Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome back, readers!

Today's article is one I've been meaning to write for a long time. It discusses something I've noticed about myself, which perhaps applies to many of you as well: the tendency to think constantly in terms of return on investment (ROI).

Most QS readers are likely unwilling to trade Legacy cards for Standard cards straight across. At the most basic level, we all understand that Standard cards will lose most of their value at rotation. It's not worth it to trade a $20 card that has held its value for years for another $20 card that didn't exist last year, and which will likely be worth $5 in another year.

It's just a bad trade at any point in time other than now. So we don't make that trade because we understand that the future value of the card will be less than its current value.

The next level of thinking is when you have something less obvious—say a proposed trade of Modern staples for other Modern staples. Here the whole issue of the obvious expected drop in value is out of the equation. That doesn't mean, however, that the concept of comparing likely future values shouldn't take place.

For example, when you have a high-dollar Modern staple like, say Liliana of the Veil, there is a high likelihood of her getting a reprint soon simply because a large number of Modern players are clamoring for WoTC to reprint it. Many of us (myself included) believe she will be in Modern Masters 2017; if so, we would expect her price to drop (likely in the neighborhood of 20-25%).

If we can trade our copy at her current value of around $95 towards cards that we know won't be in Modern Masters 2017 (like, say, Khans fetchlands), we can "lock in" her current value. We might even be able to get a premium for "trading down," though currently so many players expect her in MM17 that it may be difficult to find someone willing to make this hypothetical trade.

Either way, the cards we acquire in this trade aren't likely to be reprinted in the near future, and may steadily go up until their next reprint.

The ROI Mindset

This mindset of comparing future expected values is what I refer to as "return on investment thinking." Normally when we discuss return on investment it's more in the realm of stocks and bonds, where we (as stock or bond holders) expect to see some amount of gains (returns) on whatever money we invest. I borrow this terminology because when I trade I consider each of my cards' current values as my "investment," and I'll only trade for cards that I feel will grow in value at a faster rate than the ones I'm trading away.

One word of caution: because this thinking focuses on future values, there is obviously some risk associated with it. If we trade away our Liliana of the Veil and she's not in Modern Masters 2017, she'll likely jump by 20-25% and we may end up losing out big time.

Also remember that WoTC has complete control over what they print or reprint—thus, unlike with most other stocks/bonds, one decision by them can greatly affect the value. We as speculators have no control over this. There's always the possibility of them printing an even better option than the current ones (say, tri-color fetchlands) that would greatly hurt the values of the current ones.

This doesn't mean that they will reprint everything valuable all willy-nilly (they haven't in the past). It just means that we have to accept that sometimes we may end up very wrong.

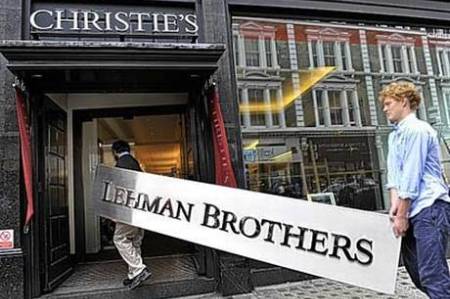

Similar things do happen with stocks and bonds, so it's not like we're the only ones taking these types of risks. History is littered with companies that showed a lot of promise and ended up making one (or more) poor decisions which bankrupted them and ruined their investors.

Taking It Too Far

There is one other danger to this mindset: when it seeps too much into other aspects of your life.

Of course, it's perfectly fine to look at some non-Magic things with this mindset. For example, if you're looking to buy a house, you'll likely notice there are many factors determining the value of the house, and it's never set in stone. In one neighborhood you might find that a 1200 sq. ft. home costs the same as 2000 sq. ft. home in another neighborhood; different houses have different amenities, different school districts, etc. You'll also be given lots of options when it comes to how you want to pay for your home: 15-year mortgage, 30-year mortgage, some other set time frame.

I can say from personal experience that I looked at well over 20 houses before finding the one I currently live in. I had to decide early on what kind of investment I wanted to make (i.e. how much did I want to spend). I was given a nice range of potential mortgage options and kinds of houses I could afford to purchase right off the bat.

It was important to me that my house payments be low enough that I didn't have to stretch my budget just to pay them (it also helps that I'm not the type who wants a grandiose house). I opted for a lower investment, because the risk of not being able to pay my mortgage was one I wasn't willing to make.

In other financial decisions, then, the ROI mindset can be enormously helpful. However, there are instances when this mindset can have negative consequences on your life. For example, when the happiness of loved ones suffers because of your unwillingness to spend money.

The number one cause of marital strife is related to finances. When your significant other wants to go on an expensive getaway and you immediately think of what other things you could spend that money on, it's easy to jump to diminishing the other persons wants or desires as a poor return on investment, compared to other things that could be purchased. Obviously this is a scenario where trying to "maximize value" will cause many more problems than it solves.

Now this isn't to say one should always bend to the will of your significant other, as that too will lead down a very unfortunate path. But it's important to be able to separate expenses into "investment" and "non-investment" categories. The more focused you become on the "investment" side, the easier it is to start viewing all things from that mindset.

If you constantly view your expenses as investments, you'll find there are a whole lot that seem poor, but you'll also watch as your happiness goes down the drain and you turn into an Ebeneezer Scrooge of sorts.

Striking a Balance

I realize that this article doesn't focus solely on the Magic finance realm, but I've been wanting to write it for a while. I've seen my own joy from the game of Magic diminished because of this mindset.

I don't play in major tournaments because I think the entry cost vs. prize is a bad return on investment, and I'll often skip out on local tournaments that I might have enjoyed greatly because they too seemed like bad ROIs. I've also caught myself wanting to trade a lot less (which used to be my main reason for attending FNMs), simply because I've become laser-focused on trading only for value, which has taken much of the fun out of it.

The key is to strike a balance. It may seem like you'd always want to maximize your ROI, but you have to leave room for living life as well. Just be careful about how you define the "I."

The statement about finances leading to problems in marriage. Do you have any references for that? Mostly out of curiosity.