Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

You might be coming into this article hoping for a nice tidy equation where you can plug in some supply and demand numbers in exchange for a price. To those people I would sadly have to say, "Hell no!"

There is no magic formula, at least certainly not one I'm aware of. That's not to say, though, that we can't use some of the fundamental concepts of economics and finance to help us understand Magic card prices to better inform our investment decisions.

Price vs. Value

Long ago, Ben Graham taught me that "Price is what you pay; value is what you get." Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.

- Warren Buffet

One of the first lessons in investing is that price and value are distinct entities. They are often heavily related, but a high price does not always guarantee a high value and vice versa. In finance, the price of a stock is what you pay for it, and the value is what you get in dividends. So how do we relate this to Magic cards? Again, the price will be what you pay, but what is the value of a Magic card?

I would argue that the value of a Magic card, much like with stock, is the sum of all the benefits gained from owning the card from now until forever. This will almost exclusively relate to the ability to play particular decks in tournaments. So the cards with the most value are the ones that give us the greatest options in terms of the tournament prizes, learning and fun we can get out of them.

We can't focus only on value to determine price, however. This is illustrated in the Diamond/Water Paradox (or what we might call the Mox/Island Paradox.) Why are diamonds so expensive and water so cheap? Water is needed to survive while diamonds are just nice to look at.

The answer to this puzzle is scarcity. While water is much more valuable to people, it is also much more abundant. In other words, the price of a good is not just based on its value (demand) but also on its relative abundance (supply).

Supply & Demand

Supply and demand curves are some of the most fundamental concepts of economics. The demand curve plots the quantity of units demanded at a given price. Meanwhile, the supply curve plots the number of units that can be produced at each price. In theory, the market will arrive at the equilibrium price and quantity where the lines cross.

If this concept is unfamiliar, you only have to remember the main point: the price of something is determined by a mix of both how much it is demanded and how easily it is supplied.

What does this look like in the world of Magic? Players who need cards will have varying degrees of urgency. Some will be willing to pay more and some less. The same will happen with sellers and the price will fall somewhere in the middle of it all. At the equilibrium price $X, the same amount of people (roughly) will be willing to buy the card for $X as people who are willing to sell for $X.

If more people are buying than selling, the price will push up, and vice versa. Many of the bot algorithms adjust their prices in exactly this way, slowly increasing their price after every sale and slowly decreasing it after every buy.

Factors that influence supply on MTGO

- Set (cards opened minus cards redeemed)

- Rarity

- Alternate printings

Factors that influence demand on MTGO

- Constructed demand

- Redemption demand

- Speculation demand

Intrinsic Value and Sentiment

So we've discussed value and price, but what about their difference? In the world of stocks, where every asset directly outputs cash and the market is highly competitive, you would expect value and price to be very close. If stocks are correctly priced, they should on average give back what they cost: their intrinsic value.

When the price and intrinsic value differ, it is referred to as sentiment. High sentiment represents an overoptimism in the market, and negative sentiment represents underoptimism.

I think this concept has a nice parallel to prices on MTGO. On MTGO, the value of a given card is almost solely based on its Constructed playability. I therefore define the intrinsic value of a card to be the price it would be at if there was no speculation, due solely to players buying it for tournament use.

Sentiment, therefore, will be related to how inflated the price is over the intrinsic value, or how many copies have been picked up for speculation.

Estimating Sentiment

To compare sentiment across cards, we will have to look at cards with similar supply and tournament demand and compare their prices.

To ensure supply is similar, I compare cards of the same set and rarity. To ensure tournament demand is similar, I compare cards with similar Standard metagame dominance percentages, that see no Modern play.

I define metagame dominance as the percentage of decks playing the card, times the number of copies per deck, divided by four. This gives the average number of playsets we can expect in a deck chosen from the field at random. 100% metagame dominance would mean every single deck played four copies of a given card.

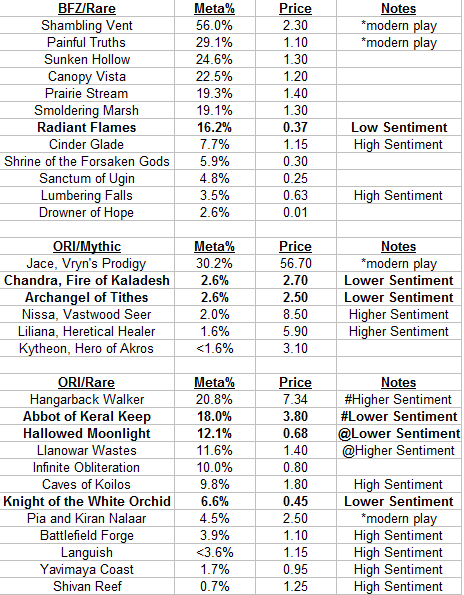

Let's take a look at some of this data applied to current Standard staples and other cards of interest. The metagame statistics are calculated using data from MTG Goldfish.

Some notes about the cards:

- Radiant Flames has seemingly low sentiment because it is priced far below anything with a similar metagame dominance.

- Cinder Glade and Lumbering Falls see much less play than their counterparts (Sunken Hollow and Shambling Vent) but speculators seem to think their metagame share will rise in time. This high sentiment inflates their prices relative to the amount of play they're seeing.

- Chandra, Fire of Kaladesh // Chandra, Roaring Flame and Archangel of Tithes are priced much lower than Nissa, Vastwood Seer // Nissa, Sage Animist and Liliana, Heretical Healer // Liliana, Defiant Necromancer even though all four are seeing a similar amount of play. This means there are a lot more speculators holding onto copies of Nissa and Liliana than Chandra and Archangel of Tithes.

- Hangarback Walker sees a tiny amount more play than Abbot yet is priced almost twice as high. This represents a much higher amount of sentiment for Hangarback Walker. A similar relationship exists between Hallowed Moonlight and Llanowar Wastes.

- All of the painlands from ORI have seemingly high sentiment. This could be due to speculation on their increased playability alongside "wastes" mana in the coming set.

- Knight of the White Orchid has a seemingly low sentiment, although it is hard to tell because the prices of the cards near it are all clearly inflated by high sentiment.

When High Sentiment is Warranted

Oftentimes high sentiment, as I have defined it here, will be warranted. This occurs if speculators have correctly predicted a future increase in price. I'll illustrate with an example.

Let's say that it's not yet Modern season, but due to increased play, card X should be worth around $10 once the season rolls around. (To keep things simple, let's ignore any notions of risk or the time-value of money.) Suppose the card is currently worth $5 due to low levels of play and zero speculation. In this scenario the card has what I have defined as low sentiment and seems like a great investment.

Let's consider three other levels of sentiment.

- Moderate sentiment - Let's say a few speculators have picked up the card and pushed the price up to $7.50. This is still a great investment opportunity, even though sentiment is not zero.

- Moderate-to-high sentiment - Now let's say a few more speculators pick up the card and push the price to $10. Now it's fairly priced and no longer presents a great opportunity.

- High sentiment - Finally, suppose even more speculators pick up the card and the price now settles at $12.50. This now represents a bad investment due to overoptimism.

So as you can see, the trick is not just to spot cards with low sentiment in some absolute sense, but low sentiment relative to what it would be if the card were fairly priced.

Holding all else equal, we want to invest in cards with low sentiment. The reason is twofold. First, the price to buy in will be cheaper, as it will be deflated relative to otherwise similar cards with high sentiment. Second, the prospects of price changes due solely to hype or speculation will be much better. The hype train will take you much further if you get on at one of the very first stops.

Investing in low sentiment cards also avoids some terrible scenarios. One of the worst things you can do is buy into a card whose price has been inflated by lots of optimistic speculators only to see the price crashing down when they all start to sell.

Sentiment by itself, however, does not paint the entire picture. In order to make a great investment, we want to invest in cards which have:

- Low sentiment

- Low metagame percentage (relative to potential)

- Low format interest in the formats they're played in (relative to potential)

The last two points are related to the dynamics and trends in the Magic marketplace. They are affected by things like high-profile tournaments, set releases, PTQ schedules, and what sets are seeing the most Limited play. I will cover these concepts in a future article.

Conclusion

Hopefully this article has made the idea of sentiment and how it relates to picking good spec targets clear. Another way to describe it would be the hype or optimism surrounding a card.

So in summary, a card's price will be determined both by its demand via Constructed play and its demand via speculation. Holding all else equal, we would like to invest in cards with low sentiment because they are cheaper and have a farther ways to increase if they pick up hype. A way to estimate sentiment for cards on MTGO is to compare prices across cards with the same set, rarity, and similar metagame percentages.

Thank you for reading, and let me know your thoughts in the comments!

- Luca Ashok

I agree with many points here but I believe that using a keynesian model of economic activity is disingenuous here; the price of a card is not simply the confluence of supply and demand, there is another factor, let’s call it leverage or access to market, that affects price. Most players can only really buy from retail or retail -X% sources, whereas dealers and those with greater leverage to the market can buy at buylist; similarly most players whom have lesser leverage can only sell at buylist or buylist +X% reliably, whereas those with greater market access can sell closer to retail.

This plays into a concept of relative value versus absolute value; value is only generated when a transaction occurs. It is only mildly relevant what the current listing price is for X card is ultimately because if nobody buys the card at that price, the only downward pressure is the pressure on a seller to out that card versus hold it for greater profits. As a result the notion of profit or profitable transactions becomes the delta between the price one can pay/demand versus the cost of not acting on the opportunity at hand and locating the product through another means (other vendor, waiting for an event causing lower prices – tournament or metagame event, cracking packs).

I feel that the scope of this article might be a bit narrow as it only explores the concept of absolute value (which is only useful as a metric) versus implied sentiment (which seems to be the delta between perceived value based on market penetration and listed price) which doesn’t paint the whole picture. It is interesting as a factor to consider, but a lot hinges on factors that aren’t discussed or referenced in this article.

I probably should have made it more clear, but my viewpoint is almost entirely influenced by the MTGO market as opposed to the real life one. I think that online the leverage or access to market as you described is very similar across all market participants. Bots may be able to get a slightly better price, but they can’t do that consistently for very large quantities except in rare instances like a few of the big bot chains that have built a strong following.

“Value is only generated when a transaction occurs.” This is where I disagree. Profit can certainly only be generated when a transaction occurs, but I think a card can continue to give a player value as he plays in more tournaments. Then, once player 1 sells a card to player 2, he transfers all of the future value the card can bring through play in exchange for cash. This is why a Standard only playable card will eventually decay in value as the season ends. I think this effect is much more pronounced on MTGO since 99% of magic play is in a true constructed format (almost no casual play from what I can tell.)

Anyways, this is my rough conception for how MTGO prices are determined (certainly not guaranteed to be correct.) I would be interested to hear some of the other factors you find are relevant.

Interesting perspective. I think the reasoning has some merit and at least it gives you a baseline for many specs.

I think one or two things the mtggoldfish metagame data doesn’t (can’t) take into account is the rate of non-tournament play (~casual, although for Standard people might be playing real deck without entering tournament) and the non-ranked tournament finishes. Maybe I’m wrong but it seems to me that the % play for cards reported in these metagame data represented only the top finishers (prize places?) leaving half of the other cards played outside of these tables.

This being said it makes sense to buy cards with “lower sentiment”. It would be great to come back to these tables and prices in a month or two.

My analysis hinges on the assumption that the mtggoldfish data (which is heavily concentrated on the top results) extrapolates well to the entire set of decks being played. There are probably some biases, but I think it is a decent proxy. Another issue is that the data is also lagged a bit since I assume it averages the decks played over the last X days.

I used to make all of my investments based on historical prices, so I think it was a positive step to start to try to disentangle whether the past or current prices were based more on heavy play or on heavy speculation. It still boggles my mind that hangarback walker can be so much more expensive than abbot of keral keep despite them seeing roughly the same amount of play in Standard and very little play outside of standard from what I can tell. My best guess is that this is due to heavy speculation on hangarback walker. (It certainly does have more potential to go back to it’s $15 tag if it goes back to it’s previous metagame% when it was in every deck.)

There is also another effect that I forgot to mention in the article where colored cards are printed slightly more often than colorless cards when you can pick a color at the prerelease.