Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, readers!

We're in full-blown Christmas season here in the US. In honor of that, I'll start today's article with a little anecdote about a trip I took on Saturday the 17th.

There's a tradition in McAdenville, NC where people flock to the city to see displays of Christmas lights put up by the local residents. They have cameras up in the town so people can live-stream, and even a little app for your phone so you can get updates about the show. Having dubbed themselves "Christmastown, USA," the city draws in tons of visitors every year.

This year my girlfriend really wanted to see it, so we decided to go. I can tell you her expectations were really high and she was very excited. I expected it would be one of those crazy light displays synced to music just stretching the length of the town, and that it wouldn't take that long to go through everything. If I was lucky, I might even be able to get back early enough to catch the last showing of Rogue One.

So we drove the hour to get there and then spent two and a half hours waiting to get into the town. Two and a half hours. She loved the lights and displays people had set up; I couldn't believe that my entire Saturday night was being wasted doing this. That mindset kept me from enjoying anything there. (For those wondering, it's not synced up to music like those houses you see on some of the YouTube videos.)

The point of this little story was that both her and I had expectations, but different ones. She was unhappy about the wait but wants to return anyway, because she enjoyed it and wonders what they'll do next year. I wouldn't voluntarily return there if at the end they gave me a choice between a PS4 and an Xbox One. We both had expectations. Hers were mostly met, mine were not.

We often fall into this same situation when it comes to Magic speculation. To complicate things, a lot of us have been through some significant boon times, thanks in large part to Modern's surge in popularity and the massive bull market we had with Modern staples for a couple years. Our expectations are so jaded by such success that we view a normalized market as unimpressive.

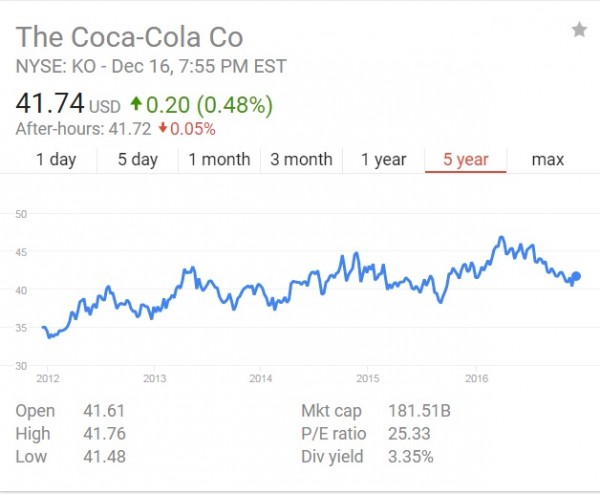

Looking at both these cards, we can see years when they saw massive rises in price, followed by the current plateau (or in some instances declines). Now let's compare those graphs to a stock that a lot of people probably recognize.

There are still a lot of investors who advise buying stock in Coca-Cola as it's been a relatively steady stock for a while now. Even Warren Buffet's Berkshire Hathaway owns a large share in Coca-Cola.

We as Magic speculators might look at this as unimpressive gains. In about five years Coca-Cola stocks went up about $6, or about 16%. That's equivalent to your $1 card going up to $1.16. Many wouldn't invest in a Magic card if they expected a 16% increase over a five-year period, despite the fact that it's healthy growth for a stock.

The Difference Between Cards and Stocks

Now, I will cede that there is a huge difference between Magic cards and stocks. If I had purchased shares of Coca-Cola back in 2012, I could sell all of them almost instantaneously and pocket my profit, regardless of whether I owned five shares or 5,000. On the other hand, if I had purchased a Magic card back in 2012 and wanted to cash out, my ability to liquidate those copies would be severely hindered by the number of buyers paying the new price.

I could probably unload five copies without a huge hassle. But if I had 5000 copies, it would be significantly difficult to do so—if not impossible at any sort of profit.

But the point is that we have dramatically different expectations for stocks and Magic cards, and while this is merited (due to the aforementioned liquidity challenge), our Magic expectations still need to be grounded in reality.

Before you go and buy into a speculation target, you should always know the minimum price that you'd sell out of it at. This is critical because, as my fellow writers have stated numerous times, you can't "time the market." It's very easy to get caught up in constant growth to the point that greed overtakes smart decisions and you end up holding onto something too long until it crashes back down.

Magic card values are dictated by several factors that us speculators have little to no control over. Not only are these factors beyond our control, they are also notoriously difficult to predict in many cases:

- Scarcity - How many copies are available? Save the Reserved List, Wizards can reprint anything at any time. Additional copies in the supply will cause a price drop (barring some instant demand increase matching it).

- Playability - Is there a lot of demand for the card due to its value in a current archetype? A card's usefulness can change with metagame shifts or new printings, and demand can go from red hot to ice cold in a matter of days.

The Cost of Outing

Another important thing to consider before going into a target is what your outs are. We in the Magic community may look at a card like Tarmogoyf and say, "Clearly there's a strong demand for this card; look at it's price." But if we could somehow determine how many copies were bought and sold each week, that number would pale in comparison to the number of trades that even most minor stocks see in a given day.

The Magic community is still a very small part of the overall population, and as print runs increase in size, the existing playerbase's demands can only absorb so many copies. So if you stockpile a large number of copies, you're far less likely to be able to unload them without watching the price drop as you do.

The other common option is to sell to a buylist (which typically does allow you to move a larger number of copies than you would selling to a single player). However, with that route you aren't going to get the retail price of the card you're looking to move. If we assume a typical buylist price of 65% on a $1 card, then in order to make a 16% profit, the price would have to go to around $1.78. That's a 78% increase in value in order to make just 16% profit.

So before buying a large number of copies of a card, you need to run these numbers to get a feel for what kind of price increase is necessary to turn a profit.

Take a Step Back

It also helps to take a step back and look at each speculation target a bit more analytically. For each card I'm considering speccing on, I like to ask myself a series of questions.

- What events would need to occur for this target to see significant enough gains for me to make a decent profit? What is the likelihood that these events occur?

- What could happen that would make this target a dud? Can I mitigate any of these risks myself?

- How confident am I in this target?

- How much am I willing to bet on this confidence?

- What will happen if I'm wrong?

- What will happen if I'm right?

- How will I track this target's gains/losses? How often will I check?

- What price would it have to drop to for me to bail on it? How much would I lose if I did bail?

- Are there similar cards whose prices I can review to see how they performed?

- If so, does their price record concur with my assumptions?

- If not, what makes me think this card will not follow a similar trend?

Conclusion

I've tried to remain relatively upbeat in Magic speculation recently, as I've seen a lot of writers and MTG speculators (some here on QS, some not) show a lot of concern about the Magic finance market.

However, I am a risk-averse individual by nature. This is why I'm more hesitant to invest in new formats like Frontier (especially after getting burned by Tiny Leaders speculation). It's also why I'm hesitant to invest in formats with a constantly shifting metagame—not that I don't have Standard specs in my portfolio, but I have much less Standard than other formats.

This also means I put more emphasis on my method, and the reasons behind each speculation target, than I do on "gut feeling" or emotional response. That isn't to say that gut feeling or your excitement about playing a new card aren't viable factors to consider when picking a speculation target. But they shouldn't be the only factors, and they shouldn't be the driving force behind your expectations.

One concept that’s stood me well on Magic Speculation, (and avoiding other sketchier various investment schemes in general) is “tell me how I can lose money doing “. If you can’t tell me how I can lose money, then you can’t tell me how to avoid losing money doing —a huge red flag. You cover those points well; sketchier “investment opportunities” will talk all about the potential profits, but either omit or downplay risks.

doing “whatever”, that is–apparently carats and the stuff within them get excluded from replies.

Don’t forget KO stock paid you a 3% dividend annually over those 5 years! Plus think of those voting rights you get for being a shareholder. (Doesn’t impact your message, but I couldn’t resist). 🙂