Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

There have never been more new Magic releases to keep track of, and the stakes have never been higher. It seems like every day another card is spiking as the market adjusts, and it’s obvious there is opportunity for profit for those that buy in ahead of time. The problem is figuring out what’s next to rise, and with so many cards to consider, it’s a daunting task.

There are all sorts of factors to weigh, and everyone sees things a bit differently from each other, but one opinion that’s hard to ignore is buylist prices - what stores are actually paying for cards.

The prices stores pay for cards is a good way to gauge how much their customers demand them, so it provides useful insight into how the market is behaving. Comparing this buy price with the best selling price - the spread - provides a more complete picture of just how hot a card is at that point in time.

By looking at these spreads, we can inform our speculation. Buying into cards with the lowest spread and anticipating that high demand will drive prices upward. Conversely, looking to move cards with the highest spreads and relatively low demand could cause their prices to sag over time.

QuietSpeculation’s TraderTools conveniently computes these spreads, identifying the buylist with the highest price. It’s useful for some quick analysis of buylist spread and identifying cards in high demand, which isn’t always so obvious looking at price movement alone.

To gain some further insight into the market and look for speculation opportunities, I’ve looked over these spreads and found some interesting information.

Core Set 2020 is not yet in Trader Tools, so I started my analysis with Modern Horizons, which is still very much a hot finance topic. This week’s spike of Wrenn and Six to $75, which comes after its spike to $50 in June, should be a sign there’s more growth to come in other staples.

I wish I had the old buylist data on Wrenn and Six to see if a low spread could have helped predict the spike, but I do remember that when I bought most of my MH1 cards from CardKingdom, Wrenn and Six was selling at a steep premium. So steep, in fact, relative to other staples I had to buy it elsewhere. It's likely to have had a relatively inflated buy price as well, which could have predicted the upcoming spike.

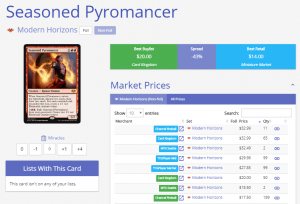

Seasoned Pyromancer was similarly overpriced, and similarly spiked soon afterward, so there’s certainly also some information to be gleaned from sell price alone. However, seeing buy prices from that time would paint a clearer picture.

Currently, the Modern Horizons card with the lowest spread is Unbound Flourishing, at 14%. TraderTools shows the cash buy price, but in my experience, the best practices for buylisting is to take advantage of trade-in bonuses and make smart buys to stretch my dollar further. When you add CardKingdom’s 30% trade-in bonus to this 14% spread, that means the card has a negative spread.

When a card has a negative spread, there’s an arbitrage opportunity to be made in buying from one place and selling to another. Opportunities for easy true cash arbitrage don’t come up often, are short-lived, and not likely to be very large. Though, it’s an interesting phenomenon that points to a card being in very high demand, and is likely to see a price increase accordingly.

While this case of Unbound Flourishing isn’t extreme, it’s a pretty clear sign to me that the card is very high-demand and is due to rise in price. It’s not a competitive card and lacks the cross-format appeal of something like Wrenn and Six, so it’s not surprising its price has been off to a slow start. Unbound Flourishing's Commander and casual appeal give this incredible long-term prospects - just look at the history of Doubling Season.

The next cards that buylists are demanding the most are Prismatic Vista and Force of Negation, both at 25% spreads. When you take the trade-in bonus into consideration, you’re essentially at a break-even point, so it’s clear these cards are selling well. It’s no surprise to me, because as a competitive Eternal player, these were the exact two cards that I bought playsets of for personal use with no plans to sell them.

Both are already proven Legacy staples with plenty of Modern applications, so I am sure many other players have had the same thought process as me, and more will begin to follow suit as the cards become more prominent.

The next most in-demand card is Thran, Yawgmoth Physician at 27%, another card with an essentially 0% spread. The card is a Commander all-star, but unlike Urza, Lord High Artificer, it lacked the same hype and came in at a much lower price point - that gives it more room to grow. Given that it’s also seeing some success as a Modern playable, it has a bright future.

Also coming in below the 30% break-even trade-in bonus spread is Silent Clearing. This was and still is the cheapest land in the cycle, but clearly, demand is catching up. Its low price makes it a bargain relative to more expensive options in the cycle and likely a good speculation target. That said, the next card in line is the 34% spread Sunbaked Canyon, which is seeing the most play of any in this cycle, and I imagine will one day be the most expensive.

Looking at spreads for MH1 was enlightening, so I was curious how past sets are behaving. War of the Spark, for example, also has a card with a 14% spread, Finale of Devastation. It makes sense, given it’s become a 4-of staple in Modern, and it’s seeing increased Standard applications now with Cavalier of Thorns. Growth seems imminent, but nothing else comes close to break-even spread, so I imagine the rest of the set should be pretty stable over the summer until the fall set shakes things up again.

The highlight from Ravnica Allegiance and Guilds of Ravnica is the Commander and casual star Smothering Tithe at a 25% spread, while the rest of the set seems relatively saturated. This Commander phenomenon extends back to Core Set 2019’s Hungering Hydra at 26% and to Dominaria, where the highlight is Muldrotha, the Gravetide at 16%, followed by Helm of the Host at 30%.

My takeaway here is that the safest way to speculate on such recent cards is to target those with the most obvious Commander potential, simply because they are still relative bargains given their strong future prospects. While their sets will rotate from Standard and most of the cards will become forgotten, it's these Commander cards that will eventually become their legacy.

Interestingly, the next most demanded cards from these Standard sets tend to be the lands, whether shocklands or checklands, but at spreads of 50% or higher are currently very stable, so it's hard to imagine their prices are going to see any significant growth in the near future.