Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Welcome to the MTGO Market Report as compiled by Matthew Lewis. The report will cover a range of topics, including a summary of set prices and price changes for redeemable sets, a look at the major trends in various Constructed formats and a "Trade of the Week" section that highlights a particular speculative strategy with an example and accompanying explanation.

As always, speculators should take into account their own budgets, risk tolerances and current portfolios before buying or selling any digital objects. Please send questions via private message or post below in the article comments.

Redemption

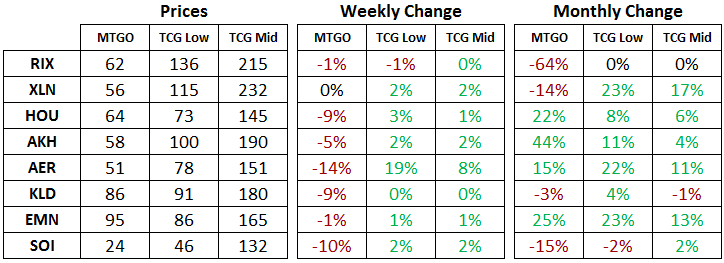

Below are the total set prices for all redeemable sets on MTGO. All prices are current as of February 19, 2018. The TCGplayer low and TCGplayer mid prices are the sum of each set's individual card prices on TCGplayer, either the low price or the mid price respectively.

All MTGO set prices this week are taken from GoatBot's website, and all weekly changes are now calculated relative to GoatBot's "full set" prices from the previous week. All monthly changes are also relative to the previous month's prices, taken from GoatBot's website at that time. Occasionally, full set prices are not available, and so estimated set prices are used instead. Although Hour of Devastation (HOU), Amonkhet (AKH), Aether Revolt (AER), and Kaladesh (KLD) are no longer available for redemption, their prices will continue to be tracked while they are in Standard.

Standard

Prices in Standard took a dip this week as the resurgence in interest wanes in the face of all the activity in Modern. From a macro perspective, there's no strong buying or selling opportunity at this moment in the churning market. I am continuing to keep an eye on Ixalan (XLN) and Rivals of Ixalan (RIX), with the fall set close to being a buy. The price of a full set of RIX is turning down, though, and it is still a few tix away from a good buying level.

My biggest trouble with full set speculations is the urge to jump in too early. Prices can look like they are reaching attractive levels, but usually there's plenty of time to be patient and wait for an even better opportunity. I think this is the case with the XLN and RIX, since there is still over a whole month of drafting to go. Don't get an itchy trigger finger just yet if you are a speculator, but if you are a player looking to fill out your playsets, then prices are just fine if you are going to get some use out of the cards in the next few weeks.

In terms of when to pull the trigger on these two sets for speculators, how the market reacts to the release of Masters 25 (A25) in March will be telling. If the set is popular to draft then prices will turn downwards as players sell their cards for tix in order to fund their drafts. At the very least there will be a temporary dip in the price of XLN and RIX boosters. Speculators will definitely want to have some tix available to scoop up deals in mid-March, the next best buying opportunity on the horizon.

In terms of singles, the emergence of a new ramp archetype in Standard has pushed the price of Hour of Promise up to 2.0 tix. This deck includes a ton of creature removal in Fumigate and Settle the Wreckage, as well as a Approach of the Second Sun as a victory condition. The use of Thaumatic Compass // Spires of Orazca is also quite novel, and the transformational sideboard includes a number of hard-to-deal-with creatures like Carnage Tyrant and Nezahal, Primal Tide. Have a look at the deck list here.

I've long since sold my copies of Fumigate, but Hour of Promise is a card that I am holding still. If you are like me and looking at this failed spec turned good, then you might be tempted to sell right away. I think this is a fine call, but I also think the card will hit 4 tix before the uptrend is over. This looks like a fun deck to pilot, and ramp has always been a popular strategy, so I expect continued uptake among the MTGO player base, which will push the components of the deck like Hour of Promise higher.

Modern

It's a boom time for Modern, and you don't have to look further than any of the Jund components, including the mana base. Stomping Ground, Wooded Foothills and Blackcleave Cliffs have all powered to one-year highs, that last one with an assist from the Hollow One deck. Liliana of the Veil has also seen a strong resurgence and is tussling with Jace, the Mind Sculptor for most expensive card in the format.

I think Liliana has the chance to go to 80 tix, but it's currently wavering at just under 70 tix. I'd like to see this card back over 70 tix in the next week to demonstrate continued buying from players. I am still holding the copies I bought in October during the Innistrad (ISD) flashback drafts, as I don't think we've seen peak Modern interest yet. If the price of this card continues to drift down into the 60- to 65-tix range, then I think that selling would be correct as the uptrend would be over.

Trade of the Week

For a complete look at my recent trades, please check out the portfolio. In some ways, the unbanning of Jace in Modern was predictable. A few times in the past I have speculated on this exact possibility, but this time I had dismissed the idea due to the diversity of decks that Modern was displaying in high-level events. Unfortunately, there will not be a chance to rewind this scene and make a boatload of tix overnight, but I started thinking about other long-term opportunities that might be sitting around, waiting for their moment.

At the top of the list are the Innistrad (ISD) check lands. Let me explain my reasoning. First of all, they rarely see Modern play so they are not too expensive; outside of Sulfur Falls, they are all cheaper than 1 tix. Since they are cheap the reprint risk is minimal – or rather, if they are reprinted, the downside loss is capped at a low level. Like the ISD check lands, the Worldwake (WWK) creature lands have only seen one printing so far, but due to their play in Modern, the reprint risk attached to this cycle of of lands is much more substantial. A reprint would significantly lower their price and generate large speculative losses for anyone holding the WWK creature lands. I would steer clear of these outside of your playsets, but the ISD check lands are a different matter. In fact the whole strategy here is to bank on a reprint, but in a Standard set.

If the ISD check lands are reprinted in a Standard set they would immediately become staples and integral to deck-building decisions. In terms of market impact, the originals from ISD would immediately be priced at a level to reflect that. To see this effect we only have to look at the fall release since XLN reprinted the allied-colour check lands. This was the fourth reprint of this cycle of lands, albeit the first reprint in a non core set. Just prior to the release of XLN Glacial Fortress carried a price tag of over 2 tix while the cheapest allied colour check land was Sunpetal Grove at 0.6 tix.

I think it would be safe to say, given the lack of a reprint, that the ISD check lands would start in a higher price range, say 1 to 3 tix at the outset with the possibility of the most in-demand card to be 4 tix or higher. The trick to here is to be able to predict when this reprint might come to Standard. I think it's possible that this will occur in Dominaria (DOM), the next large expansion due in April. If not, then each large set, including this summer's core set, will be a chance at a reprint, but it might be a year or two before the reprint actually occurs.

With this timeline in mind it's clear that this has to be a long-term speculative position. Fortunately the prices are low enough that if the reprint does not happen in the next three or four large sets there will be ample time to expand the position with cheaper copies. This is no get-rich-quick scheme but it's almost a certainty that a reprint will happen – and that anyone holding copies of the ISD check lands will experience an overnight windfall when the opposing-colour check lands are spoiled or previewed for an upcoming set.

I should have stuck to my guns and held onto Hour of Promise. I still tripled up, but I could have done MUCH better.