Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Sylvain Lehoux and Matthew Lewis. The report is loosely broken down into two perspectives. A broader perspective will be written by Matthew and will focus on recent trends in set prices, taking into account how paper prices and MTGO prices interact. Sylvain will take a closer look at particular opportunities based on various factors such as (but not limited to) set releases, flashback drafts and banned/restricted announcements.

There will be some overlap between the two sections. As always, speculators should take into account their own budget, risk tolerance and current portfolio before taking on any recommended positions.

Redemption

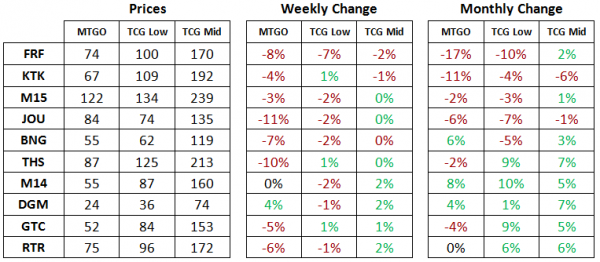

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of March 11th, 2015. The MTGO prices reflect the set sell price scraped from the Supernova Bots website while the TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid-price respectively.

Price weakness in the MTGO economy is the story this week, with almost all the redeemable sets showing a weekly drop. It’s not clear what is driving this shift exactly; on the supply side, bot operators might be anticipating the upcoming liquidity crunch and as a result have been lowering prices in order to raise tix. On the demand side, players could have be focused on Modern instead of Standard, and thus sold the cards they weren’t using.

Regardless of the nature of this drop, further short-term price weakness is anticipated. Cube drafts return this week and accompanying them will be ROE flashback drafts. These will both continue for two weeks and then it will be right into DTK prereleases.

The observed price weakness of the last week combined with the next month of tix-centric events makes it look like the DTK release event liquidity crunch has already begun. Speculators should be winding down their sales and moving into tix-hoarding mode with an eye to buying up depressed staples during DTK release events. Only cards with a high value relative to price should be considered for speculative buys.

Return to Ravnica Block & M14

The paper set price increases for both RTR and GTC are still rising week over week for TCG mid prices. It’s possible this trend will be interrupted in the coming weeks as DTK hits in paper, but looking further out, MM2 should be the medium-term peak for prices. The outlook for RTR and GTC on MTGO remains increasingly positive as a result, despite this week’s drop.

With flat prices in the past week, M14 holds less value relative to RTR and GTC at the moment, but the increase in the paper price is encouraging. Paper prices for M14 have been lagging behind the other two just-rotated large sets, so seeing larger week over week gains suggests M14 might be catching up. Lending support to M14 is the end of the downtrend on Chandra, Pyromaster and the supply on many mythics and rares is gradually dwindling.

The short-term outlook for RTR, GTC and M14 is flat-to-falling prices due to the upcoming liquidity crunch. However, the rise in paper prices as interest in Modern builds to MM2 and a return to normal liquidity conditions in the MTGO economy will lay a strong foundation for price increases through May. Selectively buying mythic rares from these sets over the coming weeks is defensible.

Theros Block & M15

As a set, THS should be moderately redeemable in the future with Thoughtseize as an all-format staple and a smattering of other fringe Modern-playable rares and mythics. It’s not too early to be considering mythic rares from this set for their redemption value and one card in particular is presenting an excellent price in recent weeks. Medomai the Ageless has recently dipped under 0.4 tix and this price level represents a good buying opportunity, with an eye to hold for the long term.

Those looking to dip their feet into MTGO speculation should consider this mythic rare an extremely safe bet, though it must be stressed that a long-term perspective is necessary. One must be willing to hold this for 10+ months in order to realize any decent gains. Also, the low price defines the value here, as paying higher than 0.5 tix for this card is a much weaker opportunity and should be avoided.

The small sets of Theros block will both have to clear a high bar to be considered redeemable. BNG in particular looks like a weak set, with only a couple of Modern playables and no outright Modern staples. Without a card or two to anchor the value of the set, it really reduces the prospects for BNG as a redemption target. Therefore it’s an easy call to steer clear of BNG junk mythic rares, now and in the future.

The long-term value of JOU is better than BNG, but the price of this set is still elevated relative to paper. The JOU junk mythics are still sitting at over 1 tix so a significant price decline will be necessary for this set to show any value to long-term speculators. It’ll be waiting to see what happens for this set, but for the near term there is very little value there.

M15 should be a decent target for redeemers with a Modern-playable planeswalker in Chandra, Pyromaster as well as the enemy-coloured pain lands. Its mythic rares should be on the speculative radar. Current prices are still elevated and so there are currently no cards with good long-term value from this set. Keep an eye on the Soul cycle though, especially if they dip below 0.4 tix; in that price range, mythic rares from this set represent ‘good value’.

Khans of Tarkir & Fate Reforged

KTK is currently working on putting in a bottom, but with some evidence of buying activity heating up. Relative to paper, sets of KTK on MTGO currently represent ‘good value’. That being said, paper prices are still in decline so there won’t be much support from redemption in the near term. Get your tix ready though as the current price levels are the cheapest that KTK will be over the next eight months.

Rares from FRF are seeing steady price declines as supply continues to enter the market. Mythic rares from this set have largely found their level, but a price dip is inevitable during DTK release events. It’s possible that by the time DTK events wind down, there will only be one or two mythic rares still over 10 tix. Don’t try to fight the flood of supply and stay away from speculating on this set in the near term.

Modern

The Modern MOCS is over and with the incoming series of set releases—DTK in three weeks, followed by Tempest Remastered and then MM2, the Modern format as a whole is bound for a slow decline. It’s possible there might even be some panic selling of staples in the weeks prior to MM2.

That trend will quickly reverse after Modern Masters 2015 hits but until then do not expect much from Modern specs. Reprints and the fear of reprints in MM2 will force the price down for many cards. Any Modern staples that do not get reprinted in MM2 that could have been printed should be immediately targeted as a ‘strong buy’.

With the release of VMA last year, Wasteland was widely expected to show up in that set and so its price was dropping in the months before VMA was released. As soon as the set list was confirmed, it immediately shot back up in price once players realized it wasn’t getting reprinted. The expectation of a reprint will drive the price lower on any given Modern staple over the next couple of months. But once the set is fully spoiled, there will be a couple of cards that don’t show up in MM2 and then skyrocket in price.

However not everything should be discarded on the spot. Many Modern prices are still cyclical even during intense set release periods. Several low-priced MMA cards for instance still have a long way to go before they reach their previous heights. Some of these were among our buy recommendations and we think upsides are ahead. For example, Kataki, War's Wage and Spell Snare are almost at their absolute bottoms and we expect them to gain value in the coming months.

Another category of Modern positions to consider is the cards from sets excluded from MM2. Grim Lavamancer, Serra Ascendant, Visions of Beyond, Thragtusk and Master of the Pearl Trident are on the rise now; whenever they drop they will constitute great buying opportunities.

Also keep an eye on Innistrad Modern staples. Past in Flames has lost 30% of its value in about a month and seems to have found a new floor. Despite the fact that Storm decks are missing in action this Modern season, a rebound shouldn’t be ruled out.

Lastly, there is potential short-term profit to be made even with cards that could potentially be in MM2. The Modern cards still swing up and down and are excellent to consider for speculation. The usual suspects include: Pyromancer Ascension, Phyrexian Metamorph, Inquisition of Kozilek, Dismember, Gitaxian Probe, Gifts Ungiven, Ranger of Eos and many other mid-priced Modern cards.

Inquisition of Kozilek is certain to be in MM2, but it’s also going to be entering the market with the flashback ROE drafts. Watch out for the dip on this one in the coming weeks.

Vintage & Legacy

Based on the weekly movers and on their respective price index, Vintage and Legacy are currently stagnating. They are not usual formats for big price spikes anyway. The outlook for these formats is still slightly positive and besides some bumps due to the upcoming set release, prices should keep creeping upward through the summer.

One reminder: with the Tempest Remastered set to be released in less than two months it is advisable to get rid of your Tempest block positions—the priciest cards in this block are going to be reprinted.

Pauper

Most Pauper cards are still on an upward trend this week—Innocent Blood, Crypt Rats, Exclude, Adaptive Snapjaw, Cuombajj Witches, Gush and Rolling Thunder are all on a steady rise.

Mental Note and Cloud of Faeries are two typical examples of cards that spiked because of speculation, then dropped a lot, and are now recovering their upward action again. This was expected and it actually shows that real demand from players is supporting the underlying trends, a good sign for speculators who hold on through any dips in price.

Targeted Speculative Buying Opportunities

Standard

Targeted Speculative Selling Opportunities

Standard

Xenagos did gain a little interest in mid February, but the forecast is looking increasingly dim on this card. It’s time to cut the losses on this position.

Is Medomai a “safe bet” long term because the price will jump post-rotation based on people needing it to complete their sets for redemption, or is there something about it I’m missing.

Also, anything in regard to foils? Or are those traditionally avoided in MTGO when it comes to speccing based on redemption?

Well written article as always. All the articles recently by all the writers have been top notch lately.

Yes, you are correct on Medomai. Most mythic rares from redeemable sets end up at 1+ tix after rotation. Therefore, Medomai at 0.5 tix or less is a good bet for a long term profitable trade. It’s almost 100% that one will be able to sell this card for 0.5 tix or more at some point in the months after THS rotates.

There’s definitely some assumptions underlying this spec, so I’d recommend looking through my article archives and reading up on redemption and the mtgo economy.

Historically I’ve avoided foils. It was a market I didn’t understand well and had a higher cost of entry, so I stuck to studying non foils.

Lately though, starting with my own experiment with KTK foil mythics (check the forums for my post), I have been trying to get a feel for the foil market. My thinking now is that there is a strong argument to be made that foil mythic rares are (selectively) a good target for speculators. I’ll explore this some more when DTK is released. Broadly, avoid the mythic rares that show up in the seeded packs as these are bound to be relatively abundant and thus cheaper. And buy any other foil mythic rares that seems reasonably priced.

Thanks for reading, and commenting!

Are Pauper cards at their peak or they still have room to grow? What will be the best time to start selling these positions?

Overall I think their still room to grow for many of them.

If Pauper really becomes popular again I expect prices to cycle like Modern, ups and downs, more or less frequent, and not all cards following the same rhythm. I don’t necessarily expect pauper cards to be really sensitive to other set releases, I don’t foresee a big deep for DTK or MM2015 for instance.

Since we are talking about commons, flashback drafts will have a huge impact on prices and I would really sell all my pauper once we know about flashback drafts.

As for when selling, looking at their previous record high is one factor to consider. If you can sell with a 200% profit that’s also a strong incentive to sell. For instance, with Mental Note, a card with no record of high prices, my target is 1 Tix (having it bought at 0.25 Tix, that more than 200%).

And since I think prices will cycle (assuming pauper see some demand) selling with moderate profit to rebuy few weeks/months later and sell again later on is a viable strategy to capitalize efficiently on moderate profits (~30-50% profits).