Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, readers! Today's article concerns an issue I've seen popping up on the forums. It's particularly true with regards to all the Reserved List spikes we've seen recently. While some make sense, others don't.

We at QS do not advocate for the "pump and dump" strategy---in fact we actively rally against it. Magic finance doesn't have the Securities and Exchange Commission to keep people in check; people can and have manipulated the card market repeatedly. That being said, it's often difficult if not impossible to determine if demand for a given card is being driven by individuals or the market.

- Market-driven - A price is market-driven when there is enough demand from a large enough population to sustain that price. The available supply usually needs to be large enough to allow for an individual to buy as much as they want without dramatically affecting the price.

- Individual-driven - A price is individual-driven when there is a small enough quantity in the supply that an individual can influence the pricing significantly.

The Magic card market is small enough that it can be driven by individuals at times. If we look at a Standard rare (of which there should be plenty available) we are likely to find maybe 5,000 copies online at any given time between all the major and minor retailers. Compare that to McDonald's stock (MCD), which has 918 million shares outstanding.

So if I really like a $2 card I could in theory own all the available copies for around $10,000 (assuming I was somehow capable of buying them all at the same time and they were all the same price). In order to do that for McDonald's I'd need to have $105.5 billion.

Self-Fulfilling Prophecies

But what happens when a card has very few copies listed online at any given time? Let's look at something like Shahrazad.

This rare from Arabian Nights is exceptionally old, but also banned in pretty much all relevant formats (Vintage, Legacy, Commander, etc.). As of writing, there are only 22 copies on TCG Player currently with prices ranging from $45.50 (HP) to $71.98 (LP). That's a pretty big price range over a pretty small sample. Not accounting for condition, the average price on TCG Player is $58.82.

If someone were to buy the cheapest copy then the average would shift to $59.37, which only moves the remaining price average up by about 0.93% (still quite a large impact for an individual purchase). If instead that same person were to buy the cheapest 10 copies they would spend $514.49 (not including shipping) and the average now jumps up to $63.74 or a 7.71% increase.

If the buyer now views this as, "wow my cards are worth 7.71% more then when I bought them," they are using faulty logic as there was no true increase in demand for the card outside of the buyer themself. This is where we have a self-fulfilling prophecy.

"There aren't a lot of copies of this card available, so that must mean that demand is high, so I should buy the cheapest copies."

"Oh look, the average went up after I bought the cheapest copies, that must mean I called this one right."

For those programmers out there (or anyone who has enjoyed watching LSV break MTGO), this is an infinite loop.

(Seriously, if you haven't seen that video, do yourself a favor and check it out).

True Market Price

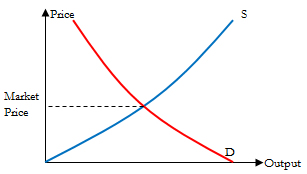

The true market price is established as the prices of X and Y converge (where X is the price people are willing to pay for the card and Y is the price people are willing to sell the card at).

In theory this should be a very simple graph in a non-manipulated market.

Manipulation

Now, this discussion might serve the opposite purpose and encourage people to try and manipulate the Magic market; but profit is only made when items have transferred ownership and payment has been received.

By this I mean if you were to buy all the copies of that $2 card on the internet and the next day people put up additional copies at $3 you might think to yourself, wow, I just turned $10,000 into $15,000, that's awesome. Except because the current price is entirely due to your own demand, the only person expected to keep buying is you...

Thus there's no real demand and you won't make any profit. Yesterday the market only wanted to pay $2 for the card and the market demand didn't actually go up (as you yourself represent a very small percent of the market itself).

So on the parabola above you are still only one dot on the "people will buy" side. If nobody else wants to buy the card at $3 then the sellers will start to drop the price in order to sell. You'll see your imaginary "profit" slip away and the card will recede back to its original market price.

Price Memory

Now, some of you might be saying, "Ah, but what about price memory?" which could be a valid point. However, price memory itself takes time to set in. If a card spikes rapidly enough and there's not enough valid reasoning behind it then there won't be enough people to say, "this card is worth the new price," and it'll eventually slip back to the market price.

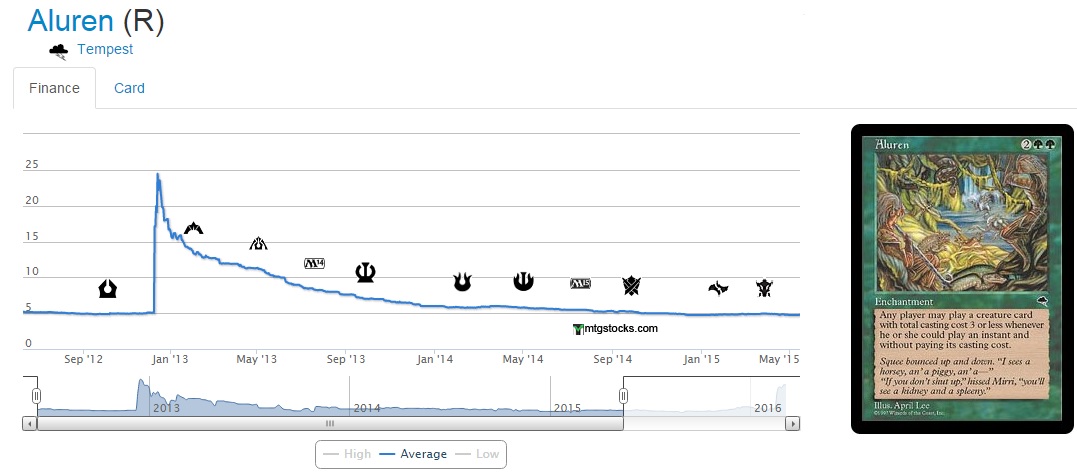

For those who don't believe me, consider this infamous example from 2013:

Aluren spiked all of a sudden in a one-to-two-day time span for no apparent reason. As you can see the number of people buying it didn't really budge and it eventually receded all the way back to its original pre-spike price (now it's higher again thanks to all this Reserved List speculation tied to the announcement of Eternal Masters).

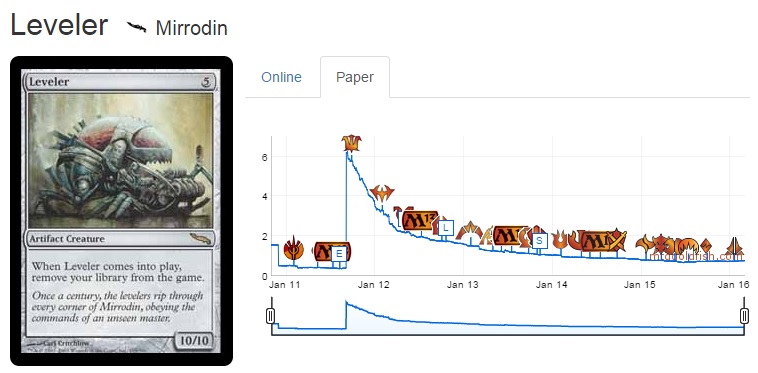

Now this isn't to say that all random spikes don't hold some price memory. For instance Cityscape Leveler spiked hard when Laboratory Maniac was spoiled in Innistrad.

As you can see by the graph Leveler is currently about double what it was worth pre-spike (now around $0.8). But in this case we had more than a few individuals buying up this card.

I recall Mr. Chas Andres himself was big on this one and he discussed it in some of his articles over on Channel Fireball way back when. This likely caused additional people to buy in as he is seen as an expert in the field of MTG finance, and his words carry more weight with a lot of people.

The critical difference between the Aluren spike and the Cityscape Leveler spike is that the Cityscape Leveler spike was caused by a lot of people actually speculating on the card, whereas the Aluren spike was caused by one individual manipulating the market.

Conclusion

In the end, what really differentiates manipulation and self-fulfilling prophecies is the intent of the individual(s) behind it. However, it's important for those without malicious intent to be able to look back on a spec and recognize whether it went up because they made it go up or because the actual market demand was there.

Unfortunately, as nobody is "tapped into" the market perfectly, the only way to truly differentiate between an increase in actual demand and an individual-driven demand is reviewing the price after the market has had time to adjust. To make it more complicated there is no set time period to begin checking, as some spikes can dissipate quickly and some may take a much longer time.

So please, before you post "the next big thing" in the forums make sure you aren't the driving force behind any movement.

Shouldn’t we make this free?

Originally I intended it to be free, but I don’t make the final call.