Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

One thing I don’t discuss frequently in this column is my passion for running. I began partaking in this near-daily exercise routine sometime during college, circa 2007. I took a year off here or there throughout the subsequent 16 years, but nowadays I’m as dedicated to the pastime as ever before.

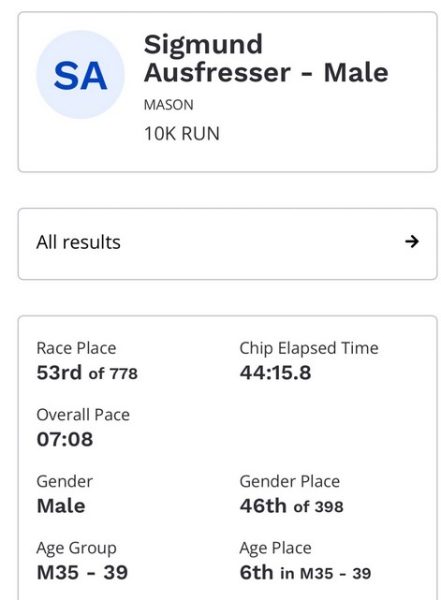

Last weekend I ran a 10K race, approximately 6.2 miles. This was an uncommon race distance for me to run, and I felt the challenge of pacing early on. I have more experience running half marathons, when you want to start much slower and monitor pace throughout, or 5K’s, when you want to go out fast and endure 20-30 minutes of pure pain.

The 10K distance is in-between—thus, you can’t give it your all as you’ll peter out before the finish, but you also can’t go out too slowly at the start because you’ll lose precious time that you won’t be able to make up in the latter miles of the course. The former is what happened to me this time around, as I started out far too fast and then lost a little speed for miles 3-6. Still, I’m happy with the performance overall given that the temperature was around 20 degrees at the start time!

Pacing In Magic Finance

What does this have to do with Magic? Like in running, pacing can be very important when buying and selling cards. There are certain scenarios, like in a shorter race, when you want to buy and/or sell cards quickly and aggressively. On the other hand, some situations merit a slower, more gradual approach, as in a longer race.

To simplify the thought process, I’ve come up with four pacing patterns that should be implemented in different scenarios, depending on the context. The four patterns are:

- Buy quickly, Sell quickly

- Buy quickly, Sell slowly

- Buy slowly, Sell quickly

- Buy slowly, Sell slowly

Let's break each of these down one at a time.

Scenario 1: Buy Quickly, Sell Quickly

In this situation, the goal is to purchase cards to flip quickly, minimizing hold time and therefore any exposure to the risk of price corrections downward. These are the buyouts that used to happen on a near-daily basis, but still come up time and again in Magic finance. When a new card is spoiled or some new deck breaks out, you want to purchase copies of the newfound cards quickly, before the price climbs higher. Then once those copies come in, you effectively want to sell into the hype as quickly as you can, before the price has a chance to cool off and settle back down.

A great example of this scenario is a card I mentioned last week: Leeches.

There’s a reason I advocated not buying this card last week—it had already gone through the buyout phase, and the resulting price correction was imminent. Don’t believe me? Just look at what the card’s price did back in early 2021: it spiked dramatically and then sold off in the following months. If you were going to make money on this card, you would have had to have bought copies immediately as the card started selling out, and then sold the cards as soon after as you could. If you had held onto copies for any real period of time after acquiring them, you would have been selling for a lesser amount.

I believe Leeches is going through the same pattern this time around. There was no time to dilly-dally, and there’s no time to waste selling into the hype right now. Melira, Sylvok Outcast is likely to be going through a similar pattern. Unless the card suddenly breaks Modern, I struggle to see its new price sticking. The same goes for many buyouts that have no substance.

Scenario 2: Buy Quickly, Sell Slowly

Like scenario one, in this scenario you want to purchase the cards in question quickly and aggressively, before the price climbs higher. Unlike the previous scenario, however, these price increases often do have a basis in actual, stable demand. As a result, their prices tend to remain higher and sometimes continue to climb further over the following months.

For example, consider the box set Ponies: the Galloping, released in October 2019. These were precursors to the Secret Lair series and sold directly on Hasbro’s website for $50. When they came out, I hemmed and hawed about the financial prospect of investing in Magic cards themed around My Little Pony. Ultimately, I decided to purchase one three-card box set.

A few months after its release, I noticed this selling for a bit higher than I had paid. Ultimately, I decided to cash out and move on.

I made two errors in this situation. First, I sold far too quickly. Second, I only bought one! These sets are around $175 on TCGplayer now, more than 200% above the original launch price. Looking back, I should have bought more of these quickly during launch, and then sold them gradually as the price continued to climb.

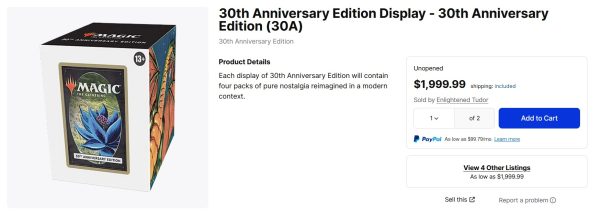

I’ve not dealt with any Secret Lair sets from Hasbro since, but I would imagine that other popular sets could follow a similar trajectory (that is unless Hasbro floods the market and creates too many of these…). If there’s a popular, limited print run product you are interested in, I’d recommend buying sets quickly upon launch and then holding for a while, gradually selling them one at a time as the price climbs higher. Even the much-maligned Magic 30th Anniversary product fits into this scenario.

Scenario #3: Buy Slowly, Sell Quickly

Not all cards should be purchased quickly—there are plenty of scenarios where a more measured approach is merited.

For this scenario, I’m focusing on speculative cards. These are cards you believe have long-term potential, or are one new card away from becoming busted in some deck. Then when that last combo piece or new card comes out, demand surges and you cash out. When the spike does come, you want to sell these cards as quickly as you can, locking in profits during the hype cycle.

This is my favorite scenario because it means you predicted something correctly and can profit on a card while many other players are scrambling to find copies either due to real demand or FOMO.

One recent(ish) example I had success with is the borderless Ikoria triomes.

A few months after Ikoria’s release, I recognized how powerful these three-colored lands could be, not only in Standard but also in Commander. Being able to fetch for one of these triomes essentially turned any fetch land into a potential five-colored card because you could fetch for any color you needed. The borderless ones looked more premium, so I focused my attention on these in particular.

Over the next few months, I dabbled here or there on these lands when I had store credit or a little extra cash sitting in the PayPal account. It didn’t take too long before these climbed into a profitable range, and Card Kingdom’s buylist followed in kind. After sitting on them for just long enough, I cashed out of them all at once to the buylist, locking in my profits.

As the launch of Dominaria United approached (September 2022), the Ikoria triomes were set to rotate out of Standard. With this backdrop, I felt fine selling when I did (despite the fact I think these have longer-term upside from Commander). Sure enough, starting around May or June, just a couple of months before rotation, these saw a measurable dip. They remain well off their highs even today. It was smart to acquire these gradually and then cash out quickly before the threat of rotation had an impact.

Scenario 4: Buy Slowly, Sell Slowly

Lastly, we have cards that should be gradually acquired and gradually sold. This is the category I focus most heavily on because it uses up the least amount of time. If you have many other commitments in life, this is the most time-efficient, lowest-risk approach to Magic finance.

In this category, I place all the Reserved List, Old School, and Four Horsemen cards. There’s an old adage that goes something like, “When is the best time to buy a Reserved List card? Ten years ago. When is the second-best time to buy a Reserved List card? Today!”

The corollary to this is of course “When is the best time to sell a Reserved List card? Tomorrow!”

While Reserved List cards have definitely seen softness over the past few months, the fact of the matter is these continue to be relatively stable ways of holding long-term value in cardboard. While I have moved off much of my collection recently, I still believe in the long-term value of extremely low-print, older cards. Beta rares are about the only cards I’m occasionally looking to buy in today’s market, and I’ve even seen some rebound in their price on Card Kingdom lately.

These are the cards you can take your time acquiring—dollar cost averaging is especially wise in this depressed market. At the same time, it’s also wise to sell them slowly because there’s always more upside potential, as long as the game remains healthy. These are the cards you don’t have to time perfectly when buying or selling. As long as you pay a good price at the time of buying, and you hold long enough, you’ll probably make some profit.

Wrapping It Up

Did you come into this article thinking that running races and Magic finance had nothing in common? Think again! Pacing can be extremely important for both pastimes.

In a race, you can’t afford to go out too quickly if the distance is longer than you are used to. You’ll run out of steam prematurely, and get burned out on the back half of the race. The same applies to Magic finance—if you purchase cards too quickly but don’t sell them quickly enough you could be left holding the bag.

Conversely, if you are running a half-marathon, you need to make sure you pace appropriately throughout the entire distance. If you start too slowly you may have gas left in the tank at the end, leading to a suboptimal race time. Likewise, if you purchase a hot product—such as a popular Secret Lair—too slowly, you’ll make money but won’t have enough copies to maximize profits when the time comes to sell.

The best advice I can give is to go into a Magic purchase knowing which scenario best applies. I wouldn’t enter a race without knowing the distance and respective strategy I’d want to implement. The same holds true in the world of Magic finance.