Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, readers!

As mentioned in my article two weeks ago, I'm going to try and make this style of article a biweekly column. The goal is to make it similar to normal stock/finance watch articles in which I'll highlight the cards in several categories that have seen the most movement.

As I learned from the previous article, it's important to list the cards that had the largest price changes (whether up or down) so I'll make sure to cover both sides from now on. I will also be bumping up the number of cards evaluated in each category to five.

My first article I went a little more in depth on the real world examples of each type of stock. I won't reiterate these ideas each time, so if you want a bit more background information feel free to read my previous article.

Penny Stocks

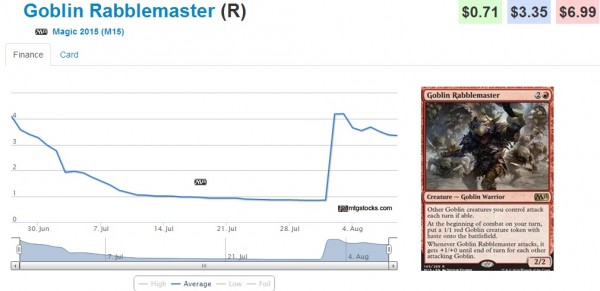

#1 Goblin Rabblemaster (+308%) - This guy's jump was solely due to a strong performance at PT M2015. This was the card that QS sent out the Insider alert on as it was being played by all members of Team Revolution.

He provides continuous threats and has a lot of synergy with the other cards in the Rabble Red deck highlighted at the PT. It's important to note that he's already dipped a little bit, but the PT was last weekend, so his price has somewhat stabilized at the new value around $3.50 per card (from around $0.80).

The deck proved it had a lot of power behind it. But being a regular rare, it will likely not break $5 again, especially if all the hype from the PT barely got it to breach $5.50 for more than a day. It's not really a splashable card and it only fits well into aggressive red decks (as if there were any other form).

#2 Legion Loyalist (+85%) - This guy follows on the heels of Goblin Rabblemaster. His abilities are relevant in the current format (first strike, trample, and can't be blocked by tokens, i.e. Pack Rats). He pairs really well with Goblin Rabblemaster, as the Rabblester's tokens help turn on his battalion trigger.

He was already seeing play in Boss Sligh (which broke a few weeks ago at the SCG Invitational piloted by Tom Ross). He makes it extremely difficult for decks to trade with attacking creatures when combined with pump spells like Rubblebelt Maaka or Titan's Strength. The first strike from Loyalist can mean that instead of trading two-for-one with the small aggressive deck, the slower deck loses their creature to a lone pump spell, and may still take some damage thanks to trample.

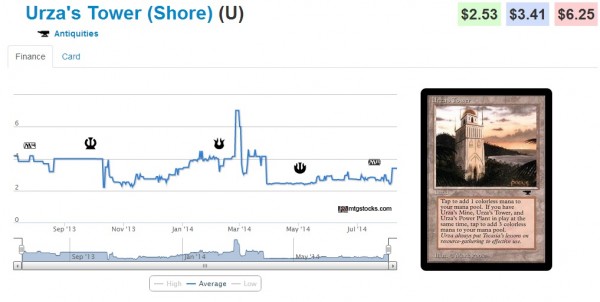

#3 Urza's Tower (Shore) (+39.8%) - The Antiquities version of this Urzatron land has had a nice price bump the past week.

The fact that the oldest printing is still under $4, while being a staple for a specific Modern deck boggles my mind. With the shore artwork going up on this one, I expect Urza's Mine (Tower) and Urza's Power Plant (Bug) from Antiquities (but not Chronicles) to follow suit. If you don't want to pony up $15-$18 for the foil versions from 8th or 9th then these are your pimp versions of choice (or if you happen to prefer the old border style).

#4 Squelch (+37.2%) - Squelch is one of those older uncommons that a lot of people may not realize exists. It serves as another way in Modern to punish people for running so many fetchlands and isn't as color intensive as Shadow of Doubt (though to be fair it doesn't serve as as much splash hate). This card can also serve as a way to stop Kiki-Jiki or Splinter Twin (for a turn) by countering the tap ability.

Our own Doug Linn called this spec over a year ago as it was seeing play in Mono-Blue Tron. If that deck is picking up, this card is likely being pulled up with its success.

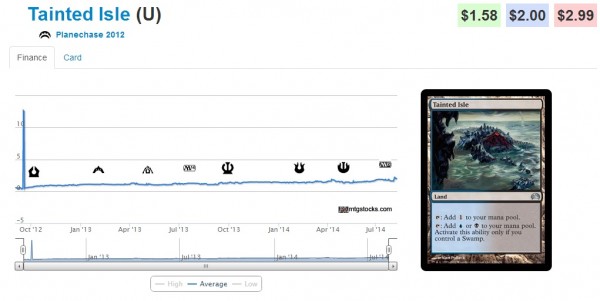

#5 Tainted Isle (Planechase 2012) (+22.7%) - I'll be honest and say I really don't get this one. The most likely explanation is very few of these are available on TCG Player (under 10 total) and when the sample size is this small, someone buying the cheapest copy or two can cause the average to move up a bit. 22.7% looks like a lot, until you realize that after that jump the card is still only $2.

Blue Chip Stocks

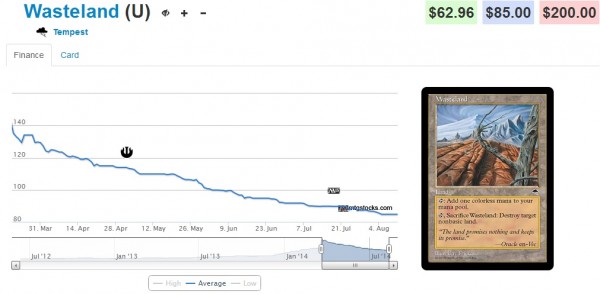

#1 Wasteland (+5.54%) - In the past few weeks we've seen a lot more UWR Delver variants doing well at the SCG Opens which appears to have caused an upsurge in Wasteland (to counteract the previous downsurge we saw two weeks ago).

#2 Tundra (+4.21%) - I believe this one goes hand in hand with Wasteland's resurgence. This is the first land usually fetched in the UWR Delver decks as blue and white are the main colors and red is more of a support color.

#3 Scrubland (+2.96%) - Esper Deathblade has enjoyed a small resurgence lately (from being out of the limelight entirely just a couple short months ago). But it seems more likely that this color combination, which is very popular with casuals, has simply started to move up slowly as one of the premier non-blue duals (behind Bayou).

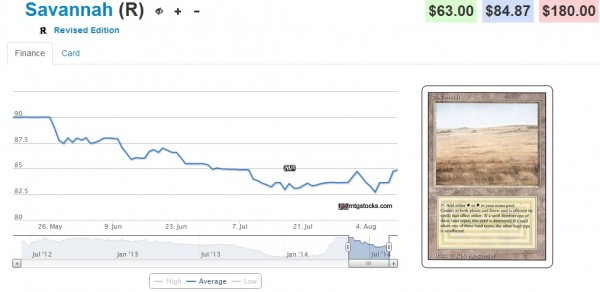

#4 Savannah (-2.11%)- The lack of any Zoo or Maverick decks in any recent Top 8's seems to be pushing this dual down in value a bit.

However, even the 2% drop is only a loss of less than $2 and when the percentages are this low there's a possibility that people just recently listed a few lower cost options on TCG Player. Looking at TCG there are a lot of HP ones available which might be forcing the owners of LP who want to sell quickly to put a lower price tag on them to encourage buyers.

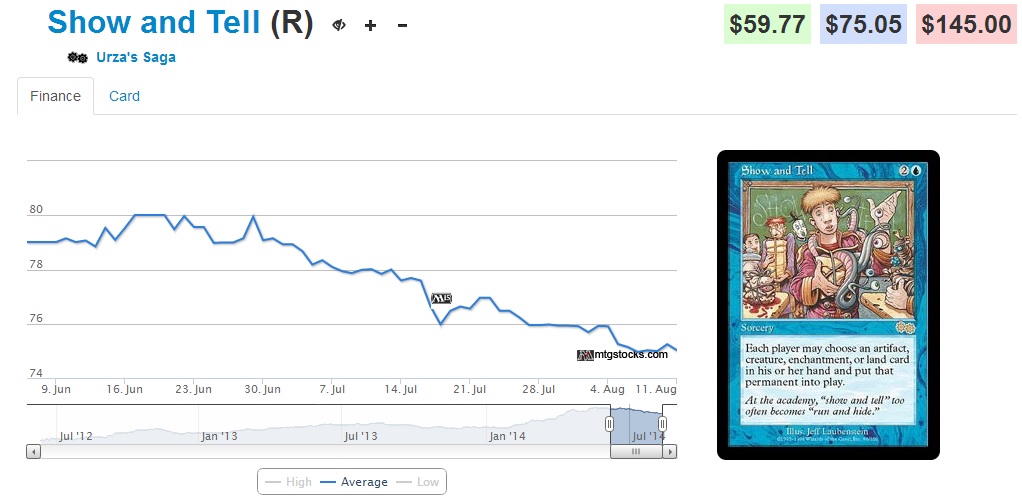

#5 Show and Tell (+2.08%) - Show and Tell decks, while not nearly as dominant as they were a year ago, have been finding homes in SCG Top 8's. There has also been a resurgence in Omnitell decks (which also require a playset of Show and Tell) doing well in opens.

Value Stocks

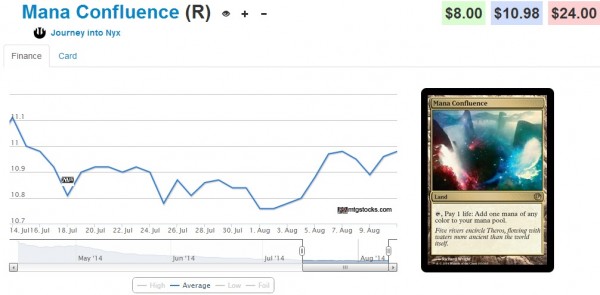

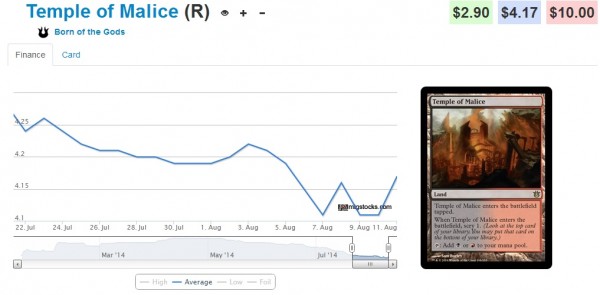

Our value stock selections from the previous article were Mana Confluence, Temple of Epiphany and Temple of Malice. As you can see by the below graphs two of my three picks have started trending upward, whereas Temple of Malice has continued it's downward trajectory.

The biggest problem with Temple of Malice (and something we might need to consider moving forward) is that black-red is often an aggro color combination, which synergizes poorly with lands that come into play tapped. It is important to note that a lot of the Jund (Monsters and/or Planeswalkers) lists run a full compliment of Temple of Malice, so it likely won't keep going down.

Upon reviewing the numbers last time, I don't really feel it's wise to post the +/- percentages on these unless there is a significant jump. A change of less than 0.1% could be attributed to a few of the cheaper copies being bought up or a few being added to the market.

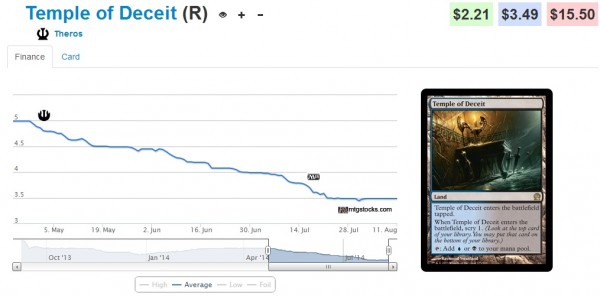

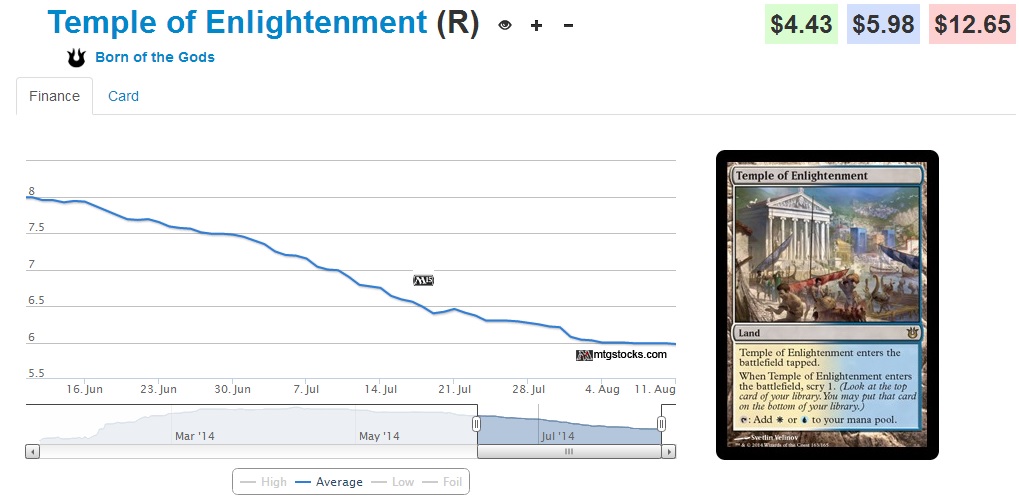

In the spirit of bumping from three to five choices, my next two value stock picks are Temple of Deceit and Temple of Enlightenment. The reason behind these picks are simply they are some of the strongest color combinations in Magic's history and currently the concern of Esper Control losing a lot of its components come rotation has people more willing to part with them, but it's important to keep in mind that both Elspeth and Hero's Downfall will still be legal post-rotation and pairing either with blue can lead to a powerful control deck.

Growth Stocks

Our growth stocks are showing a strong uptick in Worldwake and Zendikar (though again given the small sample size it's hard to argue that one or two higher-than-average sales can affect the average comparison greatly.)

The average comparison was calculated by taking (New Average + Old Average) / 2. I took this approach because it's the average of a larger sample size and we want the sample size to grow--the larger the sample size, the closer to the "market price" we'll get. We will always keep the previous two week's data next to the newest data so we can get a direct comparison to look for trends.

| Week of 8/11/14 | Box | Most Recent Completed Auction | Second Most Recent | Third Most Recent | Fourth Most Recent | New Average | Average comparison |

| Innistrad | $200.00 | $201.50 | $213.95 | $214.99 | $205.31 | 1.12% | |

| Dark Ascension | $119.49 | $98.99 | $96.00 | $109.00 | $107.62 | -1.63% | |

| Avacyn Restored | $135.98 | $134.99 | $135.98 | $116.39 | $130.17 | 0.51% | |

| Scars of Mirrodin | $170.00 | $140.51 | $167.50 | $159.00 | $156.63 | 1.67% | |

| Mirrodin Besieged | $169.99 | $159.95 | $138.50 | $155.00 | $152.61 | 2.13% | |

| New Phyrexia | $364.95 | $316.00 | $290.56 | $315.00 | $314.13 | 2.39% | |

| Zendikar | $527.00 | $499.99 | $559.99 | $485.00 | $497.00 | 4.23% | |

| Worldwake | $799.99 | $740.00 | $749.99 | $645.04 | $700.74 | 4.71% | |

| Rise of the Eldrazi | $500.01 | $549.00 | $549.00 | $540.00 | $536.99 | -0.46% | |

| Week of 7/28/14 | Box | Most Recent Completed Auction | Second Most Recent | Third Most Recent | Fourth Most Recent | Average | |

| Innistrad | $209.00 | $199.00 | $195.00 | $209.00 | $203.00 | ||

| Dark Ascension | $109.00 | $90.00 | $126.50 | $112.00 | $109.38 | ||

| Avacyn Restored | $122.50 | $117.50 | $139.50 | $138.50 | $129.50 | ||

| Scars of Mirrodin | $167.50 | $141.01 | $142.53 | $165.00 | $154.01 | ||

| Mirrodin Besieged | $155.00 | $132.50 | $150.00 | $159.95 | $149.36 | ||

| New Phyrexia | $290.50 | $315.00 | $301.00 | $319.99 | $306.62 | ||

| Zendikar | $499.99 | $568.99 | $355.00 | $480.00 | $476.00 | ||

| Worldwake | $645.04 | $650.00 | $675.88 | $700.00 | $667.73 | ||

| Rise of the Eldrazi | $579.95 | $493.03 | $510.00 | $574.95 | $539.48 |

Love these type of weekly wrap-up articles. Please keep up the great work 🙂

Thanks for the compliment. And if there’s anything different you think I need to add or suggestions, feel free to let me know.