in time and money get worse than estimated. If you do this in volume there is absolutely nothing wrong with doing this, but for a few copies it’s difficult. The problem with doing it in volume is that the misses hurt more too and you may simply not be able to get enough copies of the card you have most faith in, so you have to look for others that are more risky.

You end the article saying you hope to sell your copies for $5. By now there are 32 NM copies on TCGPlayer that are $3.50 or less.

I’m afraid that I am not convinced your profits are really worthwhile in comparison to other options I have available to me. On the other hand it does beat a lot of other things I could do that pay out even less. Basically, if someone is wasting their time anyway this is a pretty good approach. Personally I mostly do collections and bulk rares, on which my percentage margins tend to be better on bulk rares (worse on collection cards), volume tends to be higher and time spent per card tends to be considerably less as I just send everything to a store. Altogether I figure it balances out to a better hourly rate at less risk, but I must admit that I also haven’t done the detailed math on it.

Lots of information here, and I don’t think I can do justice to all of it right now. But here are some quick points to counter:

– When speculating, risk of cards not selling always exists. But buy lists ensure there’s always an exit strategy even if less profitable. Thus the “losses” are reduced. Also, I could flip the argument around and say that I am not taking into account situations when cards spike higher. I bought 11 foil dusk urchins for $2 each the other day and copies have sold for $8-$10. This cancels a small loss on Sphinx of the Final Word or what have you.

– There’s little I can do while waiting for my coffee in the morning, so browsing eBay and Twitter costs virtually no time for me. It’s probably value positive compared to what I’d do otherwise, such as check Facebook :-P.

– It doesn’t take so long to grade cards, and when you’re buying newer cards they’re often pack fresh. I could see this being more an issue when dealing with really old cards, but we are talking $2 cards here and not high value cards that merit extreme grading attention.

– I usually identify the cards through social media like Twitter and QS, which I engage with for fun anyway. No incremental time required on top of what I’m already doing out of enjoyment.

– I mail cards directly from my mailbox. Trips to the PO are only to buy stamps, which I do in larger quantities.

– I timed myself. It was literally 5 minutes once I got into the swing of things.

= Sleeves and the like are “free” because they come with cards I’m buying. The only expenses are plain white envelopes, scotch tape, and a pen. Probably less than five cents per sale.

While I won’t argue that flipping collections is far more profitable, it’s not an avenue for everyone. We also don’t all have amazing bulk rare outlets as you have identified in Europe. My point wasn’t that this was the BEST way to make profit…just that it isn’t something to be scoffed at. It’s a viable, valid approach to MTG finance. And while I wouldn’t want to flip $2 to $5 cards exclusively, I am never above buying $2 cards that I hope to flip for $5.

– The cards that spike even higher tend to be even more rare. Obviously they help to an extend, but others don’t quite reach your target of $5 either. Your profit at buylist may be too little to make it worth your time.

– You could buy cards that pay off better in the same time. A $20 card that you expect to jump to $25 may give you les of a percentage, but many of your costs remain the same for a better total profit. A more expensive card with the same percentage margin is better still.

– I wasn’t saying it takes long, I was saying it takes 10-20 seconds to unpack and grade. I regularly spend longer just unpacking if people had some fun with their tape. (If I am grading high value cards I probably spend 30 seconds to a minute each, I spend at least 5 seconds per bulk rare, more if it’s borderline acceptable).

– Your readers may not already be engaging with Twitter and QS in that way so it would be time they need to spend. I understand it doesn’t feel like spending extra time to you, that’s your benefit, but that doesn’t mean it’s a cost you can ignore when trying to convince others that this is a wortwhile endavour.

– We don’t have such service here, so I have to go to a mailbox to send mail, closest is 5 minutes from my desk to there and back. I have no idea how common your situation or mine is among your readers.

– Even 5 cent per card is significant on the low profits you’re making per sale.

I wouldn’t scoff at it, I am simply challenging some assumptions I feel you’ve made that make the hourly rate look better than it is.