Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

I’ve been writing about Magic finance for quite a while now—it’ll be ten years this fall. Throughout that time, I’ve been saving the vast majority of my articles on my local hard drive. My typical approach each weekend is to write up the article in Microsoft Word, then copy/paste the text into WordPress. From there, I add the pictures and card graphs as needed.

Throughout this entire time, I’ve been numbering my articles every time I save a new one. As it turns out, last week’s article was number 500. Of course, I had promised an article on Portal: Three Kingdoms for last week so I had to deliver on that promise. But for this week, I decided to do something a little different in honor of article number 500.

I’m going to touch upon the evolution of my engagement with the hobby. MTG finance ten years ago did not mean the same thing to me as it does now, and I think there’s value in explaining why I made the shifts I have over the past years. Not surprisingly, some of my decisions paid off nicely while others were terrible decisions. But they all had motivations, and it’s these driving forces that I would like to reflect upon this week.

I think some of this information will be new to readers; despite having done this for so long, I haven’t really revealed all the big-picture decisions I made and their motivations over the years.

Phase 0 and Phase 1: Early Days (2011 and earlier)

When I first started engaging in Magic finance, I was focused on the local scene, leveraging the trade as much as possible. From 1997, when I started playing Magic, to about 2009 I really didn’t pay attention to the fluctuations in card values. I liked that some of my cards were worth a little bit, of course, but I never had a self-assigned objective of making money from the hobby.

Under the influence of local player Jonathan Medina, I started observing the benefits of following the financial aspect of the game. This manifested itself in two ways.

First, I was following Standard card prices very closely. I remember one of the first speculative bets I made that paid off was the jump between Frost Titan and Grave Titan. The former was a $20 card for a hot minute, and then the latter became the hotter creature in Standard (after Primeval Titan, of course).

These profits were converted into other cards, and I slowly ground out a modest collection from well-timed trades (this was before I spent a lot of money on singles).

The second decision I made when it came to Magic was to buy into Legacy—not for financial reasons, mind you, but because I loved the format. I remember reading the card Ad Nauseam and I made a mental brew of lots of zero mana artifacts so I could draw nearly my entire deck. After doing some light research, I quickly realized a deck already existed that utilized this card. I was sold. I promptly dropped a couple hundred bucks to buy the Dual Lands I needed, Lion's Eye Diamonds, Mox Diamonds, etc.

From here, I decided to gradually purchase as many Legacy playsets as possible so that I could try other decks in the format as well. This may sound crazy now, but keep in mind this was a time when Underground Seas were $30-$40 and other Duals were less. It wasn’t so crazy to gradually trade and buy into Legacy. And I remember at one point acquiring a couple heavily played pieces of Power—a Timetwister on eBay for $125, an inked Mox Emerald from my LGS for around $300, and a couple others in the same price range. I ended up trading all the Power to Jonathan Medina himself in one of the most epic trades of my lifetime.

Thanks to the internet, I still have the trade saved in my inbox. This email dates back to April 27, 2011:

Medina's:

4 Mutavault

2 Ignoble Hierarch

4 Thoughtseize

1 Tropical Island

1 Bayou

2 Taiga

1 Scrubland

1 Volcanic Island

4 Mox Diamond

4 Metalworker

1 Sword of Feast and Famine

2 Underground Sea

4 Badlands

2 Tundra

1 Kabira Takedown // Kabira Plateau

2 Force of Will

2 Mana Drain

1 Karakas (Italian)

1 Mox Opal

1 Windswept Heath

2 Flooded Strand

1 Shahrazad

1 Nether Void

My:

1 Mox Ruby

1 Mox Emerald

1 Mox Sapphire

1 Time Walk

1 Timetwister

1 Library of Alexandria

It’s readily apparent that I was doing my best to leverage the Power I had purchased in order to round out my Legacy collection (plus add a couple other fun goodies to my collection). I haven’t bothered tracking whether or not this trade would stand up as well in 2021—I suspect I would have been better off holding the Power—but this really launched me into the next phase of my MTG finance career.

Phase 2: Starting the College Fund (2011-2013)

Over the next couple years, I leaned heavily on the Magic Online Trading League (MOTL) to execute trades and attempt to grind value out of Magic. In 2011 I moved from Cincinnati to Boston for work, so I didn’t really have the local scene to rely upon anymore. It was nice that I could continue my endeavors seamlessly by using online trading platforms like MOTL.

Then in 2012 a major life event happened: my son was born. Suddenly the prospect of spending hours every weekend at the local game shop was second in priority. I still went to FNM’s when I could, but I was always eager to get home—both to be with my family and also to catch up on sleep! What’s more, the Legacy scene at the local game shop I found in Boston was nonexistent, and I found myself using my cards less and less.

Then one day I made the momentous decision: it was time to sell out of Legacy. Buy prices on Dual Lands, Rishadan Port, and Jace, the Mind Sculptor were hitting all-time highs.

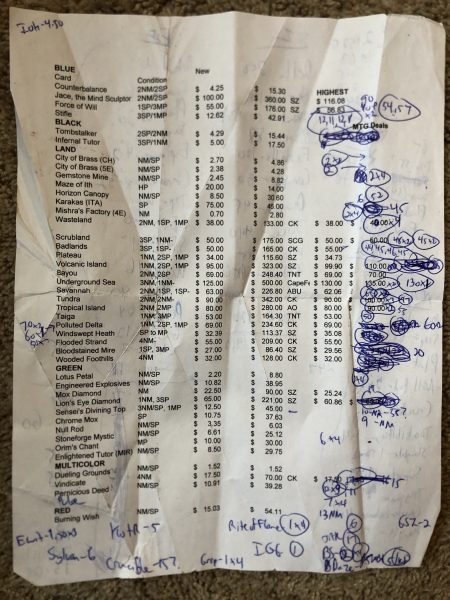

I started weighing the value of my collection against a different idea: saving money for my son’s college education. By 2013, my Legacy collection had accumulated enough value to be the seed for such a fund. I did the math, looked up buy prices across the internet, and decided it was time to sell out of Legacy. Just like with the Jonathan Medina trade, I still have the cards and their values documented from when I made the big sale—GP Providence in June 2013 was the date and place.

The spreadsheet printout became quite messy as I went from vendor to vendor, adjusting my expectations and tailoring prices accordingly (the sheet of paper also sat in the bottom of my backpack for years). But at the end of the day I accomplished my goal—my Legacy collection was gone and in its place, I had the start of a college fund.

Of course, fast-forwarding eight years it’s obvious this was not the right call from a financial standpoint. While the stocks I purchased in the college account have performed exceptionally well (mainly Visa and PayPal), even those 200%-300% gains pale in comparison to the gains I would have seen on all the Reserved List Legacy cards sold. I try to make myself feel better by looking at the non-Reserved List cards, which in many cases have dropped in price from 2013 to 2021. But at the end of the day, keeping all the cards would have been the better play.

I don’t have regrets, though, because this represented the next major shift in my mindset: focus on playing only for fun (no more major competitions/tournaments) and leveraging MTG finance to fund the college account.

Phase 3: Building Upon the College Fund & Old School (2014-2017)

While I’m disappointed that my Legacy collection is gone after seeing how prices climbed over the years, I can readily look at the bright side: the decision to leave Legacy inspired me to focus on casual play and finance, solely. At Grand Prix Las Vegas in 2015, I made the decision to shift focus to a strictly casual format: ‘93/’94 (aka “Old School MTG”).

The more I researched this format, the more I realized it was the perfect fit for me. Instead of constantly refreshing my collection to keep up with Standard and Modern, I could build a couple decks and confidently know they would remain relevant indefinitely. What’s more, the cards in the format are all old and rare—many of them are on the Reserved List—so I wouldn’t be at risk to fluctuating prices and reprints. In my mind, it was akin to having my cake and eating it too. It was a format I could play and enjoy and know that at the end, if I wanted to cash out, I’d get my money back and then some.

So at GP Vegas I started shopping for Old School cards. Unfortunately, most vendors didn’t bother bringing their fringe Arabian Nights and Legends cards to the event. I asked every vendor I spoke to if they had a Juzám Djinn for sale, and I was only able to find one heavily played copy—sold to me by Tales of Adventure for $70. I couldn’t track down any of the Beta cards I wanted, and I also only managed to track down a single Unlimited Chaos Orb. The event wasn’t a huge success from this standpoint, but it did motivate me to shop around more.

So over the next couple years, I focused almost exclusively on filling out my Old School collection. It was reminiscent of when I dove into Legacy. I wanted the flexibility of playing multiple decks, so I picked up cards strategically to enable this. Over these couple years, I wasn’t the only one exploring Old School—the format was going through a period of growth, as evidenced by the explosion in prices. As much as I regret selling my Dual Lands, I am thankful that I pursued Old School when I did. Getting into the format early has been one of the largest boons of my MTG career.

As card prices grew, I optimized my collection, selling extras that I wasn’t using so that I could continuously fund the college account..

Phase 4: The Reserved List Explosion (2018-Present)

Nowadays I don’t really tweak my Old School decks much; I like them the way they are. My buying and selling came to a peak while Reserved List cards were exploding, but once they settled down a couple months ago my transaction volume dropped to near-zero.

Nowadays I enjoy browsing my Old School collection and decks, but I don’t really aspire to purchase much for the collection. I’m rather content sitting on what I have as I wait for prices to settle a bit further. After the crazy explosion in Reserved List prices, my motivation to acquire cards dropped simply because I couldn’t justify paying the new prices.

While I don’t think the bottom will fall out from under these highly collectible cards, I do think we’re going to go through a 12 month period of consolidation. When large-scale events resume, it could lead to another small infusion of supply into the market, putting even greater downward pressure on prices. The softness in prices won’t last forever, of course, and I wouldn’t be surprised if there was another round of Reserved List speculation/buying at some point in 2022.

In the meantime, however, I’m content to sit on the sidelines and wait. I’ll take advantage of the deals that cross my path, and I’ll look to sell a card here or there. But for the most part, the past couple months have been some of the quietest I have had over the past decade.

Wrapping It Up

Hopefully, this walk down memory lane was insightful, or at least entertaining. I enjoyed re-living these memories and digging up the deals I made years ago. It can be baffling to see what prices were like years ago. The returns on Reserved List cards in particular have been stronger than almost any other investment I could have made. For this reason, selling out of Legacy was probably a mistake, but at least I converted some of the proceeds into Old School, which was one of the greatest financial decisions I made in Magic.

Since I started MTG finance in 2011, there are a couple common themes. First, as I get older and raise my children (two kids now), I have gradually moved from active involvement to a more passive one. This manifests itself in my moving away from Standard and Modern speculation and toward Reserved List and Old School investment. Second, I am consistently moving funds out of Magic and into the college fund as prices continue to climb. In this way, I moderate my exposure to MTG and keep risk at a level I’m comfortable with.

Lastly, and most importantly, no matter what stage of life I’ve been in, I have found ways to engage with my favorite game: Magic: the Gathering. I could have easily decided to abandon the hobby altogether when my son was born. Then when the Legacy scene died down and I lost interest in Standard, I could have cashed out and jumped to a different hobby. When my daughter was born in 2017, I had yet another reason to ignore Magic. But as my personal needs evolved, so has my engagement with Magic. The game is so versatile that it fits any lifestyle no matter how much time and energy you’re able to dedicate to it.

It is this last factor that keeps me engaged and writing about Magic finance. Even though my involvement with the pastime looks very different now than it did when I started writing almost ten years ago, I have always found things to get energized about with this hobby. As long as that remains the case, I hope to be writing about Magic finance for years to come.

I remember being surprised at how cheap the Lightning Bolts from Alpha were. I knew there was value potential in them but it was impossiblle to figure out how much wait there would be before they finally took off. I also remember it was extremely hard to find near mints. Even though they were cheap, they were almost never in stock. I did find enough to grab what I could, but looking back I could’ve grabbed much more.