Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, readers!

Surely those of you who check MTGStocks.com to see the biggest daily movers are weary of some of the massive jumps we have been seeing, especially in the past year. It seems like every day some obscure card gets bought out and jumps in price dramatically. Then everyone sees the percent gained and thinks they have struck gold when they pull a few copies out of their binder.

However, just because the new selling prices are much higher doesn't mean the card's value has increased. It is extremely important in any sort of investment market to understand as much as you can about a given price movement. Sometimes it is obvious, like when a stock jumps because the company announced better-than-expected profits for the quarter, or when an oft-forgotten card blows someone out on camera to win an event and suddenly doubles in price.

These movements make sense because there is legitimate causation behind them. But what we often see on MTGStocks is one person (or small group) buying all or most copies of a card, and then relisting them at much higher prices. It appears to have jumped in price—but we all know price isn't everything.

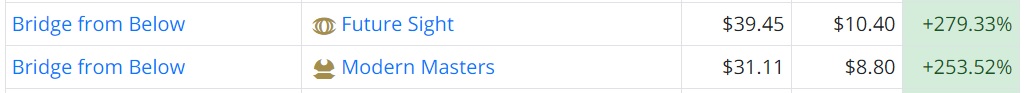

For example, here is the recent data for Bridge from Below. The TCGplayer Sales Price jump is shown below.

Notice the percent jump is very dramatic (above 250 percent). The TCGplayer Market Price jump is quite a bit lower, though still significant.

While the Modern Masters version has jumped by a similar amount, the Future Sight version showed far more modest gains.

They key here is that Market Price is only affected by completed sales, unlike TCG Mid which is affected by asking price. When you see a dramatic gap between the two it likely means a buyout has recently occurred, and the sellers are trying to capitalize by establishing a new price. In this case, using Market Price as the variable of interest paints a more accurate picture of card price movement. Sales Price can be manipulated by sellers, but market price is established by buyers.

Now, it is important to understand that market price is likely to move much slower than TCG Mid. There will be more people adding the card to their stores to capitalize on the new price than buyers looking to purchase it. Thus the rate of increase is expected to be lower. However, that's the real key characteristic we want to review: the "rate of price increase in the market value."

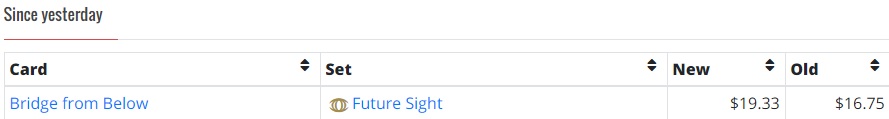

The images above were taken on August 8 (around 5:45 PM). If we look at the TCG Market price on August 10 (at around 5:45 PM again), we see the following.

So in the two days that had passed we see that the Modern Masters rate of growth is around $0.045 per day, whereas the Future Sight rate of growth is $0.88 per day.

This implies that the Modern Masters price has peaked and isn't likely to grow anymore, so now is a good time to sell them. The Future Sight versions are still noticeably lower in price, and showing a modest price rate increase, so it might be wise to hold onto them a bit longer.

One last data set taken on August 12.

We can see that the Future Sight version did in fact continue its upward trend, adding an additional 15.4% at a rate of $0.645 per day. The Future Sight version is still significantly lower than the Modern Masters version, so it is likely to continue to rise (I imagine it will eventually plateau within a few dollars of the Modern Masters version).

Moving Forward

We've seen how the TCG Mid Price doesn't really reflect the actual real market value of a card, and is easier to manipulate. So we need to instead focus on the TCG Market Price. We are far less likely to see a major price shift in the TCG Market Price, and we will use the Market Price movement to validate a card's real price movement (as again, it reflects actual sales, thus someone was willing to pay the new market price).

This protects us from moving in on any cards that are bought out for a "pump and dump" scheme, which sadly we seem to be seeing more and more this day in age.

We can also review the Market Price increase rate over a certain amount of time (I prefer using at least 2-3 days) to determine if the price will likely continue to move upwards, has plateaued, or started dropping. Then we can make an informed financial decision whether we want to pick up additional copies, list the ones we have, or stay away.

I've found that using a scientific and logical method to make one's financial decisions can help reduce or eliminate the emotional aspect of buying and selling. I've lost out on profit because I sold out too early for fear of a false spike, and I've bought cards at the peak of a spike expecting them to continue upwards. I'd rather my readers learn from these mistakes and remain in the green rather than fall into the red.

I would also be remiss if I didn't mention that MTGStocks has other additional tabs, specifically the Foil Market tab. Many of us tend to focus a lot on the TCG Mid (and now hopefully the TCG Market) tabs. However, foils are typically much rarer than regular versions of cards, so it's important to monitor foil movements as well (especially since they can be quite lucrative if you speculate smart).

It is also telling when the foil Market price doesn't even register after a regular price shoots up dramatically. Each of these cases is different, and in some cases the foil price can already have a significant multiplier on the regular version. However, it's not uncommon for foil copies to be ignored—especially during a manipulated buyout, as the buyer has to sink significant capital into the regular versions.

So when the foil multiplier isn't that high, and the foil copies aren't that much higher than the regular version, we are likely to see one of two things occur. Either the foil will rise as well (if there is truly demand for the card); or, the regular price will fall back down and the foil will remain steady (which is a decent indicator of a "pump and dump" attempt).

Good reminder for people! I almost always ignore the non-market prices now. It’s like those just show me which cards are victims of pump and dumps.

However, I usually do one thing though…I take the ‘pump and dumps’ and cross-reference those against tournament playables that haven’t risen in market price yet to figure out if I want to actually spend some money.

“Price is what you pay. Value is what you get.” ?

Thanks Edward. I too have found the market price tab to be far more valuable than the regular one (though I do use the regular one to choose which cards to list onto TCGPlayer each day)

Nice, that’s definitely good to know. =)