Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Sylvain Lehoux and Matthew Lewis. The report is loosely broken down into two perspectives.

A broader perspective will be written by Matthew and will focus on recent trends in set prices, taking into account how paper prices and MTGO prices interact. Sylvain will take a closer look at particular opportunities based on various factors such as (but not limited to) set releases, flashback drafts and banned/restricted announcements.

There will be some overlap between the two sections. As always, speculators should take into account their own budget, risk tolerance and current portfolio before taking on any recommended positions.

Redemption

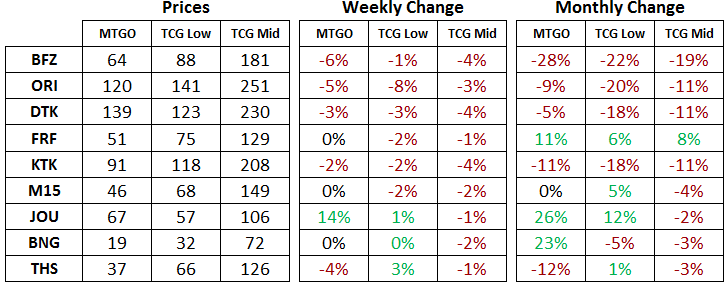

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of November 30th, 2015. The TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid price respectively.

All MTGO set prices this week are taken from Goatbot’s website, and all weekly changes are now calculated relative to Goatbot’s ‘Full Set’ prices from the previous week. All monthly changes are also relative to the previous month prices, taken from Goatbot’s website at that time. Occasionally ‘Full Set’ prices are not available, and so estimated set prices are used instead.

Theros Block & M15

The bottom is not yet in for the paper version of Theros (THS). The TCG Mid price continues to fall, while the MTGO price is getting close to its October low. Despite this general price weakness, there are pockets of strength accumulating value from this set.

The digital versions of Ashiok, Nightmare Weaver and Elspeth, Sun's Champion are showing signs of strength. As fringe-playable Modern cards, these two planeswalkers look set for further gains down the road as interest in Modern builds into the winter.

Magic 2015 (M15) has been eerily stable for nearly two months on MTGO, hovering around the 45 tix level. Like THS, the paper version of this set is still looking for a bottom. Last year, Magic 2014 (M14) bottomed by the end of December, which seems a reasonable guide for M15. A bottom in the paper price is a sufficient condition for higher prices in digital.

Journey Into Nyx (JOU) continues to power higher off the back of Keranos, God of Storms. Since the second week of October, JOU has risen 68%, going from 40 tix to 67 tix, with most of that gain attributed to the blue-red god.

The resilient Modern threat looks primed for further gains, and the third-set effect is on full display here with a real lack of excess supply. Look for this card to peak in the 40-45 tix range as players add this key sideboard card to their collections.

To a lesser extent, Eidolon of the Great Revel has also contributed to JOU's recent gains. After peaking at 20 tix, this card fell to 16 tix before rebounding slightly to where it now sits at 17 tix.

As a staple of Modern Burn and Zoo decks, two archetypes that haven't seen much headline success lately, this card currently represents an attractive risk-reward proposition. There is time over the next two months for a high-level finish to push this card into the spotlight and back over 20 tix.

Tarkir Block & Magic Origins

Price weakness continues to pervade Tarkir block and Magic Origins (ORI) in both paper and on MTGO, with all four sets down in price in the last week. With high-profile Legacy and Modern events on tap, interest in the Standard format is at a low ebb.

Consistent with that observation are the recent price declines observed on various Abzan cards in Standard. Exhibit A is Anafenza, the Foremost of Khans of Tarkir (KTK), which is back to the 10 tix level after peaking at 15 tix only a few weeks ago.

In Fate Reforged (FRF), the Abzan one-drop of choice, [card]Warden of the First Tree[card], has also been dipping in the last two weeks. It now sits under 5 tix, low enough for speculators to start considering the card as a potential buy. A renewed interest in Standard will push this and other Standard staples up in price.

Elsewhere in FRF, two cards demonstrate a large consolidation of the set's value, with Monastery Mentor and Ugin, the Spirit Dragon together forming over half the sticker price of a set. Both cards are priced between 13 and 14 tix at the moment and have more downside than upside in that price range.

Kolaghan's Command and Atarka's Command from Dragons of Tarkir (DTK) are seeing heavy play in Modern, and they're currently priced at over 10 tix on MTGO. The flexibility of the black-red command has enabled the Grixis colour combination's ascent in Modern, and the green-red command has replaced Skullcrack in decks seeking to prevent life gain.

With a high-profile Modern tournament on MTGO approaching soon, and the constructed portion of Pro Tour Oath of the Gatewatch also featuring Modern, there will be lots of attention placed on this format between now and February. These two DTK rares look primed to hit 14-16 tix at some point in that time span.

Battle for Zendikar

The newest set continues to plumb new depths in both paper and digital. Although paper prices have not yet bottomed out, the decline is slowing. The drop in TCG Low and TCG Mid paper prices in the past week is the smallest week-over-week drop yet in absolute terms, and nearly the smallest by percentage as well.

This deceleration in price declines roughly mirrors the price path of KTK last year, which appeared to bottom at the end of December before rising a little into January. Paper KTK prices resumed their downtrend by the end of January though, and continued heading lower for months, ultimately bottoming in June.

For MTGO players and speculators, this signals that the price bottom on BFZ sets is still a ways off. Value should be sought elsewhere at the moment, in overlooked Modern staples or in cards from DTK and ORI that could benefit from the Spring rotation.

Standard Boosters

The introduction of Legendary Cube draft has put a crimp in most Standard booster prices as players seek to sell excess boosters in order to play the new draft format. As a result, BFZ boosters, which were hovering near 4 tix, have dipped down below 3.7 tix.

These will be under pressure for the next two months as players increasingly choose to sell their boosters instead of draft with them. The next buying opportunity for them will be during Oath of the Gatewatch (OGW) release events.

The price of KTK and FRF boosters appears to have stabilized in the last week. This is good news for speculators holding these boosters, as it indicates the resumption of the uptrend is in the works. Once the current iteration of Cube draft is retired on December 9th, look for the price of these two boosters to head higher.

Typical rates of increase are in the range of 0.1 tix per week, but flashback events during the holiday break would again provide an alternative to Tarkir block draft. Assuming five to six weeks of demand, and a rate of increase consistent with our predictions, the short-term potential price for KTK is 3.8 to 3.9 tix, and for FRF 3.1 to 3.2 tix.

Modern

Upward pressure on Modern prices keeps pushing staples higher and higher. This past week several of the most valuable Modern staples have matched or even outperformed their previous historical record high.

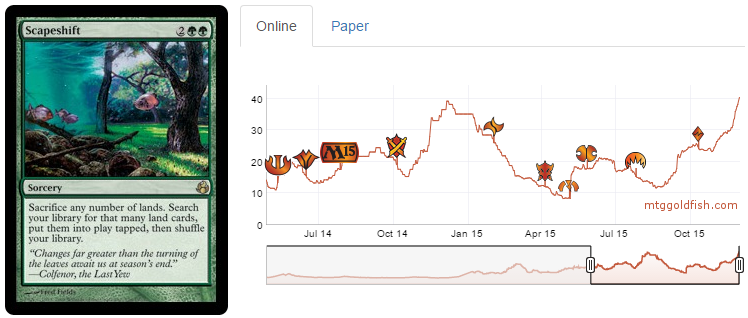

With a strong price growth over the past few weeks, Celestial Colonnade, Creeping Corrosion, Obstinate Baloth, Scapeshift, Oblivion Stone, Voice of Resurgence, Grove of the Burnwillows and Horizon Canopy are among the Modern positions currently cruising to new price records.

While we believe all Modern positions are worth holding until later in January, some price dips due to speculative movements are to be expected. However, these should not affect the general upward trend anticipated for Modern staples leading up to Pro Tour Oath of the Gatewatch.

As we mentioned two weeks ago, prices of some Modern staples remain surprisingly unaffected by this seasonal price hike. Batterskull and Shadow of Doubt, for instance, are currently priced around their two-year-plus low.

Goblin Guide, a true staple in any Modern Burn deck, can hardly break out from a baseline of 6ish tix acquired after the release of ORI. Burn's lack of popularity at the moment is probably the reason why Eidolon of the Great Revel and Goblin Guide are not trending up along with many other Modern staples.

It’s nonetheless only a matter of time before Burn decks make a comeback, and Modern speculators would do well to place a few bets on that outcome.

Lastly, the Legendary Cube will run for one more week, continuing to award Legendary Cube Prize Packs (PZ1) as prizes. These packs contain a lot of Commander and Legacy cards, and also a few Modern staples like Deceiver Exarch, Eternal Witness and Ghostly Prison.

Consequently, other versions of these Modern cards haven’t gained any value over the past two weeks. The PZ1 versions of these cards are also heavily discounted for now, a price gap that's likely to close up next week when PZ1 packs stop being awarded.

Even if a card like Eternal Witness may not go back to 4 Tix anytime soon, at ~0.10 Tix (as of Monday), the PZ1 version certainly looks like a steal.

Legacy & Vintage

If Legendary Cube Prize Packs are relevant for Modern speculators, they might be even more so for Legacy and Vintage speculators. Commander 2015 and its brand new set of cards were released in paper about two weeks ago. Unlike previous Commander sets, Commander 2015 won’t be available through the official MTGO store.

The only way to obtain digital copies of the new cards is via the PZ1 packs awarded by Legendary Cube queues. Without the possibility of direct purchase in the store, the biggest chase cards from this set won't have their price capped this time around. Prices could grow rapidly once supply from the Legendary Cube stops.

If the above assumptions hold true, a large basket of Commander 2015 mythics and rares, or even PZ1 boosters themselves, could represent good speculative positions in the mid term.

The strength of such specs also relies on a non-recurring appearance of PZ1 packs in the prize structure. This, unfortunately, could happen as soon as later this month with the traditional Holiday Cube offering.

The second MTGO Power Nine Challenge was held last weekend. Attendance clocked in at under 100 participants, short of the turnout for the first P9 Challenge. Could the Thanksgiving holiday be blamed for the lower attendance?

Eric Froehlich and his Storm deck finished in 1st place. The Top 16 decklists were a little bit more combo-oriented this time around, with two Doomsday decks and three Storm decks.

The biggest novelty of the tournament was the inclusion of Dark Petition in the Storm decks. Froehlich's deck featured the full play set---who doesn’t want to play five Demonic Tutors, after all?

At near-bulk prices, Dark Petition may be worth acquiring, in case any brewers get inspired and try to use the card in Legacy, Modern, or even Standard.

Pricewise, the Total VMA Price index and the P9 index have stalled for about a week since the price hike that hit in November. With the disappointing attendance at the second P9 Challenge, it's unclear at this point if Vintage prices will resume their upward trend, and it may be worth selling speculative positions.

Pauper

In the wake of the announcement of Pauper Leagues, prices for the cheapest competitive format continue to rise again this week. Nonetheless, some of the big gainers from the past two weeks have recently lost ground.

It's unsurprising to see some positions subject to speculative sales after such a large price hike. Mental Note, Chittering Rats, An Unearthly Child, Innocent Blood and Cloud of Faeries are among the positions with a double-digit-percentage drop in price this past week.

Other Pauper staples are likely to see similar price corrections in the following weeks. However, providing the renewed interest in Pauper continues, price bottoms will probably be found at higher levels compared to just a month ago. Speculators should then be prepared to see Pauper positions rebounding at higher prices.

Targeted Speculative Buying Opportunities

Modern

Goblin Guide

Shadow of Doubt

Batterskull

Legacy

Legendary Cube Prize packs