Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Many high-flying stocks saw a significant pullback last week. Tesla ended the week down 13.54%, PayPal ended down 9.43%, and COVID darling Zoom ended down 10.46%. These are all a healthy bit off their all-time highs as the market internalizes the implications of rising treasury yields and balances against the next round of fiscal stimulus.

This pullback is likely healthy and long overdue, but it still hurts if you’re in any of these names (I have a position in PayPal). But I am not kicking myself because I implemented certain strategies to help me better handle the emotional roller coaster of the volatile stock market.

These strategies can be reapplied to Magic, and that’s what I intend to cover this week. Even though Magic cards tend to operate on a slower, less efficient scale, I believe the same three mantras can be applied to Magic. As card prices relentlessly climb, we can apply these strategies to avoid FOMO, the pain of the volatility, and the emotional turmoil associated.

Mantra 1: Bulls make money, Bears make money, and hogs get slaughtered.

This is a quote from CNBC’s Jim Cramer, and it’s one that resonates particularly well. In short, it means that people can make money when the market goes up (bulls) and when it goes down (bears)—both are perfectly fine ways to earn some profits. But if you become too greedy and hold relentlessly, you could eventually get burned.

With any investible assets, prices cannot climb monotonically (i.e. without occasional drops) forever. The result would be a mathematical impossibility, and there are realistic (though possibly high) ceilings for valuations. Could an Unlimited Black Lotus climb to $30,000? $40,000? Possibly. Will it hit $1,000,000? Certainly not in my lifetime, unless we go through a period of hyperinflation and the US Dollar’s value depreciates like the Venezuelan Bolivar.

Throughout this period of price explosion, it’s important to not become too greedy and to sell some cards into the spike. This is nothing new, but it’s a very important reminder now because Magic prices are going through some unprecedented growth. At one point prices will overshoot to the upside, sellers will come out of the woodwork, and vendors will restock. When this happens, prices will cool off a bit.

One example I’ve noticed is Tawnos's Coffin, a fringe playable Old School card from Antiquities.

The card is unique, and I love the artwork. But its utility is limited. A couple weeks ago, Card Kingdom was paying as much as $185 on their buylist for near mint copies. I believed this was too aggressive, and I decided to sell the card (note my copy was heavily played, so I sold it to a player instead of to Card Kingdom).

Now, just two weeks later, Card Kingdom is only offering $110 for the card. You may still be able to sell for a higher amount on TCGplayer / eBay, but the easy sale is gone. That was a perfect time to cash out of any copies you had of this card at a very fair price, to a vendor, which avoids all sorts of hassle. But if you held fast in the hopes of seeing the price climb even higher, you’re stuck waiting.

Mantra 2: Nobody ever went broke taking a profit.

This is another saying I tell myself every time I decide to sell something, realizing profits. This expression is meant to address emotions we may feel when we sell an asset for profit, recognizing we are no longer “in the game.” When you sell an asset, you no longer have access to future gains that particular asset may experience, and this can generate FOMO and a resistance to sell.

This FOMO can be dangerous, though (see above). In order to recognize gains, we must sell eventually. It’s perfectly fine to hold onto an asset for further gains as long as there’s a sound hypothesis driving this decision. Emotions—the fear of missing out on future gains—is not a sound reason to hold.

How do I reconcile the emotional cost of selling an asset with the desire to make money? I remind myself of this quote time and again.

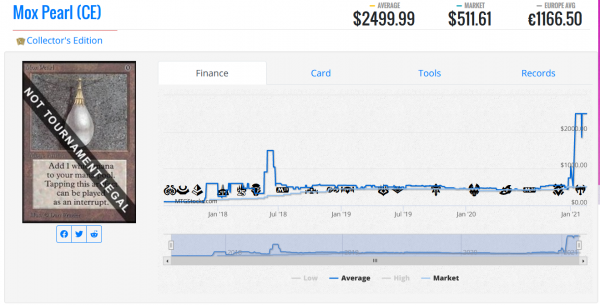

One great example here is my decision to sell my Collectors’ Edition Mox Pearl. The MTG Stocks chart makes the card’s price look higher than it truly is, but the general trend is accurate.

This was a $400-$500 card for years. YEARS! And then, over the course of a few weeks, the card’s price more than doubled. Recognizing this explosive growth, and the fact that I was not actively using the card in a deck, I decided that I would be content to cash out at the new price.

I didn’t take this decision lightly, mind you. My mind was racing through scenarios of further growth, another doubling in price, and missed gains totaling four figures! It was intimidating to sell such an iconic card. But my hypothesis that the card would climb to $1000 played out exactly as I had foreseen—the journey from $500 to $1000 felt far more realistic than the journey from $1000 to $2000. With this in mind, I listed the card on eBay and sold it for $1100.

I’ll still monitor the Collectors’ Edition Power 9 market because I want to remain informed. But I’ve promised myself I would not look back with regret. I can turn my profits into investments in other areas (including my college fund), and I’m content just to see my portfolio’s value climb. As long as I continue to have successes like these, the dream of funding two kids’ college educations remains alive.

Mantra 3: Don’t look at missed gains as a loss.

I’m not sure where I heard this one, but I’m fairly certain it’s not my novel idea. It goes hand in hand with the other two mantras, but remains a critical corollary to help further with navigating the emotions of selling.

In short, the saying helps me remember that not owning an asset—or, more importantly, cashing out of an asset early—and watching its price climb higher does not mean I’m losing money. It can be emotionally difficult to watch the missed opportunity. But there are opportunities all the time and they are everywhere. So even if I miss out on some gains, I still have plenty of areas I can put resources to work to make money.

This mindset can be muddled by the fact that Magic is also a game, and these “investments” I’m referring to are also game pieces. Let me explain what I mean.

I am in the market for a Beta Mind Twist. I would like a copy to play in my Old School deck, on my journey to black-border more of the deck’s components. As I follow the market for this card, I’m noticing its price climb. Now it will cost me more money to obtain this card for a deck—this is a bummer! I’m disappointed because it just became more expensive to complete my deck.

Mantra 3 doesn’t really apply in this case.

Now here’s a slightly different example: I would love to own a Bazaar of Baghdad. I love the art, the card is iconic, and I expect it will continue to appreciate in value. Unfortunately, I didn’t pull the trigger in time and now the card is far more expensive. If I had bought the card a couple months ago, I could be sitting on a few hundred dollars’ worth of gains.

Instead, I missed out on these potential profits and I’m stuck watching the card’s price climb on the sidelines. This is disappointing. It is a shame that I saw a profitable opportunity and I didn’t embrace it in time. The emotions associated can really be painful! It hurts to see the card’s buylist price climb week to week as I continue kicking myself.

But I need to keep things in perspective. I’m reacting emotionally to the missed profits almost as if I had lost money. Losing money hurts too, but it’s very different (and arguably much worse) than missing out on gains. So why am I beating myself up as if I had lost money? I put my resources to work elsewhere. It’s not like I bought a losing asset instead of a winning one. The rising tide is lifting all ships here, so there’s no reason to look at the “one that got away” and beat myself up about it. Most of us are dealing with limited budgets; we simply cannot afford to buy into every opportunity we see.

Because of this, it’s important to remind ourselves that missing out on gains isn’t the same as a loss, so we shouldn’t treat ourselves as though we did lose money. We’re doing the best we can with the resources we have available—that should be enough!

Wrapping It Up

We are seeing explosive growth in Magic prices during this unprecedented time. While I’ve seen some prices stabilize, and some restocking of cards on major vendor websites (finally!), there are still catalysts on the horizon that could drive another round of buying. Tax refunds are being issued and the government is actively working on another round of stimulus payments. The infusion of cash will inflate asset prices even further.

As this is happening, I encourage you to keep these three mantras in mind. They will help you remain disciplined as a seller, and hopefully overcome some of the fretful emotions associated with selling an asset. We tend to become enamored with our winners—that’s not a terrible thing, but any time emotions become too strong, it can lead to suboptimal choices.

By remembering these three mantras, we can avoid some of the negative feelings associated with selling for a profit.

I’ll conclude with one of my other favorite Jim Cramer sayings: “There’s always a bull market somewhere.” Just because you sell a card for profit doesn’t mean you’re out of the game. You can always use those proceeds to buy other cards with similar (or preferably, even better) prospects. When the name of the game is making money from Magic or trying to play Magic on the cheap, taking profits and applying them elsewhere is a natural strategy. When that strategy works, we shouldn’t look back with regret at what could have been. We should be celebrating our victories.