Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

This past week I had a few ah-ha moments (not like the picture from rockturtleneck.blogspot.com). I’m plodding along throughout the day minding my own business when all of a sudden a light bulb goes off. Usually this is triggered by a bit of my daily MTG research. If you’re going to keep up with MTG Finance these days, then checking relevant sites a few times a day isn’t unreasonable.

These minor epiphanies are probably too small to each merit their own article, but I'd like to combine them together and summarize each in a relevant way.

I’ll begin with a public service announcement which dawned upon me while reading through the QS Reseller Reviews forum. Then I will touch upon some minor shifts in my Standard portfolio coming out of the Pro Tour. Finally, I want to discuss some behaviors that are uncovered thanks to the new website mtgstocks.com.

Without further adieu…

Pre-ordering on eBay – The Ultimate Scam?

Note: I posted a short topic in the QS forums about this topic, but I feel further elaboration can be useful here.

Imagine a scenario where you are a day trader on Wall Street and your job is to cover all IPO’s (new stock listings). Throughout your week you get wind of new companies going public and you begin your assessment of what their initial stock prices should be. Then an idea dawns upon you!

You can determine the value of every new company and then, before the company goes public, you can offer pre-orders of the company’s shares. Since other people haven’t done as thorough of an analysis, you can also probably get away with charging inflated prices per share. This way you have a high likelihood of profiting, since you’d be confident the stock price will quickly drop below your artificially inflated pre-sale price.

And if for some reason there is one all-star for every 100 IPO’s that actually goes up even further – well, you just don’t give the buyers their shares when the time comes. You can just cancel the order and refund their money.

This scenario is utterly ridiculous. Yet it happens all the time! Check out the QS Reseller Review sub-forum if you don’t believe me. So many recent complaints have been about poor pre-order experiences on eBay. Sellers are exploiting a loop-hole where they can participate in price-gouging during pre-ordering season while minimizing risk on any cards that do explode.

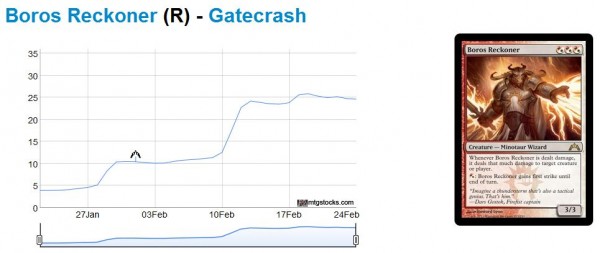

They just don’t ship orders on the all-star card (see chart for Boros Reckoner from mtgstocks.com below, Gatecrash’s all-star) and refund the buyers’ money, which results in minimal backlash in most cases. Worst case scenario, the seller receives a negative feedback, which gets diluted in the 1000’s of positive feedback received for all their other sales.

My ah-ha moment in all of this? Proceed with extreme caution when pre-ordering on eBay. If you’ve had success with a seller in the past, I suggest you stick with them indefinitely. There are too many sellers on eBay exploiting this loophole and I don’t want to see you left with a cancelled order and no “reward” for correctly calling a particular new card. Take special caution when pre-ordering more than 45 days before a set’s release, as you risk being unable to open a case against the seller.

Standard Shifts

While minor, I sense a shift in the Standard metagame, and I’d like my portfolio to reflect this somewhat. For example, Boros isn’t taking shape in the way I suspected. Sure, Boros lands are highly popular right now and at the helm of most Boros strategies is none other than Boros Reckoner.

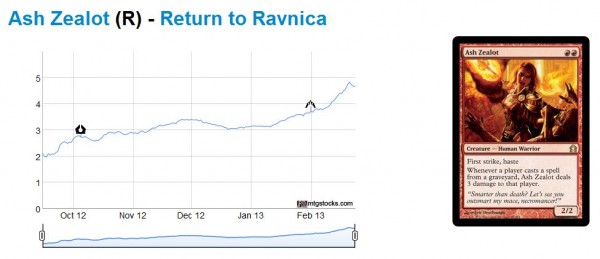

But what happened to Ash Zealot? This card shows up on occasion, but it isn’t as prevalent as I had anticipated. What’s more, I’ve noticed a subtle decline in the card’s price on eBay. I was able to sell my first set for $15.99, but I am having trouble moving the last couple sets at $13.99. Looking at mtgstocks.com, it appears the card’s rally is taking a break, and it’s difficult to predict what will happen from here. I’m selling my copies so that I can move into other cards.

The more control strategies are successful at major events, the more I like Supreme Verdict. Even Sphinxs Revelation is enticing at this point, which is a few bucks off its high according to mtgstocks.com. As more sets come out and Return to Ravnica cards dry up from people’s trade binders, these will become harder to find. If they remain a cornerstone of control decks, Sphinx’s Revelation should be well positioned for a bump. If Bonfire of the Damned can hit $40, it shouldn’t be impossible for Revelation as well.

Finally, I am also still a fan of Abrupt Decay. And in a month or so, I will also be actively looking to acquire Gatecrash Shock Lands. Even with Shock Lands appearing in Dragon’s Maze, I still feel these will rebound in the mid-to-long term.

Card of the Day

The final revelation (pun intended) I experienced this past week was regarding my new go-to pricing site, mtgstocks.com. You probably noticed my conversion from Black Lotus Project to mtgstocks.com by now, and I intend to stick with them moving forward. But besides providing up-to-date pricing trends on cards, the site has also yielded an incredibly interesting tool: Interests.

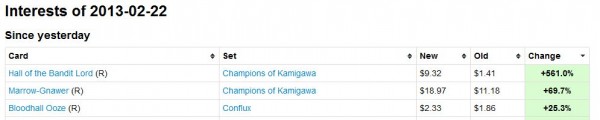

It seems innocent – the top movers of the day on TCG Player is organized into a list. But this feature has revealed some serious shenanigans of late. No longer can someone buy out TCG Player quietly – within 24 hours, mtgstocks.com reveals such behavior. This past Friday, it was Hall of the Bandit Lord.

Then on Saturday, yet another card spiked, albeit less significantly. I even joked about this on Twitter that day, but I am truly suspect that someone is behind this shift as well. How many of you were aware of the recent jump in Rasputin Dreamweaver?

With such an old card, it doesn’t take much for someone to decide the card should be worth $30 and not $20 by buying out the cheapest few copies on TCG Player. I have my eye on this one.

But the card that jumped this past Sunday is much more interesting.

It looks like Thrun, the Last Troll caught on all of a sudden. A jump of more than double is very significant, and in this case the card actually has merits as well. This may be more speculative buying for playability rather than a pump and dump like Hall of the Bandit Lord, but, either way, it is incredibly valuable to stay on top of this news.

The major takeaway here – visit mtgstocks.com every day and check out the Interests section. This will ensure you are always within 24 hours of knowing the recent ridiculous (and sometimes merited) speculation movement. As tools like this become more widespread, it will become very obvious when someone is attempting to corner the market of a card. I’m not sure what I can do about this behavior at this point, but I’m open to others’ ideas.

Turning Insight Into Action

The observations I’ve made this past week have led me to multiple insights, which I’ve summarized above. But such knowledge is only valuable when it’s applied. I’ve summarized the action I am taking in the first two sections of this article, but I’m not sure what I can do about the last one. I cannot stop people from doubling a card’s value overnight.

All I can do is be aware of such movement and sell anything that jumps irrationally. It all goes back to the mantra “buy low, sell high”. If a card jumps up suddenly with no logical basis and you are sitting on copies of the card, sell right away and ask questions later. Nine times out of ten this should pay off nicely.

…

Sigbits

While the top mover of the day on mtgstocks.com is the most interesting, the number two or three cards are also noteworthy. Consider these recent movers.

- Greater Good is on the rise. SCG only has a couple copies in stock, and the card has been a top mover on multiple occasions according to mtgstocks.com. While the card seems solid for EDH, I’m not sure if such movement is merited or not. I’ll leave that up to you.

- Sen Triplets has been on quite the run lately. The card has risen from $6 to almost $11 according to mtgstocks.com. It seems casual play continues to move many card prices, and as the player base increases this trend should continue.

- Marrow-Gnawer? Seriously?! I mean, Rat Rogues are cool and all, but I’m not paying $20 to Rats in EDH. Someone else clearly is, however, and you should be aware of this. But if someone had told me that Marrow-Gnawer would become one of the most valuable cards from Champions of Kamigawa I would have laughed.

-Sigmund Ausfresser

@sigfig8

Greater Good is really good in EDH. The $3 it was at back in July really was quite low relative to the card’s power. I wouldn’t be surprised if it goes $10+ eventually. Lots of EDH decks want to draw tons of cards when inevitably the board gets wiped.

Look at Thrun go, today he has doubled again.

Marrow-Gnawer is just strange. I could maybe see it worth $8-10 if that. Fortunately I caught its movement late December and got a few copies then for below TCGPlayer low at around 2 euro each.

Mtgstocks is great!

Greater Good may be strong in EDH, but it was also printed twice. But I know Bribery was also printed twice and it sustained a higher price tag. So I suppose you have a good point there.

My 1 copy of Thrun is still listed on eBay, but hasn’t sold yet. Come on, someone bite! 🙂

I do have high respect for mtgstocks.com.

The last printing for Bribery was 10 years ago, For Greater Good it was 8 years ago. For their original printing it’s swapped the other way around, but, Saga was more popular than Masques. Bribery was a higher profile card, which I believe might cause fewer to get lost over time. I think Bribery has a somewhat higher power level and is better for “good stuff” decks. Greater Good on the other hand needs a strategy with large creatures, however, that’s something its color pretty much does by default. Green is also a more popular EDH color than blue. Unfortunately what they do for their decks is not all that comparable. Bribery is a quick advantage kind of play, while Greater Good is gradual.

On he whole I would expect Greater Good to be cheaper than Bribery, but not all that much. I definitely felt like I should complete my playset now that they are still fairly cheap.

It’s the real deal in EDH. I win nearly every game I get it into play. Many players underestimate its power. Perhaps those players are starting to want to add it to their green decks, but then again, this is a rather sudden increase.

The foils have been expensive for a while, so no surprise there.

the print on 9ºth edition it’s almost irrelevant. No one drafted it, just kids bought those packs

Related to the pre-ordering scandals on eBay. Sellers are not allowed to sell anything they can’t ship within 30 days of payment. If you see this happening, inform eBay by reporting those sellers. If items are shipped within 30 days of payment, you still have minimum 2 weeks to file a claim (as you’ll be within the period of 45 days after payment)

But the problem isn’t really inability to file a claim (though that would be a TOTAL nightmare): the problem is that filing a claim is *exactly what the seller wants*. They’re totally fine with just refunding you your money for the card you preordered that blew up to a much higher price; that’s what’s so insidious.

So: beyond *checking feedback* and not buying from bad sellers, what can we do? Sigmund suggested in the thread that we should try to get eBay to do something about; but how??? When this happened to me with Angel of Serenity, I opened a case and explained exactly how the seller was screwing me over, but eBay just closed the case the moment the seller refunded me.

It would take more than just one or two disgruntled buyers to impact eBay in this regard. Even if the whole QS community made a concentrated effort with eBay I’m not confident we’d succeed. I’m open to ideas if anyone has any.

+1 This site opens my eyes to all the crazy market manipulation taking place these days, too.

Here’s the problem with MTGStocks and other websites which pull their average prices from TCGPlayer-type websites: It’s too easy to have a major influence on the entire market.

When I buy stock my buying power is severely limited. My purchase is hard to see on the ticker. But when I buy Magic cards I can corner a market for a short time, cause a panic, spike the price, sell before the pullback, and reliably turn a profit.

Let’s take a real world example. There are currently 45 non-foil Mirror Gallery (a $4 card if there ever was one) available for purchase on TCGPlayer. If I wanted to buy them all it would cost me $174.71 before shipping costs and $205.62 after shipping costs. If I bought out ALL of TCGPlayer and then get together with a few friends who are also sellers on TCGPlayer and we put up the 45 Mirror Galleries for $10-12. In the meantime, everyone sees that giant spike on the MTGStocks indicator, and they all go crazy looking to buy. Speculators try to figure out why it spiked. They buy if they think it’s a real thing. One could make the argument that Mirror Gallery is played on all sorts of kitchen tables and its from an underdrafted set years and years ago. I don’t even have to sell half of what I bought to break even, and then i can lower my prices back to around $4 to sell the rest.

The websites that tell you how much a card is worth simply do not pull enough data. Relatively small sets of vendors like TCGPlayer have way too much influence.

Think of this heinous example: What if I knew an influential writer who could throw together a column on a Mirror Gallery deck or two? What if I had some friends who began posting Mirror Gallery decklists on mtgsalvation, here, the mothership boards?

It’s too easy to spike MTGStocks, and too many people use it as a true barometer for what cards are worth – or, more importantly, how much cards should cost.

Of you work out how to stop this sort of thing you would get a Nobel prize, isn’t this how the financial crisis started?

I like mtgstocks but it is not the only site I check daily. I also look at eBay, Card Shark and Amazon whenever I notice a card spiking at any of these sites. So if you bought out Mirror Gallery on TCG Player, I’d first look at mtg.gg to see what the highest buy price is. Then I’d go to the above-,mentioned sites and see if I can find any copies in the range of the highest mtg.gg buy prices. I act accordingly.

For example when Thrun tripled, I went through this exercise and I found a $4 copy on Amazon. I figured since this wasn’t much above buy list and since they were getting crazy attention of late I would grab the copy.

Does everyone else do all this research? I highly doubt it. So those people would definitely fall for your hypothetical scenario. I’d like to think most subscribers to this site would know better.

Great idea, I do the same, for MTGO though.

Don’t tell too many people though, if you do there will be no room for speculators!

I don’t check buy prices, simply aren’t enough buyers in these parts, however, I do only buy at prices below TCGPlayer low and only when I have faith in the card myself. I’d probably get a $4 Thrun based on this. In fact, let me check what the cheapest Thrun I can find is.

Apparently the cheapest I can find is $4.55. I believe that is a very reasonable price for the card and think I’ll be buying a few. Next cheapest I could find was $7.58 and many above that.

I would snap-buy at $4.55 too. Especially since I just sold one for $12.99 on eBay earlier this week. Almost can’t lose.

I did order those, but, the shop does not have an online ordering system. I have sent an e-mail to them with a list of cards I’d like to get from them, they didn’t confirm the order yet.

The Thruns are a go, but he did run a bit short on 2 of the other cards I ordered (Jarad @$1.50 & Linvala @$15) for which he could only supply 1 & 2 respectively.

If you don’t check other sources when seeing a sudden spike on mtgstocks.com you deserve to get burned!

You don’t only need to read the data, also understand, make relations, check, validate, …

Image this = One seller has a few cards at $4 and puts one of them at $10 – day by day he increases the value of the expensive one ($10 -> $20 -> $30 …) This results in the average going up and it will be visible in the trends. Average goes above $4, goes to $5 and becomes $6 -> Will you buy the $4 cards he has available? I do hope not! It’s easy to manipulate the market if your buyers are not looking around and just don’t think about what they see!

Let’s help them notice these things. That’s what QS community is for, right?

Great comment WeQu, you are absolutely right. The QS community can be an excellent sounding board for movers and shakers. We can keep each other grounded to ensure we invest in the right cards and ignore the stupid ones.

Speaking of stupid ones, anyone want a set of Hall of the Bandit Lord? I can do $12 shipped 😛