Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

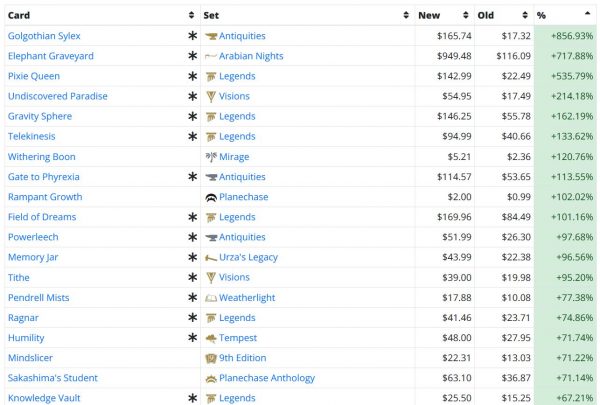

It’s becoming a daily tradition. Much like 2017, 2020 has become the year of the Reserved List buyouts. Each and every morning I check MTG Stocks’ Interests page to learn which cards were cleared out of TCGplayer. Reviewing the weekly gainers shows the breadth and depth of these buyouts.

Each time a card spikes, a series of emotions and thoughts run through my mind. But acting on instinct would only lead to poor choices—as a collector of Old School cards, the FOMO can be difficult to resist. Luckily, I’ve been through these buyouts before and know what to look for.

This week, I’m going to peel the layers of the onion back, highlighting the research I do when understanding these buyouts. This process helps me keep my emotions in check and prevents me from making rash purchasing decisions that would likely lead to losses.

The Numbers

One Legends card I’ve always appreciated for its beautiful artwork is Pixie Queen. Because of this, I made sure to purchase one copy a few years back—it probably cost me around $10. When the card spiked on MTG Stocks, my interest was immediately piqued. Not because I wanted to sell (though everybody has a price), but because I wasn’t sure why the crazy high price tag came out of nowhere.

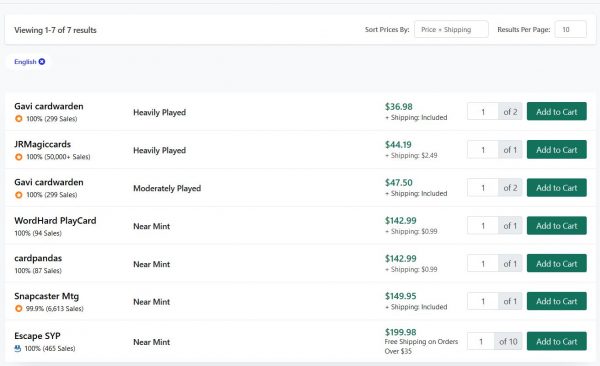

The card had been largely bought out, that was for sure. But the nature of TCGplayer’s (and therefore, MTG Stocks’) pricing algorithm was creating the artificially inflated price. TCGplayer calculates its pricing using an average of lightly played and near mint listings. Let’s take a quick look at Pixie Queen’s English TCGplayer listings as of Sunday, August 16th:

While an argument can be made that near mint copies of an Old School card merits some premium, I adamantly disagree with those who value near mint copies three times its moderately played price and nearly ten times the price from a week ago. There’s no sudden demand for this card other than interest driven by speculation. The Reserved List card may not be a $20 card anymore, but even $40 or $50 feels like too much for the unplayable green rare.

The issue is that someone listed ten near mint copies for $200. Then others came in with their copies, slowly undercutting each other to compete. Until additional listings are posted at lower prices (and I guarantee they will be), the TCGplayer pricing reflected will remain inflated. Considering the market price (reflecting actual sales) is $22, it’s readily apparent that these prices are way too high, perhaps designed to highlight the buyout and draw attention.

Here’s another example: consider Elephant Graveyard, a barely-playable land from Arabian Nights. This is another card I have a single copy of for my collection—I acquired it from Card Kingdom for something like $50 just a few months ago. Now it’s $949? I don’t think so….

Check out the listings on TCGplayer:

Prior to the spike, this was a $116 card (for LP/NM copies). The damaged listing isn’t completely unreasonable, at $86.96. And the cheapest LP copy isn’t completely offensive, representing a 3x premium versus the old price. If enough people experience FOMO, that copy could sell. But look at the bottom three listings: $1499, $1995, $2999.95?!

I guess the one copy is graded BGS 9, so maybe that carries some premium (though not that much premium). These listings are not going to actually sell. I can’t pretend to know the sellers’ motivations for sure, but my suspicion is that these listings are set exorbitantly high for the purpose of creating a perceivable “spike” in price.

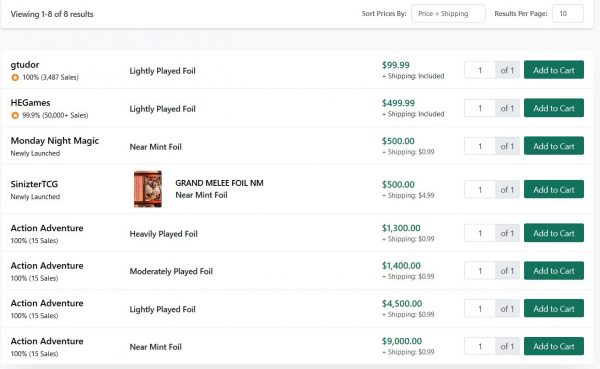

While not Reserved List, foil Grand Melee is another example of this price manipulation.

This is an ancient foil so it’s no surprise the card has low inventory. But the “market price” for foils is $5.87. There’s no reason this should be showing up on MTGStocks as being worth $2500. But the seller Action Adventure controls half the current inventory, and they are using silly high pricing—this is warping the price and making the card look far more valuable than it actually is. We need to beware this predatory pricing behavior, and truly dig into the data to see if a card truly merits the high price tag or if sellers are purposefully manipulating the price.

People check MTG Stocks, see the card is now “worth $1000”, and scramble to buy up cheaper copies throughout the internet, further cementing the buyout that already started. It’s all a numbers game.

Lost Opportunity? Not Likely.

“But Sig, I’ve been wanting an Elephant Graveyard for my collection and my tribal Elephants Commander deck! Now I can’t afford one!”

Believe me, I completely understand this frustration. The alleged price manipulation displayed above is borderline predatory, seeking to capitalize on FOMO and emotional sentiment just like the quote above. The most important thing to do here is to take a step back and consider a couple points.

First, I need to share some tough love. I understand there may be some younger players new to the game who are interested in buying a few cards from Magic’s history. This population probably exists. But for most others, you’ve had over two decades to acquire these cards at lower prices. These Reserved list buyouts occur every couple years; they should not surprise anyone anymore. If you haven’t prioritized these cards previously, they must not be that critical to your collection. I’m mad I don’t have a Gaea's Cradle and now they’re $700+. But I accept that I didn’t prioritize that card and I have to be OK with not owning one.

Second, consider what happened back in 2017 when we last had rampant Reserved List buyouts. Nearly three years ago to the day, Elephant Graveyard spiked from $50 to $300 according to TCGplayer’s pricing. Four months later it retraced all the way back down to $130. The card ultimately settled in the $100-$120 range. If history is any indication, Elephant Graveyard will likely settle at around 2x-2.5x the previous price—I predict between $200-$250, with MP/HP copies in the $100-$150 range.

Yes, it’s unfortunate that the card is suddenly going to be pricier, and it’s annoying that this increase is driven by speculators and collectors alike. But the price won’t stay 10x its old price for very long. As long as you’re patient, the price will come back down again. You’ve waited decades to acquire the card, a few more months won’t hurt.

Lastly, it may be helpful to remind yourself that at least some of these new, inflated listings are predatory in nature. These sellers are hoping to prey on others FOMO and sell their copies at crazy-high prices to cash in on the trend. They buy a card out, then re-list copies on TCGplayer at 10-20 times the previous price. The card shows up on MTGStocks, people panic-buy, and the speculators profit. The only way to “beat them” is to ignore the card for a few months. Eventually, sellers will race to undercut each other and the price will normalize.

Wrapping It Up

Reserved List buyouts are in vogue again—we’ll probably see cards disappear from the market throughout the next month or so. Eventually, this activity will taper off and things will return to normal. Once that happens, the market will begin its multi-month healing process as supply gradually returns and the price slowly normalizes.

The key here is to eschew emotion in favor of understanding the numbers. During this period of regular buyouts, it’s fun to watch the value of your collection balloon; it’s equally frustrating to see desirable cards disappear from the market. You need to keep a level head and remember that some of the new, inflated listings are predatory in nature.

A good rule of thumb is this: during buyout season, try to be a net seller. In other words, one should be selling cards into these spikes while avoiding FOMO and purchasing the bought-out cards. If in response to a buyout, you can find copies of a card at its “old price”, then it’s probably fine to sink the funds in if it’s a card you’re OK with keeping for a while.

But remember that by doing this, you’re contributing to the buyout even if unintentionally. These market manipulators buy out lightly played and near mint copies on TCGplayer, leaving behind the silly copies listed at $2000 or what have you. The price “spikes” according to MTGStocks, and others buy up the HP/MP copies, as well as any copies at the old price across the internet, and the buyout is thus completed.

The only way to combat this strategy is to not buy. Or, if you want to make a few bucks, you could buy copies you scrounge up at the old price and then list them for a modest profit, undercutting all the other sellers on the market. You are still contributing to a buyout doing this, but at least you are helping the card retrace down to a more normal price.

No matter what you decide to do, the key is to keep emotions in check, examine the data, and only then decide if action is merited. Taking this step back will help you avoid making reckless purchases during a buyout and, hopefully, reduce your anxiety as you see desirable cards temporarily escape your financial reach. A little patience, and a spiked card will inevitably retrace back to normal—it just takes a few months!