Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

This past week, an interesting conversation on Twitter caught my eye. Chas Andres (@chasandres) was participating in the discussion, and since he’s a highly regarded finance writer in the realm of MTG, I paid close attention.

The topic: Magic: the Gathering cards as an investment. I am not talking about buying cards which may see an increase in play during the next PTQ season or the next biggest Tier 1 strategy. I’m referring to investing in Magic Cards as an alternative to, say, a 401(k).

Here is a snippet of the conversation, which I eventually had to chime into since I am avidly interested in this topic.

A couple interesting tidbits and deductions leap out at me from this conversation. What are they? I’m glad you [maybe] asked!

Players Are Fickle, Collectors Are Dependable

Chas Andres agreed with my interjected comment – we both feel that one avenue for long term investing in Magic are highly graded Power 9. The reason is fairly obvious. These cards are exceptionally rare and collectors with lots of money are willing to through thousands of dollars at these rarities. Because supply is so low, only a few well-off collectors need to “demand” the card in order for the price to fly high.

One may suggest that Dual Lands are likewise stable for investing. The return on Dual Lands has been remarkable these few couple years, especially relative to the stock market.

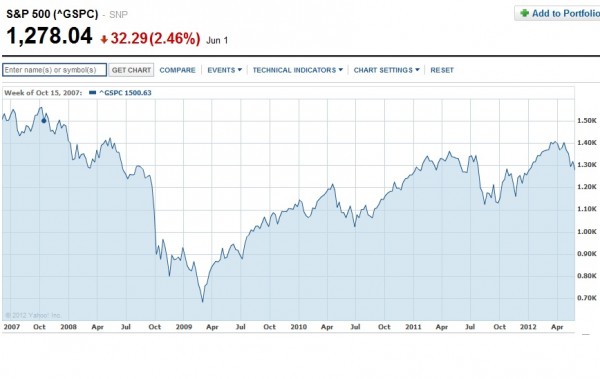

Underground Sea chart courtesy of blacklotusproject.com – note the chart only goes back to 2008, but I assure you the card’s value was growing steadily for a year or so before then as well. Compare this chart to the subsequent one, which is the performance of the S&P over the last five years, courtesy of Yahoo Finance.

But I hesitate to embrace an investment in Dual Lands for the long term. My one reason for caution lies in the unpredictable nature of the player. The game of Magic, Legacy in particular, is very popular right now. An increase in player base has driven up these cards in value multiple times. But they are still driven up mostly by their playability and NOT their collectability.

While subtle, this difference separates the safe long term investments from the short term bubble. All it would take would be a major migration for Star City Games from Legacy to Modern and Dual Land prices could collapse. Alternatively, even if Legacy continues to receive the same support, but players lose interest or become flustered with a hypothetical banning/unbanning, the prices still could drop further.

If I am moving significant quantities of cash into Magic Cards and not into other retirement plans, I want to make sure a card’s playability will not negatively impact my portfolio. This leads me to my second observation from the Twitter conversation.

Charizard Transcends Pokemon

How many people do you know who still play Pokemon? For me, the number is virtually zero, and I would wager this is not an uncommon trend. But if few people are still playing this game, then why in the world does a first edition Charizard still sell for hundreds of dollars???

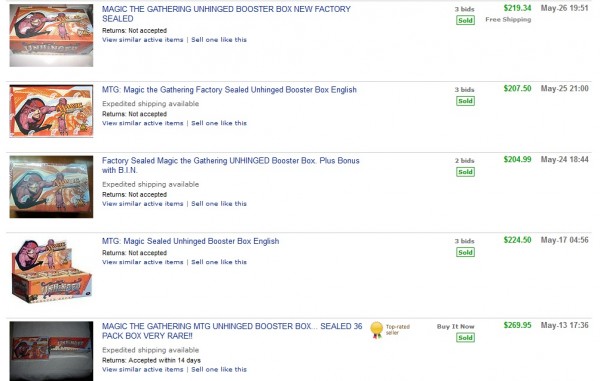

The answer is consistent with my previous point – the card is highly collectible and rare. The card needs no player base to maintain value because it is rare enough such that even a few collectors will drive the price up substantially. Don’t believe me? Check out this eBay ended auction:

If you think nearly $700 is ridiculous for a Pokemon card, then you will be completely awe-struck to hear that a PSA 10 copy of this card sold for $1,826.00! All this despite the fact the game’s player support has dwindled significantly since its peak.

The main takeaway here is that a card can lose popularity amongst players, but if that same card is very rare and collectible, it will maintain value. Hence why I support highly graded Power 9 as dependable avenues for investing.

This Is Getting Costly

I don’t know about you, but if I were to purchase a PSA 8 Alpha Black Lotus, which retails for nearly $5,000, I would need to sell the vast majority of my collection. This is the opposite of diversification and I would not condone this strategy.

There must be a happy medium. There must be a way one can invest in highly collectible cards which should increase in value while not having to shell out five grand on a single card.

I see a couple alternatives here, but they each have their drawbacks.

First, we could purchase lesser cards, such as a graded Bazaar of Baghdad or the like. At a few hundred dollars instead of a few thousand dollars, this option is much more affordable and, as long as the card’s condition is high enough, collectors should still keep this card’s value high.

But let’s face it – there are fewer people interested in a PSA 8 Bazaar of Baghdad than a PSA 8 Alpha Black Lotus. So it will be more difficult to find sellers in the long term and the card may not appreciate as much.

Second, we could consider purchasing highly graded Unlimited Power. High quality Unlimited Black Lotuses sell in the $1500 range and other Power should be even cheaper. This is an affordable way to still have a chunk of cash invested in high quality Power.

The drawback here is related to the supply. There are far greater quantities of Unlimited Black Lotuses than Alpha ones. Even though the demand may still be very high on this poster-child card of Magic, the supply keeps the value in check. Of course you could find one of the few PSA 10 Unlimited Black Lotuses, as these are likely very rare. But these will again cost thousands of dollars, so the cost of entry barrier is still there.

Lastly, we could try to brainstorm other Magic products which are highly collectible, rare, and should maintain value even should the game of Magic lose popularity. Many of you already know I have a sizable investment in sealed Magic Booster Boxes. I feel these should not drop in value because they will assuredly decrease in supply while a sufficient casual market will maintain a sizable demand. There is no need for a Star City Games tournament circuit for a sealed Unhigned Booster Box to grow in value.

If Booster Boxes aren’t your thing, perhaps there are other options. Off the top of my head, there are misprinted cards, high quality altered cards, or even sealed booster packs of older sets. I’m sure there are many other options and I would love to hear what other considerations you have come up with for a long term Magic investment.

Collectability And Rarity Are Key

The goal is to find a Magic product or card that is highly popular amongst collectors and somewhat difficult to find. These are the gaming assets which should maintain and build value in the long term. They rely little on the game’s popularity and even less on individual playability. Like a rare baseball card, they merely grow in value because they are very hard to obtain for the well-off collectors.

While Dual Lands, Force of Wills and the like have all returned terrifically in the past few years, I’m wondering how much room these cards have to run. Don’t get me wrong – I have no intention of selling my 40 Dual Lands and 40 Fetch Lands any time soon. I still like to play the game and I see the utility in these cards. But in terms of longer term holdings, I see some significant advantage to something much rarer.

-Sigmund Ausfresser

@sigfig8

How funny is that? I was in the car with Ryan driving all around Indiana picking up collections after Origins when he got into it with Chas on Twitter, so I got updated in real time.

I'm not sure you and Chas agree on why not to invest in duals for the long term. While you make the point that if the meta shifts radically, different duals will ebb and flow in their prices if they get played a lot more or a lot less (Although let's be honest, to play it safe, always bet on blue). If you read the entire exchange between Chas and Ryan, Chas mentions things like the possibility of Wizards disregarding the reserve list of their own creation and reprinting the dual lands. That is actually a thing he said.

I'm right there with you an all points, Sigmund. Doug's recent articles about potential investment in alpha poop by virture of its being alpha (the fungusaur effect) go hand in hand with your assessment that collectibility > playability. This is a really good article and not just because I saw it unfold right before my eyes.

Can't we at least agree that even for non-playing collectors, dual lands, especially ones with black borders, are just as iconic as power (or fungusaurs)? Wouldn't you say that dual lands can transcend the gap between player and collector and be just as sought-after as power, if not more-so because a beta dual can pimp out a legacy deck whereas power is played in vintage, a much less accessible format?

This all started a really good debate and it all started innocently with Ryan saying "I really think Chas is on the wrong track here" and me saying "Well, go on, say something. It's not like anyone is going to see it."

It actually was Sigmund who was posting about Alpha ;-).

I think you should diferentiate between sets for Duals. I can certainly see the revised ones drop should SCG move out of Legacy. Revised was printed in quite large volumes* and it's the set from which somebody who just wants to play the format will get their cards from. Unlimited is much more rare, on one side more will hit the market if interest in Legacy drops, but their rarity will keep their price high. I would expect that Unlimited will experience a small drop, then get back up to the current level. Alpha en Beta Duals are for the pimps out there, who are pretty commited to their formats. There's few of them around, any copies sold by Legacy pimps can go straight to Vintage or EDH pimps, these will keep rising regardless.

* http://www.crystalkeep.com/magic/misc/rarity-info…

What I wonder is, how interesting must the offer be to part with any of the best bets cards? No use moving them for their current value as you can just keep them and they'll appreciate steadily.

Also, regarding Alpha, Sigmund, I told you I was bidding on another Archers. This one was being sold by a very reputable seller (Kid Icarus, 172k feedback…). It ended up at $111.11. Many other Alpha cards he was selling ended up going pretty high as well. Could be interesting for you to have a look at his recently finished auctions, he sold off like half a set in about EX-NM condition.

Thank you both for reading and for the thoughtful comments. I love this topic and I am pleased to see others are interested in engaging in discussion on it.

Re: Duals – I did miss that particular part of the Twitter discussion. Though I failed to mention additional possible causes for Dual Land value collapse, I do agree there are multiple possible catalysts. I personally feel removal of the Reserve List policy is an unlikely one, but theoretically speaking that would certainly hurt Dual Land prices.

Black bordered Dual Lands are likely a safer bet. An even safer safer bet would be highly graded Alpha/Beta Dual Lands. These will be the ones collectors drool over. And since so many duals are played to oblivion (especially back in the day before people used sleeves), finding black bordered duals in pristine collection is difficult to do.

I wouldn't touch Revised/Unlimited Dual Lands as a long term investment – I like having my 40 Revised duals as a collector/player but I will eventually sell them. Now that I play Magic much less frequently due to having a baby, now could be a good time to sell my 40 Duals and buy some graded Power for a long term investment. Interesting to think about.

Re: Alpha – I did write that article regarding buying Alpha crap rares and the Fungusaur effect. High quality copies of Alpha rares are certainly difficult to come by these days! This could be an alternative way to invest, though, appreciation rate may be lower than Alpha Black Lotus of course.

Yeah, my fault. As a big fan of Russian history, sometimes my memories are revisionist.

As an aside, while I see the benefit as an investment I have a thorough dislike of getting cards graded as a player, which I am primarily. Prices go through the roof once a card got graded and almost anybody with grade worthy copies of cards gets them graded, reducing the amount of ungraded copies on the market. I'm stuck with playing with cards in lesser condition or buying a graded card, overpaying and then having to figure out how to remove it from its box.

Having not spent more than 13 euros for a single dual I highly doubt they will ever fall low enough for me to consider parting with my playset (I got them about 10 years ago). I can keep playing them in EDH or other casual formats anyway.

I understand your concern with card grading. I, myself, don't intend to have many of my own cards graded. I will instead attempt to acquire cards already in graded condition. It's not in my interest to get more cards graded – by doing so, I increase the supply of said graded cards thereby potentialy dropping price (not to mention the increase of price of non-graded copies). Sounds like a lose-lose scenario in that regard 🙂

My Duals were much cheaper to acquire than they would cost me today, but I definitely paid more than you did. I'd say I paid maybe $40 on average for each Dual, taking into account both the high end Seas and the low end Badlands.

Great, I'm fine with people dealing in already graded copies ;-).

When I was missing the last 8 I bought them online (the rest was traded for), those were 2 Plateau, 3 Taiga and 3 Underground Sea. I paid an average of slightly under 13 euros for them and they were in EX to EX+ condiiton. Later the guy messaged me saying he had misplaced a stack of Taiga's (!!!). I got the others and 2 months later the Taiga's arrived, including a 4th copy thrown in for my patience so in effect they were even cheaper. Of course when I started with Magic their prices everaged about 7 euros and I've seen Beta Duals for sale at a dealer for under 50 euros.

Does “The Fungusaur Effect” have its own wikipedia entry yet? 😛

No, worth doing? 🙂

Is there a popular store selling Pokemon cards so I can see how much these charizards/blastoises are worth?

I just looked up everything on eBay. I'm not sure if there are many stores still selling Pokemon cards. Anyone else know? You could try posting to the forums and asking there.

Not to be nitpicky but it seems like your article in general agrees with my assessment over Chas. His stance was that it was a poor investment which is why I chimed in in the first place. Either way good article.

Hey, so I just wrote a lengthy comment which seems to have gotten deleted when I tried to log in and post. Damn.

The point I was trying to make on Twitter was that investing all of your capital in any one thing (a company, a game, a collectible, a stock.) makes for a terribly risky long term investment. No financial adviser worth their salt would recommend this path to their clients. What you want in an investment is something that will allow your money to safely grow at a small rate above inflation. Otherwise, you are betting your future on a card game.

If you have money to speculate? Magic is fine. I agree with Sigmund that graded power and sealed boxes are the safest long-term bets.

If you want more of my thoughts on this, my second ever article on Channel Fireball talks about my thoughts on long term investment in Magic: http://www.channelfireball.com/articles/traderous…

My latest SCG article also talks a lot about the difference between investing and speculation and gets into my thoughts on risk vs. reward.

I wish I could read your latest SCG article. I guess I have about 25 days left before it's available to cheapskates who won't subscribe for premium 🙂

Thanks for the feedback. I agree with you 100% that diversification is key. That's why, while I suggest graded power is the safest long-term bet, it's also restrictive because of the inherent cost. Thus, I tried to provide a few alternatives which are nearly as safe but also enable diversification (boxes, Unlimited power, etc.). Sounds like we are on the same page with this.

You may also enjoy my article from 2 weeks ago, discussing how feasible it could be to manipulate the Alpha market, particular with regards to NM Alpha rares. If you've got the time and are interested, of course.