Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Introducing a New Article Series

If you've followed and loved the "100 Tix, 1 Year" project or you've been enjoying the MTGO Market Reports, then you'll probably love the new article series I'm starting today. "High Stakes Bankroll Management on MTGO" aims to be the perfect mix of the two series mentioned above--following realtime trades, bankroll management and perspectives on MTGO speculations.

If you followed the "100 Tix, 1 Year" project, you may have thought that 100 tix was a little too small of a bankroll for your consideration. You may have been right as a fair share of the speculations made within this project were tailored for small bankrolls. Here I'm raising the bar a little bit, about 200 times...

The bankroll I'll be dealing with for this new series is over 20,000 tix and counting. Similarly to the "100 Tix, 1 Year" series, all my trades, buys and sales will be recorded, posted and available in realtime, but this time only for QS Insiders. I set up a google spreadsheet that recapitulates the current state of my portfolio and all the most recent trades to make it easier for viewers to follow the action.

The Spreadsheet

Here is the link to the google spreadsheet. I'll update this spreadsheet within minutes to a few hours after completing any trades.

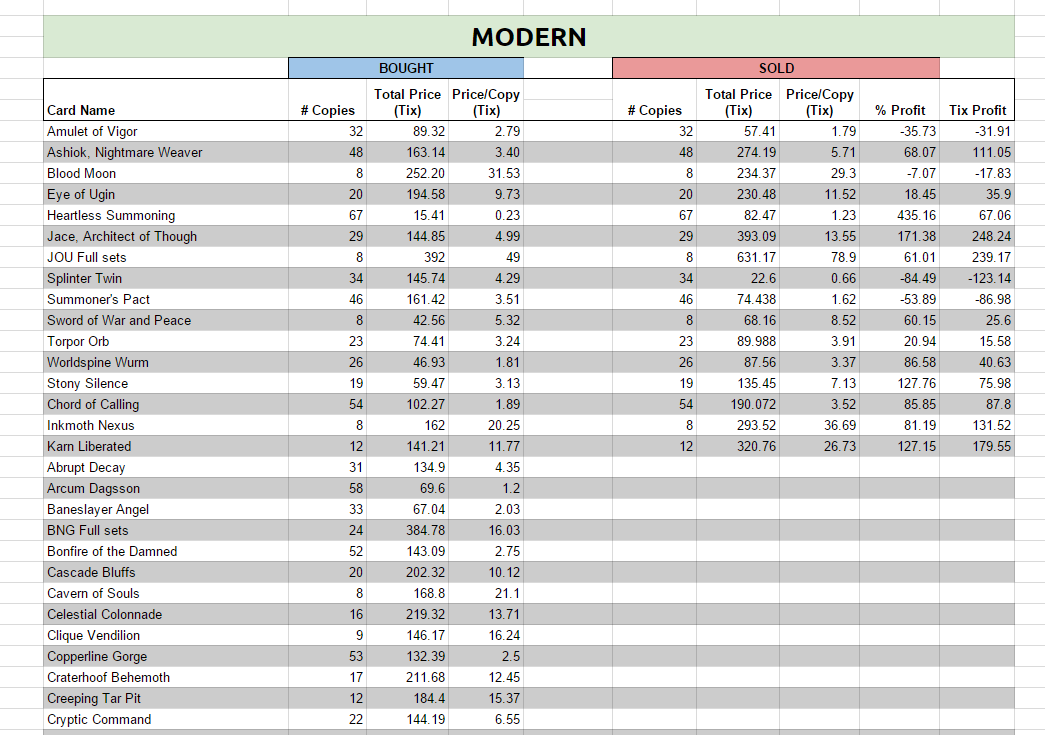

The way I organize my specs is pretty standard---name of cards, number of copies, total and per-unit prices, Modern, Standard and Other sections. I also include a percentage and tix gained/lost columns.

The recent trades are at the very top of the spreadsheet. Within each subsequent section the closed transactions are at the top followed by open transactions. From time to time I sort all of it in alphabetical order to review my specs more easily.

A Weekly Summary of My Transactions

In these weekly articles I will discuss my motivations to buy or sell any given positions during that week. I'll give a little bit of context and share my expectations on newly acquired positions.

Buys This Week

As it will be the case over the next few months, this week I was buying cards from Modern flashback drafted sets---Mirrodin, Darksteel and Fifth Dawn.

I didn't buy into the hype after the announcement of the new B&R list, partially because I was already holding several of the cards that spiked and partially because I was not really available on MTGO to grab the best cards at the best prices. Rather, I bought into cards that were directly affected by the ban of Summer Bloom but that, against all odds, present good speculative opportunities in my opinion.

As anticipated these three Mirrodin rares took a hit with the Mirrodin block flashback drafts. They are not heavily played in Modern, or in Legacy in the case of Chrome Mox, but I'm simply trying to ride the trend here.

Prices are unlikely to spike in the short term but they can't really go lower, and that's the point. These positions are better than free tix on my account and they always have the potential to spike sometime in the future.

These two are my current picks in Darksteel as of Saturday. I'm chasing more copies of both of them but I really want to keep my buying prices around 4.5 tix for Serum Powder and 4 tix for Sundering Titan. If prices keeping dropping I'll buy more for sure.

The Titan is almost unseen in Modern at the moment but has a record high above 15 tix. At an almost three-year low, it seems a good bet to me especially with a Modern format about to mutate.

With a current price half of its record high, Serum Powder only sees play in Vintage Dredge. Not great speculative stats here but I'm okay with that. After all Vintage got invigorated by the Power Nine Challenges and if Serum Powder integrated into a competitive Modern deck I would hit the jackpot.

Serum Visions is still the best filtering engine available in Modern. The ban of Splinter Twin and the scheduled flashback drafts of Fifth Dawn are only delaying a large rebound this card should see very soon.

Among others, Storm decks might be returning consumers of the blue sorcery in place of Twin decks. This card is very unlikely to be reprinted in Standard and was not reprinted in Modern Masters 2015. My max buying price is currently 2 tix but I might accumulate more copies in the following days anyway at higher prices if needed.

I had bought some Amulet of Vigor prior to the announcement of the new B&R list. The bet didn't pay off but it doesn't mean I'm done with this spec.

Summer Bloom has been banned, not Amulet. There's always a chance a similar deck, slower and less explosive most likely, could be viable in Modern---if so, Amulet of Vigor would be a centerpiece. The price has almost doubled since its rebound and I'll buy more copies if the price goes down again.

The idea is the same with Primeval Titan. The green titan got affected by the ban of Summer Bloom but can clearly find a home in other decks. Falling as low as 4.5 tix last week, the lowest it's been in Modern, I think the price drop is undeserved. I'm simply stocking up to be ready for Amulet 2.0 or any other decks using Primeval Titan.

Not sure if the price drop of Misty Rainforest is due to the B&R list changes but it seemed like a good buying opportunity to me. I wanted to buy between 18 and 20 Tix which is why I only grabbed 8 copies. I would have been okay with 4 to 6 more copies at a cheaper price.

The goal with this spec is to see a comeback to the 30ish tix range. I was also lurking after Scalding Tarn but was too slow to pull the trigger and prices got too high for me.

Cloud of Faeries has been banned in Pauper. Not Adaptive Snapjaw. A plunge from 6 tix to 2 tix seems totally disproportionate to me. I bought some copies a little bit later than I wanted to but I'm fine at 2.5 tix. I won't be buying very often outside of Standard and Modern, but Snap deserved the extra efforts.

Sales This Week

This past week I continued to sell cards that benefited the most from the recent changes in Modern. These were unexpected profits and they have reached my goals---no reason to be more greedy here. I happily cashed out without having to wait on good or bad news from the Pro Tour.

I'll start with Blood Moon. In between 8th Edition and 9th Edition flashback drafts there will be a small window when the price could theoretically go up. With the banning of the deck that's most sensitive to this card (Amulet Bloom), as well as the deck most likely to play it (Twin), profit margins got too small for me. As the trend looked uncertain I sold now.

These were among the top gainers this past week, going beyond the expectations I had for these cards. A lot of cards spiked after January 17th and, as usual, not all of them will sustain such heights. I'm taking my profits now that I know what I get and will reinvest these tix somewhere else.

Of note, the unexpected extra tix made with these five cards totally made up for the losses I incurred with Splinter Twin, Summoner's Pact and my pre-ban gamble with Amulet of Vigor. As you can see I'm also holding a lot of other Modern staples that may shine sooner rather than later benefiting from these changes in the Modern metagame.

On My Radar

Besides buying Modern staples discounted by the flashback drafts, my next big investment will be Battle for Zendikar (BFZ) full sets. I intend to take advantage of a small dip that should occur during Oath of the Gatewatch (OGW) release events to accumulate several dozen BFZ sets.

BFZ sets got as low as 60 tix in December and may not reach that price in the following weeks. I'll be happy to start accumulating the sets around 63-65 tix. BFZ will still be drafted (as one booster per draft) and prices could dip further even after the release of OWG. If so, I might be buying more sets.

I expect BFZ full set value to start rising when Standard rotates in April with the release of Shadows Over Innistrad, when BFZ won't be among the newest sets to be drafted.

Questions & Anwsers

Here is a little section I'll be dedicating to answer questions or comments in more depth in future articles of this series. Feel free to leave a comment/question after this article, on Twitter (@lepongemagique) or on the forums.

Thank you for reading!

Sylvain Lehoux

Thank you Sylvain. As always your articles are informative and a pleasure to read.

This is slightly off topic but pertains to the BFZ sets. I’ve been wanting to start buying full sets to that I may begin to do some short selling as you discussed in a previous series. Maybe I missed it in those articles, but if I was looking to start doing so with BFZ would 4 sets be enough of an initial investment to make it worth while?

Thanks in advance and I look forward to the new series this year.

900 copies of a single card!!!! I’m going to be learning a lot from this series I can already tell. I really look forward to it.

Hopefully you won’t learn that 900 copies is too much of a position 😉

New member here and continuing my subscription purely for the excellent Luca and Sylvain articles! I have to ask though… how are you going about purchasing over 900 (or any large quantity) of a single card? I can’t imagine you doing this going from bot to bot for 4 cards each time, all the while moving the market up as you buy. I feel dumb asking, but I also think there is potential for an article explaining some expeditious tactics and basic methods. I also read all of the complete set buying articles, yet still feel less than confident about the process/ease of liquidating complete sets when it’s time to sell. I love the nitty gritty of the finances/specs, but a primer would go a long way for this noob and probably others. Maybe this has all been touched on and you can point me in the right direction. Regardless, keep it up with the great articles guys!

Since many asked the question of buying/sell large quantity, such as the ~900 copies of Yaviamay Coast I’ll anwser that next Monday in the article.

As for selling full sets, I shared my usual method(s) for this on the forum, hereh: https://www.quietspeculation.com/forum/index.php/t…

Thank you! I look forward to the next article. The link cuts off but I believe this is the thread for anyone else curious on this: https://www.quietspeculation.com/forum/index.php/t… (end of link)

Glad to see some MTGO content like this. Looking forward to keeping track of it.

I love these articles (the 100 tix one and this looks to be just as awesome) despite almost no MTGO investing on my part…I am honestly a bit worried about going so deep on the painlands…only because I went deep on the temples a couple years ago a month or 2 after khans hit, expecting the typical dual land rebound we were seeing at the beggining of the next block only to get stuck with almost all of them losing value after purchase throughout their remaining time in standard…

Painlands were supposed (and are still actually) to be my surest bet of all. Even after 4 reprints in a row the M10, 11, 12, 13 check lands did great on MTGO. The expectation was the same with the painlands. Unfortunatly fetch+BFZ “duals” messed up the plan.

But I think it sill a good bet with colorless mana around and the rotation of KTK feth before ORI painlands. I’m not going to wait for 6 Tix each for sure considering the pile I have but I think doubling on all is a very decent goal (and a good amount Tix to cash in).

Love this style of article. That said, I think Sundering Titan has basically been rendered obsolete by Ulamog.

I don’t understand Arcum Dagsson… what is he in there for? The series starts interesting though!

Looking forward to this series, I enjoy reading all your articles but this is closer to my bankroll than the 100 tix series. Thanks for the continued articles!

Great article, I look forward to more in this series. How do you purchase such large quantities without causing price shifts? How many different vendors/bots do you use to do this?

Finnnnne, I’ll continue my QS subscription :). Exactly where I was hoping you’d go after the 100 tix series.

Glad to hear it:)

what other MTGO content would you like?

Some tools would be nice. We have the thing that gives you the price of a csv lost but that’s it.

And more data is always good. Something like the number of drafts firing would be useful That would involve a bot though.

20k in tix. This seems like a whole lot of money tied up in a risky investment. MTGO does not inspire the most confidence in its players as a program and interface after all. Tickets and ecards are not the most liquid of investments, and there is always a chance of some sort of crash in the MTGO economy. Clearly you can do whatever you want with your money, so I’m thinking more of the people who might be looking at your example.

A lot of financial gurus like to have guidelines as to the max percentages of net worth anyone should have tied up in a particular investment.

What is the max percentage of net worth you would consider reasonable to have tied up in MTGO speculation?

I’m definitely interested to see where this goes. Best of luck!

I think the term “risky investment” is very subjective. I’m sure many homeowners and stockholders back in 2007 in the US would have absolutely not considered a house or the stock market a risky investment. Nonetheless the vast majority of these “many” are still biting the bullet now and probably for the rest of their lives.

How risky is MTGO and MTGO investments? To me no so risky but I’m clearly aware of the potential risks. The big risk to me is a general and irreversible Big crash of, not only MTGO, but Mtg as a whole. Besides that, changes of versions, introduction of PP, increasing fees for redemption, etc… are nothing but fluctuations, from which speculators can actually take advantage of. As long as WotC is producing decent sets and keep the GP/PT circuit alive we are more than safe.

Now, and after almost 5 years of MTGO speculation, I had gotten out all the money I had put in and even with some profits. Which mean all of the $ from my “real” bank account that were on MTGO at some point are already out. Now, I’m speculating with the profits accumulated over many years. If tomorrow MTGO crashes for real and the value of cards and Tix is equal to $0 I’ll be clearly mad but it would have no financial impact in my life. I would actually love to buy vintage decks for $10 for fun and build and play EDH and cubes on MTGO for less than $50. Afterall the game is and will always be fun to play.

Most importantly: I still have a real job, health coverage, retirement plan, savings accounts, etc… Right now, the money I’m able to generate is extra money. Maybe down the road that could pay part of a down payment of a house and I might seek for legal ways to exit a large amount of $ and pay my fair share of potential taxes on it if needed.

Finally, for the reward MTGO speculations offer to me (which are much much much more than any of the “real” savings account I could ever have, stock market included) I’m totally fine with “gambling” with such large sum of money rather than selling all my Tix to Mtgotraders and buy a new car.

So if you wanted to invest as much as you could for MTGO specs you should consider this venture as speculating with the stock market, and follow some of the advice that goes with it= disposable money you have to feel comfortable losing it all if it has to happen. I would strongly recommend having a stable source of income, retirement plan, savings account, paying your mortgage, save for your kids’s education BEFORE putting $20k down on MTGO. And as I and many others have shown before, 100 Tix is enough to start seriously and significantly growing an account.

Any chance you can add a sets column to your spreadsheet?

How long are you planning on continuing this? Permanent? Or at least longer than a year? Thanks. Looking forward to following this!

I don’t have any end date for this.

Yes, I can add a set column

AWESOME!!!!