Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, readers! As I've gotten a lot of positive feedback on this series we're going to keep it moving. And as usual we'll start off with the "penny stocks" this week.

Penny Stocks

#1 Blackmail (+35.2%) - This is a Modern-legal discard spell for one black. It is not restricted in what it can be picked (no three-mana or less, or non-creature spell requirements). While it seems the weakest option as your opponent does get to pick the three cards to reveal, if they only have three or less cards in hand it discards whatever you want. Alternately if all cards in their hand are good it still hits one (just likely their third worst).

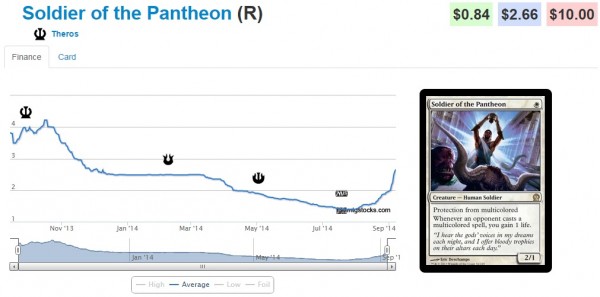

#2 Soldier of the Pantheon (+35%) - This one-drop is likely to do a lot of work in an upcoming Standard that looks to be heavily multi-colored. The more multi-colored Khans cards that are spoiled the better he becomes. White weenie aggro is already a Standard archetype and while they lose some of their one-drops come rotation a good portion of the deck remains intact. It's also important to note that the "outlast" mechanic plays really well into this archetype as a way to use excess mana.

#3 Urza's Tower (Shore) (Antiquities) (+28.1%)- Yet again we see this on the list. I'm almost curious if someone is reading these articles and buying more of them just to keep them on the list... As I've said before this could be an indicator of the increase in demand for 'pimp' tron pieces, but the fact that the other pieces aren't on the list would disprove that hypothesis. It's currently about double what all the other Urza's pieces from this set are (including the other art works of the Tower).

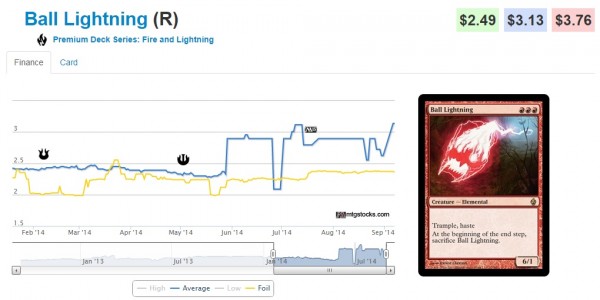

#4 Ball Lightning (Fire vs Lightning) (+19.5%) - This one is also a bit confusing; either the burn archetype has brought new players into Modern, who want to foil out their decks but don't want to pony up the extra 50 cents for an M10 foil version; or there's a glitch on MTG stocks with the price on this one. The large quantity of plateaus could be an indicator that a lot of them just aren't up for sale and/or aren't purchased so the price doesn't move much and when it does it adjusts the average enough to show movement on here.

#5 Hyena Umbra (Planechase) (+17.6%) - While this is a Modern Bogles staple, it's odd that the Planechase ones are commanding almost double that of the Rise of the Eldrazi copies. Sure there are a lot fewer of the Planechase ones in existance, but the artwork is the same. The foil Rise of the Eldrazi copies are only $6 so if you were going to pimp your Bogles deck it doesn't make sense that you wouldn't pay $6 for foil versions instead of $2.5 for non-foil Planechase ones.

Blue Chip Stocks

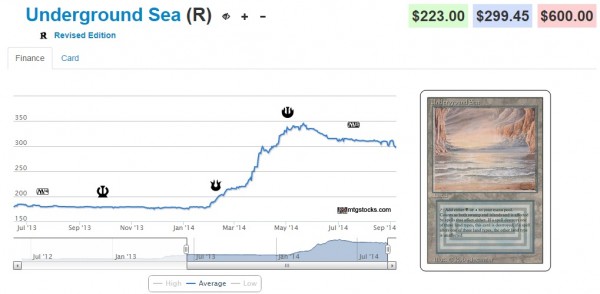

#1 Underground Sea (-3.48%) - One of the most expensive cards in Legacy has a decent drop down, though it's not all that surprising. The Legacy metagame has shifted away from decks that run the full playset of these. Storm is on the decline, as is Esper Stoneblade/Deathblade. While it does make a showing the Legacy BUG decks (both BUG Delver and Shardless BUG) only Shardless runs the full playset.

#2 Volcanic Island (-3.45%) - Sneak and Show (the deck that originally caused Volcanics to jump up to the second most expensive dual land slot) has not been performing well recently, and even RUG Delver is still in decline (as they can't beat a resolved True-Name Nemesis). Some of the Miracles decks are splashing red, but this tends to only require a single Volcanic Island.

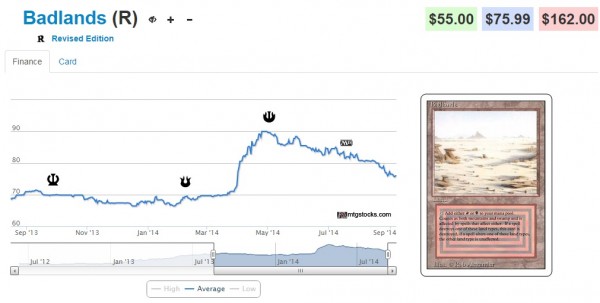

#3 Badlands (-3.17%) - Jund continues to fall into decline in the Legacy metagame and Zombardment hasn't really made a showing since its debut. Badlands continues to suffer from the over-price spike that occurred earlier in the year as demand is still limited and the color combination isn't that common in Legacy.

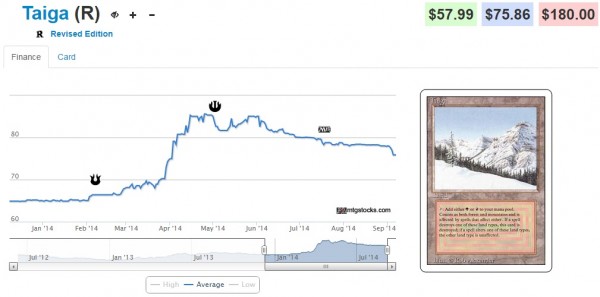

#4 Taiga (-3.16%) - Poor Taiga. This is back to being one of the cheapest duals (with only Kabira Takedown // Kabira Plateau below it) and Zoo's complete non-existence in Legacy Top...anything's has shoved this guy down into the casual only crowd. The good news is that unlike in Legacy, in EDH green is the powerhouse color.

#5 Tropical Island (-3.13%) - The decline of Tropical Island seems a bit odd as BUG decks (both Shardless and Delver) have gained some popularity recently, however, there is clearly more in the supply (thanks to the March price bump) than there is in demand (as conveyed by that constant downward trend).

Value Stocks

Now we're back to our sealed product or "value stocks". It looks like our high-dollar sealed boxes both lost value this week. I think these have definitely hit their peak price, especially Worldwake, given that if you were to win that lottery and pull a Foil JTMS you'd still be down almost $300 on your box.

The only boxes to see solid gains are Avacyn Restored, which is a bit surprising given that the announcement of the Disciple of Griselbrand GP promo dropped his price significantly. The only other highly desirable card from the set is Avacyn herself, which is sitting stable at around $24.

Another factor we may want to consider is that with the announcement of the Onslaught fetches in Khans there may be a decent amount of people trying to free up capital to buy up a lot of Khans, which could lead to an influx of higher-dollar sealed product entering the marketplace. After all, I'd trade one box of Worldwake for seven boxes of Khans all day.

| Box | Most Recent Completed Auction | Second Most Recent | Third Most Recent | Fourth Most Recent | New Average | Average comparison |

| Innistrad | $200.00 | $176.76 | $199.99 | $227.50 | $201.06 | -3.17% |

| Dark Ascension | $94.99 | $107.50 | $99.99 | $101.99 | $101.12 | -3.59% |

| Avacyn Restored | $129.99 | $139.00 | $134.50 | $137.75 | $135.31 | 9.35% |

| Scars of Mirrodin | $167.50 | $167.50 | $150.00 | $180.00 | $166.25 | -2.44% |

| Mirrodin Besieged | $169.95 | $145.00 | $167.50 | $120.50 | $150.74 | -6.63% |

| New Phyrexia | $349.99 | $338.00 | $297.50 | $364.95 | $337.61 | 2.37% |

| Zendikar | $532.69 | $518.00 | $550.00 | $532.00 | $533.17 | 0.03% |

| Worldwake | $740.00 | $621.00 | $655.01 | $725.00 | $685.25 | -6.80% |

| Rise of the Eldrazi | $584.99 | $584.95 | $510.00 | $500.01 | $544.99 | -3.15% |

Things to Consider

By now everyone is aware that the Onslaught fetchlands were spoiled in Khans of Tarkir. You can see them preselling for $25 (blues) and $15 for non-blue.

These are the exact same pre-order prices that the Zendikar fetches had and they dropped considerably after the first month or so. I expect the exact same thing to occur with the Onslaught fetchlands. To make matters worse, everyone I know wants to buy a lot of this product solely because of the fetchlands, which means that there will be a lot opened and a lot of people speculating on them.

My current plan is to wait until a month or so after they've been out and trade Zendikar fetchlands for them (which if they stabilize in price may mean I get 4:1 to 2.5:1 ratios) to the Modern players who recently started up and want the Zendikar fetchlands to finish their playsets.

sweet, looks like its a good time to pick up more duals. Great article, solid legacy knowledge on price fluctuation on duals.

Thanks, I appreciate the positive feedback. I still like duals for the long term, but as you can see by the overall trends…they are sliding back downwards (the march spike was way too much too fast) so I actually wouldn’t go cash buying them anywhere near their TCG-Mid (as several other authors have mentioned you can often by them a good bit below the TCG price on ebay).

like shockduals, everyone will now realize how important the fetchland will be, and that it’s a good opportunity to buy them now during print.

In the end, it will take years before prices go up, because demand will be much lower than expected and fear for reprints will limit the price.

Even non speculators will gather as many fetch, so I wouldn’t be surprised if prices never go below 10€

I doubt the blue ones will…but non-blue has a decent liklihood. If you recall when they announced the shocklands were being reprinted we saw the prices of the new ones pre-selling for 75% of the price of the old ones (when RTR first started preselling), but after a couple months of being opened those plummeted to 17-25% of the originals price. I know my local playerbase are all very excited for Khans and a lot more boxes will be opened than usual, which means that a LOT more fetchlands will enter the market. Maybe I’ll be wrong, but I expect to pick up the new fetchlands for $7-10 (non-blue) and $13-15 (blue).

I’m surprised that you attribute falling duals prices to meta game performance and not as a response to the artificial price hike we saw earlier this year. I’m more under the impression that retail vendors saw low supply and sky rocketed prices to increase inventory with more aggressive buy list prices. This price hike was not as prevalent on ebay where the price of volcanic island still stayed around $200.

I do mention that issue when I talk about Tropical Island and it may be a bigger one than I’d given it credit for. I do believe that it’s definitely playing a part in it, but I keep a spreadsheet with the prices on my “blue chip” stocks and update it every time I write this article and previous articles actually showed bumps in the dual land prices over previous weeks. If they were all going negative all the time, I’d agree, but when some go up and some go down it’s difficult to attribute that to anything other than changes in demand (most likely due to metagame performance). As you can see by the graphs, the overall trend appears to be universally downward (for the reason you and I both mentioned already), however, weekly price fluctuations (both up and down) are likely also tied to metagame changes.

I believe David is correct. The Meta has changes and Duals are run a lot less in Legacy as of late. Look through active decklists in the last month or two weeks. Most decks are running 2-5 range on the lower side. Growth of mono decks also.

I know it’s been said before, but I don’t think the KTK fetches will drop as much or as quickly as their ZEN counterparts did. With ZEN, Modern wasn’t a format yet and Legacy was still just starting to really grow in popularity. There’s a lot more demand for fetches now than there was when ZEN came out.

I can definitely agree that there’s plenty of demand for these across the board, but you can already pre-order Polluted Delta’s on TCG for 19.99…so your argument is that they won’t drop any lower AFTER product is open and a bunch hit the market? I think $15 is an easy target (and again wouldn’t be surprised to see them drop to $12/13). I tend to believe trends that have proven themselves accurate (Zendikar fetches dropped, RTR shocks dropped, Temples dropped).

I have seen several of the fetches for preorder on tcg for under 15 already. I am assuming it would be wise to snag up playsets at 12-13 bucks now?

Right now demand is at the highest…there are none currently available and everyone who is preselling (remotely intelligently) is limiting how many they will presell to prevent themselves from having to buy them full price to fullfill an order…so high demand and limited supply…not the recipe for a ‘buy’ call.