Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Supply and Demand. These are the two factors that dictate a card’s value. The Invisible Hand, a metaphor used by Adam Smith, matches up the supply and demand curves to identify the appropriate price for a given item.

As much as it may pain dissenters, Magic Cards are no exception. Supply and demand dictate price – the only way to materially impact the market is to alter one of these two factors in a lasting way.

I use the word “materially” because artificial, short-term impact to supply or demand will not have a lasting impact on price. It may lead to ridiculous people trying to get greedy by charging an exorbitant amount of money for a card, sure. But that doesn’t mean the price is truly “changed”, no matter what mtgstocks.com tells you.

Allow me to explain further and provide some context.

Motivation

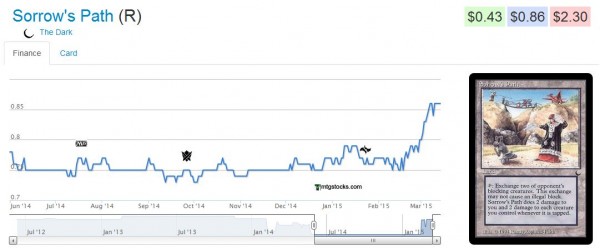

Last week, Jason wrote a terrific piece warning people who become excited by the notion of a card’s low supply. He cited multiple examples where a low supply on a card could incite panic despite there being no need to rush out and buy copies of a card. The example he cited was in my opinion the worst card in Magic: Sorrow's Path.

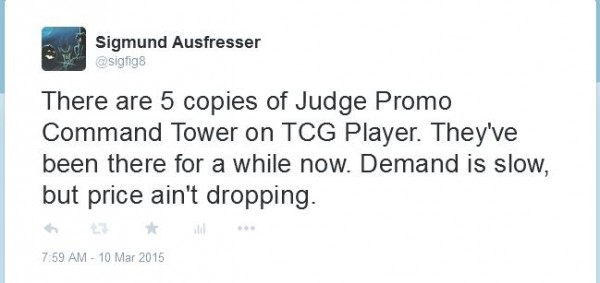

Last week I also entered into a heated debate over a Tweet I sent out.

This tweet was direct inspiration from Jason’s article. There was an edgy sarcasm to it – recognizing that Judge Promo Command Tower was extremely low in stock for weeks, I figured I’d share my observation. Those who read Jason’s article hopefully found the humor in the Tweet.

Unfortunately, some others decided this was an outrageous communication for me to make.

The last tweet above incited grand debate. Fortunately, all parties were highly civil and I left the discussion with some new insights.

So I’m calling that a win, despite the momentary increase in heart rate I experienced. Allow me to elaborate…

ZOMG – A Case Study

One day I came across a thread in the QS forums discussing Command Tower. About a zillion copies of the card exists, but many theorized a rise in popularity of Tiny Leaders could lead to increased demand for the mana-fixing land. Adam Smith tells me an increase in demand leads to a increase in price.

Certainly seemed like a sound thesis. I bought 12 copies.

But then I had an epiphany – what are Judge Foils selling for? If those are cheap, I’d rather put my money into those versions. If Tiny Leaders truly is like Legacy Light, and if many Commander players still like to foil out their decks, then demand for Judge Foil copies should be even juicier relative to the far smaller print run. Right?

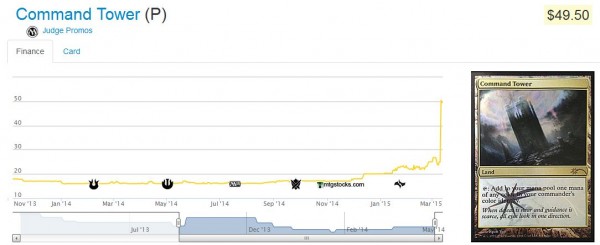

Well to my surprise, there were a whopping 8 copies in stock on TCG Player. Star City Games was sold out, eBay was nearly sold out, and other sites didn’t have more than a copy or two. So I decided to buy 3 Judge Foils from TCG Player, leaving just 5 behind.

This did not have an immediate effect on the card’s price, but let’s face it: in terms of availability on the internet, I virtually reduced the supply by roughly 30%. I found this perplexing. Using Jason’s article for inspiration, I decided to send out my tweet sharing my observation.

Two things happened. First, I initiated a heated (yet civil) Twitter debate. Second, this:

This is all my fault, right? If I hadn’t mentioned the scarcity of Command Tower, there’s no way those 5 remaining copies would have been bought up so quickly. It’s not like people actually WANT fancy Command Towers for their new Commander and Tiny Leader decks, right? /sarcasm.

FIVE COPIES!!!! Supply was SO low on this Commander staple that any shift in demand – real or artificial – would have triggered this kind of jump. I’ll admit it’s possible I may have accelerated the 5 copy buyout of this card by tweeting about the low supply. But demand for the card is strong, and increasing. With supply being so low, the ensuing price jump was inevitable!

Fly In My Ointment

Here’s the part I don’t wish to be held responsible for – the new “price” on the card. $49.50? Give me a break!

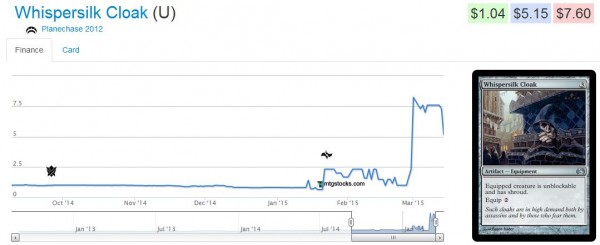

First of all, this “price” is an artifact of mtgstocks.com’s pricing algorithm. There are only a few copies on TCG Player, so naturally the greedy sellers trying to capitalize on hype will temporarily dictate the price. It’s the same reason we saw a rapid spike in Whispersilk Cloak only to be followed by a rapid drop back down to reality.

This is the way pricing works. A sudden increase in demand does lead to a rapid rise in price. However, as the price rises, more sellers dig through their binders to try and sell their own copies at the new price. After all, everyone has a price at which they’d be willing to sell a given card. That’s the way the supply curve is drawn.

Coming back to Judge Foil Command Tower, this new “price” is only an interim step as part of the ensuing drop back down to reality. I don’t expect a $50 price tag to suddenly stick simply because I tweeted about it.

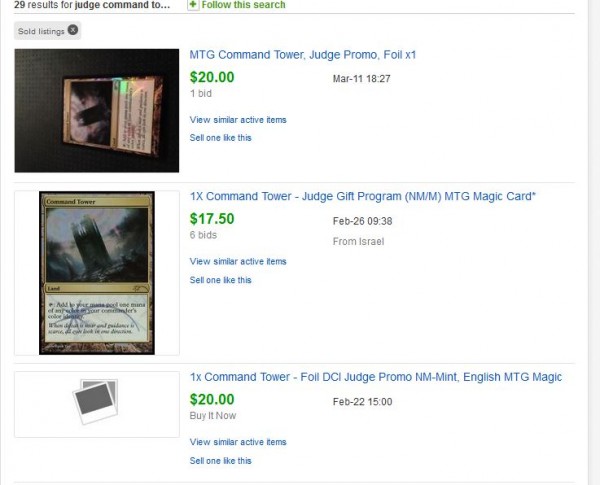

One quick look at recently sold copies on eBay supports this argument in spades: Not a single copy sold yet at the new price.

What if the price does stick, you ask? If the price sticks, it’s not because of my tweet. It’s because of the fundamental shifts in demand that inspired my purchase in the first place. People want copies more, and supply just isn’t available enough to match the growing demand. Thus the price rises.

It may overshoot a bit, but eventually the Invisible Hand gets it right. It always does.

Wrapping It Up

The major retailers currently have both foil versions of Command Tower in the $30 range, although some are currently priced higher. Given the likely long-term rise in demand and short supply of these premium cards, I’d say that kind of price increase is perfectly reasonable. I could even see $35 if Star City Games continues to remain out of stock for too long. I know I’m not willing to sell them my copies at $15, their current buy price.

Are you? If not, then expect them to increase both their buy and sell prices until they do have some in stock.

If they decide to increase their buy price, are they “manipulating the market”? Not at all. They are trying to get a sense for where the Invisible Hand is taking the price given the shift in the market. Only they’re doing it the right way – gradually increasing prices until they have supply again.

The sellers on TCG Player are doing it backwards. They are starting with an astronomically high price hoping to find a greater fool. But watch the race downward – it’ll be fun to observe. Prices will drop and drop until a buyer is found, establishing that new price.

As for my tweet? By this time next week, most will have forgotten about it. But they won’t forget about the ubiquity of Command Tower in both Commander and Tiny Leaders.

I may have caused a (silly) sudden spike in demand based simply on a scarcity metric – a mindset I condemn right alongside Jason. But the change in price was not my doing. The short term price change is being driven by an mtgstocks.com algorithm and greedy sellers. The long term price change will be driven by the increasing demand for this staple.

I feel an obligation to make one last defensive statement: I was NOT one of the greedy sellers charging $50+ for my 3 Judge Foil Command Towers.

In fact, I don’t even have a TCG Player account. If I was, then I would certainly deserve the accusations of coordinating a pump and dump effort. But my 3 copies are sitting tight in my binder. One of them will almost certainly make it into my Tiny Leaders deck, while I plan on sitting on the other two until the market stabilizes. After all, the $50 price tag may not stick in the short term.

But barring another foil printing in the original artwork, I see values even higher in the coming years. This is an investment made for the long haul. Fundamentals look terrific for this investment, with demand surely to increase against a fixed supply.

Adam Smith doesn’t need to tell us what that means for the price trajectory.

…

Sigbits

This Sigbits segment is very similar to my Command Tower tweet. I use this section of my article each week to highlight cards which are low in stock at Star City Games. These statements are for informational purposes, and are not meant to incite buyouts. That being said, low supply often does correlate well with high demand and could indicate a pending price increase. Hence my segment.

- After spiking initially, foil Abrupt Decays have stagnated. My guess is that too many speculators were in the kitchen, and now the market supply is a bit flooded at this higher price. Star City Games has 37 copies in stock, including 10 NM at $69.99. Meanwhile they are quite low on nonfoil copies – 0 NM at $12.29 and just 16 SP at $11.05.

- What began as a longshot buy for self-amusement has turned into one of my worst decisions in quite some time. I bought a set of Mishra's Bauble a couple weeks ago for around $14 shipped and promptly sold them for marginal profits when the card had zero impact on the Modern Pro Tour. Apparently that didn’t matter. The card has continued to skyrocket in price and Star City Games is now sold out at $9.99! Even a small increase in demand can do amazing things to a card’s price if supply is low enough. (see: Judge Foil Command Tower).

- Here’s one I almost missed: Karrthus, Tyrant of Jund. You know, that sweet dragon from Alara Reborn that can take everyone else’s dragons? There are currently only three sellers on TCG Player with this card in stock, although they have 15 copies amongst them. There are also 0 foil copies in stock. SCG has just 5 nonfoils in stock themselves, with 0 being NM with a $19.99 price tag. They also have just 1 foil in stock, in MP condition, at $24.99. I’m sure it’s going to be bought up quickly. I just sold my 2 foil copies on eBay myself for an average of $41. A quick shipping and fee calculation, and I don’t think there’s a ton of profit on the single MP copy. But if you have store credit with SCG, you could do FAR worse than buying up these from them.

I checked the price of command tower (foil) on magiccardmarket. Min price is 30€ for the JR. The commander’s arsenal has zero copies.

ZERO!!

i’m afraid this price jump will stay.

I picked up 2 Commander’s Arsenal copies for €20 each, sometimes it’s worth checking the stores rather than MCM (even the usually too expensive stores).

The new price will definitely be higher. But it won’t be $50 and it won’t be because of my tweet. Supply is very low and demand should steadily increase. That’s all it takes.

Thanks for adding the datapoint! I think we can all agree this is a great buy if you can find at the $20-$25 price.

Somebody may want to look into getting Pastimes 2 $20 Command Tower copies on Bidwicket for the Commander’s Arsenal printing.

I think the Arsenal printing is not as nice. Prefer Judge Foil with original artwork. I also hear the Arsenal foiling process is not as nice, but that’s just word of mouth.

Still, $20 is a steal and would probably lead to profit.

Yeah, I figured, it’s also the first foil if I’m not mistaken. Some people might prefer that art. Mostly it seemed like a pretty decent price for them.

If this is just fundamental economics, why not just buy all the promo Command Towers and then sell into the new price?

It depends on what you call the new “price”. If you buy them all, then you can temporarily set the new price. But it’s only legit if someone actually BUYS a copy at that price. A card is only worth what someone is willing to pay for it, after all. So a sudden drop in supply leads to a higher price, but if it’s an artificial drop in supply then the new price doesn’t stick. Eventually others will list their copies at lower and lower prices so they can try and sell theirs at a new, higher price. Price wars ensue until people finally buy copies again. Then the Invisible Hand completes its job.

This is always what we see with poorly coordinated buy-outs. TCG Player stock goes to 0, but there are still copies here and there to meet player demand. Meanwhile everyone rushes to sell their copies undercutting each other in price.

In the case of Command Tower Judge Promo, I DO see the resultant price settling higher than the “old” price of $20-$25. But this isn’t because someone bought out TCG Player. It’s because demand should increase over time while supply dwindles/stays flat.

Suddenly…the cheerful countenance displayed in quiet speculation’s authors’ pictures seem, inadvertently wolf-like. I’m beginning to love this website, I have nearly stopped reading the news as this is far greater a tale and makes me giggle like a little dainty school girl.

I generally like to respond to everyone who comments on my articles, but I’ll admit I’m at a loss for words here. Thanks?

Yeah I understand the basic economics, but we’ve seen time and time again that prices are sticky in Magic. The market is not as efficient as you want it to be.

This article is packed with all the normal mtgfinance justifications – “it’s not a real price,” “artificial demand,” “the price increase was inevitable,” “the people cashing in are the greedy ones,” etc.

Your tweet signaled a buyout and the price is still higher today. Whether or not you were advocating a buyout is irrelevant. People who do that sort of thing are looking directly at writers like us to tell them what to buy out next. You can assume the price increase was inevitable but there is nothing to support that.

Buyouts are an effective way to make money. It’s an unregulated hobby market, so no one is going to stop you from doing it. But let’s call it what it is.

The end result is a tax to the non-finance Magic player, which is what my tweet was referencing. You can say the price isn’t real, but if I’m a casual player who buys cards on TCG, it’s a real price in that I’m never getting the old price. The rest of the Magic community has embraced the general principle that it’s OK to leave something for the other guy so everyone is happy… be it 75% Commander or scooping to someone who still has a shot at top 8 when you are about to draw.

I feel like the writers should write and let the low stock situations resolve themselves.

I did leave something for the other guy. There were 8 copies and I bought 3. Then there were 5 copies. There weren’t many left to buy while still leaving some for the next guy. Sometimes low supply IS a reflection that a price is too low. It’s the same reason we accuse SCG of hoarding copies when they claim to be “out of stock” of a given card while it’s spiking in price. They’re just waiting for the Invisible Hand to find the right price.

But I feel like we’re not butting heads here as much as just debating semantics. I’m trying to put things in a positive light, with no ill intentions involved. You are focusing on the bad situations and manipulation. Two sides of the same coin, perhaps? This is why the words we use when communicating an opportunity to the community is very important. On this, we can both agree.

Wish we could chat about this more in real life. Feels like a great debate over a game of Magic and a beer. 😉

That would be great!

Why does everyone assume that financial players ONLY increase price discovery in the situations where the price is going up? They completely ignore the fact that the most successful financiers are pulling copies out of their stock, selling into the ‘hype’ and assisting the Invisible Hand find the right price. They’re able to do this, not because they are dirtbags who hoard all the cards, but because they evaluated the fundamental factors around that particular card, and decided that it was more likely to increase in price than to decrease in price.

I believe the biggest factor that can be blamed for the precipitous spikes that have been occurring recently is basic psychology. People hate to miss out on the next big thing, this is what is causing these divergences from what economists call “rational action.” For most of us, it is clear that the marginal cost of $50 Judge Foil Command Towers exceeds the marginal benefit of owning the card. But, to the average MTG player with little-to-no understanding of economics, all they are worried about is claiming ownership of a card before it’s “gone” or “too expensive.” When they don’t understand why a card increases or decreases normally, they don’t understand how to identify when a rapidly spiking price is a result of true demand instead of just hype.

So many more people fall victim to the ‘post hoc ergo propter hoc’ fallacy that all they can see is that you tweeted first, and the price rose after that. Trying to convince these people that other factors exist has been, in my experience, painful and hopeless. I have my own theories as to why that is the case, but they don’t advance the discussion and are really just my own musings on social psychology, backed up with absolutely no data, so I’ll leave them out.

Greeno,

In my book, this comment goes down as one of the most sophisticated posts I’ve ever seen in an article. It’s very well-thought out and uses advanced psychological concepts to illustrate the point. As for the actual statement itself, I could not agree more. People are so quick to give others blame/credit for market movement, but at best we only have a VERY short term impact and only in specific cases where supply was already extremely low.

I see a parallel here to Jim Cramer and his influence on the stock market. He’ll mention a company on his show, and inevitably that stock will jump 2% the following day. He suggests that you DON’T buy a stock he mentions right away because you’ll be paying an artificially inflated price. BUT after about 2 days, the impact is reduced to nearly zero. Any movements after that are unrelated to his comments.

Coming back to the Command Tower example, my Tweet probably caused the card to sell out on TCG Player (all 5 copies that remained), but days later we should be approaching a price that has no connection to what I said, but is rather based on fundamentals of the card itself.

Thanks again – Personally I’d like to hear your own musings on social psychology, so if you feel inspired feel free to send your thoughts to me directly. I suspect we’re going to agree on many things :).

Sig

You’re in Beast Mode. Finance style. Well said.

It’s flat out impossible to manipulate the price of a high supply card, like any regular card from a recent Standard set. With a low supply card like Black Lotus or Judge Foils, manipulation is very much possible, although it’s not like your 3 copies will do anything to affect the price. I’m sure there are people out there who hoard Black Lotus. Is it possible that their collection single-handedly increases the prices on Black Lotus by $500? Very, since one of them might be holding 10%, or even a quarter of the entire Black Lotus supply. But are they “guilty” of anything? I don’t think so.

That means they would own 5700 Black Loti ((18500+3200+1100)*0.25=5700, not counting CE and IE or artist proofs). I definitely don’t believe anybody owns that many. (Otherwise I do think your point is valid, people can own enough copies of a card to push the price up).

Valid points, Yuka. You could also use certain Alpha rares as other examples. Is there any reason to WANT an Alpha Fungusaur or Chaoslace? No way. But apparently there are people out there who collect these cards. Since supply is so low, this definitely drives higher prices. But these are rare cases indeed.

I’d go out on a limb and say there are more Judge Foil Command Towers than there are Alpha Fungusaurs, but I don’t have data to prove this.

Great article. I also experienced this same thing a few weeks ago when I tweeted about Scourge of the Throne, a card I talked up here for more than a week before I tweeted it. But the day after the tweet the card went crazy.

It’s amazing what low supply can do. But it’s going to get noticed and bought eventually. I’d rather it be by QS users or my followers than anyone else, since you can be sure that buyout isn’t coming from casual Commander guy.

Thanks for the comment, Corbin! I did manage to snag 3 Scourge of the Throne after seeing your tweet, but I’ve been unable to move 2 of them. I’ve been steadily decreasing the price, but in this case the card is still dropping toward it’s rational value. You may have been a catalyst to help things along, but fundamentals still dictate it’s a solid card to acquire and the Invisible Hand will eventually find the right price!

And as for people who get upset when a card gets mentioned because they then feel obligated to buy it, this is also a fallacy. If they want the card, they should prioritize it. If they don’t want it badly enough, they shouldn’t assume “well there are ten copies in stock so I’ll just hold off from buying for now”. You have to pick and choose what you’re going after, and if you missed the boat then get upset about not prioritizing it sooner and NOT about the sudden jump in price.

Agreed. I have a few Scourges, and I’m happy holding onto them for however long, because it’s fundamentals that were dictating the price movement in the first place, and will continue to do so in the future.

Indeed a compliment to all of your works, much love and appreciation!

Thanks, Stephen! Now THAT’S a comment I can understand (and truly appreciate). I appreciate the kind words!

“I was NOT one of the greedy sellers charging $50+ for my 3 Judge Foil Command Towers.”

Why is this a problem? What is a greedy seller exactly? If I evaluate a cards price, supply, and demand and conclude it has a higher value, why am I a villain for capitalizing? Isn’t that the point of mtg finance? You should care less about what they tweet.

We aren’t destroying magic, we’re adding depth to the hobby. If all we had were sub $10 cards, everyone would play the same decks, there would be no large tournaments, and no huge prize payouts. Then the game would die. How do you believe retailers pay for events? It must be from evil greedy profits!

Anyway, I firmly believe you’ve done nothing wrong. Even if you did “pump and dump” that’s your prerogative. It doesn’t make anything else you write any more true or false. Your opinion is just that and should be taken as so. Don’t let this deter you from making the same call in the future. It is your job after all.

Fwiw, You’ve gained some respect from me.

Greg,

Thanks for the kind words and for the pep talk, of sorts. The reason I don’t want to be associated with the “greedy sellers” is because the price they chose was a bit ridiculous. 2x the old price was far too drastic of an increase given that copies were still available elsewhere. I suppose if someone could sell copies at that price point, they’re welcome to try. But if I DID try to capitalize, it would have been at a more reasonable price.

Most importantly, I’m not listing my copies for sale yet because the long term prospect for Judge Foil Command Towers is QUITE attractive. $50 will be hit eventually, with potential for higher. This is not a one shot pump-and-dump scheme. This is seeing an opportunity, sharing the wealth (it’s my job, as you put:) ) and then reaping rewards.

Thanks again for the comment!

Sig

If QS writers start tweeting more specs publicly, the site should now be called LoudSpeculators. There will be less advantageous information available for your premium subscribers now. I enjoy the Sigbits part of your article since it gives solid strategy like Sylvan’s articles.

Bob, you make a very valid point! I’ve thought on this balance quite a bit – I want to make sure QS Insiders get their share of premium content exclusive to those paying the bill. But I also want to build personal equity by sharing valuable insights to the public on Twitter. The key is in the balance.

In some cases, it may make sense to share an idea first on QS, let it stew a little, and then go public with it. In other cases, information should remain exclusively behind the pay wall. There’s really no hard-and-fast rule here, so it’s really up to writers’ discretion. I’ll definitely take note that you and others are paying attention though. Good to know!

Sig