Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Finance writers, myself included, are always discussing cards they are buying and selling. We are quick to identify cards that are possibly due for a price increase and we are sometimes able to point out when a card has hit its peak.

All these articles make it seem like finance writers are the cowboys of MTG finance. They take wild risks, they buy hundreds of a card and hope to run up the price. And they are not as accurate as they make themselves to appear. This is not wholly true.

I buy cards with the hope of profiting on them – of that there is no secret. But what some people may overlook is the fact that the majority of my purchases are not solely based on speculation. In fact, being so risk averse, very few of my hard-earned dollars go into pure speculation. Why take such high risks when there are better reasons to buy cards?

The Hype Curve

Cards don’t increase in price overnight (unless they are unbanned from constructed play). There is often a period of a few days to a week where the card price slowly rises before making what appears to be a significant jump.

The most recent example I can site is Overmaster (chart from blacklotusproject.com):

Observe how the card was making a steady rise throughout July and most of August, but recently the card has spiked. It’s almost as if there were a few people truly speculating on this card and when it gained some notice, the masses decided it was worth jumping in.

Of course, much like other cards which go through a brief period of hype, I’m willing to take a guess at how this curve will look in September and October…

Okay, maybe this is a bit pessimistic. If Overmaster sees fringe Legacy (such as Troy Thompson's Omni-Tell deck from this past weekend) play it could end up in the $2-$3 range, kind of like Trickbind or Angel's Grace. But it will probably hit a peak soon and then pull back.

Let’s dissect this curve a little further. Here, we can try and identify what type of buyers are purchasing a card like Overmaster as it passes through this hype curve.

Buying Overmaster in July when it was initially “noticed” would have been very risky. This is where the true speculators play. They identify a card that saw Legacy play for the first time ever in someone’s sideboard and they snap-buy a bunch. I call this area high risk based on the likelihood of return. In a way, the risk isn’t really too high since copies of this card could be had for $0.25 at the time. But the likelihood of profit was still debatable.

In the middle of the chart, the card already gained some traction. Pros may have taken notice to the card, testing it out in MTGO events. This is where the risk level begins to diminish but the potential reward has shrunk, due to the card’s doubling in price.

Finally, right before the huge spike is the pump and dump zone. This is where many speculators buy out eBay and TCG Player, driving the price up to a ridiculous high only to sell them right away. At this stage, finding a copy of Overmaster below $1 was the easiest way to make money since the card was already selling for over $2 on eBay. As long as you are thorough in your search to ensure you are paying less than auction prices, there really is a low degree of risk here.

When I “speculate”, I try to participate in the second half of that curve. I wait for the card to gather some attention and maybe buy a set. Then when I observe that I can sell this set on eBay for profit and we are approaching the price spike, I scour the internet for any underpriced copies of the card (side note – in this case it was Amazon and Card Shark, where I bought 8 copies and 5 copies respectively for under $1 each shipped). I made this purchase only after seeing sets selling on eBay for over $2 each.

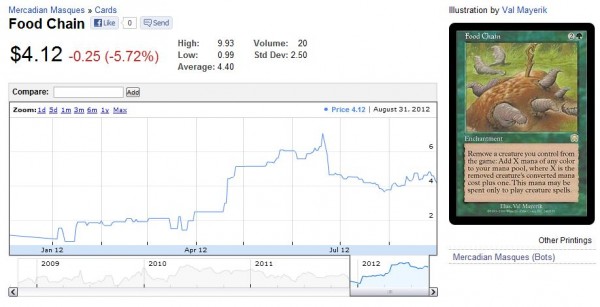

A well-known finance writer once sent me a Tweet that appeared condescending at first, but truly was a solid piece of advice in the end. I had been sharing my thoughts on Food Chain being a good speculation target (chart from blacklotusproject.com).

To paraphrase, this well-known writer told me that what I was doing was not true speculation. Rather, I was merely practicing good timing.

While this offended me at first, I later realized he was absolutely right. Food Chain was already noticed as a speculation target and I was merely buying underpriced copies and selling them for profit. This is precisely where I like to play. It keeps risk down and it nets me rapid profit.

Real Estate

I’m not advocating only waiting for these opportunities to buy cards. After all, this would lead to long periods of stagnation when your money could be working for you!

In between the hyped cards, I often try to slowly acquire cards I have high reason to believe will be stable or even increase in value. I’ve already discussed the Innistrad Dual Lands to oblivion, so I won’t waste space here elaborating upon why I felt these were a constant buy in the past couple months.

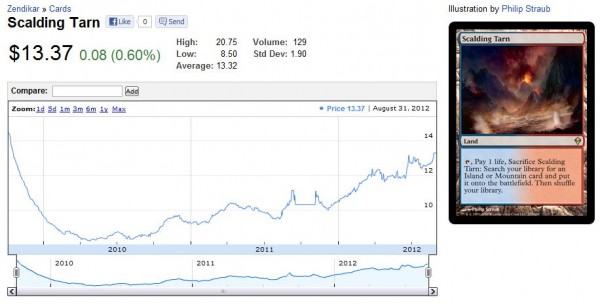

Real Estate is generally a solid approach to take even beyond Innistrad Duals – especially if the land cards are playable in Eternal formats. Everyone knows about the Zendikar Fetch Lands, and I make it a point to always have an extra dozen or so in my trade binder. When I have the chance to trade them away or sell them for profit, I do so only to restock them again when I find a deal (chart from blacklotusproject.com).

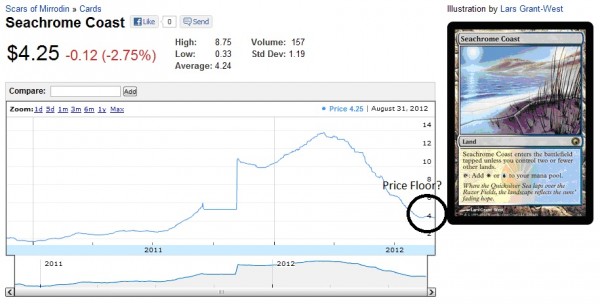

Other Real Estate I’ve got my eyes on now are the Scars of Mirrodin Fast Lands. After spiking to double digits a couple months ago, the blue ones are hitting lows as they approach rotation. But these lands do see some play in Modern and they supplement mana bases of aggressive decks very well.

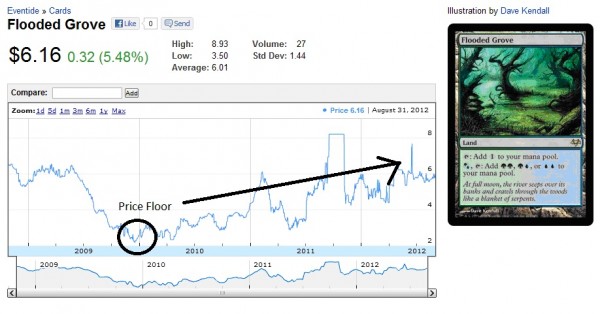

I just may be looking to pick up my set of 20 Fast Lands in the coming months if I can find a good price. Don’t agree? Just compare the chart of Seachrome Coast with the charts of the Filter Lands, which also see some Modern play (charts from blacklotusproject.com).

High Turnover

Another category of cards I actively purchase are cards which I find generally easy to move. Whether it is in trades or sales, I always strive for high turnover in my binder. Cards that I can move quickly, especially at a premium to what I bought them at, are cards I often like to purchase.

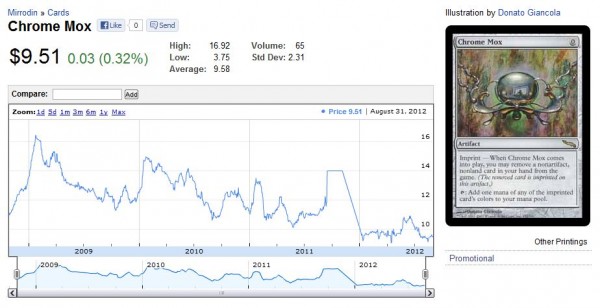

A recent example of a card like this is Chrome Mox (chart from blacklotusproject.com).

While it may appear this card has fallen out of favor, I had no difficulties moving the couple extra copies I owned at GP Boston. This card appears to move in cycles, possibly with Legacy or Modern seasons. Either way, I always like to have ubiquitous staples like these in my trade binder. Other examples include Aether Vial, Vampiric Tutor and, of course, Dual Lands.

I don’t necessarily buy every copy of these cards that I can find. Instead, I do occasional eBay and MOTL searches to see if anyone is selling these cards at a discount. If so, I make my move. But again, the idea here is that I’m taking very little risks when I acquire these cards at a discount knowing they aren’t too difficult to move.

It’s Not About The Glory Of Speculation

I am not a frequent speculator – I am way too risk averse. In fact, I’ve had a couple abysmal experiences with true speculation. Past in Flames and Skaab Ruinator were both cards I bought into with no success.

I find the easiest way to profit without major risk is to a) buy cards at the right time, b) buy into Real Estate at their price floors and c) buy into cards that are always easy to move. Perhaps this sets me apart from other finance writers. Or perhaps I’m more honest with myself when I confess I am no great guesser.

Instead, I take pride in being good at scouring the internet for good prices and timing my purchases well. This is how I’ve made my profits and I think it’s very reproducible.

-Sigmund Ausfresser

@sigfig8

How would you view your Alpha purchases not to long ago in this regard? To me it seems there is a fairly high risk of having to sit on them for a long time.

I'm pretty risk averse myself in many ways. I know it'll take me a long time to move cards as mostly I trade within a small group or online. Only rarely do I sell. I just know that something like a quick Overmaster spec is not for me, need to move the card too quickly. Likely not enough people have caught up on the card here in NL before it starts dropping again.

I prefer to get into the slower moving stuff, cards like Diaochan, which you can gradually get into knowing she'll eventually go up and settle on a much higher price. Sure, somebody who can move cards much faster has better opportunities to make a profit in a shorter timeframe, but for me this kind of card is ideal. Obviously there is some risk, she might not rise at all, but I feel the Medium Risk Speculation timeframe is where we are at now and that timeframe is much longer than for cards like Overmaster. I don't really see her drop unless they do a reprint. Also I like to get into EDH/casual stuff as I know my local group will take those cards.

I speculated on Modern to mixed results. Some of the cards moved well, but others didn't. I might have been in the Medium Risk Speculation part of the curve there, but due to slow turnover many prices have already come down again to not much above what I got in at.

Obviously I should work on my ability to move cards, however I mostly keep up with finance to make sure I get the rising cards before they start costing far too much. I'm just doing a bit of speculation to keep the costs down. Actively moving cards is simply not something I have time for even if it costs me some profit I might have otherwise made.

First, thanks for commenting! 🙂

My Alpha run was a bit risky in that I sunk about $600 into Alpha cards before seeking a return. But I minimized the risk by acquiring cards at or below what I thought SCG would pay on the cards I was buying. For example, I snap-bought a NM Two-Headed Giant of Foriys for $56 on eBay when I knew SCG was paying $60. I know you feel 10% profit is not worth your efforts, but since I knew i was going to an upcoming GP where I'd be able to sell my Alpha in person (so that grading discrepancies wasn't a concern) I found this transaction to be easy money. But this Alpha move I made is not a sustainable strategy.

For one, I don't have plans to attend another premier event for a while. But also, people are finally catching on that they can get much more for their Alpha rares…even terrible rares like Chaoslace!

I would definitely recommend you explore additional outlets to sell your cards. If you had a chance to acquire Overmasters at less than a buck, you could have unloaded them on eBay for profit, much like Gerv and I are doing. Shipping may be steep, but I'd wager shipping in a plain white envelope would be low risk on small sales so that the cost wouldn't destroy your profits. Even after fees I'm making 100-300% profit on my Overmasters. If only I had bought more!

Timing is important, but usually there's a decent 2-3 week window to unload cards so that you could still do it even across the pond 🙂

No problem, I know you like comments :-).

I am looking for outlets, however The Netherlands is really small. This limits me somewhat. Others choose to go through Ebay or MCM but I just don't want to move the volumes to make that interesting (I'm not going to start selling on Ebay just for some overmasters is what I mean). What I would like, and what seems to slowly start, is that more shops would put up buylists. I'm happy to move cards at a lower price to shops if I fear cards will drop before I can regularly move them.

One way I'm trying to increase my outlets is by moving cards for crappies on an online forum where selling is forbidden (as you know). Results so far have been inconclusive, so I don't want to add much detail on this here. I might write an extensive forum post or maybe even an article on it in the future.

Usually cards take about 2 weeks to get to me from the US, I don't feel comfortable with selling before I get them. European shops tend to be more expensive (in many cases the dollar amount equals the euro amount). Not that it would be impossible to make profits by moving quickly, but it is somewhat hard and whenever I try to act on such an opportunity I find I wind up holding the 'hot potato' more often than not. Of course I could try harder at moving them, but more effort is hard time wise and als0 means less profit per time spent (and I value my time).

In short, I'm aware of the issue, but haven't identified a good way to resolve it (yet).

Really liked this article. Keep up the good work!

Thanks for the comment and for your feedback!!

Great work as always. As you know, you and I are both very risk-adverse. It is, for example, why I'm waiting for the spoiler of the combo card to buy into Cackling Counterpart rather than buying a million now. What you're doing is the right approach, so keep it up.

Thanks for your support! Yes, I am very risk averse but I still make good bank even with the conservative approach. I tried my best to outline how in this article 🙂