Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

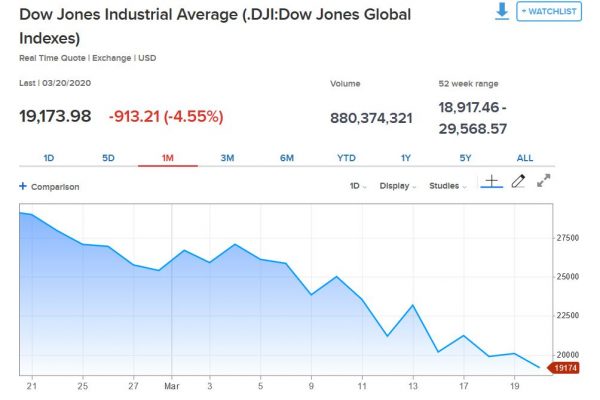

It’s no understatement to say the stock market has been a rough place to invest this past month. Sadly, last Friday’s drop in the Dow Jones of 913 points actually felt tame. Volatility is at an all-time high and we’re seeing new stocks hit multi-year lows almost daily.

The Dow Jones is more than 10,000 points in just one month!

As someone who monitors the stock market closely, I have to say the recent sell-off is gradually becoming more and more attractive. This is not meant to be financial advice, so please make your own evaluations before investing in the stock market. But I’m seeing prices on amazing companies that I haven’t seen in a long time, and this is enticing.

The Demand for Cash

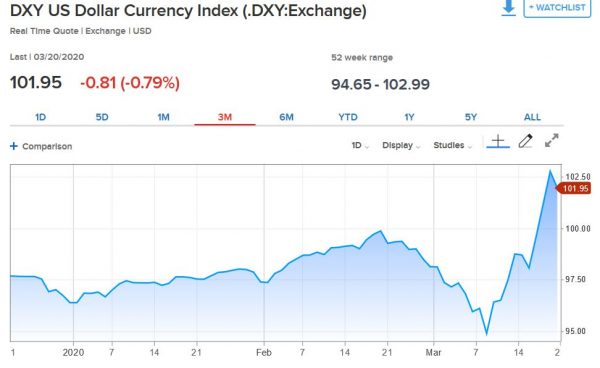

As asset prices drop, the demand for cash—namely, U.S. dollars—has soared. Take a look at the three-month chart below. While the absolute value seems small, in the world of currency such a move is significant and sudden.

This flight to cash has reverberations throughout all asset classes. Stocks are obviously dropping, but we’re also seeing certain bonds, precious metals, and, of course, Magic cards selling off. People all across the globe are raising cash during this time of uncertainty.

Because this is a Magic website, I will focus on prices associated with this hobby. In a word, they are dismal. I continue to watch Card Kingdom’s hotlist on a daily basis and I am seeing their buy prices steadily drop. Some sell prices are also reflecting the market softness.

Even high-end, “blue chip” Magic cards are not immune to the recent sell-off. The demand for cash and the uncertain market environment provide compelling motivation to sell. Cash is liquidity, and that liquidity is treasured in times of distress like these.

Trying to Look Ahead

Last week I discussed how market softness would become the new norm as Magic investors seek liquidity via cash. COVID-19 has wreaked havoc on Magic stores large and small. ChannelFireball is shutting down their warehouse. Card Kingdom is quarantining packages for 72 hours before receiving them and grading buylist orders.

On the other hand, some vendors are having a difficult time restocking on cards with a lack of MagicFests. Recently, 95Games posted an online buylist in order to restock key staples. Despite this, the net effect of COVID-19 on the Magic market has been net negative. This will not end any time soon.

If you’re like me and you didn’t cash out of your entire Magic collection, you may be left wondering what to do. Is it too late to fire-sell cards in order to raise cash? Will prices rebound if we hold for the long haul?

Personally, I have confidence that the Magic market will not permanently shatter under the pressure of this pandemic. This game has been around for 27 years and has withstood many crises. Now, more than ever, people need distractions from reality and Magic: the Gathering is an outlet that can truly help us escape. Even though social distancing is becoming prevalent, I suspect people will find creative ways to keep enjoying their favorite hobby.

Therefore, I remain confident in the long-term prospects for Magic cards.

But I’m Still Selling

Selling into this softness is painful. Card prices don’t fetch nearly what they could just a few months ago. However, I am still trimming the fat around my collection in order to raise cash.

This doesn’t reflect my lack of confidence in Magic. Instead, it reflects an imbalance in opportunity. As stock prices drop, they become more attractive. Suddenly, stocks that once appeared overpriced are offering reasonable entry points. Because my end goal of Magic finance is to fund my kids’ college educations, I need to compare the upside offered by stocks as compared to Magic.

Recently the equation has been tipping in favor of stocks. Do I prefer to own a card like Beta Wheel of Fortune or am I better off buying shares of a company?

Which one offers better upside potential from here? How about lesser-played Old School cards? How will those handle this crisis (many have already pulled back significantly)? Despite their recent sell-off, I am starting to feel like stocks are more attractive than these cards.

While we’re at it, precious metal prices are dropping towards a more attractive entry point. And while it’s not my area of expertise, cryptocurrency may be the safe haven people reach for in this time of uncertainty. After dropping 50% in a month, Bitcoin has rebounded from around $5200 to $6200 in rapid fashion. Maybe it’s worth putting some cash to work there?

Let’s not forget that the U.S. Dollar is extremely strong right now, meaning other currencies around the globe are suddenly much cheaper.

Whatever your focus is, I wouldn’t go and liquidate your entire collection (unless you absolutely needed the money). Doing so now would be equivalent to liquidating your stock portfolio amidst this fear. Rather, I’m considering this a rare opportunity to rebalance my investment portfolio in a holistic manner. Magic still has a place in the mix, but I think it needs to have a smaller place while other asset prices are so depressed.

Don’t Forget It’s a Buyer’s Market

It’s true my goal for these next couple months is to raise positive cash flow in Magic cards. But that doesn’t mean I won’t purchase a single card. We must not forget that this is a buyer’s market, and that dropping prices prevent their own opportunity in Magic.

Not much will be immune to this sell-off. I would encourage you to keep a mental list of cards you’ve been wanting for a while because you may get a shot at some pretty good deals this Spring. I’ve noticed Dual Land prices have been steadily coming down—many investors have extras of these, and are now looking to cash out, taking advantage of their liquid nature. Old School cards are taking a beating, though some are holding up better than others like everything else.

I’m not currently shopping around for any specific cards, but I’m watching some ABUGames auctions on eBay. In fact, eBay auctions are now my favorite way to buy cards. If demand is truly dropping, then there will be fewer bidders who will be willing to pay market prices. Buy-it-now listings and TCGPlayer pricing allows the seller to specify their price, but if cards don’t sell for a while, we may not get an accurate reflection of true cash value of cards using that data. Instead, we need to look at auctions and completed listing on eBay to glimpse a truer representation of where cards are selling.

For example, a heavily played Revised Underground Sea has a TCG low price of $291.93. However, a recent auction for a heavily played copy sold for $254 via eBay auction.

I’d strongly encourage you to set eBay search reminders for auctions of the cards you are most interested in, and then place a few bids out there. You never know when you’ll get lucky and a card will sell for well below its “market price”. There are simply fewer people shopping for some Magic cards now than there were a few months ago.

Wrapping It Up

There are a few reasons Magic cards are dropping in price right now. First, people could be fleeing to cash out of fear and to preserve capital. Perhaps they need that money to help pay bills and keep food on their kitchen tables. Second, they could be selling their cards because they anticipate more attractive entry points in a few months and they are trying to get out before things get worse. That’s a reasonable strategy, though it’s not my style.

Lastly, people could be selling their Magic cards because they’re interested in purchasing alternate assets at newly depressed pricing. This is the category I fall in. It’s tough selling cards for less than I could have six months ago, but the reality is I believe other assets offer a more attractive risk/reward profile at this time.

For this reason, I’m trimming a small portion of my collection in order to buy stocks. I’m not doing this aggressively and I’m not doing it all at once. I still maintain my Old School decks and a Vintage deck, with no plans on selling them into this pullback. But I do plan on maintaining a flow of money out of Magic and into other assets.

I believe others may be doing the same, and I would keep these trends in mind when navigating this tumultuous MTG finance market. It’s a crazy world out there—a world where cards are being traded for stocks, gold, and Bitcoin. Until things stabilize, this volatility and uncertainty will be the new normal. If nothing else, you need to be aware of this trend and its implications: lower Magic prices for at least the next few months.

Sigbits

- Want some examples of dropping buylist prices at Card Kingdom? All their Dual Land numbers are down across the board. Underground Sea and Volcanic Island buylist for $250 and $225, respectively, much lower than where they were just a few weeks ago.

- Yesterday I checked Card Kingdom’s buy prices on all cards from the Arabian Nights The first thing I noticed was that the big three cards are off their buylist altogether! They are currently not buying Library of Alexandria, Juzám Djinn, and Bazaar of Baghdad! You may deduce that this is because they have a large stock of these cards, but they only have three copies of Juzam in stock! I think this is to protect cash flow. Suddenly, ABUGames’ structure of offering low cash value and a huge trade-in bonus makes sense.

- I had been watching Card Kingdom’s buy prices on Power steadily drop. But recently, they took things one step further: they removed six of the nine pieces of the Power 9 from their buylist altogether! The only three they kept were the three they’re out of stock on: Black Lotus ($6600), Timetwister ($1900), and Mox Jet ($1650). If they get a copy of these in stock, I bet they’ll remove these from their buylist too!

Magic as an investment I think is directly tied to WotC (Hasbro) and it’s financial liquidity, which as it stands today is extremely good. The game of Magic itself may be suffering as the tours are being cancelled, but other board games are flying off the shelves as families find ways to pass their time in their homes.

Magic the Gathering and Dungeons & Dragons along with the other iconic games like Monopoly and Clue account for $2.5 billion dollars in revenue for Hasbro. That’s a massive amount of revenue. So no, I don’t think Magic will suffer as much as an investment even when the secondary market becomes stagnant.

The only problem with Magic as it stand now is that despite its loyal following of millions of players worldwide, the game has still never found its way to the mainstream public. I’m excited for the recent Magic the Gathering series being developed for Netflix by the Russo brothers, who directed the latest Captain America and Avengers movies. That’s a huge production by some of the best in the industry, so they clearly see the potential. The pandemic might probably put that on hold, so there’s something that I’ve been keeping my eye on. Still I only see this as a minor bump on the road. I still think that the market for it as a whole will remain healthy.