Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

From 2017-2018, the Old School community exploded as the format gained traction outside Sweden (its birthplace) and around the globe. This growth was enough to earn the attention of the finance community. Speculators and investors alike flocked to these older cards as a safe haven, expecting to turn profits galore.

And it worked, if you purchased cards early enough in the cycle. But anyone who came to the party in late 2018 was met with an unpleasant surprise: prices plateaued and then dropped far from their peaks. This left speculators and vendors with excess stock for which they paid too much. Demand slowed at the higher prices (naturally) and prices had to drop back down again.

So where are we now? What’s the trajectory from here? What should we expect for 2020? This week I’ll share my lukewarm viewpoint and reveal how I’m cautiously approaching the year.

Assessing the Landscape

First, I need to examine where supply and demand stand as of this moment. These data will be important in determining both direction and timeline for the year to come.

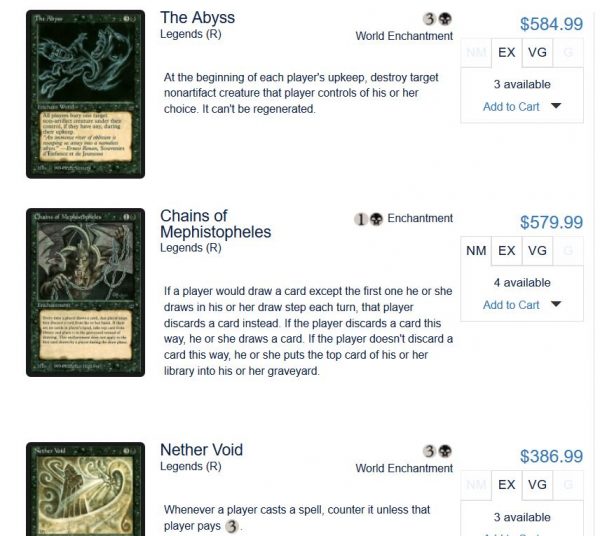

On the supply side, things still look relatively glum. Browsing sites like Card Kingdom and ABUGames, which are known for keeping robust stock of Magic’s earliest cards, I find many copies of various cards sitting in stock.

For example, at Card Kingdom, I’ve seen the same copies of Nether Void, The Abyss, and Chains of Mephistopheles in stock for weeks now. I’ve been following these closely in the hopes that they drop pricing further (making them more attractive to acquire with store credit). Since I started watching, their price has drifted down about $10-$20…still not enough. (As an aside, for some reason Moat has sold well for Card Kingdom, and they have increased their price twice in the past three months).

Browsing stock from other early sets, such as Arabian Nights and Antiquities yields a similar picture. Even Alpha is relatively plentiful. I remember thinking the time was soon coming when Alpha rares would disappear from the market due to their scant supply. Now, other than Black Lotus, you can have your pick of Power, Duals, and high-end rares on Card Kingdom’s site. While ABUGames’ stock of high-end Alpha and Beta cards isn’t as robust, Card Kingdom seems to have enough supply to keep the market afloat.

Besides these two vendors, I’ve also noticed supply has flowed back onto TCGPlayer and eBay. In general, if you want a fair price on an older card, there are plenty of options available.

So how about demand? The health of demand is a little trickier to evaluate. We can gauge demand by examining buylist prices, but these have obviously dropped as stores restocked the staples. Vendors have been slow in adjusting their prices, so it’s no surprise their overpriced cards haven’t been selling rapidly.

I’d prefer to look at this more anecdotally. I’m an active participant in the Old School Discord group, and cards are posted for sale there on an hourly basis. Most times a card is posted with a reasonable price (10-15% below TCG low and Card Kingdom), it sells. I have had success selling through a couple playsets of Thunder Spirit, a Beta Icy Manipulator, and some Dual Lands lately. In each case, these sold within a few hours.

Of course, this isn’t enough data to make a definitive claim about market demand. I’ll merely conclude that the most desirable, older cards can still sell easily as long as their prices are adjusted sufficiently. No one is paying retail on these cards right now, but a 10-20% discount to retail will net a quick sale. This market is still liquid enough if you’re an eager seller.

My Current Action Plan

The current landscape of supply and demand is questionable at best. Increasing supply and falling buylist prices make for a challenging environment in which to turn a profit. Up until recently, my favorite angle has been trade credit arbitrage with ABUGames. Falling trade credit offers has rendered this strategy nearly obsolete.

For example, I recently purchased a heavily played Beta Smoke from Cool Stuff Inc for $45 because ABUGames offered $90+ in credit. By the time the card arrived, however, ABU’s offer had dropped 30% to $69.60, eliminating the profit potential entirely. The same happened to me with Unlimited Fork as well.

These constantly dropping numbers has turned me off completely from ABU credit arbitrage. So where does that leave me?

Put simply, I’m in a “buy what I want to keep for a while” mode. Quick flips and easy arbitrage has mostly evaporated except for a few corner cases. I’ve shifted my focus away from these opportunities and towards adding cards I most want to collect and play. If I’m going to sink more cash into Old School, I want it to be in cards I can enjoy—I can’t count on easy gains at this time.

For those curious, my recent acquisitions have included a playset of Thunder Spirit, a Nether Void, and a Beta Copy Artifact. I’m trying to pick up cool cards I can potentially use, and have a decent enough demand profile. Prices have retreated so much that I felt content acquiring these at their current prices.

In summary, I’m a net buyer at these depressed prices, but only the most useful/interesting/playable cards. This is not the time to be buying random Old School junk that no one plays, such as garbage Alpha and Beta rares and terrible Legends cards.

Looking Ahead to 2020

After my failed attempt to predict trends in 2019, I’m hesitant to make any bold predictions for the year ahead. In Old School in particular, it is especially difficult to predict what will happen with prices.

And it’s not just me having this existential dilemma—this past weekend, the Old School Discord was abuzz with debate on what card prices will do in the future. Some felt that Old School play has leveled out and prices will continue to drift downward. Others were banging the drum on Alpha, stating that even a fading market could still support cards from Magic’s first set due to its collectability. Others still have seen new Old School players entering the format, and predict a recovery in prices this year.

For me, I am voting with my dollars. I don’t think buying a stack of inexpensive Alpha Holy Armors will be all that rewarding in 2020. Instead, I’d rather be taking advantage of these price drops by purchasing cards I’ve been wanting anyways. There are plenty of deals to be found these days, between eBay auctions ending lower, peer-to-peer deals, and coupons galore. Sticking to the most playable cards ensures the best demand profile.

Want some specific examples? Well, Winter Mishra's Factory seems to have pulled back dramatically and is highly desirable. I already mentioned Thunder Spirits and will double down on them here. I especially like Beta cards that are playable in other formats: Swords to Plowshares, Lightning Bolt, and Sol Ring come immediately to mind. I’d avoid Dark Ritual, though—there just seems to be a ton of these for sale out there.

Wrapping It Up

All the rampant speculation in 2017 and 2018 inflated Old School prices tremendously, and prices became highly unsustainable. It has taken over a year for prices to cool back down toward reality, and I genuinely believe we’re finally leveling out. That begs the question, though: where do things go from here?

I’m hesitant to be 100% bullish as I have been in the past. Magic is in a weird place right now, and prices aren’t as volatile as they once were. I check MTG Stocks daily, and many times there are only a few cards that have moved more than 5%. Most movement in Old School cards has just been noise.

The daily movement of up 3%, down 4%, up 5%, down 3%, etc. probably won’t end this month or next. As 2020 unfolds, however, I do expect some of the more desirable Old School cards to climb. But I wouldn’t advocate speculating in anticipation of this trend. Instead, buy only what you’ve been wanting to acquire so you don’t mind waiting patiently for things to unfold.

With some luck, we’ll see a nice rebound in staples. If not, and prices fall further, I know of dozens of players in the Old School Discord who will eagerly buy at lower prices given the opportunity. This provides a sort of price floor, making me feel more confident in my purchases today.

…

Sigbits

- If you want to review what cards are most desirable from Old School, I’d recommend checking out their hotlist. You won’t find stuff like North Star and Cleanse on there. Instead, you’ll find the stuff that’s selling well for the store. The top card on their list today is Drop of Honey. This is a card that skyrocketed to $600 on Legacy play (of all things), but has pulled way back from that high. Now CK offers $245 on their buylist. A recovering Old School market would likely send this card higher.

- I mentioned Beta Lightning Bolt before and it’s no coincidence the card is on Card Kingdom’s hotlist with a $140 buy price. Card Kingdom’s aggressive buy price is somewhat surprising given they nine copies in stock already. They must sell this one quickly to maintain the high buy price.

- Here’s one I haven’t seen on Card Kingdom’s hotlist in quite some time, but is there now: Mirror Universe. This is one that speculators and investors hit hard due to the card’s more iconic nature. Then the price pulled way back down when people realized it had little utility in play. Card Kingdom’s buy price is $120 now, and they have a dozen copies in stock. No need to rush on this one if you need a copy—more inventory will have to drain before this can tick higher again.