Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Sylvain Lehoux and Matthew Lewis. The report is loosely broken down into two perspectives. A broader perspective will be written by Matthew and will focus on recent trends in set prices, taking into account how paper prices and MTGO prices interact. Sylvain will take a closer look at particular opportunities based on various factors such as (but not limited to) set releases, flashback drafts and banned/restricted announcements.

There will be some overlap between the two sections. As always, speculators should take into account their own budget, risk tolerance and current portfolio before taking on any recommended positions.

Redemption

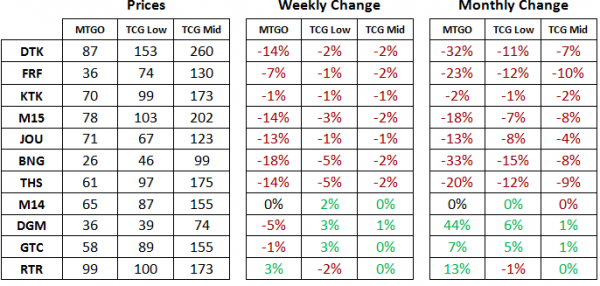

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of June 1st, 2015. The TCG Low and TCG Mid prices are the sum of each set’s individual card prices on TCG Player, either the low price or the mid-price respectively.

All MTGO set prices this week are taken from Goatbot’s website, and all weekly changes are now calculated relative to Goatbot’s ‘Full Set’ prices from the previous week. All monthly changes are also relative to the previous month prices, taken from Goatbot’s website at that time. Occasionally ‘Full Set’ prices are not available, and so estimated set prices are used instead.

The set price data for this week has the interesting aspect of being completely red for all Standard-legal sets in both paper and digital, for both weekly and monthly changes in price. The price swings in the MTGO economy are related to the liquidity crunch generated by the release of MM2 this past week. This liquidity crunch occurs for two reasons.

The first is that players need tix in order to draft MM2 and their preference for selling cards for tix dominates over purchasing tix directly from the store. This leads to falling prices as players sell cards into the market.

The second reason is that the bots also need tix at the same time players are looking for tix. The bots are trying to stock the new set and so need a higher amount of tix in order to buy the cards coming onto the market from drafters.

These two effects are working in the same direction, pushing up the utility of tix during set releases. This is the most important feature of the MTGO economy for speculators to understand and to integrate into their speculative decisions. Accumulating tix in advance of set releases and then deploying tix during set releases is the best top down strategy available for maximizing speculative returns.

Return to Ravnica Block & M14

The set price of DGM is up over 40% in the last month on the back of Voice of Resurgence. After last week’s sell recommendation, the peak appears to be in as the price of the mythic two-drop has backed off from 30 tix to 28 tix.

Ongoing interest in the Modern format will broadly support the price of this card but depending on how the metagame develops, it could dip back to the 20 tix level. At that price, it would be time to consider establishing a new position in this card. For the time being though, speculators should avoid purchasing this card and look outside of DGM for speculative opportunities.

The two large sets from the second Ravnica block are seeing mixed price activity in the last week. Paper prices continue to inch up and grudgingly the price of RTR and GTC sets on MTGO are also trending higher. However, as pointed out last week, the gains are recently concentrated in the shocklands and the Modern-playable mythic rares.

Junk mythic rare prices are stable to negative, but there is evidence that this trend might be near an end. MTGOtraders currently has over half of the mythic rares from RTR and GTC on its hotlist, suggesting a looming supply crunch, which would set the stage for the next broad advance in mythic rare prices for RTR and GTC. The trigger for higher prices on this subset of cards will be fading interest in Modern Constructed on MTGO. After the Modern Festival concludes, value will accrue to the junk mythic rares as players sell their shocklands for tix.

The available supply of cards from M14 is higher and so in contrast, a supply crunch does not appear to be developing for this set. Sustained upward pricing pressure from higher paper prices will be necessary before further gains are possible on the junk mythic rares from this set.

Theros Block & M15

The start of MM2 release events on Thursday was the trigger for another substantial price drop for these sets. Ranging from a 13% drop for JOU to an 18% drop for BNG, the drop is steep enough that a bounce back is possible after the excitement for MM2 winds down. Nevertheless, for these sets the march towards Standard rotation continues and it is a death march.

At the moment, junk mythic rares are the only place in these sets to focus on for safe, long-term holds, and M15 sees both Soul of Shandalar and Soul of Ravnica dipping below 0.4 tix this week.

If speculators are willing to hold these cards for six-plus months, then prices higher than 0.6 tix are anticipated. Buying at 0.4 tix is a low-risk speculative bet with the potential for 100% gains. Speculators should keep in the mind the opportunity cost of holding these cards before making any purchases though.

Tarkir Block

Similar to THS block, the three sets of Tarkir block saw broad price declines this past week in the wake of the release of MM2. The liquidity crunch is in, with both DTK and FRF plumbing new depths and KTK only 5 tix off of its low. The next ten days will be a low-risk time to accumulate cards from all three sets of Tarkir block. Picking the absolute bottom for DTK and FRF will only be possible in hindsight, but it’s getting close.

A few cards from DTK appear to have found their footing and should be on speculators' radar as contrarian, buy-low candidates for speculating. Dragonlord Kolaghan of DTK has drifted back down to the 1.0 to 1.5 tix range, while Sarkhan Unbroken and Narset Transcendent are around 4 and 5 tix respectively.

On the pricier end of the spectrum, DTK mythic rare foils appear to be currently following a similar pattern to the KTK mythic rare foils from earlier this year. That pattern is one where value slowly accrues in the mythic rares that were not awarded in promo packs for prerelease events. Only Dragonlord Ojutai is bucking that trend as the other four dragonlords are the four lowest-priced foil mythic rares.

Although foil sets of DTK have lower potential overall due to the lack of fetch lands, the set is still having a broad impact across Modern and Standard. Further price increases on foil versions of cards like Shorecrasher Elemental and Descent of the Dragons are anticipated. The speculative strategy around foil mythic rares on MTGO needs further refinement but it appears to be safe to apply it to large sets so far. Stay tuned for further developments on this strategy.

Modern

Strengthened by the release of Modern Masters 2015, prices of Modern staples not reprinted in MM2 have continued to climb this past week. For speculators, the optimal selling window is several weeks ahead and more profits are still to come. These staples are nicely recovering from the low point they hit in the early Spring and many of them are on their way to reaching their previous record high.

Some staples have already passed their previous high and are cruising in uncharted territory. Serum Visions was 4 tix last year at this time and is currently priced at over 9 tix, an unprecedented price for a Modern-only common. The situation is very similar for Path to Exile, currently at 9 tix (the price of this card is the primary reason boosters of the original Modern Masters are selling for 8 tix).

Next there is Gitaxian Probe which went from 1.5 tix a month ago and is now flirting with 5 tix. Finally, Deceiver Exarch saw its price multiplied by 6 in less than a month, moving from ~0.5Tix to ~3 tix. On the rare front, the Scars fast lands, led by Blackcleave Cliffs, are soaring to prices not seen since Caw Blade Standard pushed the price of Seachrome Coast to 10+ tix.

Selling some of these positions now is prudent considering how impressive the gains have been in such a short time. Selling now will also free up tix to deploy into MM2 reprints. After less than a week of MM2 drafts, prices on the reprinted cards are down significantly, with the exception of Tarmogoyf.

Such price drops have attracted players eager to complete their Modern decks at discounted prices, triggering a rebound since the lows of the weekend. As the opposing forces of constructed players looking for cards to buy and drafters selling into the market tussle for control of prices, further price drops could be delayed. Speculators willing to wait a week or two may find better prices, especially for rares and uncommons.

Based on the price history from MMA, mythic rares will rebound quickly within the first two weeks of releases. The vast majority of rares, uncommons and commons will see their prices decreasing until the end of June and possibly until the release of Magic Origins.

The big factor this time around though is the series of Modern events scheduled for the start of summer that will have most prices rebounding by the end of June rather than in July and August. Estimating the absolute bottom on cards from MM2 will be a balancing act, but being approximately correct won’t be difficult.

Legacy & Vintage

Tempest Remastered drafts are closed since last week and prices of all playable TPR cards are now on a slow and steady rise. No big price jumps are expected from TPR cards but building some positions from this set is a safe strategy, at least until the Legacy MOCS at the end of this year.

Other Legacy and Vintage staples can be divided into two categories—those reprinted in Vintage Masters and those only printed in their original set (or as promos). Staples reprinted in VMA are in a relatively flat trend over the past three to six months. Those Conspiracy cards that made it into VMA such as Dack Fayden and Council's Judgment, are showing a little bit more interest and are slightly on the rise.

Cards only printed in their original set have a different story. Some of them, including Rishadan Port, Doomsday and Misdirection are still on a four-year-long upward trend. Others, such as Metalworker, Gaea's Cradle and Goblin Welder, are continuing to trend down after large price increases around the release of VMA.

Even without any clear speculative goals, these prices are becoming very attractive on their own, both for players and long-term speculators. 25 Tix for Goblin Welder may not happen anytime soon but 7 to 10 Tix is a possibility if the card sees a little demand.

Pauper

This week again Pauper positions all across the board are looking good and additional gains have been recorded compared to the past week. According to the Mtggoldfish Pauper Metagame stats, Mono-Red Burn has became the most popular deck early this week. The deck is relatively cheap and filled with cards printed multiple times, so no relevant changes are expected from this metagame shift.

All of the Pauper positions we have discussed so far in this report are showing price strength and it is still worth holding onto them for potential additional profit. Several of them have a decent room to grow in comparison to their previous highest prices.

Targeted Speculative Buying Opportunities

None

Targeted Speculative Selling Opportunities

Modern

Serum Visions

Slippery Bogle

Gitaxian Probe

Path to Exile

Pyromancer Ascension

All of these five positions have seen a huge price increase over the past month and since we recommended buying them. In addition they all have broken their previous record high. Fro these two reasons we recommend selling these now to maximize profit and time. The extra Tix generated here could be reinvested next in MM2 opportunities.

One thing to consider regarding the price of Modern Masters 2015 singles, it’s not just the tug and play between drafters drafting and modern players buying into staples. We’re going to see SERIOUS speculative action on this set like none ever before. I have the feeling speculators are already buying in and may keep the prices higher than they might drop to otherwise. This may affect the normal course of price decrease among rares and uncommons that we saw in MM1.

For sure the speculation game is likely to be more intense this time around. However heavy speculation few days after release doesn’t really make sense for me. Prices are dropping but the bottom of any set has never been found 3 days post release.

Also I would imagine that higher prices resulting from players or speculators would encourage more players to draft if the EV is maintained higher?

I can certainly agree that prices of top mythics won’t tank much or for a long period of time (several weeks). But highly doubt that rares or top uncos won’t drop below their current price.

I’m not sure if the mtggoldfish charts are completely accurate, but if you look at MM1 the set was 199 tix three days after the release and hit its low at about 189, which overall is negligible.

Also if you look at the current top 10 most valuable cards from MM1 today, they all hit their low 3 days after release including Mythics (Tarmo, clique), rares (Cryptic and blood moon) and even uncommon (Path to exile).

There are some exceptions, like Sword of Fire and Ice and Elspeth, but a lot of staples hit their bottom in the first few days.

Do you guys know why there is such a big difference between the MTGO and IRL foil set of RTR? Also, do you guys know why certain foil RTR mythics are worth like 30 and others are like 9 (on mtgo)?

I’m not so sure there is a big difference between MTGO and IRL foil sets. I see on ebay that there are some for sale in the 500 to 550 range. And I just totaled up what a foil set would roughly cost in the individual cards, and it looks like about 400 tix. However, availability of individual cards might mean this is too low. To get the last couple of foil mythic rares might cost you well over 60 tix per card.

As for the differences between the price of RTR foil mythics, I don’t know if there was a different distribution of these cards, like the distributions generated by recent seeded pack pre releases for Tarkir block. I would say it’s that some of the foil mythics have ‘disappeared’ in inactive accounts, but it’s not clear why this would affect some cards and not others. Hypotheses on this topic are welcome!

I’m continuing to refine my ideas around foil mythic rares, and I am getting excited by the results I have seen for Tarkir block. I’ll be experimenting more fully with Magic Origins and should have a well developed strategy ready for Battle for Zendikar.